Abstract:Discover the most trusted forex broker reviews and ratings. Use the WikiFX app to compare and find top brokers safely and confidently.

Introduction: Navigating the Forex Market with Confidence

The world of foreign exchange, or forex trading, moves trillions of dollars every single day. For many traders—new or experienced—picking the right broker can be the difference between success and disappointment. A trusted forex broker reviews search tool serves as the compass that helps investors steer clear of scams, inflated promises, and unregulated platforms. This article explores the most reliable ways to identify credible forex brokers, interpret reviews, and make informed trading decisions through verified platforms like WikiFX.

Why Choosing the Right Forex Broker Matters

A forex broker acts as the gateway between traders and international currency markets. The broker‘s credibility determines several crucial aspects of trading: order execution speed, fund security, spreads, leverage, and customer protection. In an industry where some firms engage in misleading marketing or operate under weak jurisdictions, traders need transparent and verifiable information about each broker’s performance.

Choosing a broker based on reputation and regulatory compliance rather than advertising hype is essential. Trustworthy reviews offer insight into a brokers regulatory status, history of complaints, user satisfaction ratings, and real trading performance. When collected from a reliable source, these reviews empower traders to make sound financial decisions.

Key considerations include:

- Regulation and licensing authority (such as FCA, ASIC, or CySEC)

- Withdrawal reliability and transaction speed

- Trading platform stability (MT4, MT5, or proprietary platforms)

- Customer service quality and multilingual support

- Transparency of fees, spreads, and policies

Before depositing any funds, traders should explore multiple verified forex broker review platforms to cross-check these elements.

What Defines a Trusted Forex Broker Review

Not every review posted online offers value. The credibility of a forex broker review depends greatly on who writes it and how it is verified. Honest and data-backed reviews evaluate a brokers track record using both quantitative measurements (execution times, slippage, spread analysis) and qualitative feedback (user satisfaction and service quality).

A trusted forex broker review typically includes:

- Verification of regulatory authority through official channels

- Assessment of user complaints versus resolutions provided

- Analysis of historical data, not just short-term performance

- Evaluation of platform usability, mobile compatibility, and trading tools

- Clarity in rating criteria rather than vague testimonials

Such a comprehensive review helps separate emotion-driven opinions from practical insights, helping traders build genuine confidence in their broker choices.

The Role of Ratings in Forex Broker Analysis

Forex broker ratings simplify the decision-making process by assigning objective scores based on measurable factors. Ratings provide a quick overview of a brokers trustworthiness, transparency, and service performance.

Common rating parameters include:

- Regulation strength and location

- Financial transparency and capital adequacy

- Historical reliability and absence of fraud records

- Customer service responsiveness

- Trading costs and hidden charges

When paired with detailed reviews, forex broker ratings act as a visual summary of where each platform excels or falls short. Reputable tools that aggregate these ratings—such as WikiFX—offer real-time updates that reflect any changes in regulation, sanctions, or broker misconduct reports.

How to Use a Forex Broker Reviews Search Tool

A forex broker search tool is designed to streamline the comparison process for traders seeking reputable brokers. Instead of browsing multiple websites, a single search interface brings together broker data, ratings, and regulatory information for an all-in-one view.

Here is how to use it effectively:

- Enter the broker‘s name: Input the full name or license number into the tool’s search bar.

- Verify authenticity: Check the regulators logo, license number, and the jurisdiction listed.

- Read reviews: Examine user feedback for consistency in complaints or praises.

- Compare ratings: Use side-by-side comparison features to analyze risk scores.

- Access historical data: View the brokers performance over time to detect patterns.

These steps help traders eliminate unreliable brokers early and focus only on those verified by recognized regulators.

Spotting Fake Forex Broker Reviews

Fake or manipulated reviews remain a significant risk, especially as competition among brokers intensifies. Some firms commission positive reviews to mask weak performance or regulatory deficiencies. Recognizing fabricated reviews is a vital skill for traders.

Common indicators of false reviews include:

- Overly promotional language without factual evidence

- Negative reviews targeting competitors rather than providing data

- Repetitive writing style or template-based wording

- Absence of verifiable proof, like screenshots, trade IDs, or account summaries

- Contradictory feedback that ignores objective trading results

Cross-referencing different forex broker review sites, verifying license information, and checking regulated watchdog reports help expose these inconsistencies.

Why WikiFX Is the Most Trusted Reference Tool

Among global platforms offering forex broker reviews and ratings, WikiFX stands out as a respected authority for its transparency, regulatory verification system, and community-driven insights.

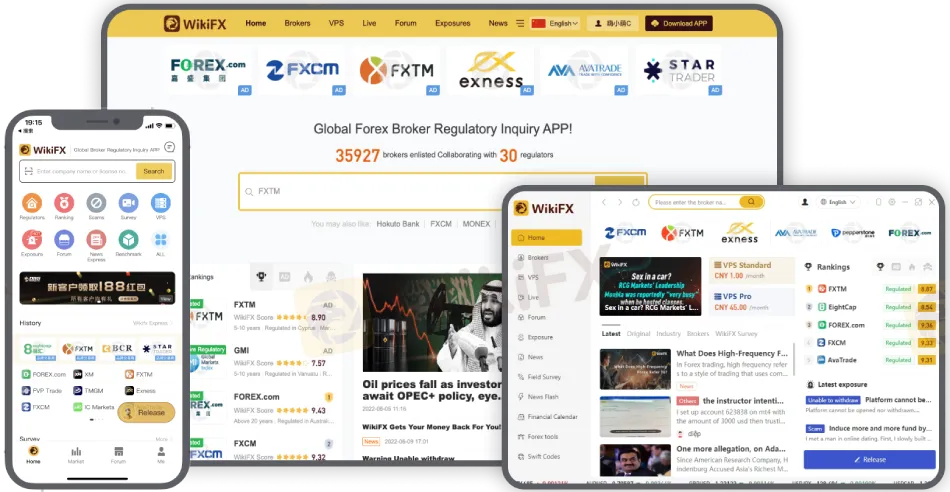

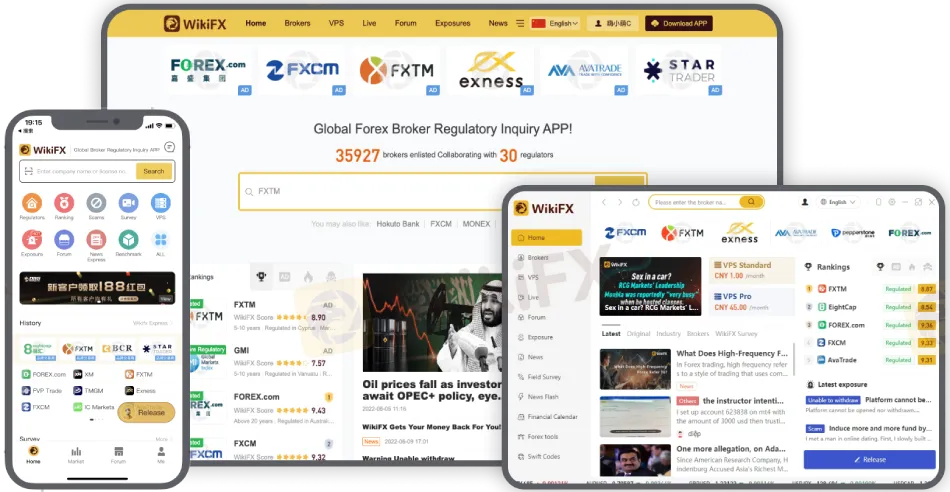

What is the WikiFX App?

WikiFX is a professional forex broker information platform that gathers data from over 40 financial regulators worldwide. It evaluates brokers legitimacy based on license validation, risk warnings, and field investigations. Through its mobile app, traders can instantly access broker ratings, real-time regulation updates, and detailed review analyses.

Key Features:

- Verified Regulation Data: Confirms each brokers license through partnerships with institutions like FCA, ASIC, NFA, and CySEC.

- Risk Warnings: Displays alerts about unregulated brokers or suspended firms.

- Community Reviews: Provides authentic feedback from verified users with trade experience.

- Broker Comparison Tool: Allows traders to compare multiple brokers and their risk indices.

- Educational Resources: Offers guides and case studies on avoiding common trading scams.

The WikiFX apps combination of expert verification and user-driven commentary has positioned it as an indispensable resource for traders seeking reliable forex broker reviews.

Step-by-Step Guide: Finding Top Brokers with WikiFX

- Download the App: Available on iOS, Android, and desktop versions.

- Create a Free Account: Enables access to saved searches and personalized recommendations.

- Search Your Broker: Type the broker name to view its profile, license, and ratings.

- Read Verified Reviews: Explore genuine user experiences and regulatory information.

- Compare Competitors: Use comparison graphs to evaluate broker strengths and weaknesses.

- Spot Fake Brokers: Identify cloned or suspended licenses listed with red-coded warnings.

- Stay Updated: Set alerts for changes in broker compliance or regulatory news.

By following this sequence, traders can avoid unregistered entities and focus on reliable, regulated brokers that align with their trading style.

The Future of Forex Review Technology

As financial technology evolves, real-time verification tools powered by global regulatory APIs are reshaping how traders assess brokers. Instead of relying solely on word-of-mouth or forum feedback, advanced applications like WikiFX apply data science and regulatory integration to provide factual evidence of broker integrity.

Future review tools are expected to feature AI-based fraud detection, blockchain-based license authentication, and predictive trust ratings based on past compliance behavior. These innovations aim to eliminate bias and improve fairness in broker evaluation.

Conclusion: Trade Smarter with Verified Reviews

Navigating the forex market without guidance is risky. However, by leveraging a trusted forex broker reviews search tool, traders reduce uncertainty and improve decision-making. Verified platforms like WikiFX have revolutionized the transparency of forex trading by enabling users to verify regulation, read authentic reviews, and compare brokers with ease.

In the dynamic world of forex, knowledge remains the traders best defense. Using verified reviews and ratings empowers investors to trade with greater confidence, protect their funds, and focus on sustainable profit generation rather than trial-and-error experiences.