Abstract:Many traders start looking for a new broker by searching for special deals and bonuses. The phrase "Uniglobe Markets no deposit bonus" is something people often search for. Let's address this question clearly and directly. Based on all the information we have, Uniglobe Markets does not currently offer a no-deposit bonus. Instead, this broker focuses on bonuses that require you to deposit your own money first. To get any bonus credits, traders must put in their own capital. Read on to learn how this entire bonus works out for traders.

Introduction

Many traders start looking for a new broker by searching for special deals and bonuses. The phrase “Uniglobe Markets no deposit bonus” is something people often search for. Let's address this question clearly and directly. Based on all the information we have, Uniglobe Markets does not currently offer a no-deposit bonus. Instead, this broker focuses on bonuses that require you to deposit your own money first. To get any bonus credits, traders must put in their own capital.

This article gives you a complete and fair analysis of these offers. We will break down the different deposit bonuses, examine the rules that control them, and most importantly, look at whether this broker is safe and reliable overall. A bonus is only worth something if the broker offering it can be trusted. This guide will help you look beyond the attractive percentage numbers and make a smart decision by weighing the advertised rewards against the possible risks.

A Detailed Breakdown of Promotions

While a no-deposit bonus is not available, Uniglobe Markets offers several other promotional deals aimed at attracting both new and existing clients. These offers are designed to increase a trader's available margin through bonus credits. Understanding the specific details of each promotion is the first step in evaluating how useful they really are for your trading strategy. Below is a clear overview of the main bonus programs and other incentives provided by the broker.

The 100% Deposit Bonus

This long-running promotion is a main feature of the broker's offerings. It matches a trader's deposit with an equal amount in credit.

· Eligibility: Available to both new and existing clients.

· Offer Period: The promotion, as per the website, stays valid until December 31, 2025.

· Minimum Deposit: $100.

· Bonus Type: This is a 100% credit bonus, meaning it is added to your trading margin but you cannot withdraw it as cash.

· Cash Back Component: A rebate of $2 is offered for every standard lot (100,000 units) traded. This cash back is reportedly credited monthly.

· Leverage Restriction: Accounts using this bonus are limited to a maximum leverage of 1:200.

· Bonus Cap: The total bonus amount is capped at $5,000 per trading account.

· Validity: The credit bonus is valid for 60 days from the date of deposit.

· Exclusions: This specific offer does not apply to trading on indices.

The 200% Deposit Bonus

A more aggressive offer, this bonus provides double the deposit amount in trading credit, but it is a time-limited promotion.

· Minimum Deposit: $100

· Offer Period: This promotion remained valid until August 31, 2025. To know whether it still exists, contact the brokers support system.

· Validity: The bonus credit expires 60 days after being applied to the account.

The 20% Tradable Bonus

This bonus offers a smaller percentage but may come with different conditions, specifically concerning leverage.

· Minimum Deposit: $100

· Leverage Restriction: The maximum leverage available for accounts with this bonus is not found on the brokers website. You need to contact the support team to know more about it.

· Validity: This bonus, which can be availed of up to $2,000, has a 60-day expiry period.

Other Promotions

Beyond direct deposit bonuses, Uniglobe Markets encourages client referrals and trading volume through other programs.

· Refer a Friend: This program allows individuals to earn a commission based on the first deposit of a client they refer. The referrer receives 10% of the referred client's initial deposit. A key condition is that both the referrer and the new client must have a verified live account with the broker.

· Trade to Win: This is a loyalty program where traders accumulate points or credits based on the number of lots they trade. These can then be exchanged for various gifts. Participation requires opening a live account and actively trading.

The Fine Print: Real Impact of Terms

Attractive bonus percentages grab your attention, but the terms and conditions are where you find the true value and potential problems of a promotion. When evaluating a bonus, we look past the headline number to the underlying rules, as these determine the bonus's real-world impact on a trader's capital and strategy. Understanding these conditions is not optional; it is a critical part of managing risks. For traders considering Uniglobe Markets, several key terms across their promotions need careful consideration.

Time Pressure: The 60-Day Window

A common condition across the 100%, 200%, and 20% bonuses is the 60-day validity period. On the surface, two months may seem like plenty of time. However, in trading, this fixed deadline can create significant psychological pressure. Traders may feel forced to trade more often or take on larger position sizes than their strategy would normally require, all in an effort to “make the most” of the bonus before it expires. This behavior, known as over-trading, goes directly against disciplined risk management. It can lead to hasty decisions, poor trade entries, and ultimately, an increased likelihood of losing money. A good trading strategy should be based on market conditions, not on a promotional expiry date.

Leverage Restrictions and Meaning

Another critical term is the restriction on maximum leverage. While the broker's Micro account offers leverage up to 1:500, accounts that accept a bonus are often capped at a lower level, such as 1:200 for the 100% bonus or 1:300 for the 20% bonus. For example, with $1,000 of equity and 1:500 leverage, a trader can control a position size up to $500,000. With 1:200 leverage, that same $1,000 can only control a position of $200,000. While lower leverage is a smart risk management tool that reduces the potential for huge losses, this restriction directly impacts trading flexibility. Strategies that rely on higher leverage to control larger positions with smaller capital will be less effective. Traders must calculate whether the benefit of the added bonus margin outweighs the limitation on their position-sizing capabilities.

Credit Bonus vs Withdrawable Cash

This is perhaps the most misunderstood aspect of forex bonuses. The primary bonuses offered by Uniglobe Markets are credit bonuses. This is not free money that is added to your withdrawable balance. Instead, this credit exists for one purpose: to increase your trading margin. It allows you to support larger or additional positions and provides a buffer against margin calls. Your account equity might show $1,000 deposit + $1,000 bonus = $2,000 total equity, but only the original $1,000 (plus or minus any trading profits/losses) can be withdrawn. The bonus credit itself cannot be withdrawn and will typically be removed from the account upon expiry, withdrawal of funds, or if the account equity drops to the level of the bonus. This is different from the “$2 cash back” offer, which is a rebate that, once earned through sufficient trading volume, becomes part of the trader's real, withdrawable cash balance.

Beyond the Bonus: A Critical Look

A promotional offer, no matter how generous it seems, is only as secure as the broker providing it. Before putting money in to chase a bonus, traders should focus on the broker's basic safety, which is determined by its regulatory status, company transparency, and user feedback. This section provides an objective assessment of Uniglobe Markets based on publicly available information.

The Critical Issue of Regulation

The single most important factor for any trader's safety is regulation by a reputable financial authority. Our review of available information indicates a significant concern in this area: Uniglobe Markets appears to operate without a valid license from any major, top-tier financial regulator.

This lack of oversight has not gone unnoticed by regulatory bodies. Several European authorities have issued public warnings concerning the broker:

· Cyprus Securities and Exchange Commission (CYSEC): Issued a warning regarding the entity.

· Autorité des Marchés Financiers, France (AMF): Placed the broker on its blacklist of unauthorized companies.

· Comisión Nacional del Mercado de Valores, Spain (CNMV): Issued a warning regarding the firm's unauthorized operations.

Operating without regulation means traders face higher risks. There is no access to investor compensation funds, no required separation of client funds from company funds, and no independent body for dispute resolution. Potential clients should be fully aware of these official warnings.

Company Structure Discrepancies

Looking at the broker's company details reveals further inconsistencies that can be a red flag. There appear to be conflicting pieces of information regarding its operational and legal structure.

· Registered Region: The broker is listed as being registered in the United Kingdom.

· Company Address: The provided physical address is in Gros-Islet, Saint Lucia.

· Associated Company: An entity named UNI SMART SOLUTIONS LTD, registered in the UK, is listed as “Deregistered.”

This difference between the stated registration country and the physical operating address, combined with a deregistered associated company, makes it difficult for a client to figure out which legal entity they are contracting with. This confusion could create serious challenges in the event of a legal dispute.

User-Reported Issues

Community feedback and user-reported experiences provide real-world insight into a broker's operations. A review of various online sources, including news segments and user forums, highlights several recurring complaints from individuals claiming to be clients of Uniglobe Markets. These include:

· Withdrawal Difficulties: Reports of delays, excuses, and outright denials of withdrawal requests are a common theme.

· High Slippage: Users have complained about significant slippage on trade execution, where the execution price is substantially different from the requested price, negatively impacting profitability.

· Account Blockage: There are mentions of accounts being blocked or frozen without clear justification, preventing access to funds.

For a comprehensive overview of all regulatory data and a full spectrum of user feedback, we strongly encourage traders to review the broker's full profile on WikiFX.

Trading with Uniglobe Markets

For traders who are still evaluating the broker after considering the risks, it's important to understand the practical aspects of the trading environment. This includes the different account tiers, the available trading platforms, and the range of instruments that can be traded. This information helps compare the broker's offerings against industry standards and your trading needs.

Account Tiers Compared

Uniglobe Markets structures its offerings across several account types, each with a different minimum deposit requirement and a corresponding maximum leverage level. The following table summarizes the main account tiers.

*Disclaimer: The following information is based on available data and should be verified directly with the broker. Leverage is a double-edged sword; it can amplify both gains and losses.*

Platforms and Instruments

The choice of trading platform and the variety of available assets are key components of a broker's service.

· Trading Platforms: The broker offers clients access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are industry-standard platforms known for their strong charting tools, support for automated trading via Expert Advisors (EAs), and user-friendly interfaces, catering to both new and experienced traders.

· Available Instruments: The broker lists a range of asset classes for trading. These include forex currency pairs, cryptocurrencies, stock CFDs, copy trading, major global Indices, precious metals such as gold and silver, and commodities such as oil.

· Inconsistent Information: It is worth noting a difference in the available information regarding cryptocurrency trading. While some summaries mention cryptocurrencies as a market instrument, other detailed lists explicitly mark them as unavailable. We advise traders to seek direct clarification from the broker on this matter before making any decisions. To check the latest details on available instruments, you can visit the Uniglobe Markets profile for more information.

Conclusion: Weighing the Bonus

Our analysis of the Uniglobe Markets bonus offers and its overall profile reveals a clear and critical trade-off. On one hand, the broker presents a series of high-percentage deposit bonuses that can seem very appealing, promising to significantly enhance a trader's available margin. These promotions, including the 100% and 200% deposit bonuses, are designed to attract traders looking to maximize their trading potential.

However, these offers come with important conditions, such as leverage restrictions and strict 60-day time limits, which can divert traders toward poor strategies. More importantly, these bonuses are offered by an entity that carries a significant risk profile. The most critical finding of our review is the broker's complete lack of regulation by any major financial authority. This is further worsened by multiple official warnings from European regulators and a pattern of serious, user-reported issues concerning basic operational aspects such as withdrawals and trade execution.

The final verdict is a cautionary one. The appeal of a large bonus should never overshadow the basic need for broker safety and reliability. The absence of regulatory oversight means that client funds are not protected by compensation schemes, and traders have no official recourse in the case of disputes. The promotional offers, while seemingly generous, are presented by an entity with a documented history of regulatory warnings and user complaints. We strongly advise any trader considering this broker to prioritize security over incentives. We recommend you conduct thorough research and review all the verified data, user reviews, and regulatory warnings for Uniglobe Markets directly on WikiFX before committing any capital.

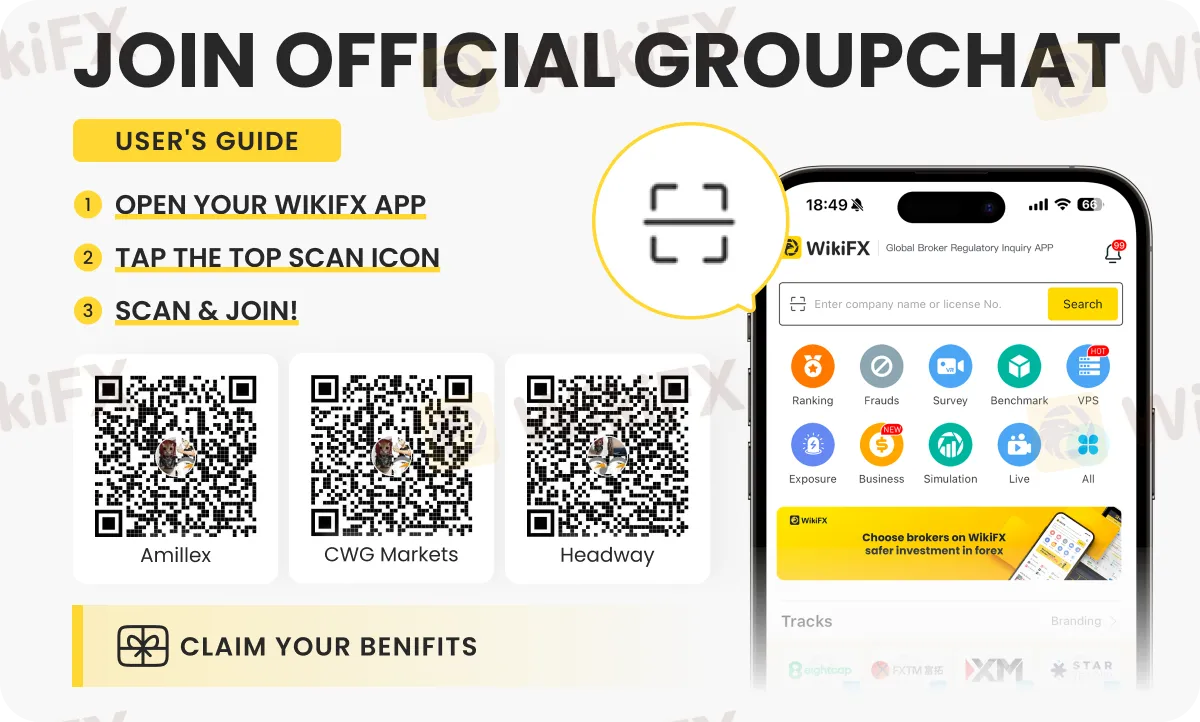

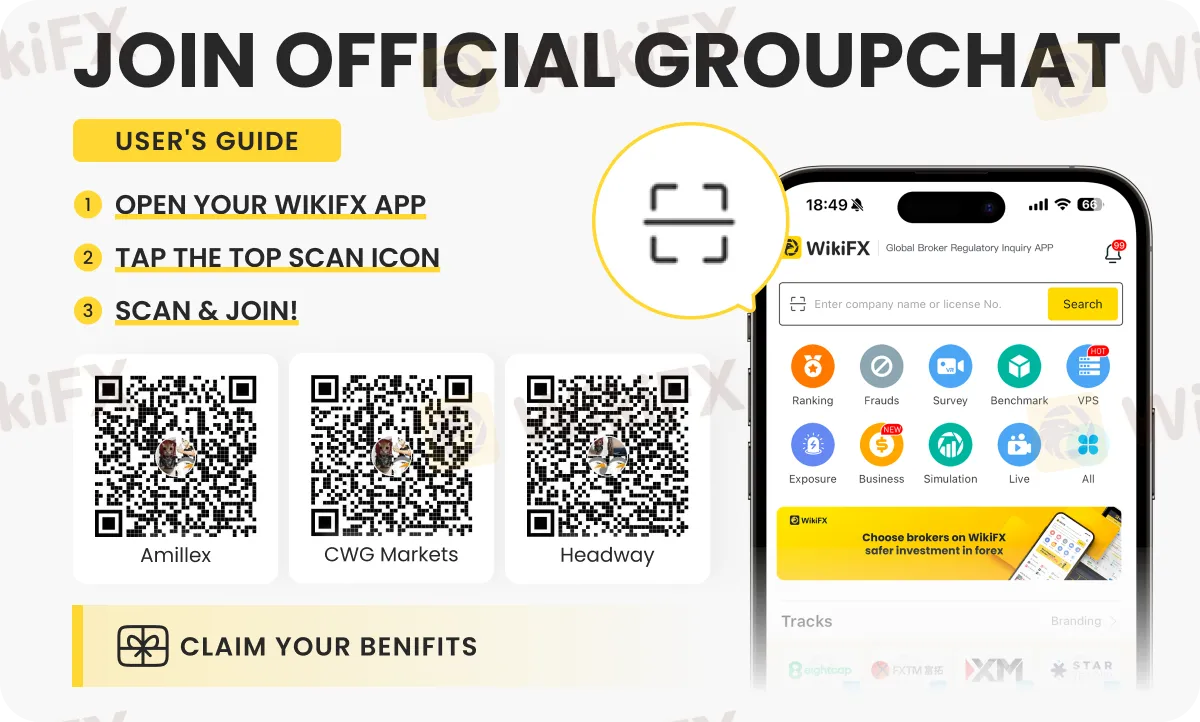

Want to stay updated about the latest forex trends? You need to be part of these chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown in the image below.