Abstract:When traders ask, "Is uniglobe markets legit?" They want a clear answer about whether their capital will be safe. This simple guide for 2025 will give you that answer by examining the broker from every important angle. The most important thing we found is that Uniglobe Markets works without proper financial rules and oversight, causing serious risks. This review will carefully examine its legal status, look at confusing company information, explain its trading conditions, and share real user problems. When checking any broker, it's smart to use websites with detailed verification. Traders can find complete profiles and current warnings for thousands of brokers on WikiFX to help with their research. This article will show you the facts, so you can decide smartly based on evidence, not advertising promises.

When traders ask, “Is uniglobe markets legit?” They want a clear answer about whether their capital will be safe. This simple guide for 2025 will give you that answer by examining the broker from every important angle. The most important thing we found is that Uniglobe Markets works without proper financial rules and oversight, causing serious risks. This review will carefully examine its legal status, look at confusing company information, explain its trading conditions, and share real user problems. When checking any broker, it's smart to use websites with detailed verification. Traders can find complete profiles and current warnings for thousands of brokers on WikiFX to help with their research. This article will show you the facts, so you can decide smartly based on evidence, not advertising promises.

Looking at Legal Status

The most important thing about a broker's safety is whether it follows financial rules. Financial rules create a system of guidelines and oversight designed to protect traders. This includes requirements to keep client funds separate from company funds, ensuring fair trading practices, and offering a way to solve problems if they happen. Without this oversight, traders have little to no help if fraud, bad practices, or bankruptcy occur.

We have confirmed that Uniglobe Markets currently has no valid financial regulation. This lack of oversight isn't just missing paperwork; the broker has been actively warned against by multiple European financial authorities for working without permission. These official warnings serve as major red flags for any potential investor.

The following regulatory bodies have issued public warnings about Uniglobe Markets:

· Cyprus Securities and Exchange Commission (CySEC): Issued warnings about unregulated companies. (Disclosure times: 2025-08-14, 2023-10-26)

· Autorité des Marchés Financiers (AMF - France): Put the broker on its blacklist for providing unauthorized forex services. (Disclosure time: 2020-02-27)

· Comisión Nacional del Mercado de Valores (CNMV - Spain): Published a warning for unauthorized firms, specifically naming Uniglobe Markets. (Disclosure time: 2020-02-10)

Having multiple warnings from respected regulators across Europe sends a clear and unified message. The direct result is that working with an unregulated broker that has been officially blacklisted carries a high risk of losing capital, with no guarantee of fund safety or fair treatment.

Breaking Down Company Details

Beyond regulation, a close look at a broker's company structure can show telling inconsistencies. Honest and legitimate firms typically provide clear, checkable information about their business base and legal entities. In the case of Uniglobe Markets, the details present a conflicting and confusing picture that raises more questions about its legitimacy.

A summary of the broker's provided information highlights these differences.

The first major red flag is the conflict between the claimed “United Kingdom” registration and the physical addresses provided. The business addresses are located in Saint Lucia and St. Vincent and the Grenadines, two offshore locations. This setup is common among brokers trying to avoid the strict regulatory requirements and costs associated with operating in a top-tier location such as the UK.

Furthermore, the related UK entity, UNI SMART SOLUTIONS LTD (Registration No. 13579888), is officially listed as “Deregistered.” This means the legal entity tied to its UK claim is no longer active, making the “Registered in United Kingdom” claim highly misleading.

Another confusion for traders is the “Full License MT5” designation. It is important to understand the difference between a software license and a financial regulatory license. The former is a license purchased from MetaQuotes, the developer of the MT4 and MT5 platforms, allowing a broker to offer that software to its clients. It has no bearing on the broker's legal authority to offer financial services or its adherence to fund safety rules. Having an MT5 license does not mean the broker is regulated by any government body. These conflicting details make it difficult to verify the broker's true business base and legal standing. We encourage users to view the complete entity genealogy and company summary on the Uniglobe Markets profile page to see these connections for themselves.

Looking at Trading Offerings

While the regulatory and corporate structure raises serious alarms, it is also important to objectively assess the trading products and conditions the broker advertises. This allows for a complete picture of what is being offered to potential clients. Uniglobe Markets presents a wide range of account types and instruments, but these must be viewed through the lens of the high risk established by its unregulated status.

Tradable Instruments

The broker claims to offer a variety of asset classes. However, there are inconsistencies in the information provided.

*Disclaimer: Information about cryptocurrency trading is inconsistent. While some summary text mentions cryptocurrencies as a tradable instrument, the detailed instrument list clearly marks them as not supported. Traders should ask the broker directly for clarification, but this inconsistency is another minor red flag.*

Account Structure and Leverage

Uniglobe Markets serves different types of traders with a tiered account system, starting with a relatively low minimum deposit.

The availability of leverage up to 1:500 is a key feature. From an expert perspective, this level of leverage is a double-edged sword. While it can increase potential profits from small price movements, it equally and dramatically increases losses. A small market move against a highly leveraged position can wipe out a trader's entire deposit almost instantly. When combined with an unregulated broker where there is no oversight on pricing or execution, such high leverage becomes an extreme financial risk.

Platforms and Payments

The broker provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. For deposits and withdrawals, it lists several popular methods, including Neteller, Skrill, Bank Wire, VISA, Cashiu, OK Pay, and Perfect Money. A notable claim is the offer of no deposit or withdrawal fees. While appealing, this claim's reliability is subject to the broker's discretion, as there is no regulator to enforce such policies. Traders interested in the specific spread details or commission structures for these accounts can examine the full account breakdown on the Uniglobe Markets profile.

Looking at User Experiences

Marketing materials and advertised features only tell one side of the story. To get a reality check, we must turn to documented user experiences and reported issues. These firsthand accounts provide crucial insights into how a broker operates in practice, particularly when things go wrong. For Uniglobe Markets, the user feedback paints a concerning picture that aligns with the risks suggested by its lack of regulation.

Withdrawal Issue Claims

One of the most serious complaints a trader can have against a broker is the inability to access their funds. A news exposure report dated September 19, 2025, brought together several major claims from traders. According to the report, users have experienced significant issues, including claims that broker officials “deny your withdrawal requests, giving numerous excuses.” This is a critical claim, as the ability to withdraw profits and principal is fundamental to legitimate trading.

The same report highlights other serious operational problems. Traders reported “constant high slippage” that drained their profits. High slippage, especially if it consistently works against the trader, can indicate unfair execution practices. Furthermore, the issue of “account blockage” was raised, where traders allegedly found themselves locked out of their accounts without clear reasons. These recurring issues have led many affected traders to voice frustration and share negative reviews.

Direct User Feedback

Direct questions and answers from the trading community further validate these concerns. When asked about the cons of trading with the broker, one user directly addressed the core issue: “The main con for me is the lack of regulation...the absence of a regulatory body makes trading with Uniglobe Markets riskier.” This sentiment directly answers the question of whether Uniglobe Markets is legit from a user's risk perspective.

Another user, when asked if the broker is regulated, stated, “Uniglobe Markets is not regulated, which raises concerns for me...the lack of official regulation means there's no oversight to ensure the safety of my funds.” This feedback demonstrates that experienced traders understand the direct link between regulation and fund safety. These are not isolated opinions; they represent a fundamental concern shared by those who have investigated the broker. Prospective traders can read more first-hand reviews and exposure reports on the dedicated Uniglobe Markets page to get a comprehensive idea of the risks.

Looking at Pros and Cons

To bring together all the information, a side-by-side comparison of the broker's advertised features against the verified risks provides a clear, final analysis. This allows for a balanced view, but one where the weight of the evidence falls heavily on one side.

Understanding this balance is straightforward. The “Pros” list consists of standard features that are common across the industry. Items such as MT4/MT5 support, a variety of account types, and high leverage can be found at hundreds of other brokers. However, the “Cons” list contains critical, fundamental flaws that undermine the broker's entire credibility. The lack of regulation is not a minor drawback; it is a deal-breaker for any safety-conscious trader. This, combined with official regulatory warnings and severe user complaints, completely overshadows any of the advertised benefits.

Final Answer

Based on a complete review of the available evidence, Uniglobe Markets cannot be considered a legit or safe broker for traders in 2025. The answer is built on three undeniable facts: a complete lack of valid financial regulation, multiple official warnings and blacklistings from respected European financial authorities, and a significant volume of severe user-reported issues, including withdrawal denials and account blockages.

The risks associated with putting money into an unregulated entity are huge. Without regulatory oversight, there is no guarantee of fund separation, fair trade execution, or a legal path for recovering your capital if the broker acts badly or becomes bankrupt. The advertised benefits, such as high leverage and a range of account types, are insignificant when weighed against the fundamental risk to your entire capital.

As a final piece of advice, the world of online trading has many regulated and reputable options available. We strongly encourage readers to always conduct thorough research on platforms like WikiFX before committing any funds to a broker. Protecting your capital should always be the number one priority, and that starts with choosing a properly regulated broker.

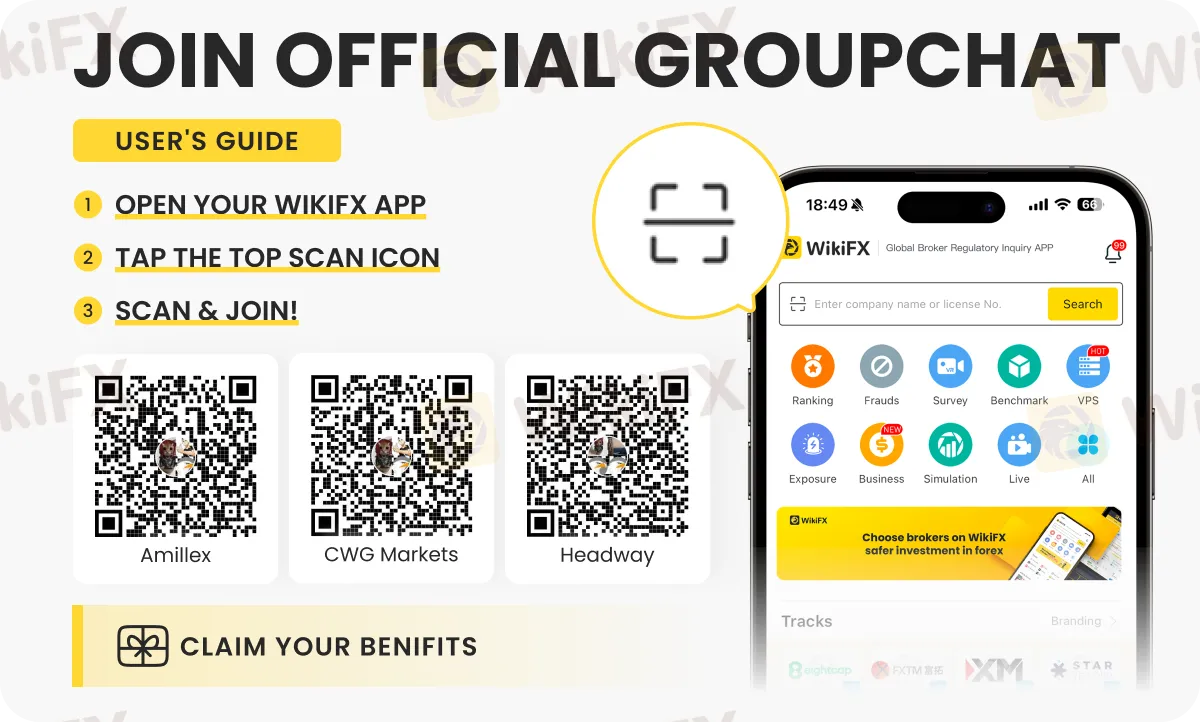

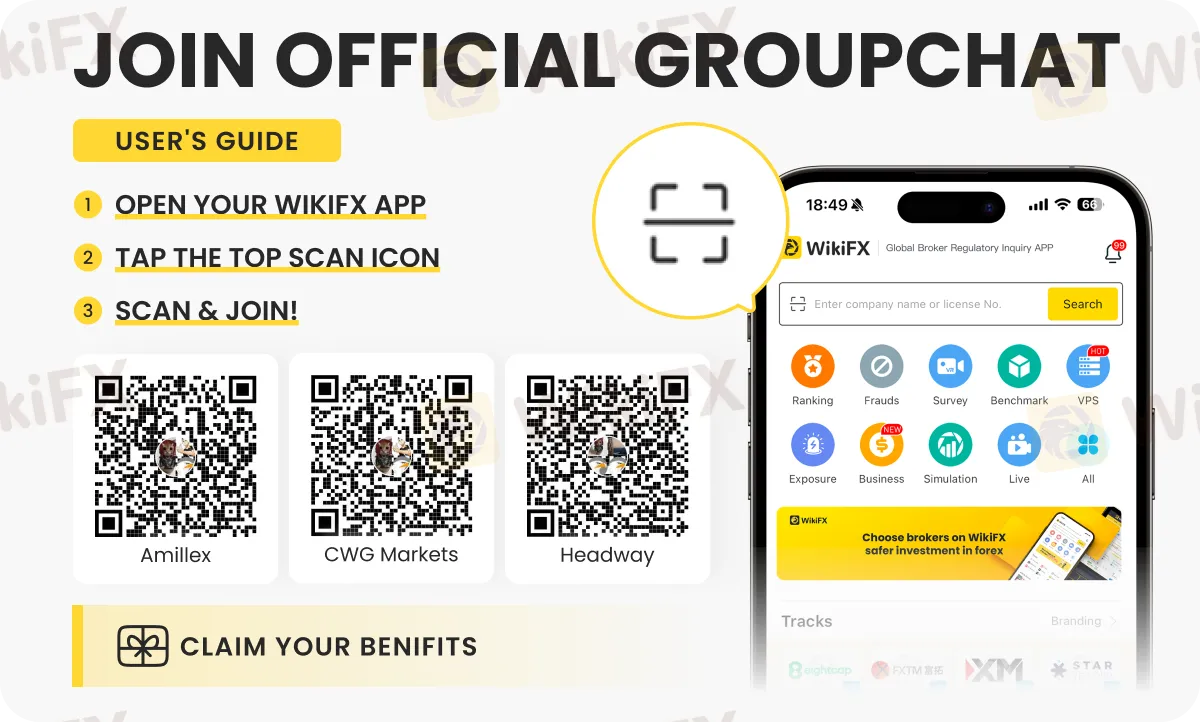

Update - Now you can know more about different forex brokers on any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Just follow the instructions shown below for the same.