Abstract:Inzo Broker presents itself as a modern forex and CFD broker, started in 2021 and registered in Saint Vincent and the Grenadines. At first glance, it offers an attractive package for traders: access to the popular MetaTrader 5 (MT5) and cTrader platforms, different types of accounts for various budget levels, and a wide selection of assets to trade. These features are made to attract both new and experienced traders.

However, a closer look shows a big difference between these advertised benefits and the real risks. The broker works under an offshore regulatory system, which gives limited protection to investors. More importantly, Inzo has collected many serious user complaints, especially about withdrawing funds and changing trading conditions unfairly. This mix of weak oversight and serious user claims creates a high-risk situation that potential clients must carefully think about. This review will break down these parts to give a clear, fact-based view.

Introduction: Benefits vs Dangers

Inzo Broker presents itself as a modern forex and CFD broker, started in 2021 and registered in Saint Vincent and the Grenadines. At first glance, it offers an attractive package for traders: access to the popular MetaTrader 5 (MT5) and cTrader platforms, different types of accounts for various budget levels, and a wide selection of assets to trade. These features are made to attract both new and experienced traders.

However, a closer look shows a big difference between these advertised benefits and the real risks. The broker works under an offshore regulatory system, which gives limited protection to investors. More importantly, Inzo has collected many serious user complaints, especially about withdrawing funds and changing trading conditions unfairly. This mix of weak oversight and serious user claims creates a high-risk situation that potential clients must carefully think about. This review will break down these parts to give a clear, fact-based view.

Regulation and Safety Concerns

A broker's regulatory status is the foundation of trader security. For Inzo Broker, this aspect is a main concern because of its offshore licensing structure. Understanding this system is important for judging the safety of your capital.

Registration and Licensing

Inzo Broker works under two different companies. The parent company, INZO L.L.C., is registered in Saint Vincent and the Grenadines (SVG). It is important to know that the Financial Services Authority in SVG does not regulate forex brokers, making this registration mainly for business purposes. It offers no real regulatory oversight or investor protection for trading activities.

The licensed company is INZO GROUP LTD, which holds a Retail Forex License (No. SD163) from the Seychelles Financial Services Authority (FSA). This officially makes the broker “Offshore Regulated.” While this is a formal license, the Seychelles FSA is not considered a top-level regulator such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These top-level bodies enforce strict compliance rules, including separated client funds and participation in investor compensation programs, which are not guaranteed under an FSA license.

High-Risk Warnings

The broker has been marked for a high number of user complaints across various platforms. These complaints are not small problems but often involve serious claims of financial wrongdoing, which have negatively impacted its overall trust score within the trading community. Given these factors, a formal warning is needed.

*Warning: Trading with an offshore-regulated broker carries a higher level of potential risk. Funds may not be protected by investor compensation programs, and resolving disputes can be challenging. The following information is for reference only, and traders should proceed with caution.*

Trading Accounts and Conditions

Inzo Broker provides a layered account structure designed to accommodate a wide range of traders, from beginners with small capital to institutional-level professionals. While the variety is a positive feature, the trading conditions connected with these accounts have been a significant source of user complaints.

Overview of Account Types

The broker offers six main account types, each with different minimum deposits, leverage, and commission structures. The availability of swap-free (Islamic) accounts for most types is a notable feature for traders seeking compliance with Sharia law. A detailed comparison is the most effective way to understand the offerings.

Leverage: A Double-Edged Tool

Inzo advertises a maximum leverage of up to 1:500, a feature that can be very attractive for traders looking to maximize their market exposure with smaller capital amounts. However, high leverage naturally increases both potential profits and, more importantly, potential losses.

Importantly, this advertised feature is at the center of many user complaints. Multiple traders have reported that after making a deposit, their account leverage was drastically and unilaterally reduced from the promised 1:500 to as low as 1:30 or 1:20. According to these reports, the broker often cites unclear or false regulatory reasons for the change. This practice is not only misleading but can also completely disrupt a trader's strategy and risk management plan, potentially leading to unexpected margin calls and losses.

Instruments, Platforms and Features

A broker's usefulness is also measured by the range of its market access and the quality of its trading technology. Inzo provides a solid offering in this regard, supporting well-regarded platforms and a diverse range of tradable instruments.

Available Trading Markets

Inzo provides access to a comprehensive selection of global markets, allowing traders to diversify their portfolios across different asset classes. The available instruments include:

· Forex: A wide range of major, minor, and exotic currency pairs.

· Indices: Contracts for Difference (CFDs) on major global stock market indices.

· Metals: Trading precious metals such as gold and silver.

· Energy: CFDs on key energy commodities such as oil.

· Stocks: A selection of CFDs on individual company shares.

· Cryptocurrencies: A variety of popular digital currencies.

Trading Platforms: MT5 and cTrader

The broker has chosen to offer two of the industry's leading third-party platforms rather than a proprietary solution, which is generally a positive for traders.

· MetaTrader 5 (MT5): The successor to the legendary MT4, MT5 is known for its powerful charting tools, extensive library of technical indicators, and a vast ecosystem for automated trading via Expert Advisors (EAs). It is a platform well-suited for advanced technical analysis and algorithmic trading.

· cTrader: This platform is praised for its modern, clean, and intuitive user interface. It is particularly noted for its advanced order types, Level II pricing (Depth of Market), and fast execution speeds, making it a favorite among scalpers and discretionary traders.

Additional Services and Promotions

To attract new clients, Inzo offers several additional services. A Copy Trading service is available, allowing beginners to automatically copy the trades of more experienced users. The broker also advertises promotions, including a $30 welcome bonus and a 30% deposit bonus. However, traders should always exercise caution and thoroughly read the terms and conditions associated with any bonus, as they often come with restrictive withdrawal conditions.

To get a live, comprehensive list of tradable instruments and check for any current promotions, we encourage traders to view the Inzo Broker profile directly on WikiFX for the most up-to-date information.

User Experiences: Praise vs Claims

Marketing materials can only tell part of the story. To understand the true nature of a broker, it is essential to analyze the real-world experiences of its clients. In the case of Inzo, the feedback is sharply divided, with a small number of positive reviews being heavily outweighed by a pattern of severe and consistent claims.

The Positive Feedback

A portion of user reviews for Inzo are positive. The recurring themes in this feedback generally focus on the accessibility and basic features of the platform. Common points of praise include:

· Good for Beginners: Some users find it a suitable entry point into the trading world, likely due to the low minimum deposit requirements.

· Customer Support: The 24/6 live chat service is mentioned as being helpful by some clients for resolving basic questions.

· Deposit/Withdrawal Process: A few users have reported a smooth and easy process for both funding and withdrawing from their accounts.

· Copy Trading: The copy trading feature is cited as a useful service for those new to the markets.

The Red Flags: Serious Complaints

Despite the positive remarks, a significant number of users have reported extremely negative experiences. These are not minor issues but form a consistent pattern of claims pointing to potentially misleading and manipulative practices.

· Withdrawal Obstacles: This is the most common and serious complaint. Many traders claim that they are unable to withdraw their funds, especially after generating profits. Reported tactics include the broker demanding multiple video selfies, which are then repeatedly rejected without a clear reason. Some users claim to be forced into video conferences with numerous staff members, where they are subjected to repetitive and intrusive questioning. The overall theme is one of creating impossible bureaucratic hurdles to prevent withdrawals.

· Sudden Changes to Trading Conditions: Another critical pattern involves the broker allegedly changing trading conditions after a client has deposited funds. This includes:

· Leverage Manipulation: As mentioned earlier, traders report having their leverage cut from an advertised 1:500 to as low as 1:20, with the broker blaming non-existent regulatory rules.

· Market and Instrument Manipulation: There are multiple detailed accounts of the broker suddenly changing available trading pairs, dramatically widening spreads, or introducing significant slippage, particularly after a deposit is made or when a trader is in a profitable position. Some have even reported their open trades being closed without authorization.

· Misleading Support and Lack of Transparency: While some users praise the support, those facing serious issues report a completely different experience. They claim the live chat support provides misleading information, outright lies about terms and conditions, and is ultimately useless in resolving critical problems such as blocked withdrawals or manipulated leverage.

Deposits, Withdrawals and Fees

The ease and transparency of moving funds into and out of a trading account are fundamental aspects of a broker's service. While Inzo offers a modern range of payment methods, this area is undermined by a lack of transparency and is connected directly to the most severe user complaints.

Supported Payment Methods

Inzo provides a decent variety of funding options to cater to a global client base. The accepted methods include:

· Credit/Debit Cards: VISA, MasterCard

· Cryptocurrencies: Bitcoin, Ethereum, Tether

· E-wallets: Payeer, Voucherry

Lack of Clarity on Fees

A significant red flag is the lack of clear, accessible information regarding transaction costs. While the deposit and withdrawal methods are listed, the official website and supporting documentation fail to provide specific details on withdrawal fees or standard processing times. This lack of transparency is a major point of concern, as traders cannot accurately assess the full cost of using the service.

Connecting to User-Reported Issues

The listed payment methods are meaningless if the withdrawal process itself is blocked. It is crucial to repeat that, despite offering modern options such as crypto and e-wallets, the single most common complaint against Inzo is the inability of users to withdraw their capital. The claims of endless verification loops and blocked withdrawals directly contradict any notion of an “easy and smooth” process, suggesting the advertised convenience may not reflect the reality for profitable traders.

Conclusion: A Balanced Verdict

After a thorough examination of Inzo Broker's services, regulatory standing, and user feedback, a clear but troubling picture emerges. The broker's offerings are a study in contrasts, where appealing features are consistently undermined by high-risk factors and serious claims.

Inzo Broker: Pros vs Cons

Final Verdict

On paper, Inzo Broker presents an attractive proposition, particularly for new traders, with its low barrier to entry, modern platforms, and diverse asset selection. However, these benefits are heavily overshadowed by the fundamental risks associated with the broker.

The combination of a weak offshore regulatory license from the Seychelles FSA and a consistent, documented pattern of severe user claims is impossible to ignore. The complaints are not trivial; they focus on the core functions of a broker, including the ability to withdraw funds and the provision of fair and stable trading conditions. The reports of leverage manipulation, blocked withdrawals, and misleading support suggest a high-risk environment where client interests may not be protected.

Therefore, we strongly advise extreme caution. The risks appear to substantially outweigh the potential rewards. Potential traders should perform thorough research, and you can review the latest user complaints and check the broker's live regulatory status on WikiFX before committing any funds.

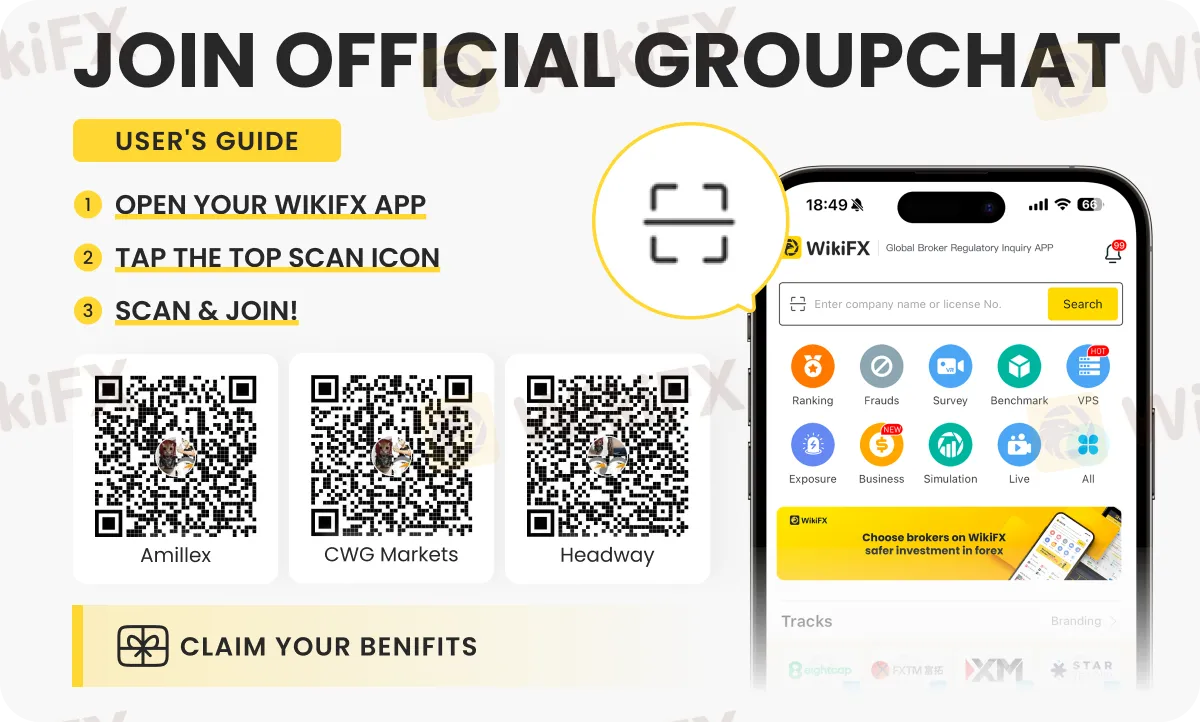

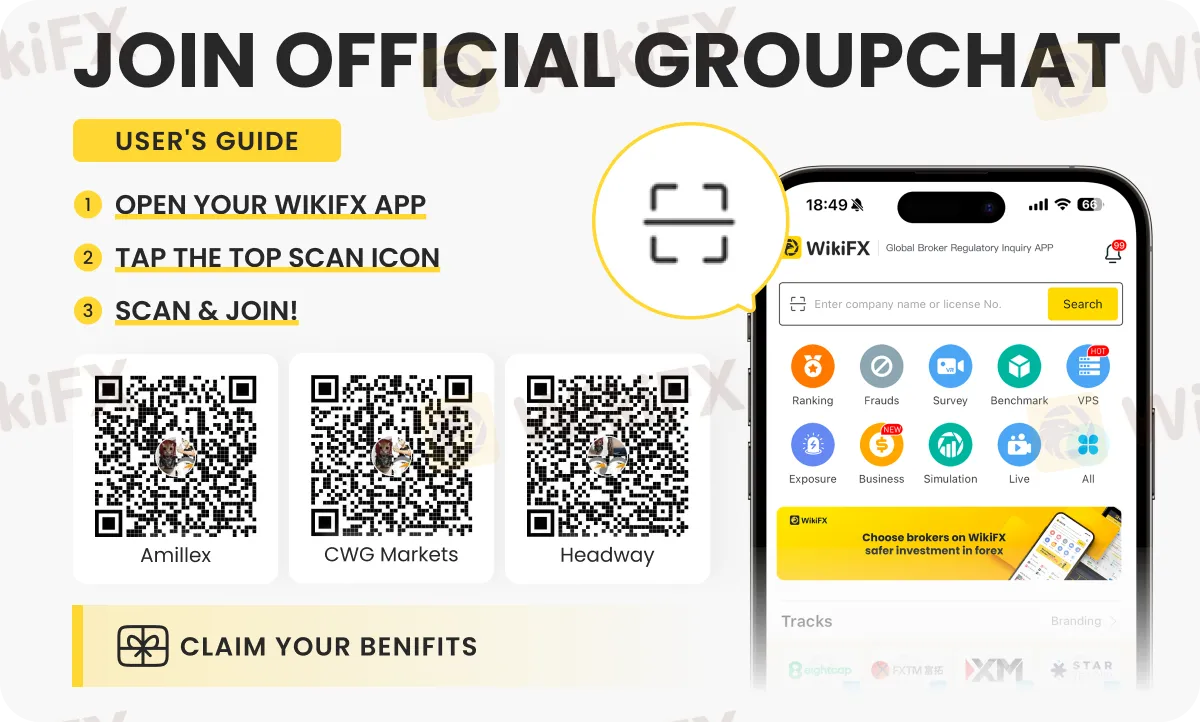

For more information about different brokers, be part of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.