简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GGCC Review: An In-Depth Analysis for Experienced Traders

Abstract:In the competitive landscape of forex and CFD brokerage, traders are tasked with the critical job of distinguishing credible, long-term partners from high-risk operations. This GGCC review provides a comprehensive, data-driven examination of GLOBAL GOLD & CURRENCY CORPORATION (GGCC), an online broker that has been in operation for 2-5 years. Aimed at experienced traders who prioritize capital safety and a fair trading environment, this analysis delves into the broker's corporate structure, regulatory standing, trading conditions, and client feedback, drawing primarily from verified information compiled by the global broker inquiry platform, WikiFX.

In the competitive landscape of forex and CFD brokerage, traders are tasked with the critical job of distinguishing credible, long-term partners from high-risk operations. This GGCC review provides a comprehensive, data-driven examination of GLOBAL GOLD & CURRENCY CORPORATION (GGCC), an online broker that has been in operation for 2-5 years. Aimed at experienced traders who prioritize capital safety and a fair trading environment, this analysis delves into the broker's corporate structure, regulatory standing, trading conditions, and client feedback, drawing primarily from verified information compiled by the global broker inquiry platform, WikiFX.

While GGCC presents itself with a professional website and the popular MetaTrader 5 (MT5) platform, a deeper investigation reveals significant concerns that any serious trader must consider before committing capital. This review will systematically unpack the available data to build a clear picture of what it's like to trade with GGCC, moving beyond marketing claims to focus on the facts that truly matter for a sustainable trading career.

GGCC Corporate Profile and Regulatory Standing: The Core Concern

A broker's regulatory status is the bedrock of its trustworthiness. It determines the level of protection a trader has, the rules the broker must follow regarding client funds, and the avenues available for dispute resolution. In this crucial area, GGCC falls critically short.

According to data verified by WikiFX, GLOBAL GOLD & CURRENCY CORPORATION is registered in the offshore jurisdiction of Saint Lucia. While not illegal, offshore registration is a common tactic for brokers wishing to operate with minimal oversight and lower capital requirements compared to top-tier regulatory hubs. The company, Global Gold and Currency Corporation Limited, lists a physical address Ground Floor, The Sotheby Building Rodney Bay, Gros Islet Castries, Saint Lucia. It provides a Saint Lucian contact number +1-202-773-7152 creating a complex jurisdictional picture that can complicate legal recourse for clients.

The most alarming finding, however, is the broker's complete lack of valid regulation. WikiFX explicitly states, “It has been verified that this broker currently has no valid forex regulation. Please be aware of the risk!” This means GGCC is not licensed or supervised by any reputable financial authority such as the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC).

The implications of trading with an unregulated broker are severe:

• No Segregation of Client Funds: Regulated brokers are required to hold client money in accounts separate from their own operational funds. Without this mandate, there is a risk that client deposits could be used for the broker's business expenses, placing them in jeopardy if the company faces financial difficulty.

• No Investor Compensation Scheme: Traders with regulated brokers are often protected by an investor compensation fund (e.g., FSCS in the UK) that can reimburse them up to a certain limit if the broker becomes insolvent. GGCC clients have no such safety net.

• No Independent Dispute Resolution: If a trader has a dispute with GGCC over a trade execution or a withdrawal, there is no official ombudsman or regulatory body to appeal to for a fair and binding resolution.

Reflecting these grave risks, GGCC holds an extremely low score of 1.90 out of 10.0 on WikiFX. This score is accompanied by a direct and unambiguous warning: “Low score, please stay away!” For any experienced trader, the absence of regulation is a non-negotiable red flag, and this finding alone positions GGCC as a high-risk entity.

Analysis of Trader Complaints and User Experience

While a lack of regulation is a theoretical risk, user-generated exposure reports provide practical evidence of how a broker operates. The WikiFX portal contains numerous verified complaints against GGCC, painting a troubling picture of the client experience. These reports, primarily from traders in India and Pakistan, highlight recurring issues in the most critical areas of the broker-client relationship.

Widespread Withdrawal Problems

The single most important function of a broker, after executing trades, is to process withdrawals promptly. This is where GGCC appears to fail its clients consistently. Verified complaints detail a pattern of severe withdrawal difficulties:

• Delayed and Pending Withdrawals: Multiple users report that their withdrawal requests remain “pending” for extended periods, far beyond the 24-hour timeframe sometimes promised by customer service.

• Unresponsive Customer Service: A common theme is that after a withdrawal is requested, the broker's customer service team becomes unresponsive, leaving clients with no information or recourse.

• Disappearing Funds: One trader from India reported that after initiating a withdrawal, the funds were deducted from their trading dashboard but never received, effectively vanishing.

• Stalling Tactics: A particularly detailed complaint describes a deliberate stalling strategy involving endless verification requests. The user claims that after submitting all required documents (ID, utility bills, bank statements, etc.), the broker would go silent for days before demanding new, often random, forms of verification in a clear effort to frustrate and delay the withdrawal process.

Poor Trading Execution and Severe Slippage

Beyond fund safety, trade execution quality is paramount. Here too, GGCC faces significant criticism. Several traders have reported experiencing severe slippage, which is when an order is executed at a price different from the requested price. While some slippage is normal in volatile markets, the complaints suggest it is excessive and consistently negative at GGCC.

One user from Pakistan noted that the slippage “erodes my confidence in their platform,” feeling that their orders were being mishandled. Another trader from India warned that their account was “blown” due to extreme slippage on high-volatility assets like Gold (XAU/USD). They stated that their stop-loss orders were triggered at significantly worse prices, leading to catastrophic losses. This user's advice was stark: “If you must use GGCC don't trade high volatility assets... Better still avoid using them.”

Prohibitive Costs and Account Issues

Complaints also touch upon the cost of trading. One user referred to the broker's spreads as “criminal,” suggesting that the trading costs are far higher than advertised. When combined with severe negative slippage, this creates a trading environment where achieving profitability is exceptionally difficult.

Furthermore, one report details a trader being unable to log in to their account after incurring significant losses, preventing them from attempting to withdraw any remaining balance. This raises concerns about the broker potentially deactivating unprofitable client accounts to prevent withdrawals.

A Note on Positive Reviews

It is worth noting that the WikiFX profile for GGCC does contain two positive, but “unverified,” reviews. One from Ukraine praises “excellent” service and “speed of light” withdrawals, while another from the Netherlands compliments the easy deposit process and helpful support. However, these brief, unverified comments stand in stark contrast to the volume and detail of the verified negative complaints. Experienced traders should weigh the evidence, giving more credence to verified reports that describe specific, recurring, and severe issues.

GGCC Trading Environment: A Closer Look at Accounts and Platforms

A GGCC broker review for traders would be incomplete without examining the tools and conditions offered. While the broker provides access to a leading platform, the underlying technical infrastructure and account terms reveal further weaknesses.

Trading Platform: A Licensed MT5 with a Caveat

GGCC offers its clients the MetaTrader 5 (MT5) platform, for which it holds a full license. MT5 is an industry-standard platform revered for its advanced charting tools, support for algorithmic trading via Expert Advisors (EAs), and multi-asset capabilities. The fact that GGCC has a full license suggests a degree of technical maturity and access to proper support for the platform itself.

However, a platform license is a commercial agreement with MetaQuotes Software and is in no way a substitute for financial regulation. More importantly, the quality of the trading experience on MT5 is heavily dependent on the broker's server infrastructure. WikiFX data reveals several concerns here:

• Server Location: The broker's server, GlobalGoldCurrency-Server, is located in France.

• High Latency: The measured ping to the server is 187 ms, and the average execution speed is a slow 212.00 ms.

For traders, especially those located far from Europe (such as in India, the broker's main business area), this high latency can be a significant disadvantage. Slow execution speeds increase the likelihood of slippage and requotes, directly impacting profitability. These technical metrics align perfectly with the user complaints regarding poor trade execution.

Account Structure and Trading Conditions

GGCC advertises five different account types: Micro, Standard, Foresight, Premium, and Master. This tiered structure suggests an attempt to cater to different types of traders. However, detailed information is only available for the top-tier “Master” account, which requires a minimum deposit of $2000.

This minimum deposit is exceptionally high for an unregulated, offshore broker. It places a significant amount of client capital at risk from day one. Other advertised conditions for this account include:

• Maximum Leverage: 1:300

• Minimum Spread: From 0.9 pips

• Commission: No

The “from 0.9 pips” spread is a marketing figure that represents the best-case scenario. It does not contradict user reports of “criminal spreads” in real-world trading conditions. The zero-commission model confirms that GGCC operates as a market maker, profiting directly from the bid-ask spread, which can create a conflict of interest with its clients.

Available Instruments

The broker offers a wide range of tradable instruments, including Forex, Commodities, Cryptocurrencies, Stocks, and Indices. On the surface, this is an attractive feature. However, the value of a broad product range is completely undermined if the execution environment is hostile and the withdrawal of profits is uncertain.

Safety, Influence, and Market Presence

A broker's standing in the industry is a reflection of its business practices. GGCC's market presence and influence metrics are as concerning as its regulatory status. The broker has an Influence Index rating of 'D' on WikiFX, which is a low score indicating minimal impact and recognition in the global market.

The data also shows that GGCC surpasses only 19% of the brokers listed on the platform, meaning a staggering 81% of its competitors have a better overall rating. The broker's primary business area is identified as India, which correlates directly with the geographic origin of the most severe complaints. This suggests a business model focused on attracting clients in jurisdictions with less stringent local regulations, where traders may be more vulnerable.

For traders conducting their own due diligence, a visit to the WikiFX platform can provide a real-time view of GGCC's regulatory status, detailed user exposure reports, and its current score.

GGCC Review: Strengths vs. Overwhelming Weaknesses

To summarize this GGCC review, it is helpful to weigh the broker's few potential advantages against its numerous, significant drawbacks.

Potential Strengths

• Full MetaTrader 5 License: Provides access to a powerful and familiar trading platform.

• Wide Range of Assets: Offers a diverse selection of instruments across multiple asset classes.

• Tiered Account Structure: Theoretically offers different account types for various trader needs.

Documented Weaknesses

• Complete Lack of Valid Regulation: This is a critical failure that exposes clients to immense risk.

• Extremely Low Trust Score: A WikiFX score of 1.90/10 signals a fundamental lack of reliability.

• Severe and Verified Withdrawal Issues: A consistent pattern of clients being unable to access their funds.

• Widespread Reports of Poor Execution: Documented complaints of excessive slippage leading to major losses.

• High-Risk Deposit Requirements: A $2000 minimum deposit for the Master account is inappropriate for an unregulated entity.

• Offshore Registration: The Saint Lucia incorporation offers virtually no protection for traders.

• Poor Technical Performance: High server latency and slow execution speeds contribute to a poor trading experience.

Final Verdict: A High-Risk Proposition for Traders

GLOBAL GOLD & CURRENCY CORPORATION is a broker that, despite offering the MT5 platform, is defined by its most critical failing: a complete absence of credible financial regulation. This single fact is the source of almost every other major issue identified in this review. The lack of oversight enables the poor practices reported by its clients, from the failure to process withdrawals to a trading environment plagued by slippage.

The numerous, verified complaints are not isolated incidents but form a consistent pattern of behavior that directly harms traders and puts their capital at extreme risk. The high minimum deposit, offshore registration, and poor technical performance only serve to compound these fundamental problems.

While the decision to use a broker is personal, the evidence strongly suggests that GGCC does not meet the minimum standards of safety, reliability, and fairness required for long-term trading. The risks associated with depositing funds with this entity are substantial and, based on the available data, far outweigh any perceived benefits of its platform or asset range.

Ultimately, the decision rests with the individual trader, but before committing

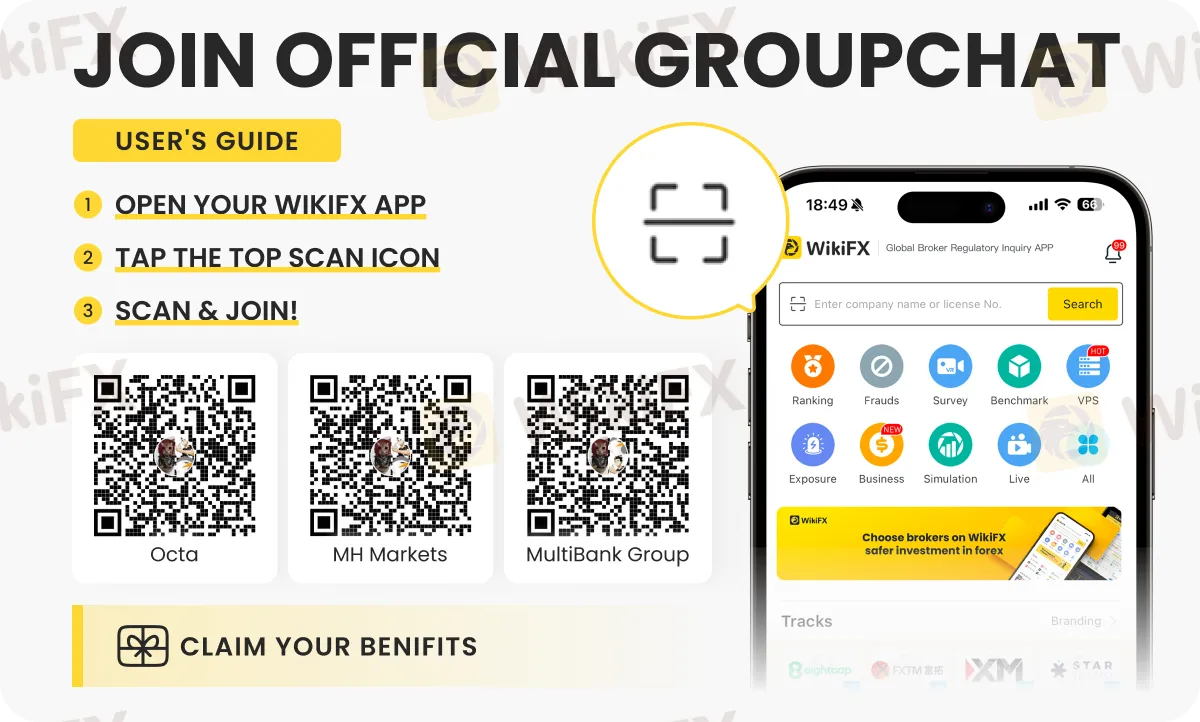

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Situation In Venezuela Adds To Dollar Uncertainty

EURUSD Fails to Make New Highs

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

RM2.95 Million Gone: Terengganu Director Falls for ‘High-Return’ Scam

Trade War Crossroads: Supreme Court Ruling and Tariff Maze Threaten Economic Stability

Dollar Reigns Supreme: Economic Resilience Eclipses Political Noise Ahead of

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

The 'Just-in-Case' Era: Strategic Hoarding Ignites Commodity Supercycle

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Top Forex Brokers Offering Free Demo Accounts

Currency Calculator