Abstract:When thinking about a new forex broker, the main question on any trader's mind is about security. This brings us to an important question: Is Tauro Markets a safe platform for your capital? This complete 2025 analysis aims to give a clear answer by breaking down the main parts of broker safety. We will do a thorough Tauro Markets safety evaluation, looking beyond surface marketing, to examine the facts.

Our deep look will carefully examine the broker's most important safety foundations. We will start with its regulation, the essential foundation of trust. We will then look into its operational transparency, including the company structure behind the brand and how accessible its services are. Finally, we will check its trading conditions and funding processes to find any potential warning signs that could affect your financial security. This fact-based review is designed to give you the information you need to make a smart decision.

When thinking about a new forex broker, the main question on any trader's mind is about security. This brings us to an important question: Is Tauro Markets a safe platform for your capital? This complete 2025 analysis aims to give a clear answer by breaking down the main parts of broker safety. We will do a thorough Tauro Markets safety evaluation, looking beyond surface marketing, to examine the facts.

Our deep look will carefully examine the broker's most important safety foundations. We will start with its regulation, the essential foundation of trust. We will then look into its operational transparency, including the company structure behind the brand and how accessible its services are. Finally, we will check its trading conditions and funding processes to find any potential warning signs that could affect your financial security. This fact-based review is designed to give you the information you need to make a smart decision.

Main Safety Concern: Regulation

The most important factor in deciding if a broker is safe is its regulatory status. This is not just a preference but a basic requirement for protecting traders. A license from a respected financial authority ensures oversight, following strict operational standards, and a safety net for client funds. In this section, we analyze Tauro Markets' position in this critical area.

Confirmed Status: Unregulated

Our investigation confirms a critical finding: Tauro Markets holds no valid regulatory licenses from any recognized financial authority. The complete absence of regulation is the biggest risk a trader can face. This status is shown in its extremely low safety score, which currently stands at 1.31 out of 10. This number serves as a clear warning, placing the broker in the highest risk category. A broker operating without regulatory oversight works outside the established framework designed to protect investors, leaving clients completely exposed. This lack of regulatory oversight means the broker is not accountable to any higher authority for its business practices, a fact that should be the main consideration for any potential user.

What No Regulation Means

Understanding what “unregulated” means in practical terms is essential for assessing the real-world risks. For a trader using an unregulated platform, such asTauro Markets, the consequences are direct and severe.

· No Client Fund Protection: Regulated brokers are typically required by law to hold client funds in separate accounts, apart from the company's operational capital. This ensures that if the broker becomes insolvent, the clients funds are protected and cannot be used to pay company debts. Without regulation, Tauro Markets has no legal obligation to separate funds, meaning your capital could be mixed with its own and be at extreme risk.

· No Dispute Resolution System: If a dispute arises—for instance, regarding a trade execution, a platform error, or a withdrawal request—traders with regulated brokers can appeal to the financial authority for mediation or a binding resolution. With an unregulated broker, you have no such option. Your only choice is to deal directly with the company, which holds all the power, or pursue costly and complex international legal action with a low probability of success.

· Lack of Oversight: Reputable regulators continuously monitor brokers to ensure fair pricing, transparent business practices, and ethical marketing. They conduct audits and can impose fines or revoke licenses for misconduct. An unregulated broker operates without this vital supervision. There is no one to ensure their spreads are fair, their order execution is not manipulated, and their platform is stable and secure.

Location Analysis: SVG

Tauro Markets is registered in Saint Vincent and the Grenadines (SVG). While this is a legitimate country, its Financial Services Authority (FSA) has publicly and repeatedly stated that it does not regulate, license, or supervise international business companies (IBCs) that engage in forex trading or brokerage activities.

This location has become a popular choice for offshore brokers precisely because of this lack of oversight. Registering a company in SVG is a simple, low-cost process that allows firms to operate a forex brokerage without meeting any of the strict capital, reporting, or client protection requirements mandated by top-tier regulators such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Therefore, the registration of Tauro Markets in Saint Vincent and the Grenadines offers no protection or credibility whatsoever to international clients. It is, for all practical purposes, equivalent to being completely unregulated.

Operational Transparency and Background

Beyond regulation, a broker's trustworthiness can be measured by its company transparency. This involves a clear and verifiable company structure, accessible legal documentation, and reliable communication channels. A lack of transparency in these areas often signals underlying operational problems and increases the risk for traders.

The Company: JM Financial

The entity operating the Tauro Markets brand is identified as JM Financial LLC. Further investigation reveals an associated company with the same name registered in Michigan, USA. This US-based entity, established on September 12, 2023, is marked with an “Abnormal” status in company registries.

This is a significant red flag. While the specific reasons for an “Abnormal” status are not publicly detailed, it generally indicates inconsistencies, a failure to file required documents, or other compliance issues with state authorities. For a financial services company, any such irregularity in its company registration is a major cause for concern and warrants extreme caution from potential clients. The recent establishment date also suggests a very limited operational history, which further undermines claims of experience and reliability.

Website and Communication Concerns

During our 2025 review, we noted that the official website for the broker, `https://www.tauromarkets.com/`, was consistently inaccessible. This is a critical failure for any online business, but it is especially alarming for a financial services provider. An inaccessible website prevents users from performing the most basic research, such as reviewing the terms and conditions, accessing legal policies, or even opening an account. It also raises serious questions about the company's operational viability and technical competence.

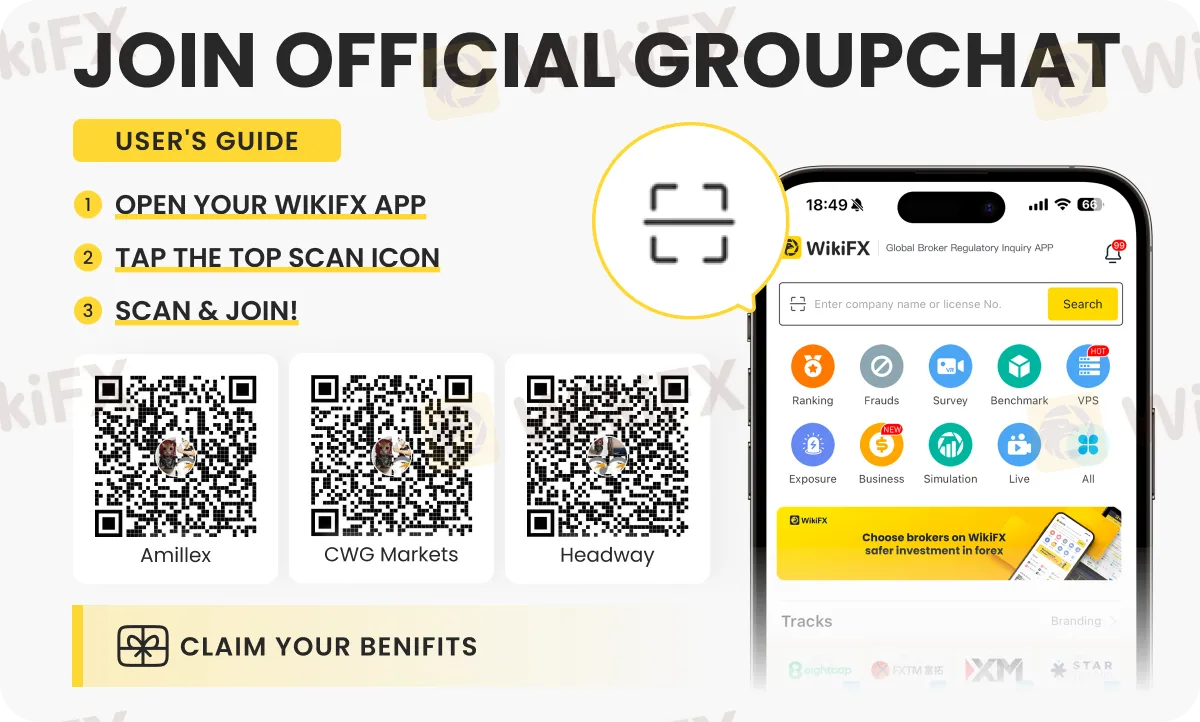

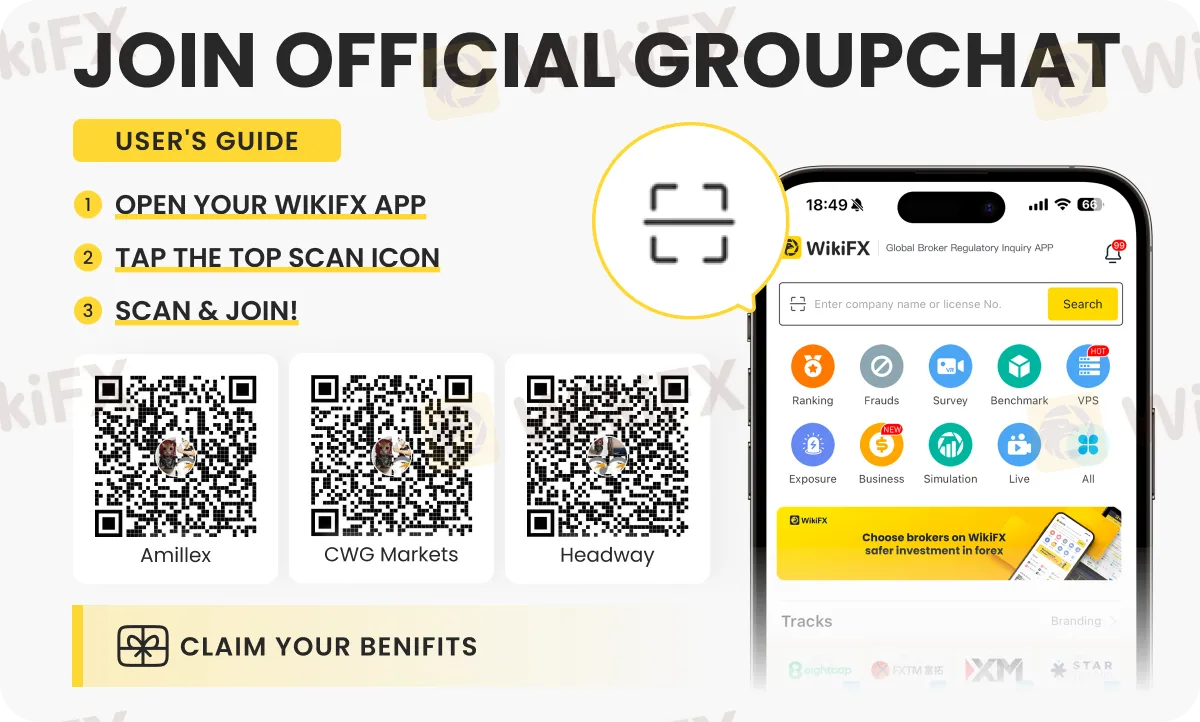

The only listed contact method is a support email, `support@tauromarkets.com`. The absence of a constantly functional website, a physical office phone number, or a responsive live chat severely limits a client's ability to get support, especially in an emergency. This lack of accessible communication channels creates an environment of opacity and significantly damages the broker's credibility. To verify the current status of the broker's website and company details, traders can check the live-updated profile for Tauro Markets on WikiFX.

Trading Accounts and Conditions

While the regulatory and company red flags are most important, an analysis of the trading conditions offered can provide further insight. Often, high-risk brokers attract clients with attractive-sounding terms that may not be sustainable or transparent. We will now objectively review the trading environment promised by Tauro Markets.

Account Types and Minimums

Tauro Markets presents three distinct account levels designed to appeal to different types of traders. The structure is straightforward, with varying spreads and commissions based on the initial deposit. A low entry barrier is set with the Classic account, requiring only a $100 minimum deposit, a common tactic to attract new traders.

The Raw account, with its promise of zero-pip spreads for a commission, is designed to attract experienced traders or those using automated strategies. However, the attractiveness of these conditions must be weighed against the fundamental lack of safety and regulation.

Trading Platforms and Tools

The broker provides access to the globally recognized MetaTrader 4 (MT4) platform, available for Windows, iOS, and Android, as well as a proprietary WebTrader. The inclusion of MT4 is a standard and generally positive feature, as it is a platform familiar to millions of traders, known for its stability and extensive charting tools.

However, the platform offering is not without its limitations. While the inclusion of the industry-standard MT4 platform is a positive, traders who prefer the advanced features of MT5 will find their options limited here. This is a point of feedback noted by other users who seek more advanced analytical tools and order types available on the newer platform. The proprietary WebTrader's features and reliability cannot be independently verified due to the inaccessible website.

A Critical Missing Feature: No Demo

A glaring and significant drawback is the fact that Tauro Markets does not offer a demo account. This is a major departure from industry best practices. Demo accounts are an essential tool, allowing prospective clients to test a broker's platform, execution speeds, spread stability, and overall trading environment without risking real capital.

The absence of a “try before you buy” option is a serious red flag. It can be interpreted as a lack of confidence on the broker's part in its own technology and pricing. It forces traders to deposit real capital to experience the platform, putting their funds at immediate risk without any trial period. For a broker with so many other safety concerns, this lack of a demo account further reduces any potential for building trust. Users can explore the detailed breakdown of account features and platform availability on the Tauro Markets page to see how it compares with other brokers.

Deposits, Withdrawals, and Security

The process of funding an account and, more importantly, withdrawing profits and capital is a major concern for traders. Transparency, speed, and reliability in financial transactions are hallmarks of a trustworthy broker. This section examines Tauro Markets' processes for handling client money.

Supported Payment Methods

Tauro Markets lists several common and convenient payment methods for deposits and withdrawals. The accepted channels include:

· Visa

· Wire Transfer

· MasterCard

While these methods are standard in the industry, the mere availability of these options does not guarantee the safety or efficiency of the transactions. The crucial details lie in the policies and procedures governing these payments.

Red Flag: Fee Confusion

A major operational risk emerges from the complete lack of transparency regarding transaction-related details. Crucial information concerning deposit and withdrawal processing times, as well as any associated fees for either funding or retrieving capital, is unknown and not disclosed.

This confusion is a serious red flag. Reputable brokers provide clear, detailed schedules of all potential costs and expected timelines for transactions. This lack of clarity is a point of friction for traders. As one user highlighted, while the payment methods are convenient, not knowing the processing times or potential fees makes financial planning impossible and introduces significant uncertainty into the withdrawal process. This opacity creates a risk that traders may face unexpected charges or extensive, unexplained delays when attempting to access their funds.

*Disclaimer: As this information is unverified and subject to change, users should be aware that unexpected fees or long delays in withdrawals are a potential risk when dealing with a broker that fails to provide this essential information upfront.*

Summary of Findings

After a thorough examination of Tauro Markets' regulation, company structure, trading conditions and financial processes, we can combine our findings to provide a clear and decisive conclusion on its safety.

Pros and Cons Summary

To provide a balanced view, we have summarized the key points from our investigation into a simple pros and cons list. This allows for a quick comparison of the broker's offerings against its significant drawbacks.

Pros:

· Wide range of tradable instruments (Forex, Indices, Metals, etc.)

· Access to the popular MT4 trading platform

· Low minimum deposit of $100 for the Classic account

Cons:

· Completely unregulated (major safety risk)

· Registered in an offshore location (SVG) with no forex oversight

· Parent company (JM Financial LLC) has an “Abnormal” status

· Official website is inaccessible, indicating operational issues

· No information on withdrawal fees or processing times

· No demo account available for platform testing

Final Decision on Safety

The final decision on Tauro Markets safety is clear. While the broker presents some superficially attractive features, such as a low entry deposit, the MT4 platform, and tight spreads on its Raw account, these are completely overshadowed by fundamental and non-negotiable safety deficiencies.

The single most important factor is the broker's unregulated status. Operating without oversight from any credible financial authority removes all standard protections that traders should expect in the modern market. This risk is made worse by severe transparency issues, including an inaccessible website, an associated company with an “Abnormal” legal status, and a complete lack of clarity on withdrawal procedures and fees.

Given the combination of no valid regulation, a lack of operational transparency, and severe communication barriers, traders must weigh the potential benefits against these substantial risks. The evidence strongly suggests a high-risk environment for client funds, where traders have no recourse in the event of a dispute and no guarantees regarding the security of their capital.

For the most current information, including any new regulatory updates or user exposure reports, we recommend that traders research by regularly checking the broker's detailed profile on a verification platform, such as WikiFX, before committing any funds.