IG Adopts AI to Strengthen UK Marketing Compliance

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:GMI Markets, an FCA‑regulated forex broker, will cease global operations on Dec 31, 2025. Clients must withdraw funds by January 31, 2026.

London, UK – December 18, 2025 – WikiFX has received confirmation that GMI Markets, a forex and CFD broker regulated by the UKs Financial Conduct Authority (FCA), will end all operations globally on December 31, 2025.

The company, established in 2009, announced that the decision follows difficulties in finding a successor to lead the firm. The current management cited health concerns and retirement plans, noting that while several financial institutions expressed interest in acquiring GMI, none met the companys requirements for operational integrity. The announcement stressed that client safety was prioritized over transferring ownership to a party that might pose risks in the future.

GMI Markets has outlined the following schedule for clients:

The broker stated that it will gradually process client withdrawals during the liquidation period. This means clients will have a window of time to recover their funds, rather than an immediate one‑time settlement. WikiFX will continue to monitor this matter to ensure that the withdrawal process is carried out as promised and that clients are not left with unresolved claims.

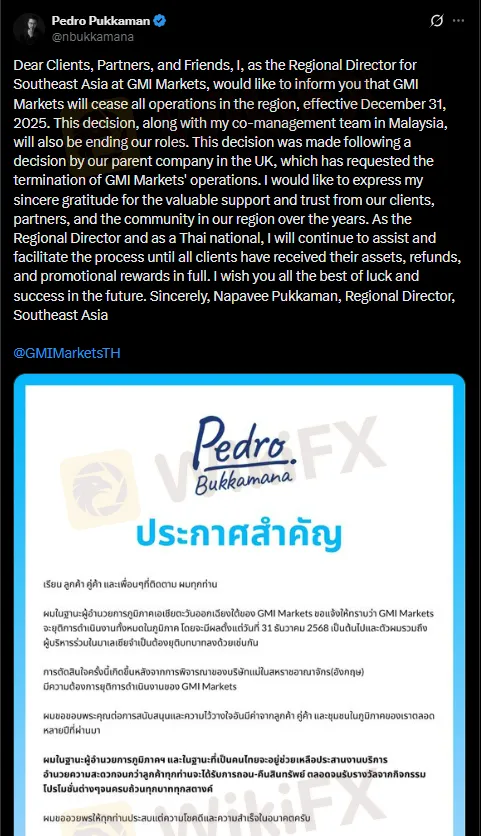

Napavee Pukkaman, Regional Director for Southeast Asia, confirmed that operations in Malaysia and other regional offices will also close on December 31, 2025. She indicated that her team will assist clients until all assets and refunds are processed. The regional statement emphasized that communication channels will remain open during the transition, allowing clients to seek clarification and support.

GMI Markets operates under FCA license No. 677530 in the United Kingdom, with a Straight Through Processing (STP) license type. The license has been active since November 23, 2015. The FCA regulation means that GMI has been subject to oversight in areas such as client fund protection and operational standards, though the closure decision itself is a business choice rather than a regulatory directive.

The broker has offered trading in several asset classes, including:

Cryptocurrencies, bonds, options, and ETFs were not part of its product offering. This limited scope reflected GMIs focus on traditional forex and CFD markets rather than newer digital assets.

The companys pledge to gradually process withdrawals is a key point for traders who may be concerned about the safety of their balances. WikiFX will continue to track developments and report on whether GMI fulfills its obligations. For now, clients are advised to submit withdrawal requests promptly and maintain records of their communications with the broker.

Established in 2009, GMI Markets became a leading global forex and CFD broker, serving over 1 million traders worldwide. The company is regulated by the UKs Financial Conduct Authority (FCA) and has been recognized for its advanced trading technology, low‑cost solutions, and client fund safety.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and fraudulent practices. Stay vigilant and protect your funds.

When traders think about choosing a new broker, two main questions come up: Is ZarVista safe or a scam? And what are the common ZarVista complaints? These questions get to the heart of what matters most—keeping your capital safe. This article gives you a detailed look at ZarVista's reputation using public information, government records, and real experiences from people who used their services. Our research starts with an important fact that shapes this whole review. WikiFX, a website that checks brokers independently, gives ZarVista a trust score of only 2.07 out of 10. This very low rating comes with a clear warning: "Low score, please stay away!" The main reason for this low score is the large number of user complaints. This finding shows that ZarVista might be risky to use. To get the complete picture, we will look at the broker's government approval status, examine the specific complaints from users, check any positive reviews to be fair, and give you a final answer based on fact