简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bull Waves Review 2025: An Honest Look at the High-Risk, High-Reward Trading Platform

Abstract:Bull Waves is a new trading company that started in 2023 and has quickly gotten a lot of attention. Many traders like it because it offers many different things to trade and focuses on social trading features. However, there's one big problem: it's regulated offshore, which means less protection for traders. This mix of good and bad features makes it important to look closely at this company. This complete Bull Waves review will examine how it works and give you facts about what's good and what's bad. We'll look at its rules and regulations, trading conditions, fees, and what users say about it to give you a clear picture. Before you put your money with any trading company, especially one like this, you need to research it carefully—this isn't just a good idea, it's absolutely necessary.

Is Bull Waves the Right Choice for You?

Bull Waves is a new trading company that started in 2023 and has quickly gotten a lot of attention. Many traders like it because it offers many different things to trade and focuses on social trading features. However, there's one big problem: it's regulated offshore, which means less protection for traders. This mix of good and bad features makes it important to look closely at this company. This complete Bull Waves review will examine how it works and give you facts about what's good and what's bad. We'll look at its rules and regulations, trading conditions, fees, and what users say about it to give you a clear picture. Before you put your money with any trading company, especially one like this, you need to research it carefully—this isn't just a good idea, it's absolutely necessary.

Rules and Regulations: How Safe Is Your Money?

The most important question for any trader is whether their money is safe. For Bull Waves, this comes down to what rules and regulations control it. This section looks carefully at its license and what this really means for you as a trader.

Understanding Offshore Regulation

Bull Waves works under the name Equitex Capital Limited. This company is controlled by the Seychelles Financial Services Authority (FSA) with license number SD185. This is called offshore regulation. According to expert analysis from sites like DayTrading.com, this type of oversight is in a “Red-level” trust category, which means it has weaker rules and less protection for investors compared to top-level authorities. Top-tier regulators, like the UK's FCA or Australia's ASIC, have stricter rules and often provide money to investors if a broker goes out of business. Bull Waves, because of where it's regulated, doesn't offer this kind of protection fund.

| Feature | Bull Waves (Seychelles FSA) | Top-Level Regulators (like FCA, ASIC) |

| How Strict the Rules Are | Lower | High |

| Money Protection Fund | Not Available | Often Available (like FSCS, ICF) |

| Financial Openness | Low (Not publicly listed) | High (Must share financial information publicly) |

| Trust Rating | “Red-level” (Lower Trust) | “Green-level” (Higher Trust) |

Important Safety Features

Even though the regulatory oversight is weak, Bull Waves does use two important, standard security measures. It keeps client accounts separate, meaning your money is kept apart from the company's operating money. This gives some protection against misuse of funds. Also, the broker offers negative balance protection, which makes sure you can't lose more money than you put into your account—this is very important in unpredictable markets. While these features are good, it's important to understand that they are standard practice and don't replace the complete protection offered by a top-level regulatory license.

Your Verification Step

Given the problems with offshore regulation, we strongly recommend traders double-check a broker's claims. Independent sites like WikiFX provide real-time regulatory information and user reviews, giving you an essential way to verify information before you put any money in.

Looking at Trading Conditions

Understanding a broker's main offering—its accounts, trading instruments, and platforms—is key to figuring out if it fits your trading plan. Here, we break down what it's like to trade with Bull Waves.

Available Account Types

Bull Waves offers different account levels designed for different investment amounts. The main differences are the minimum money required to start and the associated costs. All accounts offer high maximum leverage of 1:500, which can increase both gains and losses.

| Account Type | Minimum Money to Start | Costs From | Leverage | Stop Out |

| Classic | $100 | 1.6 pips | 1:500 | 50% |

| VIP | $3,000 | 0.8 pips | 1:500 | 50% |

| ECN | $5,000 | 0.1 pips | 1:500 | 25% |

Many Different Trading Options

Perhaps the biggest strength of Bull Waves is its impressive range of trading instruments. With over 280+ CFDs available, it stands out from many competitors. The variety is especially notable in forex and cryptocurrencies. The broker offers over 100 forex pairs and more than 100 cryptocurrency pairs. This selection includes not only major and minor pairs but also unusual and rare crosses like USDCOP (US Dollar vs. Colombian Peso) and LTCCAD (Litecoin vs. Canadian Dollar). This allows traders to access unique market opportunities that are often not available at other trading companies.

Platform and Key Features

Bull Waves has standardized its platform offering on MetaTrader 5 (MT5). It no longer supports the older MT4 platform. MT5 is a powerful and popular choice, known for its advanced charting tools, extensive technical indicators, and excellent testing capabilities, making it suitable for both new and experienced traders. A main part of the broker's strategy is its focus on social and copy trading. This feature lets less experienced traders automatically copy the trades of seasoned market participants, providing a way to learn and potentially profit from the expertise of others.

Looking at Costs and Fees

A broker's appeal can quickly disappear if the trading costs are too high. We will now look at the complete cost structure at Bull Waves, including both trading and non-trading fees, to give you a clear view of what you can expect to pay.

Trading Costs and Commissions

Bull Waves advertises all its accounts as commission-free, which can be attractive. This means the main trading cost is built into the spread—the difference between the buy and sell price of an instrument. However, the costs on the entry-level account are not competitive. The Classic account has spreads that start from 1.6 pips. For major pairs like EUR/USD, our research shows spreads can be as high as 2.0 pips. Compared to industry leaders who often offer spreads closer to 1.0 pip or less for the same pair, this is considered expensive and can significantly hurt the profitability of short-term trading strategies.

Customer Support

Bull Waves provides various channels to connect. The following are the methods:

Email - Support@bullwaves.com

Phone Number - +248 4379848

+44 1212258769

Physical Address- CT House, office number 9A, Providence, Mahe, Seychelles

Important Non-Trading Fees

Non-trading fees can eat into a trader's money if not watched carefully. Bull Waves has several such fees that you must know about:

• Inactivity Fee: An account is charged a $10 fee if it shows no trading activity for just 30 days. This is a much shorter grace period than what most competitors offer, who typically allow 90 days or more before charging such a fee.

• Withdrawal Fees: While putting money in is free, taking money out can cost you. A €10 fee is applied to bank wire withdrawals under €100. For other methods (except credit card refunds), a €10 fee is charged for any withdrawal under €20.

• Deposit Fees: On a positive note, Bull Waves doesn't charge any fees for putting money into your account, no matter what method you use.

User Reviews and Complaints

User feedback gives an invaluable real-world view of a broker's operations. For Bull Waves, the story told by its clients shows sharp contrasts, with great praise on one side and serious, high-risk complaints on the other.

The Positive Feedback

On Trustpilot, the profile for `bullwaves.com` has a “Great” rating of 4.1 out of 5 stars from over 680 reviews. This suggests many satisfied customers. Positive comments often praise specific parts of the service. Users often report “excellent customer service,” “fast withdrawals,” and “good execution speed.” Comments like, “Bullwaves from the excellent customer service to the fast withdrawals has been brilliant,” paint a picture of a reliable and professional broker. This positive sentiment forms a significant part of the broker's public image.

Serious Warning Sign Complaints

However, looking deeper reveals a disturbing pattern of serious negative reviews. These are not minor complaints but claims that strike at the core of a broker's trustworthiness.

• Account Closure & Profit Taking: One of the most alarming claims involves a trader whose account was allegedly closed and profits taken. The user stated, “They are a fraud company who closed my account and confiscated my profits without giving any valid reason. They accused me of 'market abuse' but provided absolutely no evidence to support the allegation.”

• Withdrawal Problems: Another user detailed a frustrating month-long struggle to withdraw funds after making a simple error in their bank details. They described the support response as “perfunctory,” highlighting a potential lack of effective customer care when problems arise.

• False Bonus Claims: A trader reported a “fake credit bonus” that was allegedly removed from their account in the middle of a live trade, causing a margin call and the loss of their entire £1,000 investment.

A Tale of Two Websites

Adding to the confusion and risk is the existence of two different Trustpilot profiles associated with the Bull Waves brand. While `bullwaves.com` is highly rated, a separate profile for `www.bullwaves.global` has an extremely poor score of 2.2 out of 5. The reviews on this second profile are overwhelmingly negative and echo the serious complaints of withdrawal problems and potential scams. This difference is a major concern, suggesting either brand confusion or a separate, highly problematic company operating under a similar name. This matches our own testing, where the advertised 24/7 chat support was unresponsive, supporting user complaints about poor service.

Bull Waves Pros and Cons

To summarize our findings, this section provides a clear, quick summary of Bull Waves' strengths and weaknesses. This balanced view helps weigh the broker's attractive features against its significant underlying risks.

| ✅ Bull Waves Pros (The Good Points) | ⚠️ Bull Waves Cons (The Risks) |

| Wide Range of Assets: 280+ instruments, including over 100 FX and 100 crypto pairs. | Weak Offshore Regulation: Seychelles FSA license offers minimal investor protection. |

| MT5 Trading Platform: Access to a powerful and popular trading terminal. | Very Short Operating History: Founded in 2023, lacking a long-term track record. |

| Social & Copy Trading: A strong feature for beginners looking to learn. | High Entry-Level Costs: Classic account spreads start at a non-competitive 1.6-2.0 pips. |

| Zero-Commission Trading: No commission fees on any account type. | Harsh Inactivity Fee: $10 fee charged after only 30 days of inactivity. |

| Zero Deposit Fees: Fund your account without extra charges. | Serious User Complaints: Alarming reports of withdrawal issues and arbitrary account closures. |

| Negative Balance Protection: A standard but important safety feature. | Lack of Openness: Not publicly listed, no public financial disclosures. |

| Separate Client Accounts: Funds are held separately from company capital. | High-Risk Environment: Official disclosure states 75.2% of retail CFD accounts lose money. |

Conclusion and Final Advice

Based on the evidence gathered, we can now provide a final assessment and practical advice for traders considering Bull Waves.

A High-Risk Choice

Our analysis concludes that Bull Waves is a high-risk broker. This assessment is based on a combination of critical factors: its weak offshore regulation, its very short operational history since 2023, and the presence of serious user complaints regarding fund withdrawals and account closures. While the exceptionally wide range of trading instruments is a legitimate and powerful attraction, we do not believe it outweighs the fundamental risks to money safety that are present.

Who Should Be Careful?

Given this risk profile, we advise that beginners and any trader who puts the security of their funds first should avoid this broker. The potential for issues related to regulation and fund access is too significant. Instead, we recommend traders look for established brokers with a long track record and, most importantly, top-level regulation from respected financial bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). These regulators provide a much stronger safety net for investors.

A Critical Safety Check

> Your money security is most important. No matter which broker you consider, never skip the research step. We strongly urge all traders to use an independent verification service like WikiFX before opening an account or putting in funds. A quick search on WikiFX can reveal a broker's real-time regulatory status, license details, and unfiltered user reviews, which can protect you from potential scams and problematic companies.

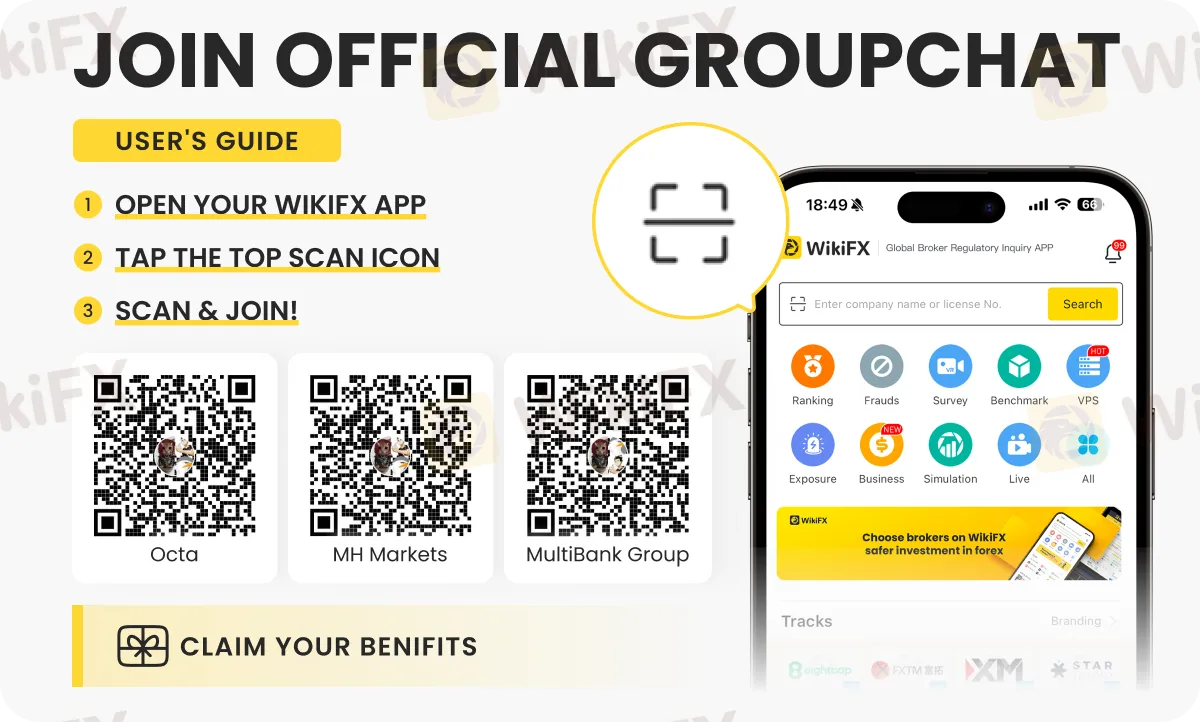

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Currency Calculator