Abstract:Quotex is an online brokerage established in 2020. While the platform has built a presence in markets such as Canada, Ecuador, and the United States, significant concerns regarding its safety and legitimacy have been raised. The broker currently holds a WikiFX Score of 1.52, which is considered very low and indicates a high-risk trading environment. Furthermore, Quotex is classified as unregulated, with its headquarters located in St. Vincent and the Grenadines.

Quotex is an online brokerage established in 2020. While the platform has built a presence in markets such as Canada, Ecuador, and the United States, significant concerns regarding its safety and legitimacy have been raised. The broker currently holds a WikiFX Score of 1.52, which is considered very low and indicates a high-risk trading environment. Furthermore, Quotex is classified as unregulated, with its headquarters located in St. Vincent and the Grenadines.

Pros and Cons of Quotex

Based on the available data and regulatory reports, here is an overview of the broker's current standing:

- ✅ Customer Support: Offers support via Email and various social media channels (Twitter, Facebook, Instagram, YouTube).

- ✅ Market Presence: Established in 2020 with active search interest in multiple regions.

- ❌ No Regulation: The broker does not hold a valid license from any financial regulatory authority.

- ❌ Low WikiFX Score: A score of 1.52/10 suggests poor reliability.

- ❌ Regulatory Warnings: Multiple financial authorities (Portugal, Indonesia, Malaysia) have issued warnings or blocked the platform.

- ❌ User Complaints: A high volume of complaints regarding deposit failures and withdrawal blocks.

Is Quotex Safe? Regulatory Analysis

For traders evaluating whether Quotex is legit, the regulatory data presents serious red flags. The broker currently operates without valid regulation from any recognized financial institution.

Regulatory Warnings

Several global regulators have flagged Quotex for unauthorized activities:

- Portugal (CMVM): The Portuguese Securities Market Commission issued a warning stating that Quotex (and related entities like Maxbit LLC / Awesomo Ltd) is not authorized to carry out financial intermediary activities in Portugal.

- Indonesia (BAPPEBTI): The Commodity Futures Trading Regulatory Agency blocked the platform, categorizing it as an illegal commodity futures trading website operating under the guise of trading. The regulator specifically noted the risks associated with “binary options” platforms like Quotex.

- Malaysia (SCM): The Securities Commission Malaysia placed Quotex on its Investor Alert List for carrying out unlicensed capital market activities specifically related to securities dealing.

Risk Warning

The lack of a Tier-1 license (such as FCA or ASIC) combined with specific warnings from government bodies indicates that user funds are not protected by standard financial compensation schemes.

Real User Feedback and Complaints

Recent data highlights a surge in negative feedback, with 7 complaints lodged within the last three months. Users have reported issues ranging from missing deposits to account suspensions.

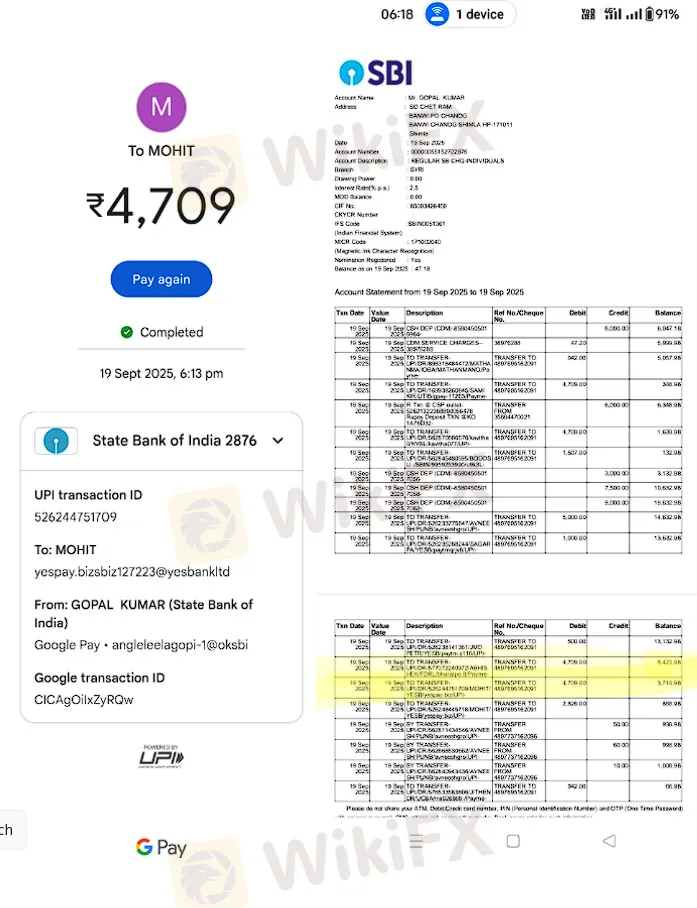

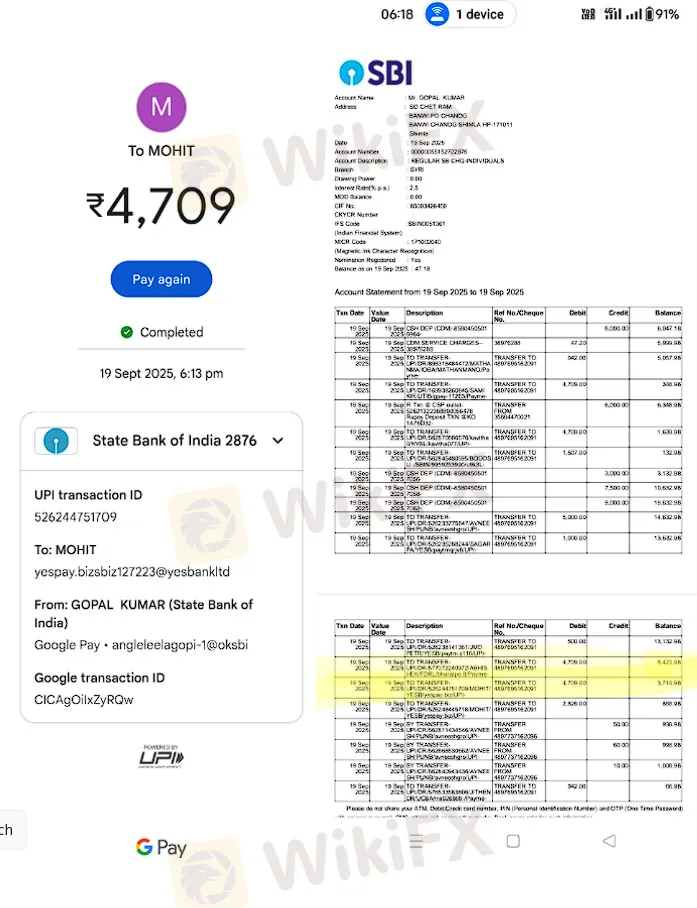

Deposit Failures

Multiple traders have reported that funds deducted from their bank accounts were never credited to their trading balances.

- India (2025): A user reported depositing INR 4709.00 (approx. 50 USD) via QR code. Despite the amount being debited from their savings account, the trading balance remained unchanged. The user cited a lack of response from the support team.

- Vietnam (2024): Another trader stated they transferred $100 to a recipient named “Ho Van Minh” via the Quotex system, but the account balance remained at $0. The user claimed this was the third time such an issue occurred.

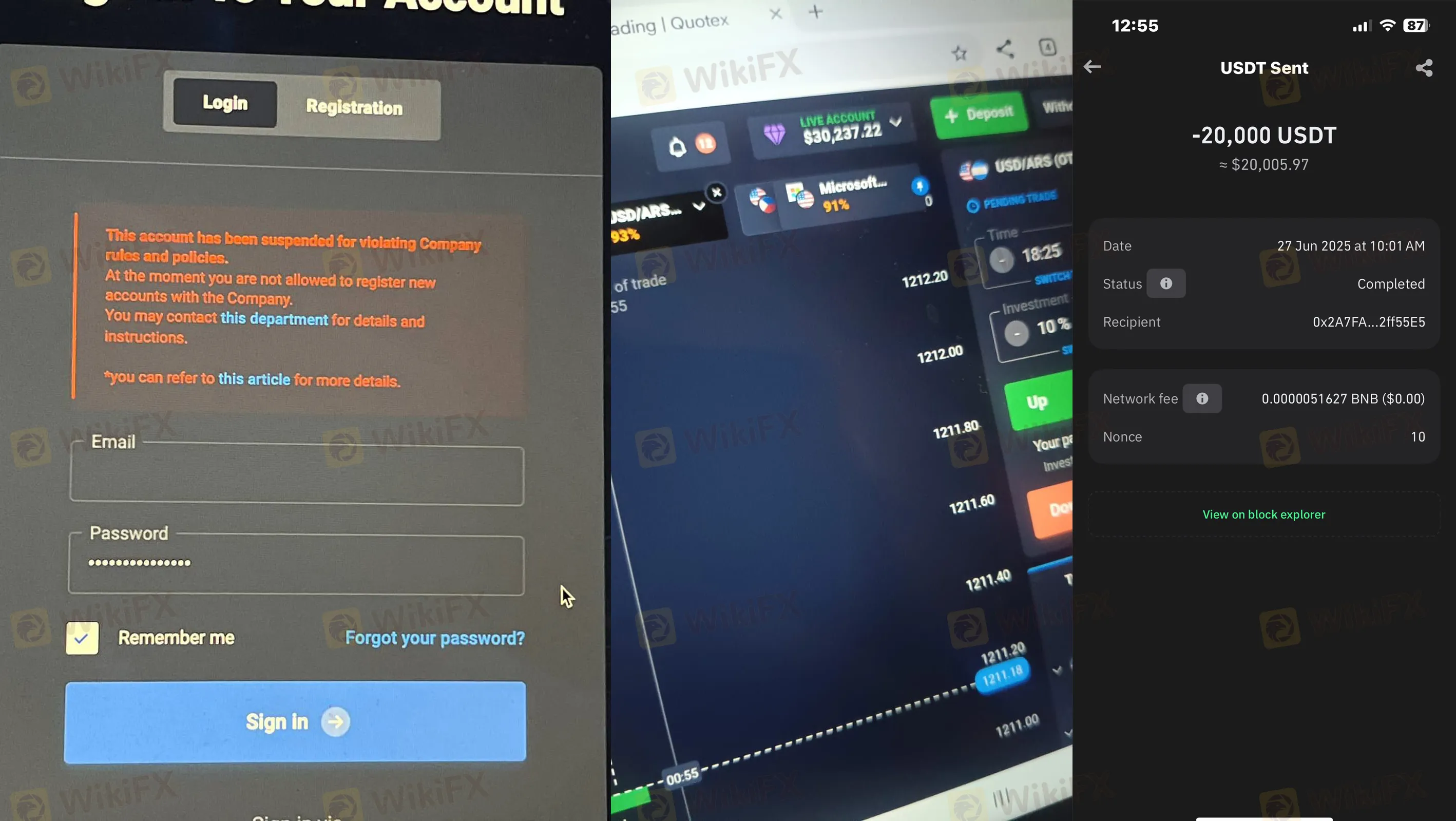

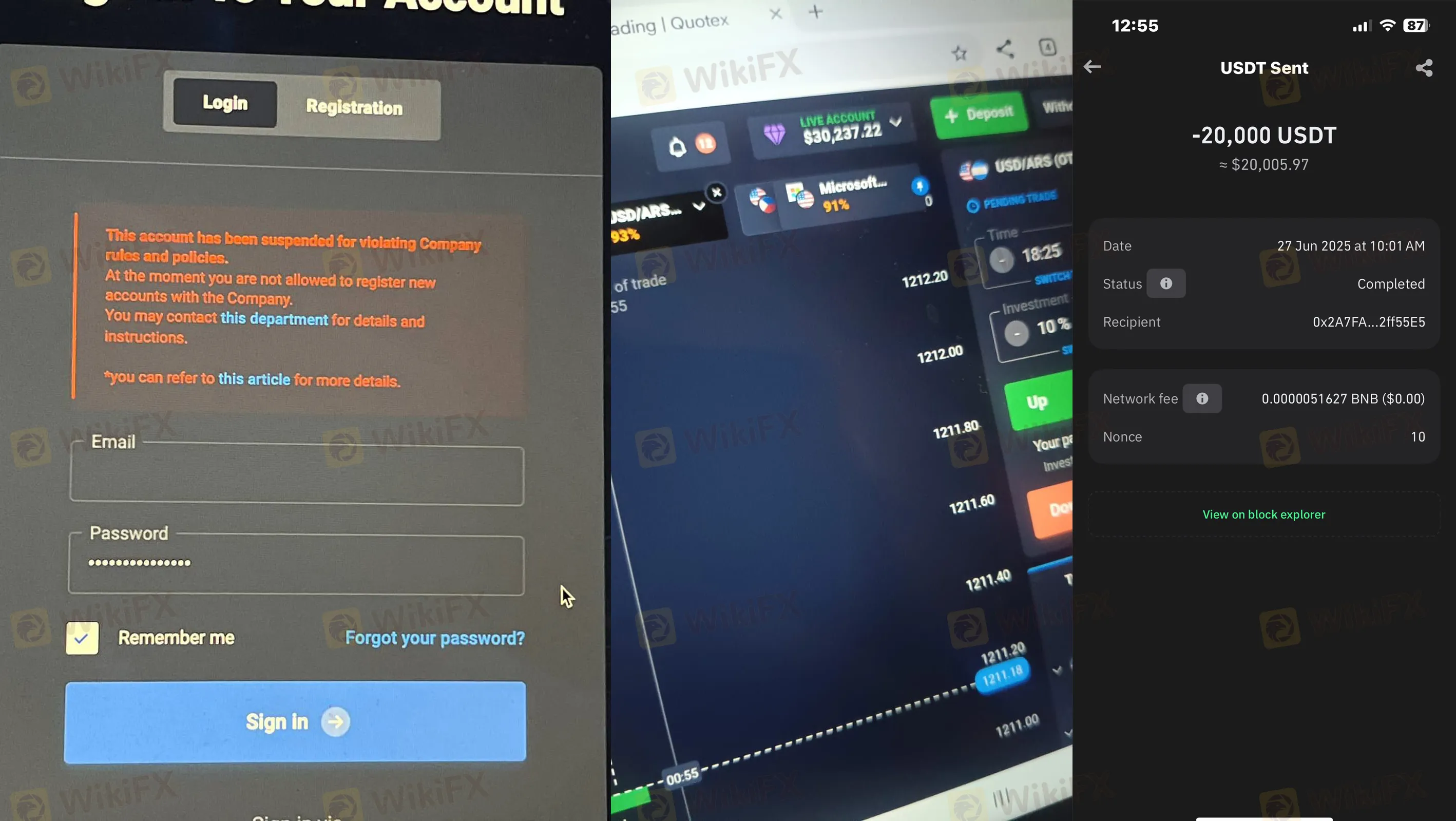

Withdrawal Suspensions and Profit Blocking

More severe complaints involve the inability to withdraw profits.

- India (2025): A trader claimed their account was suspended after growing a balance to $43,000. They alleged that while they were allowed to lose $18,000 previously without restriction, the verifiable account was blocked immediately upon attempting to withdraw profits.

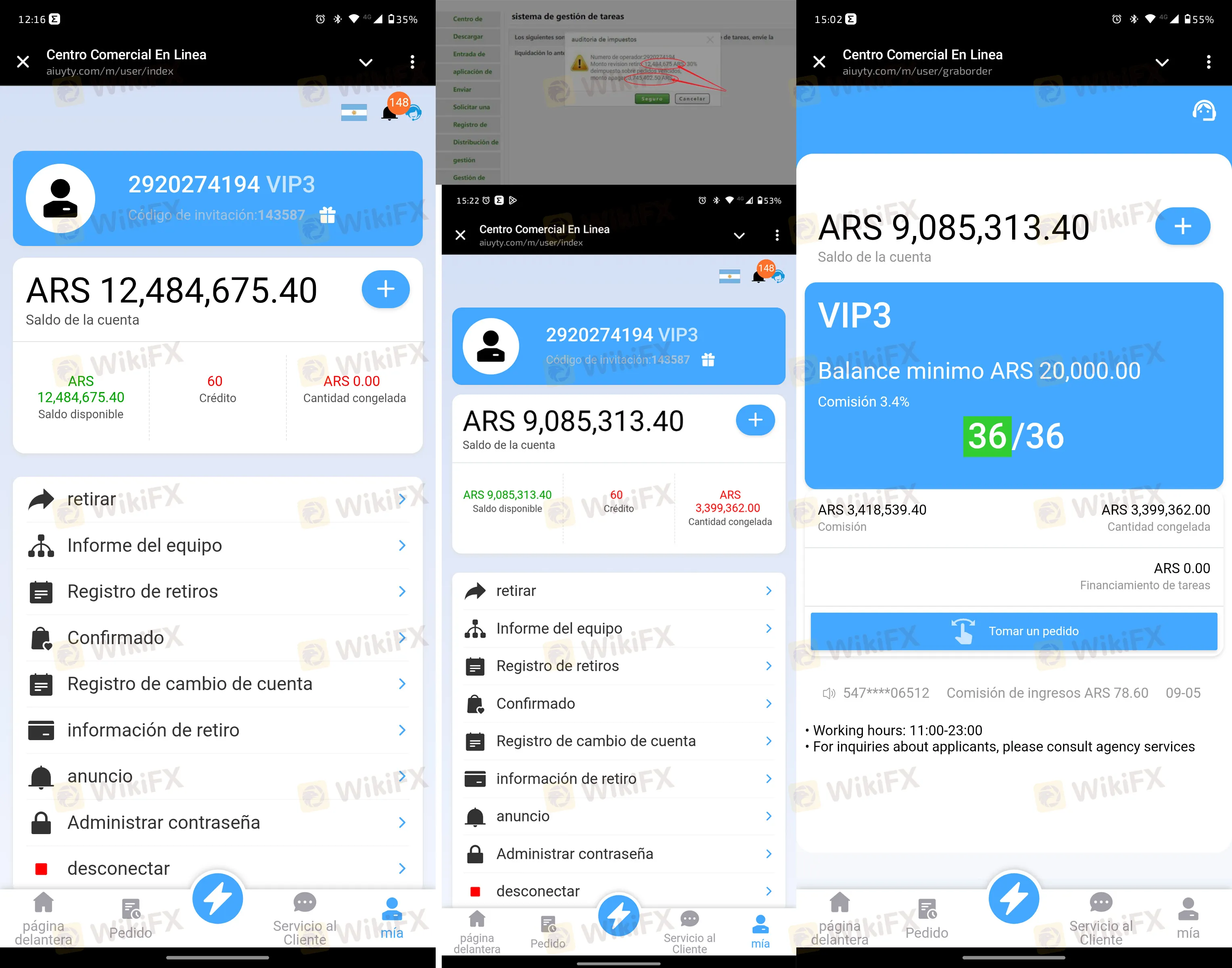

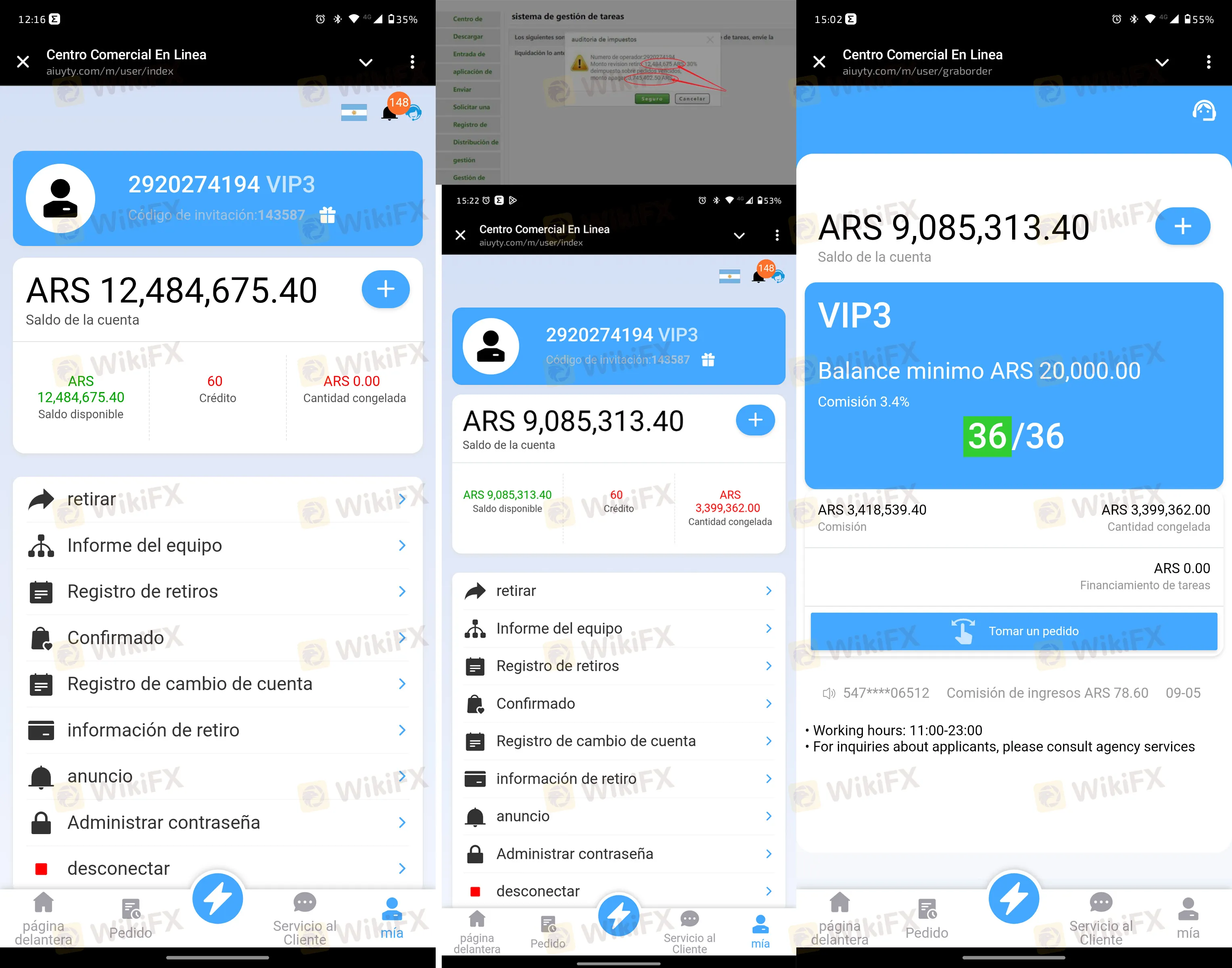

Argentina (2025): A user reported that after accumulating funds, the platform required them to deposit more money to cover alleged taxes before allowing a withdrawal, a common tactic associated with withdrawal friction.

Final Verdict

Quotex presents a significant risk to traders. Although established in 2020, the broker operates without regulation and has been explicitly blacklisted or warned against by financial authorities in Portugal, Indonesia, and Malaysia. The extremely low WikiFX Score of 1.52, combined with serious user allegations regarding stolen deposits and blocked withdrawals, suggests this platform is not safe for trading.

To stay safe and view the latest regulatory certificates, check Quotex on the WikiFX App.