简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

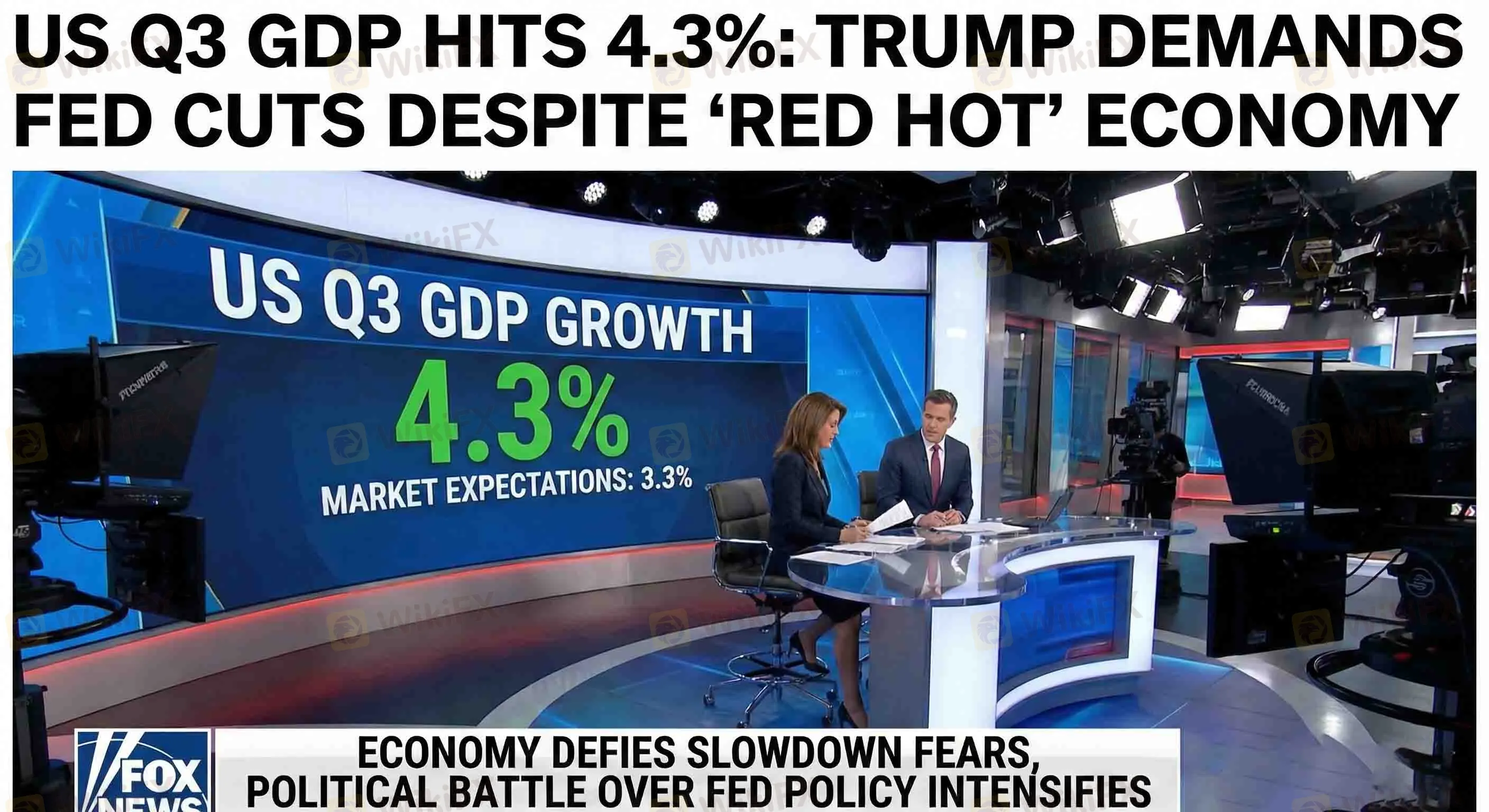

US Q3 GDP Hits 4.3%: Trump Demands Fed Cuts Despite "Red Hot" Economy

Abstract:The US economy defied slowdown fears with a blistering 4.3% annualized growth in the third quarter of 2025, shattering market expectations of 3.3%. However, the strong print has paradoxically intensified the political battle over monetary policy, with President Trump doubling down on demands for rate cuts regardless of economic heat.

The US economy defied slowdown fears with a blistering 4.3% annualized growth in the third quarter of 2025, shattering market expectations of 3.3%. However, the strong print has paradoxically intensified the political battle over monetary policy, with President Trump doubling down on demands for rate cuts regardless of economic heat.

The “Loyalty Test” for the Next Fed Chair

In a direct challenge to central bank orthodoxy, President Trump declared on Tuesday that the next Federal Reserve Chair must commit to lowering interest rates even when the economy is performing well. “I want a Fed Chair who lowers rates when the market is good, not one who destroys it for no reason,” Trump stated on social media. This “loyalty test” complicates the succession planning for Jerome Powell's replacement in 2026, with candidates like Kevin Hassett and Kevin Warsh viewed as frontrunners.

Data vs. Policy

White House Adviser Kevin Hassett argued that despite the 4.3% GDP print, the Fed is “behind the curve” on easing, citing AI-driven productivity gains as a deflationary force that allows for looser policy. Meanwhile, Treasuries faced selling pressure, pushing yields higher as traders grappled with the cognitive dissonance of a booming economy, sticky inflation (Core PCE at 2.8%), and immense political pressure for monetary stimulus.

Fiscal-Monetary Shift?

Treasury Secretary Scott Bessent has also floated a radical shift in targeting, suggesting the Fed move from a fixed 2% inflation point to a flexible “range” (e.g., 1.5%-2.5%) and potentially scrapping the dot plot to reduce market noise. Such changes could fundamentally alter the USD's long-term valuation metrics.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

Johor Authorities Arrest Eight in Suspected Fraud Call Centre

HIJA MARKETS Scam Alert: Forex Trading & Investment Risk

Currency Calculator