Abstract:The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

Macro Context: The anticipated fiscal consolidation in the United States faces structural headwinds, keeping upward pressure on US debt issuance and long-term yields.

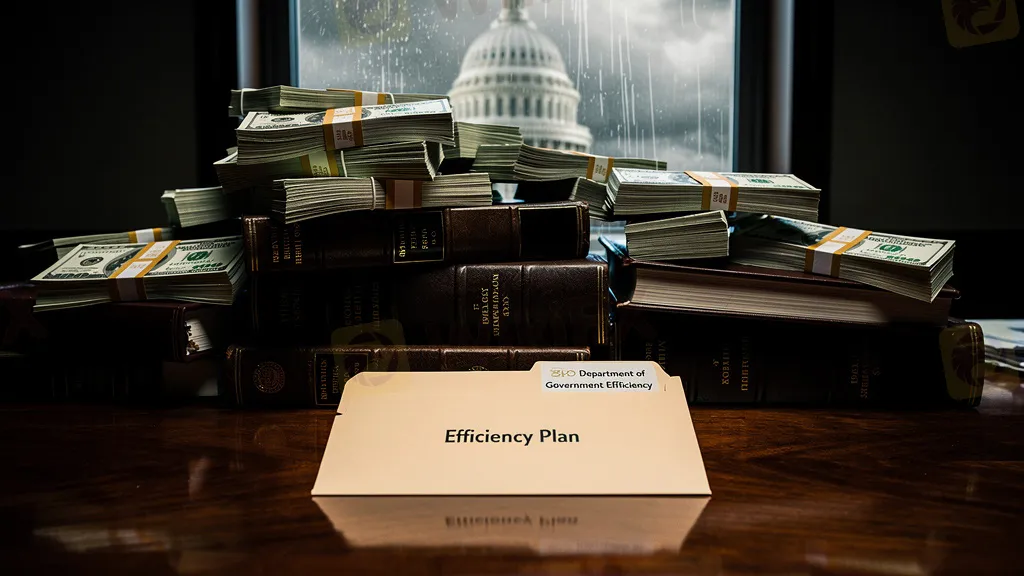

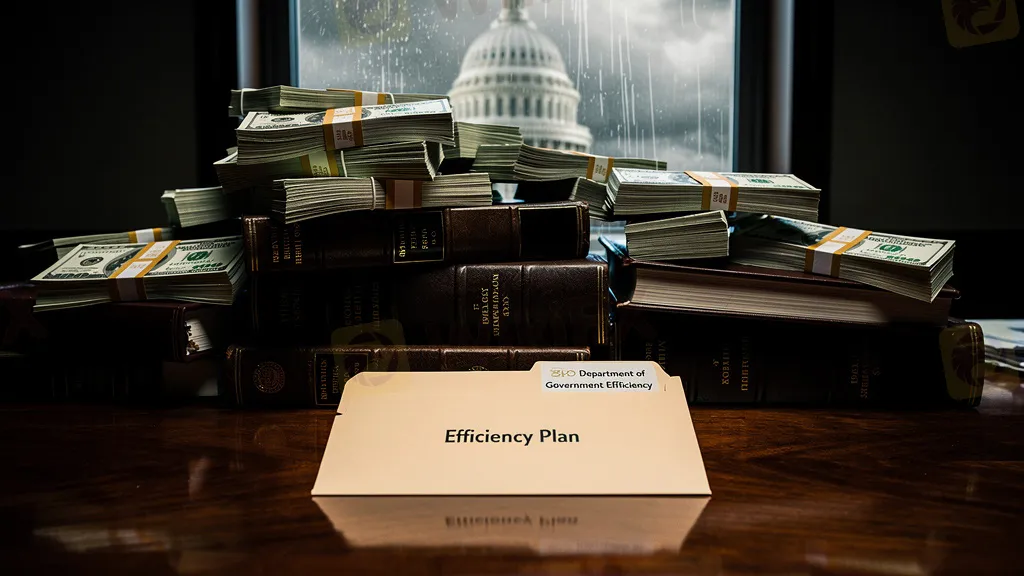

Despite the high-profile narrative of cost-cutting under the “Department of Government Efficiency” (DOGE), led briefly by Elon Musk, federal spending continues to rise.

- Headcount Reduction: Federal payrolls dropped by approximately 270,000 in 2025, a significant contraction in the bureaucracy.

- Spending Reality: Conversely, total government spending rose nearly 6% to $7.56 trillion.

The Structural Trap

The divergence highlights the rigidity of the US budget. “Mandatory spending” (Social Security, Medicare) and, crucially, interest on the national debt, are outpacing operational savings. With the national debt expanding by over $2 trillion recently, interest payments alone have surged by $100 billion.

Market Takeaway: For Forex traders, this reinforces the “Fiscal Dominance” theme. Efficiency measures are insufficient to offset debt servicing costs. This dynamic supports a long-term steepening of the yield curve, as the Treasury must flood the market with supply, potentially weighing on the USD if foreign appetite for US debt wanes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.