简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Manfacturing Survey Signals "Wile E Coyote" Scenario

Abstract:With 'hard' data showing resilience into year-end, 'soft' survey data has cratered (not helped by th

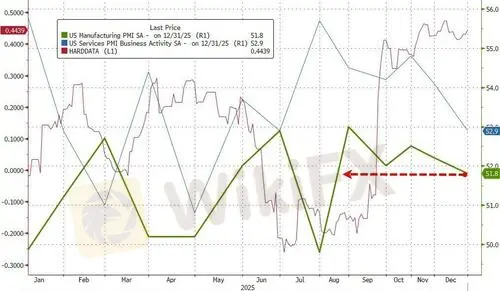

With 'hard' data showing resilience into year-end, 'soft' survey data has cratered (not helped by the government shutdown)...

Source: Bloomberg

...and this morning brings more weakness as S&P Global's US Manufacturing PMI (final print for December) dipped to 51.8 - its lowest since July (the only contractionary - sub-50- month of 2025)...

Source: Bloomberg

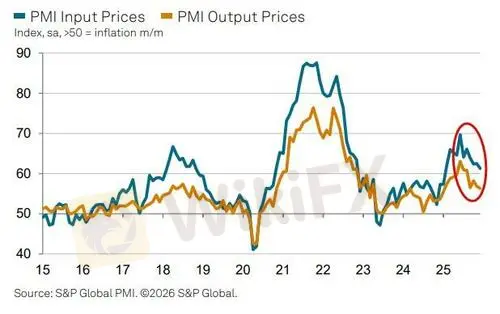

The latest survey showed a weaker gain in production, amid a renewed contraction in new order books – the first in exactly a year. International sales continued to fall, in part linked to tariffs, which also continued to push up operating expenses at an elevated pace. That said, although remaining historically elevated, both input and output prices rose at their slowest rates for 11 months.

Although manufacturers continued to ramp up production in December, suggesting the goods producing sector will have contributed to further robust economic growth in the fourth quarter, prospects for the start of 2026 are looking less rosy, according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

The gap between growth of production and the drop in orders is in fact the widest seen since the height of the global financial crisis back in 2008-9:

Payroll numbers will also be adversely impacted if production capacity has to be scaled back.

There is some good news:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

Scammed Twice: How a RM1,500 Loss Escalated to RM1.2 Million

Celebrate the New Year and Usher in a Safer 2026 for All Traders!

Is 4SYTE TRADING LTD Legit or a Scam? 5 Key Questions Answered (2025)

Poland Fines Trading Firms $5.7M Over Pyramid Schemes

AURO MARKETS Review 2025: Institutional Audit & Risk Assessment

Euro Under Siege: French Fiscal Crisis Weighs heavily on the Common Currency

SogoTrade Fined $75K Amid Compliance Failures

Indonesian Nickel Supply Cut Sends LME Prices Soaring

Fed Focus: Markets Pause for Minutes as 2026 'Dovish Shift' Looms

Currency Calculator