简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

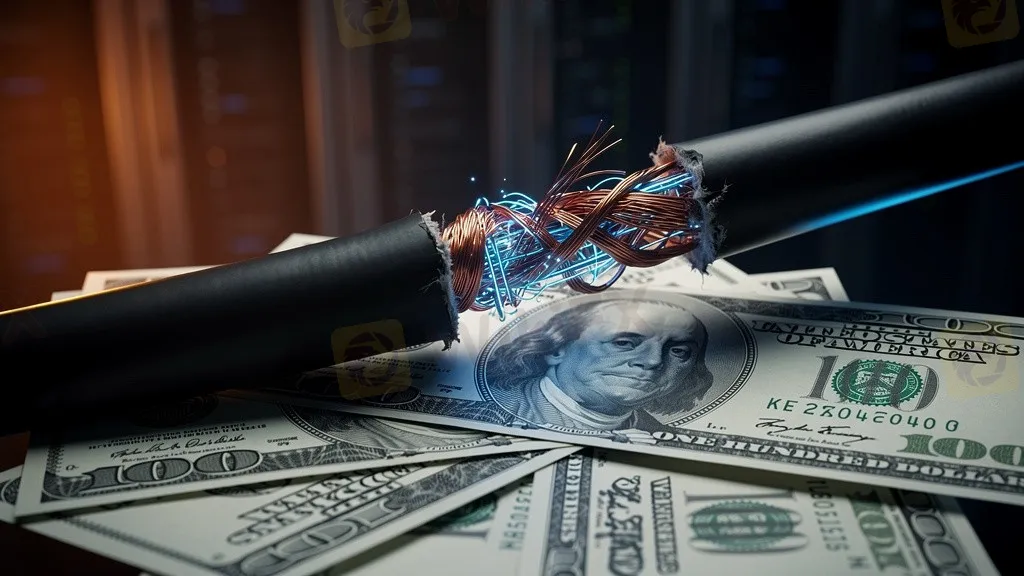

US Macro Alert: AI 'Energy Crunch' Stokes Inflation Fears and Political Backlash

Abstract:A growing bipartisan backlash in the US against energy-intensive AI infrastructure, combined with grid capacity shortages and rising hardware costs, threatens to stoke structurally higher inflation and disrupt Big Tech capital expenditure plans.

The rapid expansion of Artificial Intelligence infrastructure in the United States is colliding with physical grid limitations and a rare bipartisan political firewall. This convergence signals potential headwinds for US equity markets and adds a rigorous layer of complexity to the Federal Reserve's long-term inflation outlook.

Sticky Inflation: The Energy & Hardware Nexus

While market attention remains fixed on immediate CPI prints, structural inflationary pressures are building within the US energy grid. Data indicates that residential electricity prices are projected to rise 5% in 2025 and a further 4% in 2026. This uptick is largely driven by the localized monopoly of data centers, with the PJM Interconnection—the largest US power grid serving 65 million people—forecasting a 6 gigawatt (GW) supply-demand gap by 2027.

Independent market regulators warn that roughly $23 billion in grid capacity costs are directly attributable to data sector expansion, creating what analysts describe as a “massive wealth transfer” from ordinary consumers to tech conglomerates.

Beyond utilities, the “AI premium” is beginning to infect broader supply chains.

Political Headwinds Threaten Tech CapEx

A significant risk to the “Soft Landing” narrative is the potential stalling of Big Tech Capital Expenditure (CapEx). JPMorgan estimates suggest major US tech firms plan to inject $620 billion into AI infrastructure by 2026. However, this liquidity injection faces new political hurdles.

In a rare alignment, volatility is emerging from both sides of the political spectrum:

Asset Class Implications

USD & Rates: If electricity and durable goods inflation proves sticky due to structural AI demand, the Federal Reserve may be forced to maintain a higher terminal rate floor, supporting the US Dollar in the medium term.

Equities: Validated threats to the 2026 deployment timeline for AI infrastructure could trigger a repricing in the Nasdaq 100, as valuation multiples are heavily pegged to uninterrupted AI growth.

Commodities: The struggle for power reliability underscores the long-term bullish structural case for Natural Gas and grid-modernization commodities (Copper), despite the immediate focus on renewable transitions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator