Abstract:When checking if a broker is safe, the first and most important step is to look at its regulatory credentials. For traders researching ZFX in 2026, the answer is not simply yes or no. ZFX, a brand under the Zeal Group, which commenced its operations in 2017, works through a complex, dual-license structure. This means the broker is controlled by two separate legal entities under two very different regulators: the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. This dual framework has major effects on a trader's security, available leverage, and overall account terms. Understanding the entity you are dealing with is extremely important for accurately assessing your risk. This guide will break down this structure, providing the clarity needed to make an informed decision.

ZFX's Dual Regulatory Framework

When checking if a broker is safe, the first and most important step is to look at its regulatory credentials. For traders researching ZFX in 2026, the answer is not simply yes or no. ZFX, a brand under the Zeal Group, which commenced its operations in 2017, works through a complex, dual-license structure. This means the broker is controlled by two separate legal entities under two very different regulators: the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. This dual framework has major effects on a trader's security, available leverage, and overall account terms. Understanding the entity you are dealing with is extremely important for accurately assessing your risk. This guide will break down this structure, providing the clarity needed to make an informed decision.

Corporate Structure Behind ZFX

To understand ZFX regulation, one must first understand its corporate structure. “ZFX” is not a single company but a brand name representing multiple legal entities under its parent holding company, Zeal Group. Zeal Group's operations go beyond retail brokerage into financial technology, liquidity provision, and asset management. For the retail trader, the two most important entities are the ones that hold brokerage licenses. Transparency begins with knowing their exact legal names and registered locations, as this determines the legal and regulatory environment your funds will operate within. These are the basic facts for any serious research.

· UK Entity: Zeal Capital Market (UK) Limited

· *Registration Address:* No. 1 Royal Exchange, London, EC3V 3DG, United Kingdom.

· Seychelles Entity: Zeal Capital Market (Seychelles) Limited

· *Registration Address:* Room B11, First Floor, Providence Complex, Providence, Mahe, Seychelles.

A Tale of Two Licenses

The core of ZFX regulation lies in the stark contrast between its two licenses. One represents the highest level of financial oversight available globally, while the other is a popular offshore license that offers different advantages and inherent risks. A trader's experience, safety, and potential recourse in the event of a dispute are defined entirely by which of these two licenses governs their account. This section provides a deep dive into what each license means in practical, real-world terms, moving beyond marketing claims to deliver a factual analysis of the protections and conditions associated with each ZFX entity.

The UK FCA License

Zeal Capital Market (UK) Limited holds a license number 768451 from the UK's Financial Conduct Authority (FCA). The FCA is universally recognized as a tier-1 regulator, known for its strict requirements and focus on consumer protection. This is not a basic registration; the entity holds a full “Market Maker (MM)” license, subjecting it to the highest levels of scrutiny. For clients onboarded under this UK entity, the benefits are substantial and legally binding.

First and foremost is the mandatory segregation of client funds. This regulation requires the broker to hold client capital in separate accounts at top-tier banks, such as Barclays, completely isolated from the company's own operational funds. This measure protects client capital from being used for the broker's business expenses and provides a crucial safeguard in the event of corporate financial distress.

The most significant protection offered under the FCA license is participation in the Financial Services Compensation Scheme (FSCS). This is a fund of last resort for customers of authorized financial services firms. Should the UK entity of ZFX become insolvent, the FSCS guarantees protection for eligible clients' funds up to a maximum of £85,000. This level of concrete financial insurance is the gold standard in the brokerage industry and a primary reason why traders seek FCA-regulated firms.

The Seychelles FSA License

The second entity, Zeal Capital Market (Seychelles) Limited, is regulated by the Financial Services Authority (FSA) of Seychelles under license number SD027. This is a “Securities Dealer” license from a well-known offshore jurisdiction. Offshore regulation serves a different purpose and appeals to a different risk appetite compared to its tier-1 counterparts. The primary attraction for many retail traders is the set of more flexible trading conditions it allows.

The most prominent feature is the availability of significantly higher leverage. While the FCA imposes strict caps on leverage for retail clients (e.g., 1:30 for major forex pairs), the FSA-regulated entity can offer leverage up to a dynamic 1:2000. This allows traders with smaller capital to control much larger positions, amplifying both potential profits and potential losses.

However, this flexibility comes with a critical trade-off. Accounts registered under the Seychelles entity are not covered by the UK's FSCS or any comparable investor compensation scheme. In the case of broker insolvency, there is no formal, guaranteed safety net for client funds. Furthermore, offshore regulatory oversight is generally less rigorous than that of the FCA. While the entity still practices fund segregation, the overall regulatory framework is significantly lighter.

FCA vs FSA Implications

This brings us to the most critical question for any prospective client: which license will govern my account? The answer depends almost entirely on your geographic location. Despite the group's prominent marketing of its FCA license, our analysis shows that the majority of international clients, particularly those from Asia and mainland China, are onboarded through the Seychelles-based entity, Zeal Capital Market (Seychelles) Ltd.

This means that while the ZFX brand benefits from the reputational halo of the FCA, the actual legal protections for many of its clients do not include the key benefits of that license, such as FSCS coverage. It is a common industry practice known as regulatory arbitrage, but one that every trader must be acutely aware of. The protections of the FCA license do not extend to clients of the separate Seychelles entity. The following table clarifies the differences.

Verifying the ZFX License

Trust, but verify. This principle is non-negotiable in the financial markets. Any trader considering a broker should never rely solely on the information provided on the broker's website. Learning to independently confirm a broker's regulatory status is a fundamental skill for risk management. Fortunately, top-tier and most offshore regulators maintain public registers for this exact purpose. The process is straightforward and provides definitive proof of a company's licensing claims. This actionable guide not only helps you vet ZFX but also provides a template for evaluating any broker you may consider in the future.

Verifying the FCA License

To confirm the status of Zeal Capital Market (UK) Limited, you can check the FCA's official register directly. This is the ultimate source of truth for UK-regulated firms.

1. Navigate to the official FCA Financial Services Register website.

2. In the search bar, type “Firm reference number (FRN)” and enter the number: 768451.

3. The search result should display “Zeal Capital Market (UK) Limited”.

4. Verify that the firm's status is listed as “Authorized”.

5. Critically, cross-reference the registered address, phone number, and approved website domains listed on the FCA page to ensure you are not dealing with a clone firm.

Verifying the FSA License

A similar process can be followed for the Seychelles entity, although offshore registers can sometimes be less user-friendly.

1. Go to the official website of the Financial Services Authority (FSA) of Seychelles.

2. Find the section for “Regulated Entities” or “Capital Markets”.

3. Look for the public list of licensed “Securities Dealers”.

4. Search the list for the name “Zeal Capital Market (Seychelles) Limited” and its license number, SD027.

5. Confirm that the license is current and active. This check confirms the entity is indeed registered but does not change the nature or limitations of offshore regulation.

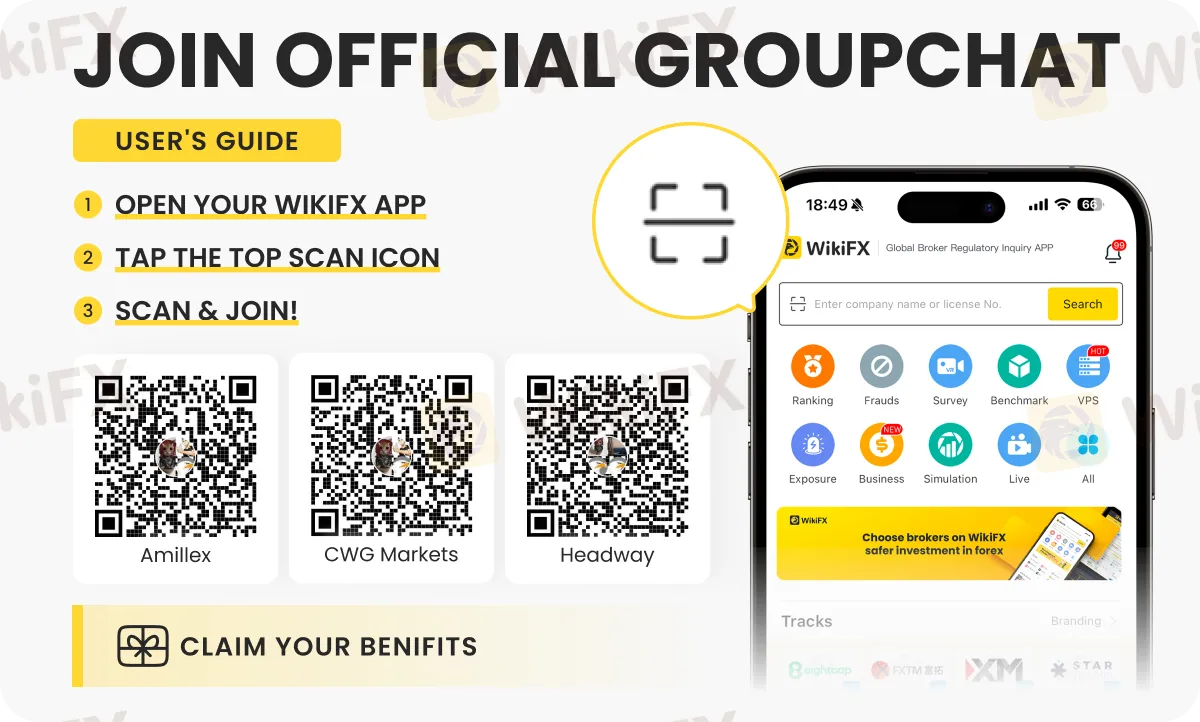

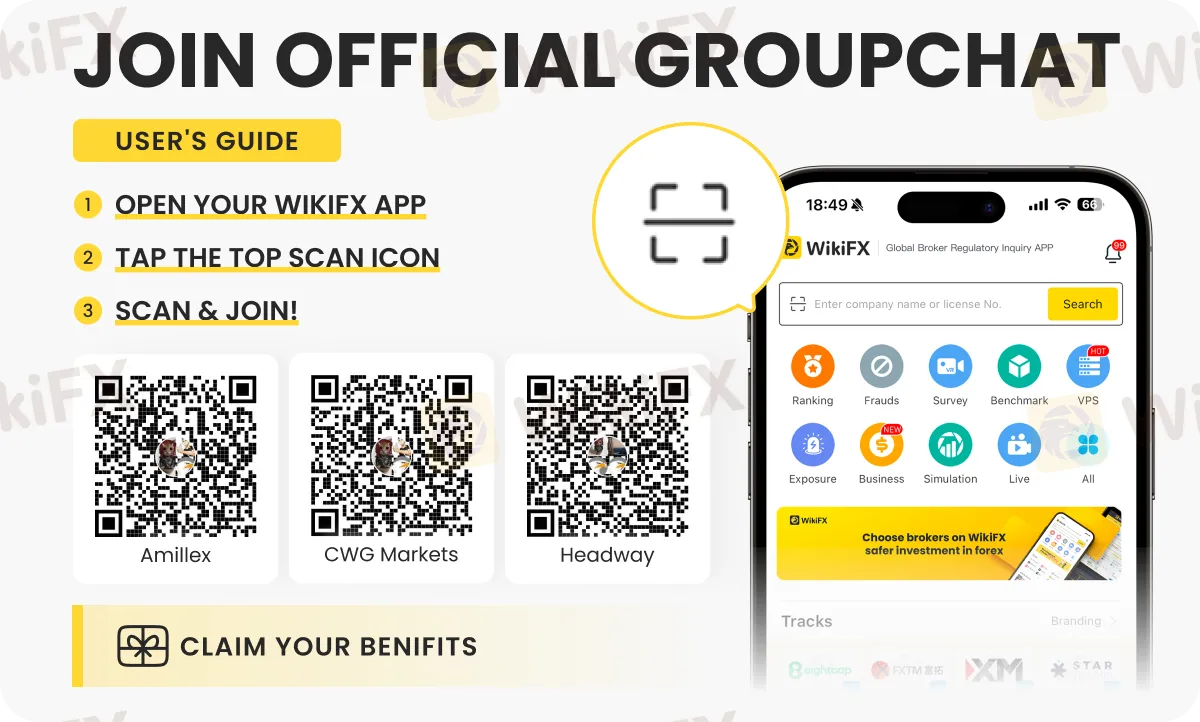

Using Third-Party Tools

For a more streamlined approach, traders can use aggregated data platforms. For a quick and consolidated view, platforms like WikiFX compile regulatory data from multiple sources. We recommend using such tools to cross-reference the information you find on the official registers before making any financial commitment. These platforms often let you see a broker's entire licensing portfolio in one place and may include other valuable data points and user feedback.

Key Risks Beyond Licensing

A license is a foundational check, but it doesn't tell the whole story. The practical experience of trading with a broker is shaped by its business model, risk management policies, and operational integrity. Based on documented user experiences and an analysis of the broker's offerings, several key risks emerge that traders should be aware of. These are not necessarily signs of wrongdoing but are inherent characteristics of the business model that can directly impact a trader's capital and outcomes.

The Regulatory Arbitrage Trap

As highlighted earlier, the practice of using a strong, tier-1 license for marketing while onboarding the majority of retail clients to a weakly regulated offshore entity is a significant risk. This is often termed “regulatory arbitrage.” A trader may be drawn to the ZFX brand because of its FCA credentials, mistakenly assuming those protections apply to them. The reality is that by accepting the terms and conditions for an account under the Seychelles entity, traders are legally contracting with that entity and forgoing any claim to FCA-related protections like the FSCS. It is crucial to read the client agreement carefully during the onboarding process to confirm the legal entity you are signing up with.

The Dynamic Leverage Risk

The advertised leverage of up to 1:2000 is a powerful marketing tool, but it is not a fixed figure. ZFX employs a “dynamic leverage” system. This mechanism automatically reduces the maximum available leverage as a trader's account equity or notional exposure increases. For example, a small account might enjoy 1:2000 leverage, but as the account grows through profits or further deposits, the leverage could automatically be reduced to 1:1000, 1:500, or even lower. While this is a risk management tool for the broker, it can be a significant danger for an unprepared trader. A sudden, automatic reduction in leverage can dramatically increase margin requirements, potentially triggering a margin call or a stop-out of positions, even with no adverse market movement.

Threat of Impersonator Scams

A broker's brand recognition can be a double-edged sword. ZFX's visibility, particularly in Asian markets, has made it a target for scammers who create fraudulent clones. There are numerous documented reports from users who have been tricked by fake “ZFX” websites, social media groups, and mobile applications, often used in “pig butchering” scams. These impersonators have no connection to the legitimate Zeal Group but exploit its name to defraud victims. It is absolutely essential for users to be extremely vigilant. Always ensure you are on the official, verified domain. Scammers frequently create convincing clones of legitimate brokers. A crucial safety check is to use a verification service like WikiFX, which often flags and lists known fraudulent impersonators and provides the verified official website URL.

A Balanced Verdict

In conclusion, the regulatory status of ZFX is a complex topic that requires careful examination. The broker is a legitimate, established operation, and the Zeal Group's ownership of a fully authorized FCA-regulated entity in the UK is a significant mark of credibility. This entity, Zeal Capital Market (UK) Limited, offers the highest standard of client protection available.

However, this is only half of the picture. The other half is the offshore entity, Zeal Capital Market (Seychelles) Limited, where a large portion of its international retail client base is housed. This entity offers the high leverage and flexible conditions that many traders seek but does so without robust safety nets, such as a formal compensation scheme, that define a tier-1 regulatory environment.

Ultimately, the level of traders safety depends entirely on which of these two legal entities their account is registered with. There is no single answer to the question “Is ZFX safe?”—the answer is conditional. The brand itself is backed by a reputable structure, but the protection afforded to an individual trader is determined by geography and the fine print in the client agreement.

Ultimately, the decision to use any broker rests on your personal risk tolerance and due diligence. Before proceeding with ZFX or any other broker, we strongly advise you to visit a comprehensive verification platform like WikiFX. There, you can review their full profile, user reviews, and any recent alerts, ensuring you have the most complete picture available.

Want to check more broker reviews? Join these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - where you can check user reviews concerning several forex brokers.