Abstract:ThinkMarkets is regulated by FCA, CySEC, FSCA, Seychelles FSA. Licenses for forex, futures, securities trading. TF Global Markets entities ensure client protection.

ThinkMarkets operates under multiple regulatory licenses from top-tier authorities like the ASIC, FCA and CySEC, alongside others from FSCA and the Seychelles FSA. These cover forex, futures, and securities trading through TF Global Markets entities. Client protection features stand out, but trader complaints raise questions about execution in practice.

ASIC License Details

TF Global Markets Aust Pty Ltd holds regulation from the Australia Securities and Investments Commission (ASIC). Registered in Australia since around 1999 with 10-15 years operating history, it carries a Market Making (MM) license. The Melbourne office at Level 18, 357 Collins Street was verified in 2024 field visits, confirming physical presence.

ASIC enforces strict client money rules and AFSL requirements, aligning with ThinkMarkets' AA environment rating. This Tier-1 status adds credibility for APAC traders, though retail access is restricted in Australia itself. Compared to FCA, ASIC emphasizes disclosure on leverage risks up to 1500:1

FCA License Details

TF Global Markets (UK) Limited holds FCA license 629628, effective since January 23, 2015. This UK entity at www.thinkmarkets.com/uk authorizes foreign exchange trading, futures, financial derivatives, securities, and options for institutional and retail clients. Exclusive sharing status means no third-party use, bolstering segregated client funds under strict FCA rules.

The Financial Conduct Authority enforces STP execution models, matching ThinkMarkets offerings. No physical UK office was verified in recent checks, signaling potential reliance on digital operations. Traders value FCA oversight for negative balance protection and dispute resolution via the Financial Ombudsman Service.

CySEC Regulation Overview

CySEC license 215/13 for TF Global Markets (Europe) Ltd dates to September 20, 2013. Based at sites like www.thinkmarkets.com/europe, it permits forex, asset management, derivatives, securities, and bonds. Cross-border services reach 16 EU states, expanding access under MiFID II protections.

An operational office in Cyprus was confirmed as of December 19, 2025, at locations like Griva Digeni in Limassol. CySEC mandates investor compensation up to €20,000 per client, a safeguard absent in looser regimes. Execution remains STP, aligning with EU transparency standards.

FSCA South Africa License

TF Global Markets South Africa Pty Ltd secured FSCA license 49835 on February 5, 2019. Contactable at 010 8800273, it covers derivatives trading, securities, bonds, and consulting. Described as a light-touch framework, it still requires prudential standards but lacks the stringency of FCA or CySEC.

This entity targets African traders with financial derivatives and investment advice. No specific complaints tied to this license appear, though global issues spill over. Leverage caps here align with broader broker policies up to 500:1.

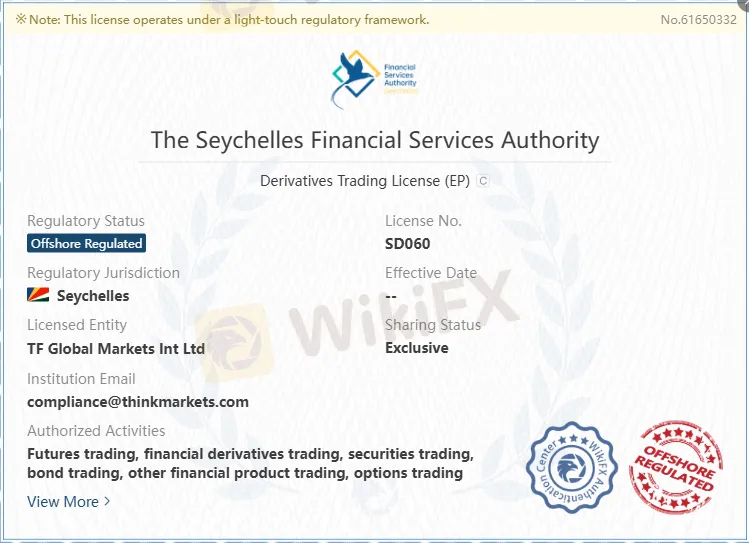

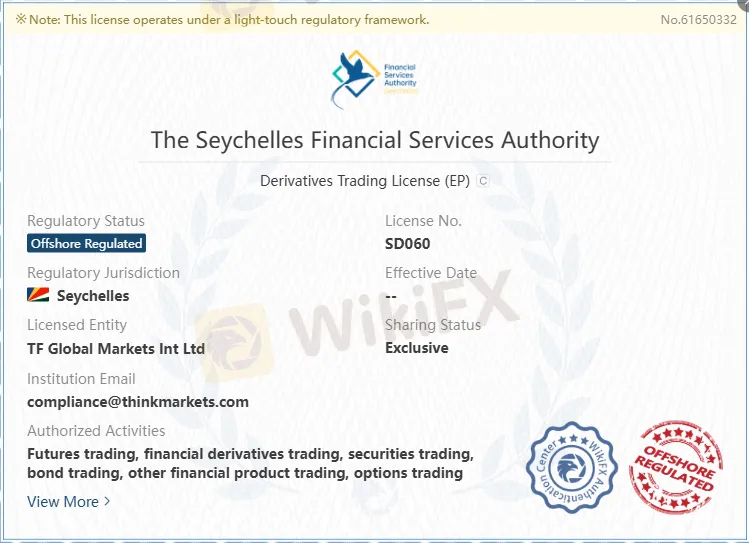

Seychelles FSA Offshore Reg

Seychelles FSA license SD060 for TF Global Markets Int Ltd labels it as offshore regulated. Email compliance@thinkmarkets.com handles oversight for futures, derivatives, securities, bonds, and options. Exclusive status limits scope, but lighter rules invite higher risk tolerances.

Offshore setups often mean weaker client fund segregation compared to Tier-1 regulators. ThinkMarkets leverages this for global reach, including high leverage up to 1500:1. Traders weigh this against top-tier protections elsewhere.

ThinkMarkets Regulation Pros/Cons

Strong multi-jurisdictional oversight from FCA, CySEC, FSCA, and FSA provides layered safety nets. TF Global Markets entities ensure segregated funds and compensation schemes in key regions. However, offshore Seychelles adds risk, and unverified UK presence flags operational gaps.

Pros outweigh for diversified traders; cons hit high-risk profiles.

Trading Instruments Offered

Access 4,000 CFDs on forex, indices, commodities, cryptos, stocks, ETFs, futures, and gold. No bonds or options in core listings, focusing on high-liquidity assets. Crypto includes BTC, ETH, USDT, XRP, and more via TRC-20, BCH, etc.

Spreads start at 0.0 pips on ThinkZero, floating to 0.4-0.8 on others. Leverage hits 500:1 standard, up to 1500:1 major pairs. Compared to IG Groups similar range, ThinkMarkets edges on crypto variety but trails in bonds.

Account Types Breakdown

Standard account needs $250 min deposit, offers 350 instruments on MT4/MT5, and spreads from 0.4 pips. ThinkTrader at $50 min accesses 4,000 instruments via its platform and TradingView. ThinkZero requires $500, raw spreads from 0.0 pips on MT4/MT5.

Swap-free suits Islamic traders, demo for practice, joint on request, ThinkCopy for social trading. Base currencies: USD, AUD, GBP, EUR, SGD, CHF, NZD. Lower mins beat Plus500‘s $100 but lag eToro’s $50 social focus.

Platforms and Execution

MT4 suits beginners with web/desktop/mobile; MT5 adds futures/options for pros. TradingView integrates charts; ThinkTrader is proprietary for mobile/web. Average speed 506.1ms, AA environment rating.

No major slippage reports beyond complaints; STP model confirmed across licenses. Vs. Pepperstones MT suite, ThinkMarkets, adds TradingView but lacks cTrader. Execution is reliable for scalpers on ThinkZero.

Fees and Funding Methods

Zero commissions on Standard/ThinkTrader; low on ThinkZero. Deposits free via Visa/MC, Apple/Google Pay, Neteller, Skrill, crypto (BTC/ETH/USDT instant), bank wire (1-3 days). Currencies: AUD/EUR/CHF/GBP/USD + regionals like INR/ KES/GHS.

Withdrawals mirror deposits, no fees noted, but complaints highlight delays. Inactivity fees absent; swaps apply except Islamic. Cheaper than XMs $5 min wire, but crypto speed beats traditional banks.

Reported Trader Complaints

Multiple unverified cases surface: one trader deposited ~$8k in April 2025, partial withdrew, but $5k+ frozen since August, ignored support. Another claims $30k principal + $43k profit seized post-June profits, labeled “illegal activity.” Scam accusations include deposit-only, pending withdrawals for weeks/months.

FX codes like 7104043152, 6295236062 detail holds on TRC20/crypto outs. No regulatory resolutions noted; Hong Kong filers dominate recent posts. These contrast pros like 24/7 multilingual chat (UK:44-203-514-2374, SY:248-4373952).

Office and Domain Checks

Australia office verified at Level 18, 357 Collins St, Melbourne (2024 visits). Cyprus operational; UK no presence (2025 check). Founded in 1999/registered in Australia, 10-15 years op, WikiFX score 7.75/10.

Domain thinkmarkets.com is stable; regional subs like .com/uk/europe. Vs. competitors, physical verifies lag virtual-heavy brokers like IC Markets. ASIC mentioned in summary, though not detailed in licenses.

ThinkMarkets vs Competitors

ThinkMarkets‘ multi-reg beats offshore-only like FBS, but trails Saxo’s full bank status. 4,000 instruments rival IG (17k), but leverage 1500:1 tops EU-capped rivals. Platforms' diverse vs. pure MT4 brokers; complaints are higher than Pepperstones clean record.[1]

Restricted in US/Canada/Bermuda/EU/AU/UK/RU/JP limits vs. global eToro. Awards like TradingView Newcomer 2024 add cred. Basic education (academy/videos) suits novices over CMC Markets depth.

Bottom Line

ThinkMarkets' regulation mixes robust FCA/CySEC with offshore FSA, suiting experienced traders chasing 4k instruments and raw spreads. TF Global entities protect via segregation/compensation, but withdrawal complaints demand caution. Safe for low-stakes via demo/Standard; risky for large profits amid unverified disputes—verify entity per region.