简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Screenshots Surface: Trive Accused of Withholding Salaries and EPF Contributions

Abstract:Fresh allegations against Trive have sharply intensified concerns surrounding the Trive broker, as WikiFX has now received screenshot-based evidence suggesting that employees in Malaysia have not only gone unpaid but have also been denied their mandatory EPF contributions.

Fresh allegations against Trive have sharply intensified concerns surrounding the Trive broker, as WikiFX has now received screenshot-based evidence suggesting that employees in Malaysia have not only gone unpaid, but have also been denied their mandatory Employees Provident Fund contributions.

This latest development marks a serious escalation in the ongoing payroll controversy. While earlier complaints focused on delayed salaries, these new claims point to possible non-compliance with Malaysian employment law, igniting widespread alarm among traders and industry observers.

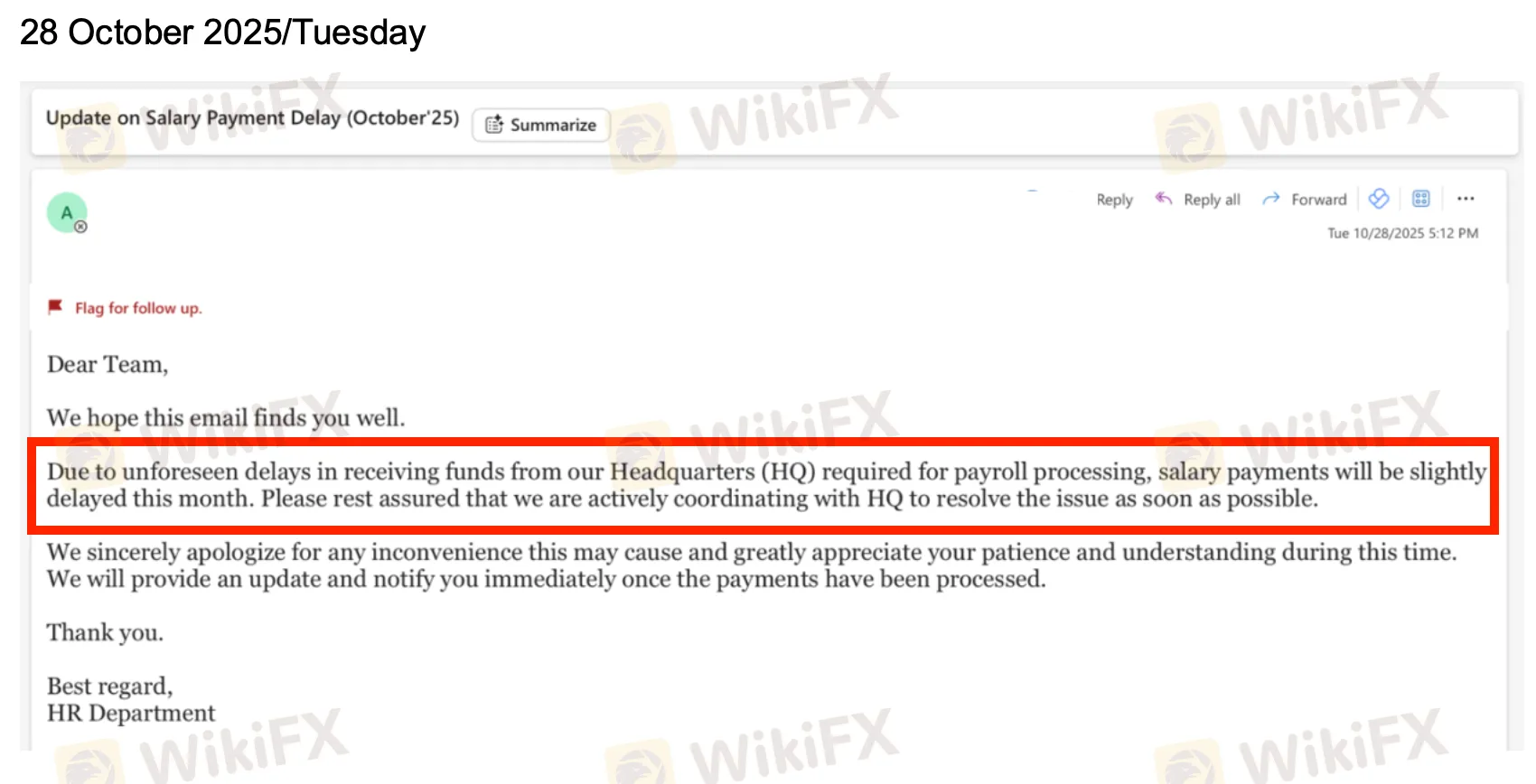

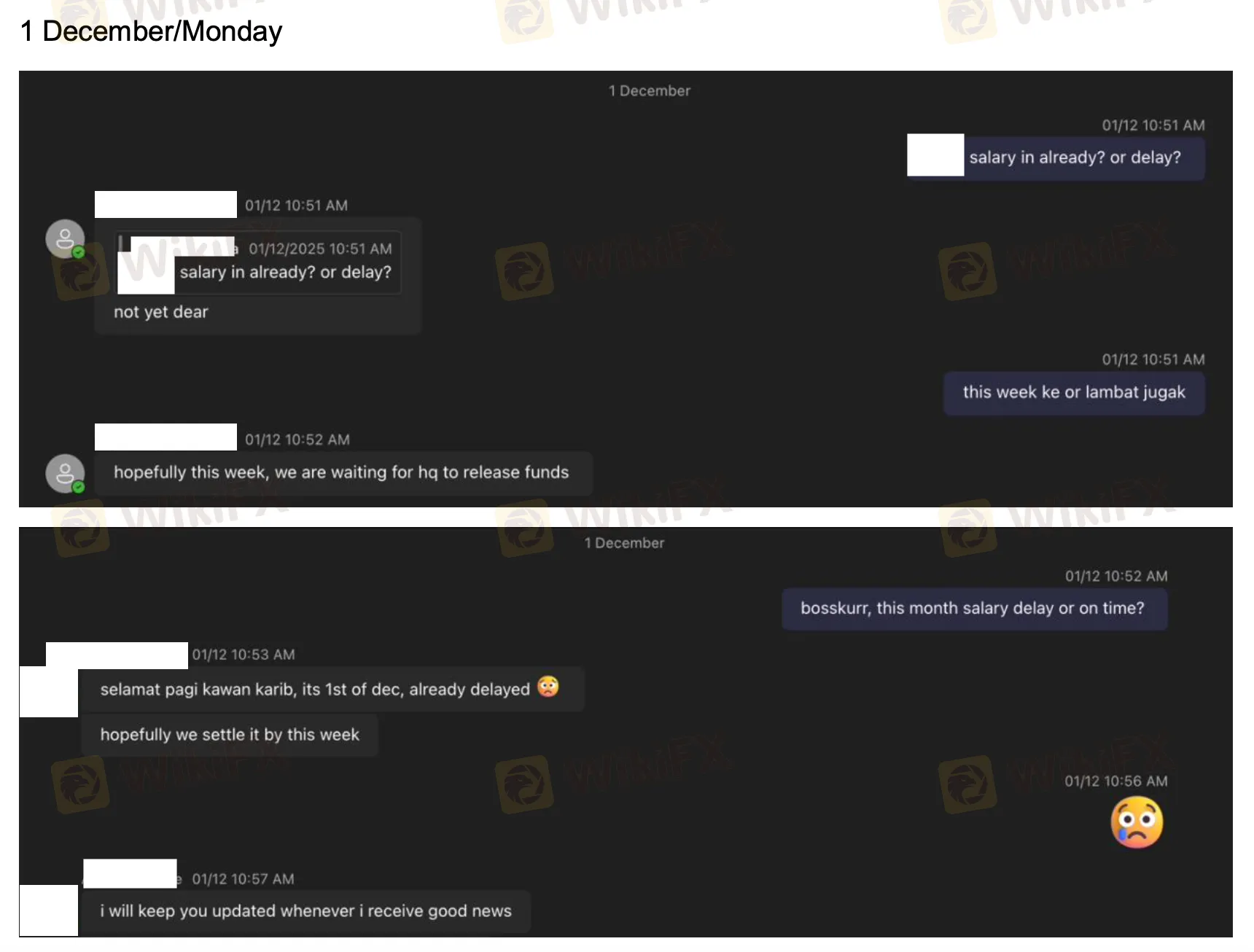

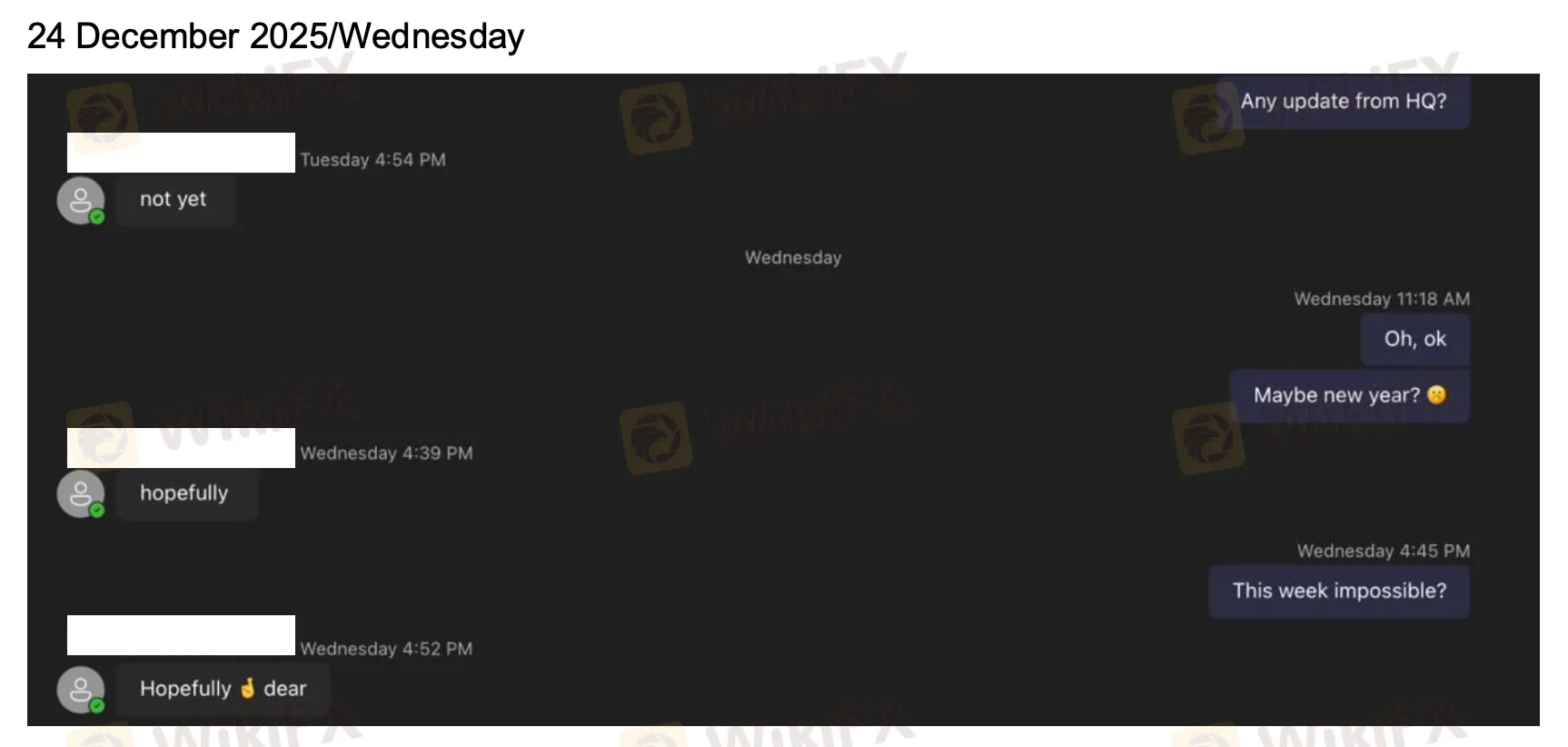

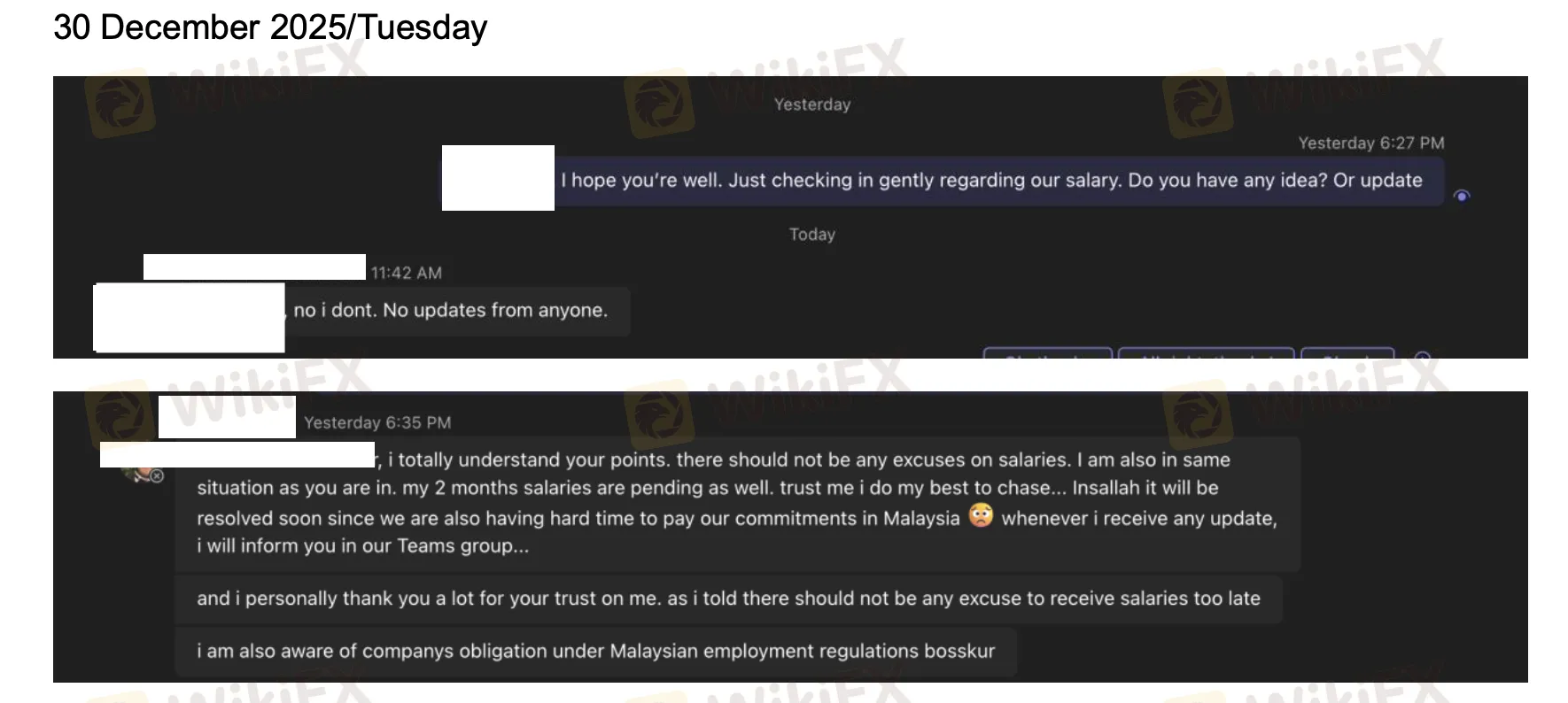

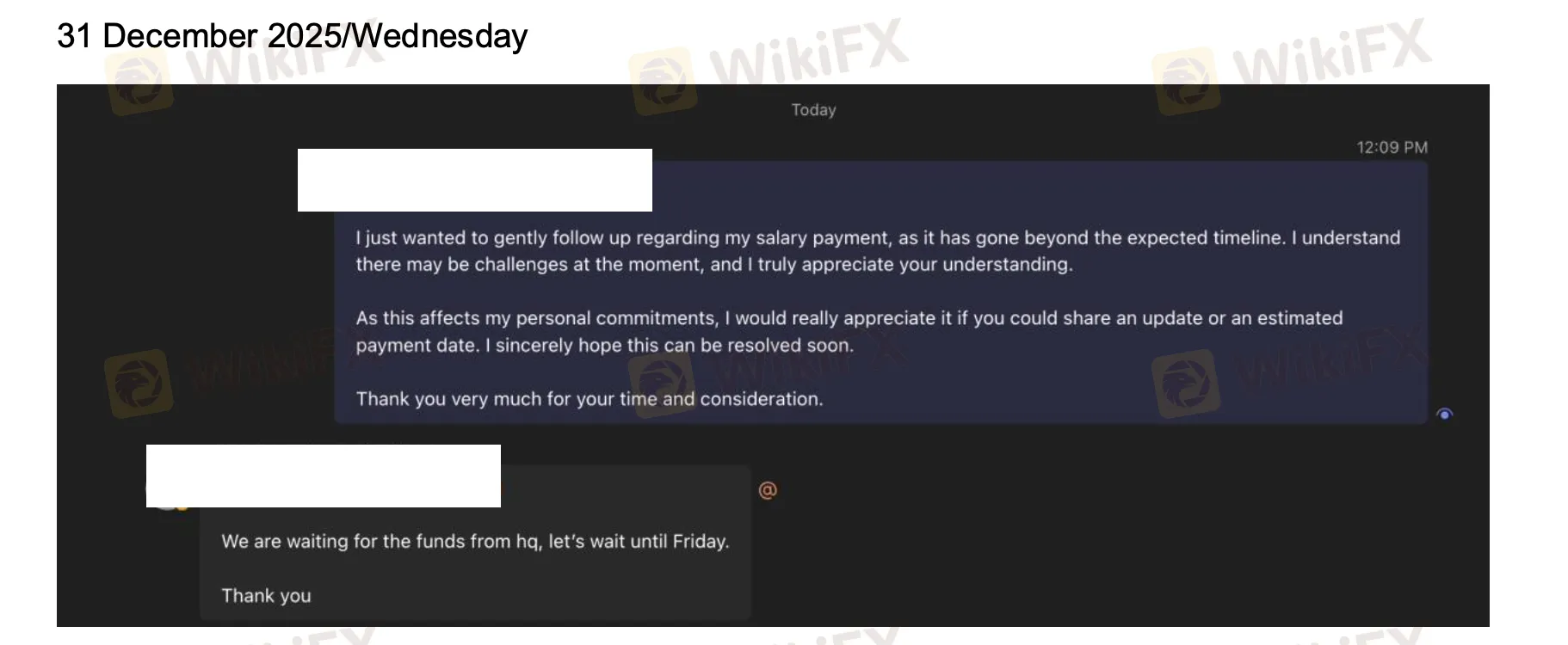

According to information submitted to WikiFX, screenshots shared by affected individuals appear to show internal communications, payment records, and employment documentation indicating that salary payments were not made on time or, in some cases, not made at all for Malaysian staff. More concerning still, the evidence suggests that EPF contributions, which employers in Malaysia are legally required to deduct and remit on behalf of employees, may not have been paid.

In Malaysia, EPF is not optional. It is a mandatory retirement savings scheme, and failure to contribute is a serious offence that can expose employers to penalties, enforcement action, and criminal liability. Allegations that a broker may have withheld or failed to remit EPF contributions push this situation far beyond a routine payroll delay.

What has further fuelled outrage is the apparent contrast between Trives public image and its alleged internal practices. While the company continues to present itself as a functioning global financial firm, these screenshots paint a very different picture behind the scenes, one that employees say has been quietly deteriorating for months.

As with earlier complaints, Trive has reportedly pointed to cryptocurrency-related payment issues at its headquarters as the cause of delayed salaries. However, this explanation becomes increasingly difficult to justify when statutory retirement contributions are also implicated. EPF payments are not discretionary and are not subject to experimental payment channels. They are a legal obligation.

Read the earlier complaints regarding Trive here:

From an analytical standpoint, this latest development significantly alters the tone of any Trive review. A broker accused of failing to pay salaries already raises serious credibility concerns. A broker now alleged to have neglected mandatory retirement contributions raises much deeper questions about corporate governance, compliance culture, and financial stability.

Screenshots, while still requiring verification, are powerful. They circulate rapidly, spark discussion, and often encourage whistleblowers to come forward. Since these images began circulating, industry chatter surrounding Trive has intensified, with traders increasingly questioning how a firm entrusted with client funds could allegedly neglect its most basic duties to its own employees.

This situation also brings renewed attention to Trive regulation. Regulatory oversight is designed to ensure that brokers maintain operational soundness and legal compliance, not only client-facing performance. Employment law breaches, particularly those involving statutory contributions, often signal systemic governance failures that regulators take seriously.

For traders, the implications are immediate and difficult to ignore. A broker facing internal disputes, unpaid wages, and alleged statutory non-compliance may be operating under severe financial or managerial strain. Such conditions have historically preceded withdrawal delays, service disruptions, regulatory intervention, and abrupt operational collapse.

The growing volume of complaints, combined with the emergence of screenshot evidence, has transformed this issue from a quiet internal concern into an industry-wide talking point. Social sharing, private trader groups, and online forums are already abuzz, with one recurring question gaining traction: if employees are not being paid, what level of protection can clients realistically expect?

WikiFX reiterates that whistleblower submissions and documentary evidence play a critical role in identifying early warning signs within the financial industry. While investigations require time, ignoring credible signals often allows risks to escalate unchecked.

As a global broker regulatory query platform, WikiFX remains committed to delivering timely and transparent broker-related intelligence so traders can act before potential damage occurs. Our mission is to ensure that warning signs are surfaced early, especially when they involve employee welfare, statutory obligations, and potential regulatory breaches.

The unfolding situation involving Trive is no longer confined to salary delays. With Malaysian wages and EPF contributions now reportedly affected, the controversy has entered a far more serious phase. Until clear explanations, proof of payment, and regulatory clarity are provided, the Trive broker remains under intense scrutiny, and traders would be wise to stay alert and reassess their exposure without delay.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Najm Capital Ltd: Regulated Forex Broker Strengthens Its Presence in the MENA Online Forex Market

HEADWAY Rebate Service Review 2026: Is this Forex Broker Legit or a Scam?

UAE SCA Rebrands as CMA: What It Means for Forex and CFD Brokers?

OmegaPro Review 2026: Is This Forex Broker Safe?

Legal Headwinds for Tariffs: US States Sue to Block Trump's Trade Agenda

Is Malaysia Losing Control of the Online Scam Economy?

FINRA Fines Altruist Financial $150,000 for Supervisory Failures in Securities Lending Program

Angel One Exposure Review: Low Score & Unregulated Forex Broker Risks

A Complete Xlibre Review: High Leverage and Major Warning Signs to Consider

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Currency Calculator