Abstract:Reports claimed NAGA has blocked some client withdrawals after profits, raising concerns about transparency and fund protection.

Introduction

NAGA, operating under European and offshore licenses, faces scrutiny after some traders reported withdrawals blocked following profitable trades. Clients cite frozen balances, rejected requests, and accusations of “market abuse” without supporting evidence.

One trader in Turkey claims $12,680 was locked after approved trades and no warnings. In Kuwait, complaints allege that over $80,000 in profits were withheld, with the details described as unclear. These cases question NAGA's practices, oversight, and client risks. This article summarizes cases, reviews regulations, and lists steps traders can take.

Case Study: $12,680 Frozen in Turkey

A Turkish trader says NAGA denied $12,680 in withdrawals from a hedging account, even after previous successful withdrawals. NAGA cited market abuse without clear evidence. The trader refused a $4,000 partial settlement.

Key details: Hedging account was enabled and previously permitted.

- Previous withdrawals occurred before profits increased.

- Balance locked: $12,680.

- Broker cited “market abuse” without technical evidence.

- A partial settlement of $4,000 was offered and refused.

The absence of execution logs, latency data, or trading warnings prompts questions. Blocking withdrawals after profits while deposits and trades continue may suggest retaining client funds for compliance purposes. A similar situation has also been reported in Kuwait.

Another trader from Kuwait described a similar experience, marking a second notable report. After accumulating profits of over $80,000, the account was reportedly restricted. Attempts to resolve the issue reached NAGAs CEO, Octavian Patrascu; however, communication ceased without resolution, which the trader felt highlighted concerns about accountability.

Customer support cited bonus conditions that were not shown at registration and not accepted, according to the trader. The trader insists they never requested a bonus, but NAGA claimed a $1,800 bonus had expired and deducted nearly $59,800 from the account.

These cases may show a pattern: NAGA withholds profits using unclear rules. Traders report little recourse or clarity. Undisclosed terms may affect trust in NAGA.

Repeated Complaints and Patterns

More traders from other regions are reporting sudden account restrictions, unexplained withdrawal rejections, inaccessible funds, and accusations of market abuse or expired bonuses.

- Withdrawal requests rejected without explanation.

- Balances are visible but inaccessible.

- Vague accusations of “market abuse” or expired bonuses.

- Lack of transparency in terms and conditions.

These reports suggest NAGAs business model may use regulatory gaps and vague contracts. Deposits and trades go through, but profitable withdrawals face obstacles, according to the cases.

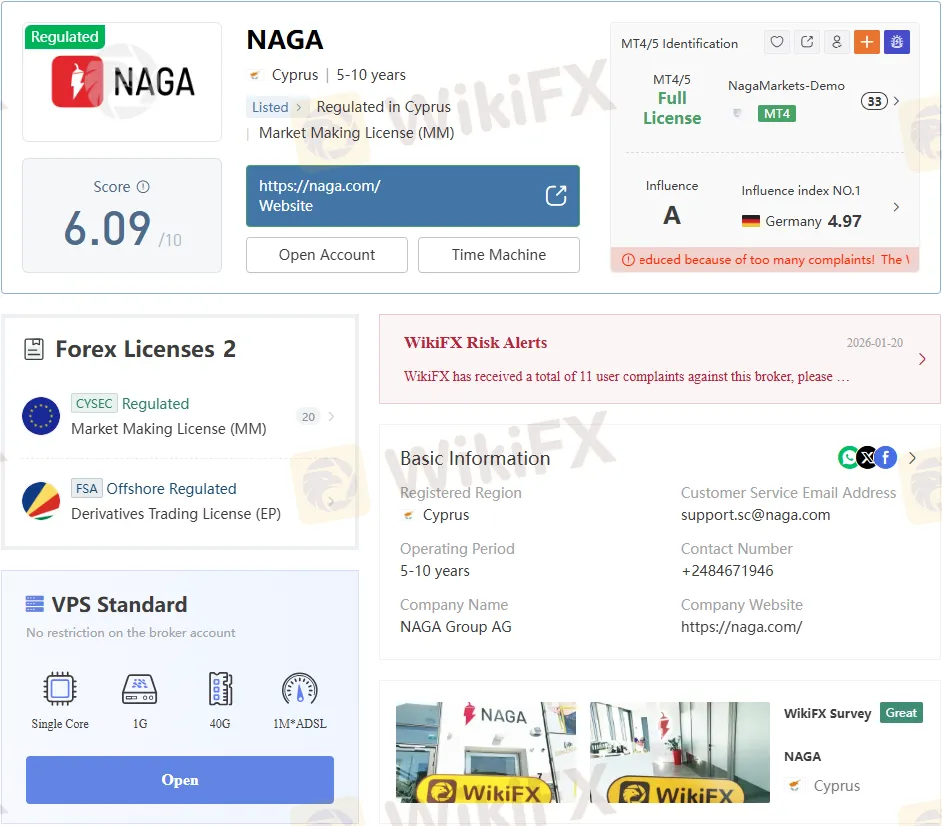

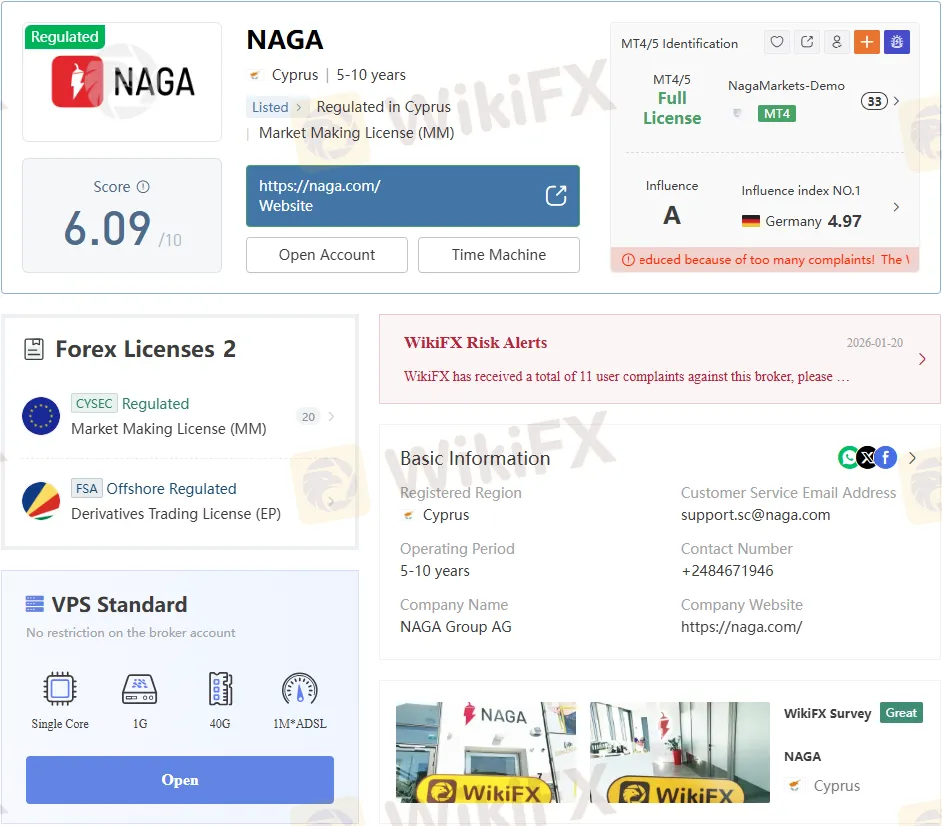

Regulatory Framework: Cyprus and Seychelles

NAGA operates under dual regulatory jurisdictions:

- Cyprus Securities and Exchange Commission (CySEC): License No. 204/13, effective since 2013, covering foreign exchange and derivatives trading.

- Seychelles Financial Services Authority (FSA): Offshore license SD026, covering futures, derivatives, and securities trading.

CySEC, located in the EU, provides a regulated environment, but its oversight is sometimes considered insufficient to prevent flexible broker practices. Seychelles offshore licenses are widely seen as offering weaker client protection due to less stringent enforcement.

NAGA is formally compliant with multiple jurisdictions, but traders often face limited protection in practice. Offshore regulation can make disputes hard to resolve.

Business Scale and Branding

NAGA presents itself as a large-scale, reputable broker. Founded in 1996 and registered in Cyprus, it offers over 4,000 trading instruments, including forex, cryptocurrencies, shares, indices, ETFs, commodities, and futures. The company promotes six account types—Iron, Bronze, Silver, Gold, Diamond, and Crystal—with spreads starting at 1.1 pips and minimum deposits as low as $10.

Its platforms include NAGA Web Trader, mobile apps for iOS and Android, MetaTrader, and even a Telegram Mini App. Copy trading is also marketed as a key feature. Brand ambassadors, including celebrities like Mike Tyson, are used to enhance credibility and attract retail traders.

Reported cases show a gap between NAGAs ads and some client experiences. Its scale and branding can hide problems with withdrawals.

Customer Support and Accountability Issues

Many traders report that customer support is evasive and lacks evidence to support accusations of market abuse. Contact with the CEO did not resolve one traders issue.

This lack of accountability leads some to question NAGAs processes. Regulated brokers should document their activities, communicate transparently, and resolve disputes fairly. Reports show traders find these processes difficult at NAGA.

Such reports could influence trust and highlight the importance of regulatory bodies maintaining effective standards for customer support and complaint processes.

Offshore Risks and Limited Recourse

NAGAs Seychelles license means it does not follow all EU rules. Offshore regulation often offers weak consumer protection and limited dispute options.

Traders often cannot recover funds in disputes. Offshore complaints are hard to enforce, and cross-border legal action is complex and costly.

NAGA's dual licensing allows it to claim regulatory oversight, but offshore licenses offer little oversight. Traders should be cautious with brokers using offshore setups.

Marketing vs. Reality

NAGAs marketing emphasizes innovation, accessibility, and social trading. With slogans like “Your go-to app for everything money,” the company positions itself as a modern, trustworthy platform. Minimum deposits of $10 and copy trading features appeal to retail traders seeking easy entry into financial markets.

Trader reports say experiences often do not match NAGAs marketing. Some reports withheld profits, blocked withdrawals, and unclear balance removals. These differences underscore the need for caution when dealing with brokers.

Traders should demand transparency, regulation, and proven track records, not just branding or endorsements.

Lessons for Traders

The cases against NAGA provide important lessons:

- Verify regulatory protections: Ensure that brokers are regulated under jurisdictions with strong enforcement mechanisms.

- Scrutinize terms and conditions: Hidden clauses or undisclosed bonus rules can be used to justify withholding funds.

- Monitor withdrawal processes: Test withdrawals early and frequently to confirm accessibility of funds.

- Avoid reliance on offshore licenses: Offshore regulation often provides minimal protection.

- Document all interactions: Record trades, communications, and withdrawal requests to support complaints, if needed.

Use these steps to reduce risk and avoid unregulated brokers.

Bottom Line

Some clients report NAGA blocked withdrawals after profits, with traders saying balances of $12,680 and $80,000 were withheld on unclear grounds. NAGA operates under CySEC and Seychelles licenses, but these cases suggest that regulations may not always protect clients, especially with offshore structures.

Traders: dont be swayed by branding or celebrity endorsements. Check broker terms, test withdrawals early, and avoid brokers with offshore licenses. Transparency, accountability, and regulation are essential. Without these, traders risk losing both profits and trust.