简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ALERT: eToro’s "Regulatory Shuffle" Cost a Trader $170,000 – Is Your Money Safe?

Abstract:Our investigation exposes a critical 'regulatory arbitrage' risk where eToro traders report being quietly shifted from protected jurisdictions to offshore entities, resulting in catastrophic losses up to $170,000. With the Philippines SEC blacklisting the platform for unauthorized operations and Australian regulators suing over consumer harm, the safety of your funds is in question.

WikiFX Special Investigative Report

Urgency Level: critical

The $170,000 Trap: A Users Worst Nightmare

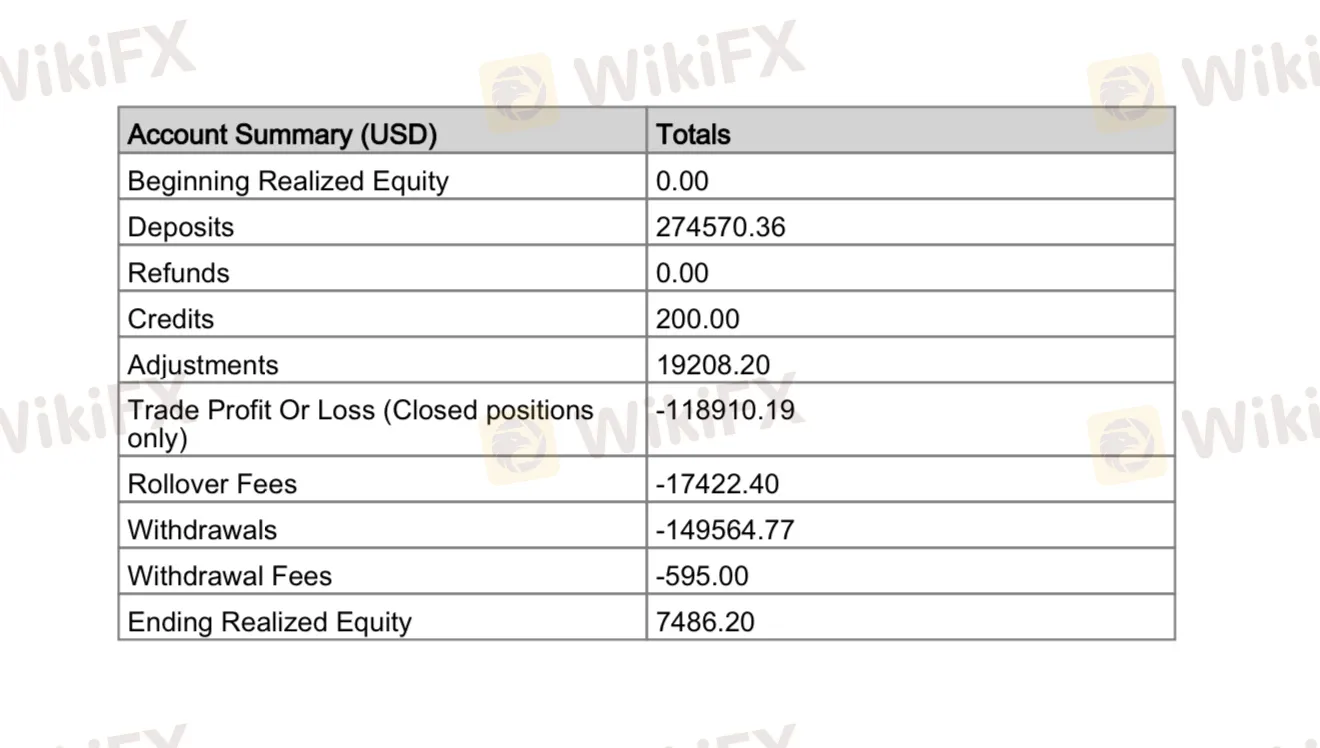

Every trader believes their broker is a fortress. But for one eToro user in Morocco, that fortress turned into a prison. On October 20, 2025, a trader reported a devastating loss of $170,000, not just due to market volatility, but because the safety net was yanked away.

According to the victim's testimony (Case ID: Morocco/en), eToro unilaterally transferred their account from the high-protection jurisdiction of ASIC (Australia) to the Seychelles FSA (Offshore).

> “Instead of protecting me, eToro moved my account... stripping away my legal protections without warning... Now Im buried under $200,000 in debt.”

This is not a “glitch.” This is Regulatory Arbitrage—moving clients to regions with looser laws to circumvent strict consumer protections. When you click “I Agree” on an update, you might be signing away your right to legal recourse.

Regulatory Reality Audit: The License Paradox

eToro projects an image of global safety, displaying top-tier licenses. However, our deep dive into the regulatory data reveals a stark contrast between “on paper” safety and the reality for international clients.

| Regulator | Country | License Type | REAL STATUS |

|---|---|---|---|

| SEC | Philippines | -- | Blacklisted / Unauthorized |

| ASIC | Australia | MM License | Lawsuit Filed (Design & Distribution Failure) |

| FSA | Seychelles | Retail Forex | Offshore / Low Protection |

| FCA | UK | MM License | Authorized (Clone Warnings Issued) |

| CYSEC | Cyprus | MM License | Authorized |

The Red Flag: While eToro holds prestigious licenses in the UK and Australia, many global retail traders are funneled into the Seychelles entity, where protections are minimal. Furthermore, the Securities and Exchange Commission (SEC) of the Philippines has explicitly warned that eToro is unauthorized to sell securities to the public there.

Why Your Funds Are At Risk

1. The “Hard-to-Fail” Screening Test

Australian regulators (ASIC) have taken legal action against eToro, alleging that the platform's screening tests were “hard to fail.”

- The Allegation: eToro‘s quizzes allowed users to modify answers until they passed, granting them access to high-risk CFD products they didn't understand.

- The Cost: Between October 2021 and June 2023, nearly 20,000 clients lost money.

- The Stat: eToro’s own data admits that 77% of retail investor accounts lose money when trading CFDs.

2. The Withdrawal Blockade

It is not just about losing trades; it is about accessing your own money. Recent complaints from Thailand and Indonesia in 2024 and 2025 highlight a pattern of frozen funds.

- Case 2 (Thailand, 2025-08-28): A user reported spread manipulation and forced position closures “for safety,” followed by an inability to withdraw.

- Case 4 (Indonesia, 2024-05-31): Simply stated: “Cannot withdraw funds. Please return my money.”

(User evidence showing platform failures and locked withdrawals)

The Verdict: Unsafe for the Unwary

eToro is a giant, but giants can crush the little guy. The evidence suggests a broker that uses its global footprint to maneuver clients into vulnerable legal positions.

WikiFX Warning List:

- Forced Jurisdiction Swaps: You may be moved to offshore regulation without fully understanding the consequences.

- Withdrawal Obstacles: Multiple reports of delays and silence from support.

- Regulatory Action: Active lawsuits and warnings from major regulators (ASIC, Philippines SEC) prove that eToro pushes the legal limit.

Our Advice: If you are outside the UK or EU, check exactly which “eToro” holds your funds. If it says Seychelles, you are trading without a safety net.

*Protect your capital. Check your regulatory status on the WikiFX App today.*

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Currency Calculator