简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IUX Review 2026: Comprehensive Safety Assessment

Abstract:IUX holds valid licenses from ASIC and FSCA, presenting a mixed safety profile with a WikiFX score of 6.08. However, a recent warning from CySEC regarding unauthorized operations and a surge in complaints about withdrawal delays suggests significant caution is required despite its competitive spreads.

Executive Summary

In this in-depth review, we analyze the key metrics defining IUXs position in the global financial markets. Headquartered in Mauritius and established in 2019, the broker has expanded its influence significantly across Southeast Asia and Africa. As a broker entity operating with a WikiFX score of 6.08, IUX sits in a middle tier of reliability. While it secures credible regulation from South Africa and Australia, persistent withdrawal complaints and regulatory warnings suggest that its operational safety may not match its aggressive marketing. This review 2026 aims to determine if the low entry barriers justify the potential risks.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under. IUX has secured licenses from two major bodies: the Financial Sector Conduct Authority (FSCA) in South Africa (License 53103) and the Australian Securities & Investments Commission (ASIC) (License 529610). These are substantial credentials, theoretically ensuring that the broker adheres to strict standards regarding capital adequacy and client fund segregation.

However, the regulatory landscape is not entirely spotless. A significant red flag appeared in July 2025 when the Cyprus Securities and Exchange Commission (CySEC) added the domain “iux.com” to its warning list of unauthorized entities. This creates a dichotomy where specific regional branches are compliant, but the global offering may expose traders to unregulated jurisdictions. Traders must verify exactly which entity they are contracting with, as the protections afforded by regulation in Australia do not extend to offshore accounts.

2. Forex Trading Conditions

For traders focusing on Forex instruments, IUX provides an environment characterized by extremely high leverage and low costs. The broker offers a maximum leverage of 1:3000, which is significantly higher than the limits imposed by top-tier regulators like the FCA or EMA (typically 1:30). While this allows for massive exposure with a minimum deposit of just $10, it exponentially increases the risk of rapid account liquidation.

On the cost front, the Forex pricing is highly competitive. The “Raw” account offers spreads starting from 0.0 pips, and the “Standard” account begins at 0.2 pips. These conditions are attractive for algorithmic traders and scalpers. However, users have reported issues with slippage and order execution (Case 11), which can erode the benefits of tight spreads during volatile market movements.

3. User Feedback & Complaints

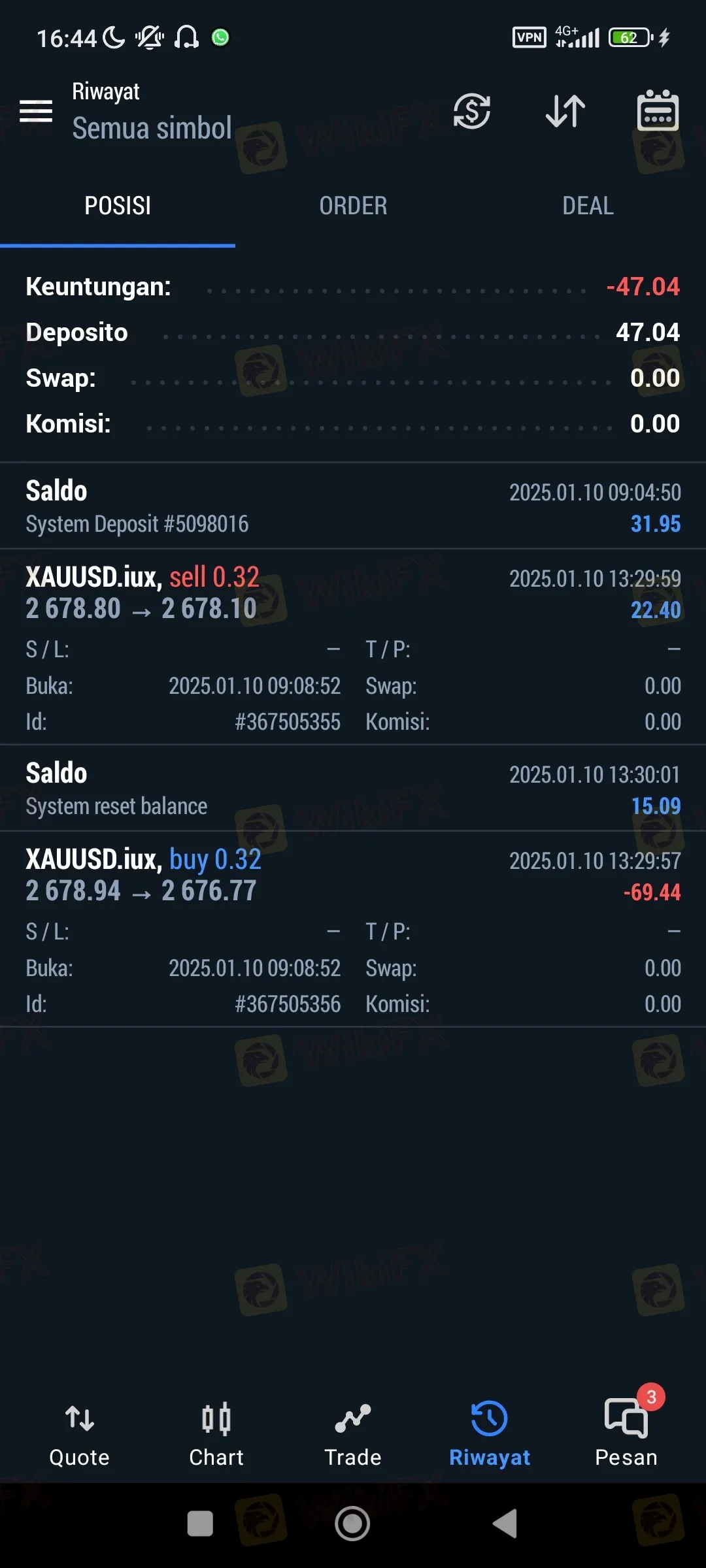

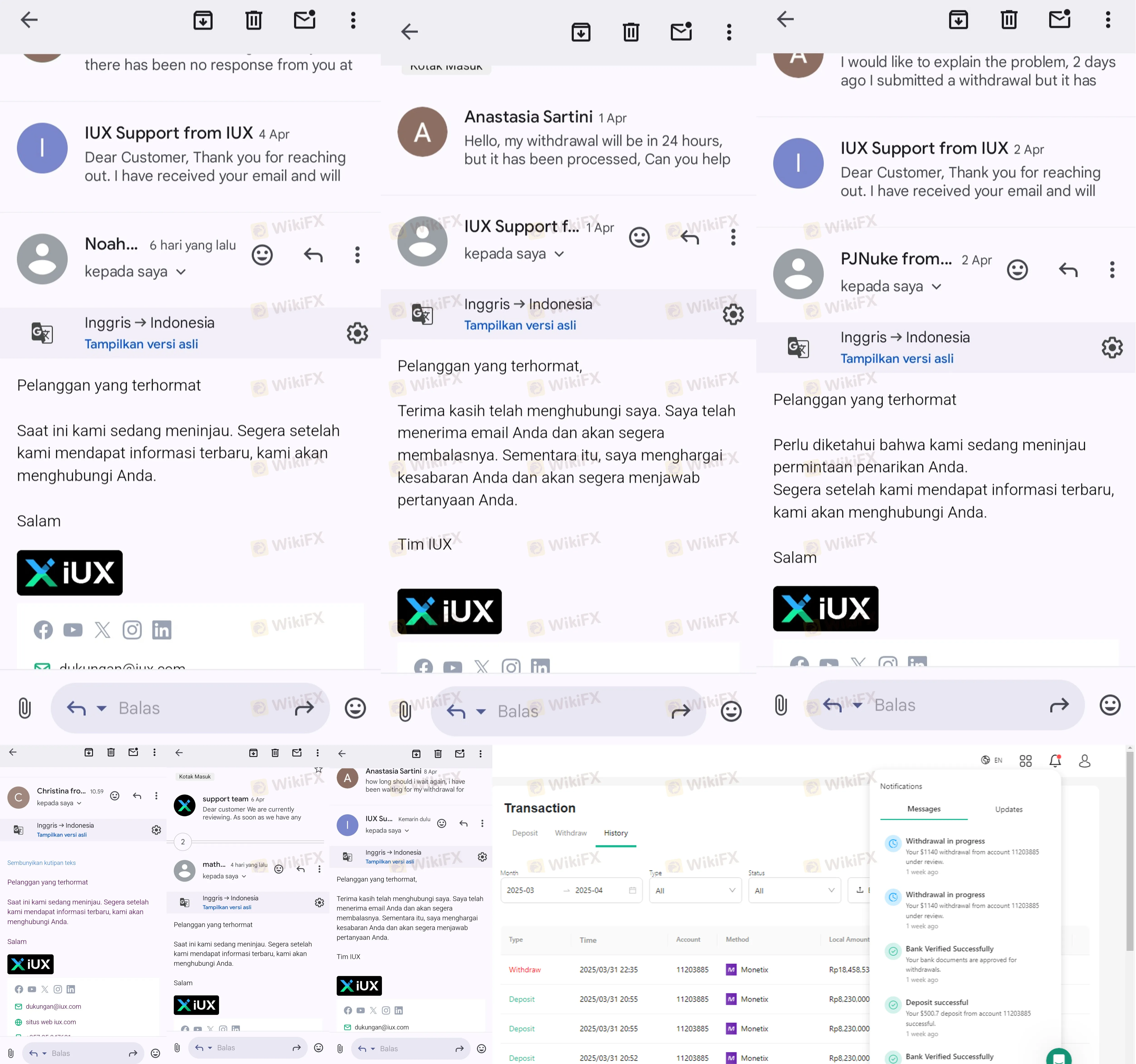

A review of recent user activity reveals a high volume of disputes. WikiFX has received over 20 complaints in the last three months, with the vast majority centering on withdrawal failures. Traders from Vietnam, Indonesia, and Thailand have reported that funds are not credited to their bank accounts even after the broker marks the transaction as “successful.”

Technical issues also plague the user experience. In one specific instance (Case 20), a user reported that their account was locked without explanation, preventing a successful login to the portal to resolve the issue. This pattern of account freezing and delayed payments is a critical risk factor.

4. Software & Access

IUX utilizes the MetaTrader 5 (MT5) platform alongside a proprietary mobile app, catering to both advanced analytics and casual trading. MT5 is the industry standard for multi-asset trading, offering robust tools for automation.

To access the platform, traders must complete the login security steps. While the software itself is reliable, the lack of advanced security features like two-factor authentication on the proprietary app is a missed opportunity for securing client data. Furthermore, as noted in the complaints, a smooth login process is irrelevant if the backend systems fail to process withdrawals efficiently.

Final Verdict

IUX offers a conflicting proposition: it holds reputable ASIC and FSCA licenses and offers ultra-low spreads, yet it is marred by severe withdrawal delays and a CySEC warning. The 1:3000 leverage further classifies it as a high-risk provider. For real-time updates on regulation status or to verify the official login page, consult the WikiFX App before committing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Currency Calculator