简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

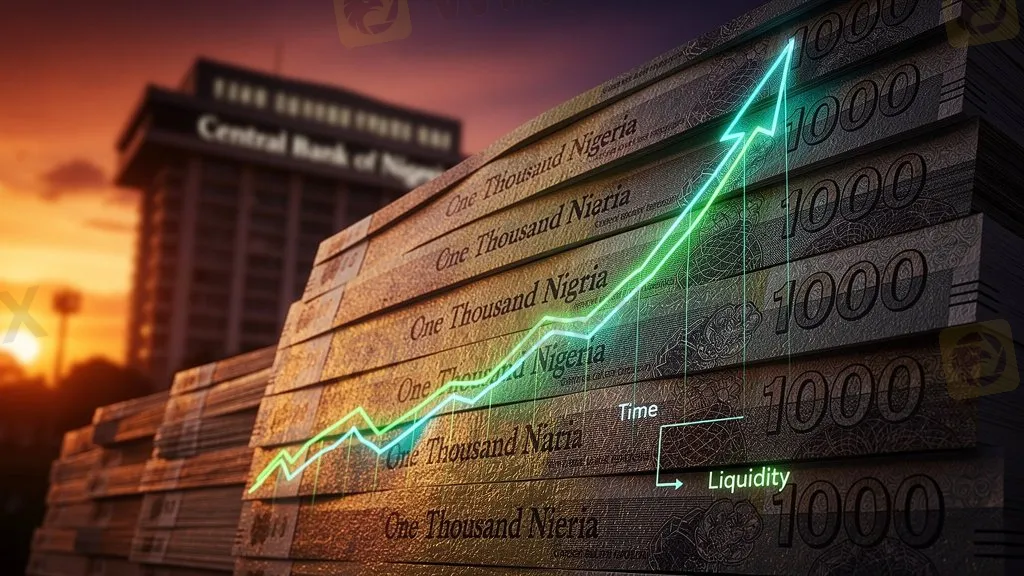

Nigeria Macro Alert: N8.6 Trillion Liquidity Surge Expected in February 2026

Abstract:Nigeria's financial system faces a massive N8.6 trillion liquidity injection in February 2026, putting pressure on yields and the Naira as markets await Central Bank sterilization measures.

Nigeria's financial markets face a massive liquidity inflow as N8.61 trillion from bond coupons, OMO, and T-bills matures in February 2026, challenging the CBN's monetary stability efforts.

Yield Curve and Currency Implications

This injection typically triggers yield compression unless the Central Bank of Nigeria (CBN) intervenes. For market participants, the stability of the Naira (NGN) remains the focal point of volatility risk.

- Total Liquidity: N8.61 trillion

- Expected Date: February 2026

- Primary Currency: NGN

- Regulatory Body: CBN

Market Dynamics

If the excess Naira is not mopped up, inflationary pressure and currency devaluation become imminent. The Fed-style tightening via OMO auctions is expected.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Toyar Carson Limited Review: A Detailed Look at a Risky Broker

USD Resilience: Strong Data Cushions Political Volatility as Trump Targets Fed

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Italy’s Financial Regulator Expands Crackdown on Unauthorised Investment Websites

Naira Rallies to Start February as Government targets Fiscal Consolidation

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Currency Calculator