简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MSquare Review: A Digital Slaughterhouse Built on Forged Receipts

Abstract:MSquare is a regulatory phantom operating with a toxic 1.31 score and a trail of 19+ formal complaints involving forged transaction records and systemic withdrawal blocking. If you value your capital, treat their 'verified' claims as the digital fiction they clearly are.

MSquare isn't just another subpar brokerage; it is a masterclass in financial deception. With a WikiFX score of 1.31, this entity has spent 2024 and 2025 systematically gutting the accounts of retail traders across Algeria, China, and Australia. The evidence doesn't just point to incompetence; it points to a calculated campaign of fraud involving Photoshopped payment confirmations and “money laundering” accusations designed to extort further funds from victims.

The Regulatory Mirage: MSquare Regulation Exposed

The broker claims an Australian identity, yet the data tells a hauntingly different story. While they attempt to cloak themselves in the legitimacy of an ASIC registration, the reality is a status of “Unverified.” In the world of high-stakes trading, “Unverified” is a polite term for a regulatory ghost. They operate without the oversight required to protect your deposits, making them a high-risk entity that bypasses every standard safety protocol.

| Regulator | License Type | Status |

|---|---|---|

| Australia ASIC | Investment Advisory License | Unverified / 499761 |

The lack of a legitimate Forex regulation framework means they answer to no one. When MSquare decides to freeze your account, there is no ombudsman to call, no insurance fund to claim, and no legal recourse beyond the screen youre staring at.

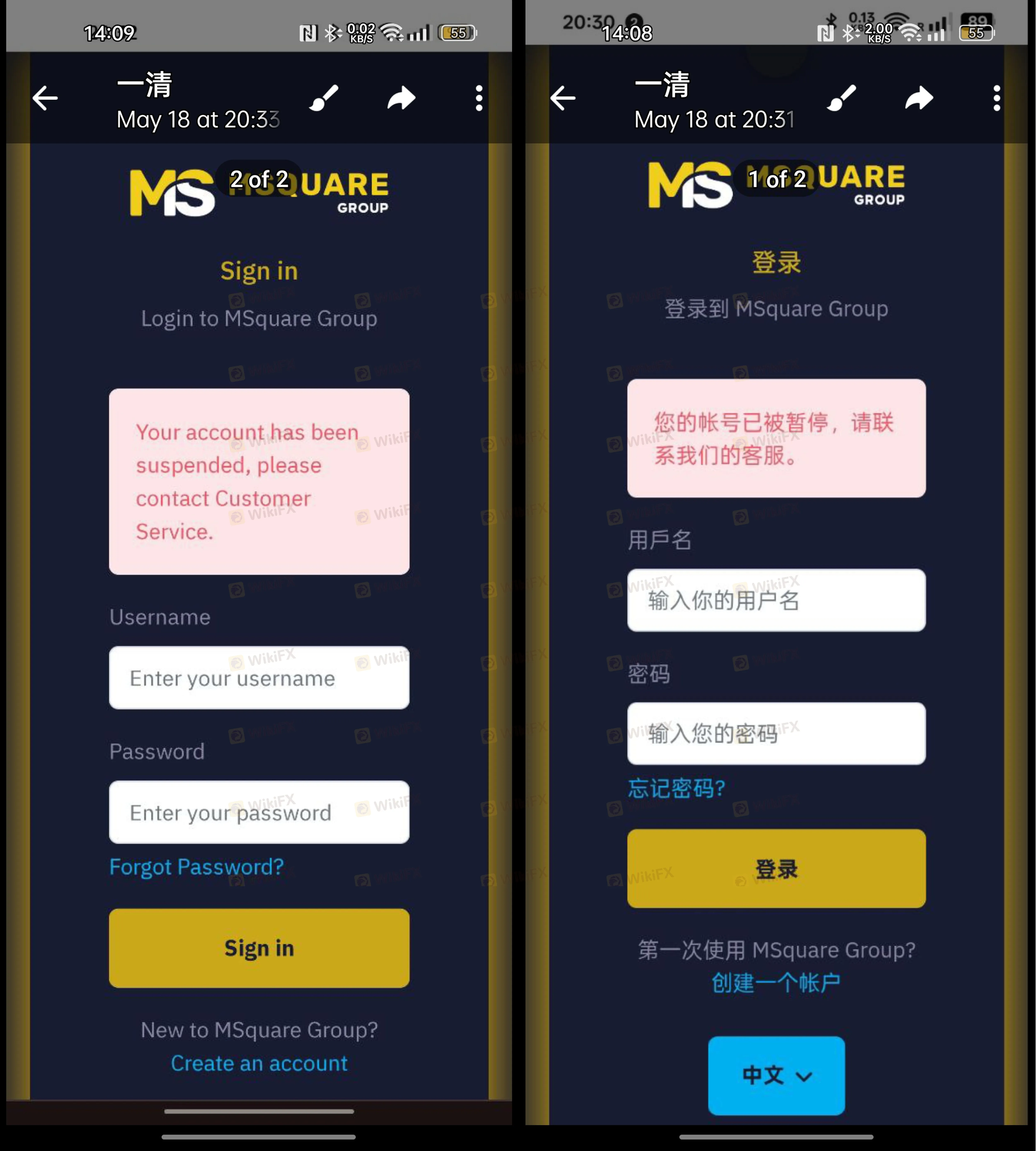

The Withdrawal Trap and The “Login” Smoke Screen

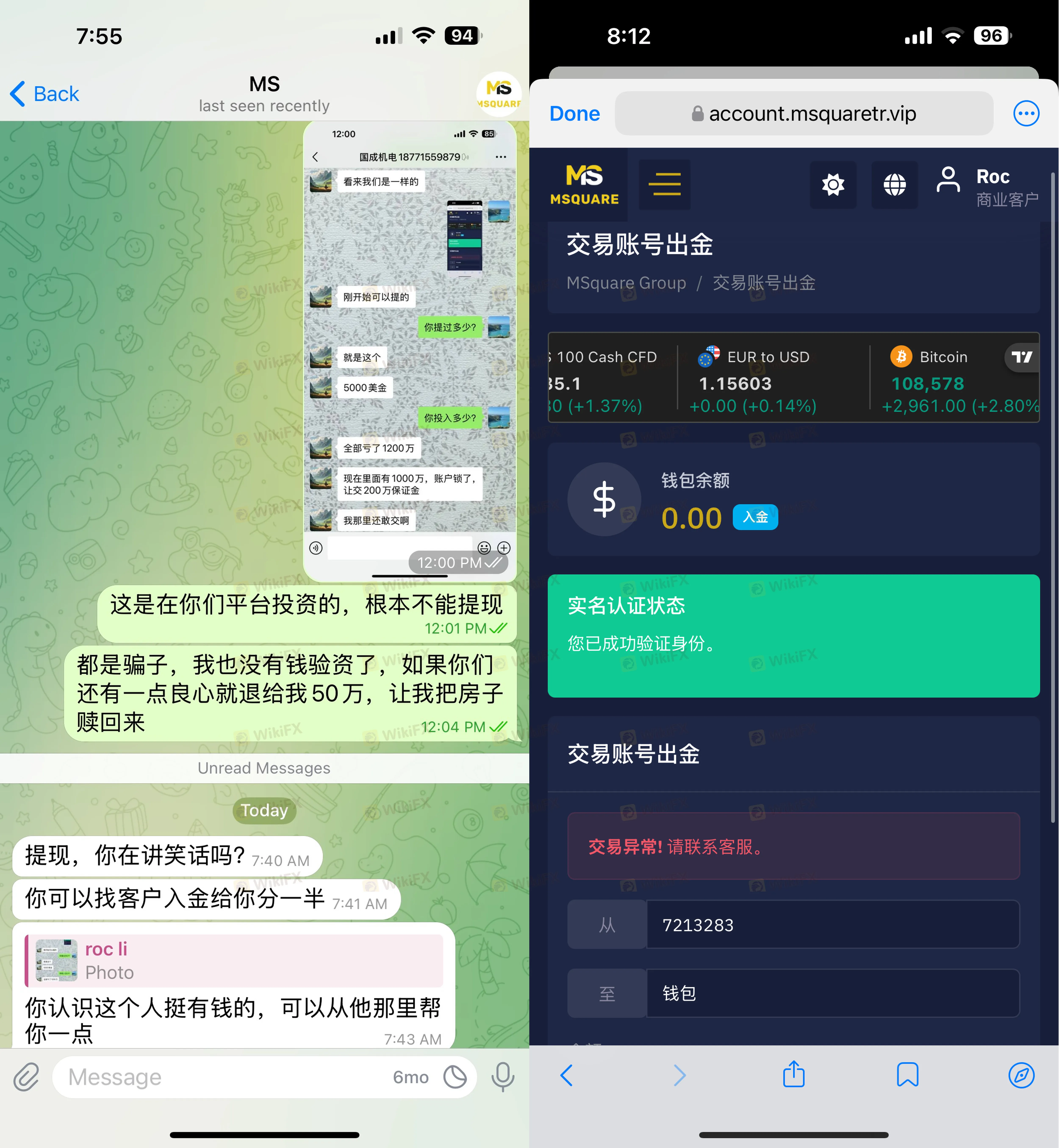

What happens after you use your login credentials for the last time? For MSquare victims, the professional facade vanishes the moment a withdrawal is requested. We have documented cases where the broker demands a “45% capital verification fee” or “28% tax” before funds can be released.

In more sophisticated scams, MSquare issued fake TXID (Transaction ID) screenshots to users. Investigations into these receipts revealed three fatal flaws:

1. Timestamp Paradox: Payments “received” days before the transaction was actually logged on the chain.

2. Formatting Errors: Screenshots missing standard decimal separators used by real exchanges.

3. TXID Fraud: When checked on the blockchain (OKLink), the TXID either didn't exist or showed funds being sent to a completely different wallet address.

If you find yourself unable to access your dashboard, do not be fooled by claims of “system maintenance” on the login page. This is a common tactic to stall while the broker moves your liquidity elsewhere.

Mapping the Scam: From TikTok to Total Loss

The MSquare review process wouldn't be complete without looking at their “human-centric” trap. Reports from Algeria indicate that MSquare agents recruit victims via TikTok under the guise of “side hustles” or “forex education.” They walk you through the deposit process with extreme patience, only to block your communication channels the moment you ask for your 40,000 USDT back.

Final Verdict on MSquare Broker

There are no “technical glitches” here—only a deliberate architecture of theft. This broker offers 1:3000 leverage not as a tool for your profit, but as a lure to get you to deposit more “margin” when they inevitably manipulate the trade against you.

Whether you are looking at their Forex pairs or their “Standard” account types, the outcome remains the same: your money enters, but it never leaves. The 1.31 score is a generous estimate for a platform that treats its users' capital as a personal slush fund.

Risk Warning: Trading with an unverified entity like MSquare is equivalent to throwing your money into a void. If you currently have funds in an MSquare account, attempt a withdrawal immediately, document every conversation, and do not—under any circumstances—pay “taxes” or “verification fees” to unlock your account. Once you lose access to your login , the recovery process becomes nearly impossible.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Currency Calculator