Abstract:GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

Swiss financial authorities have issued a warning against GmtFX (gmtfx1.io), drawing attention to a platform that claims a Zurich presence but shows no evidence of being authorised to provide financial services. Independent risk data and platform analysis further reinforce concerns that investors may be exposed to significant financial risk.

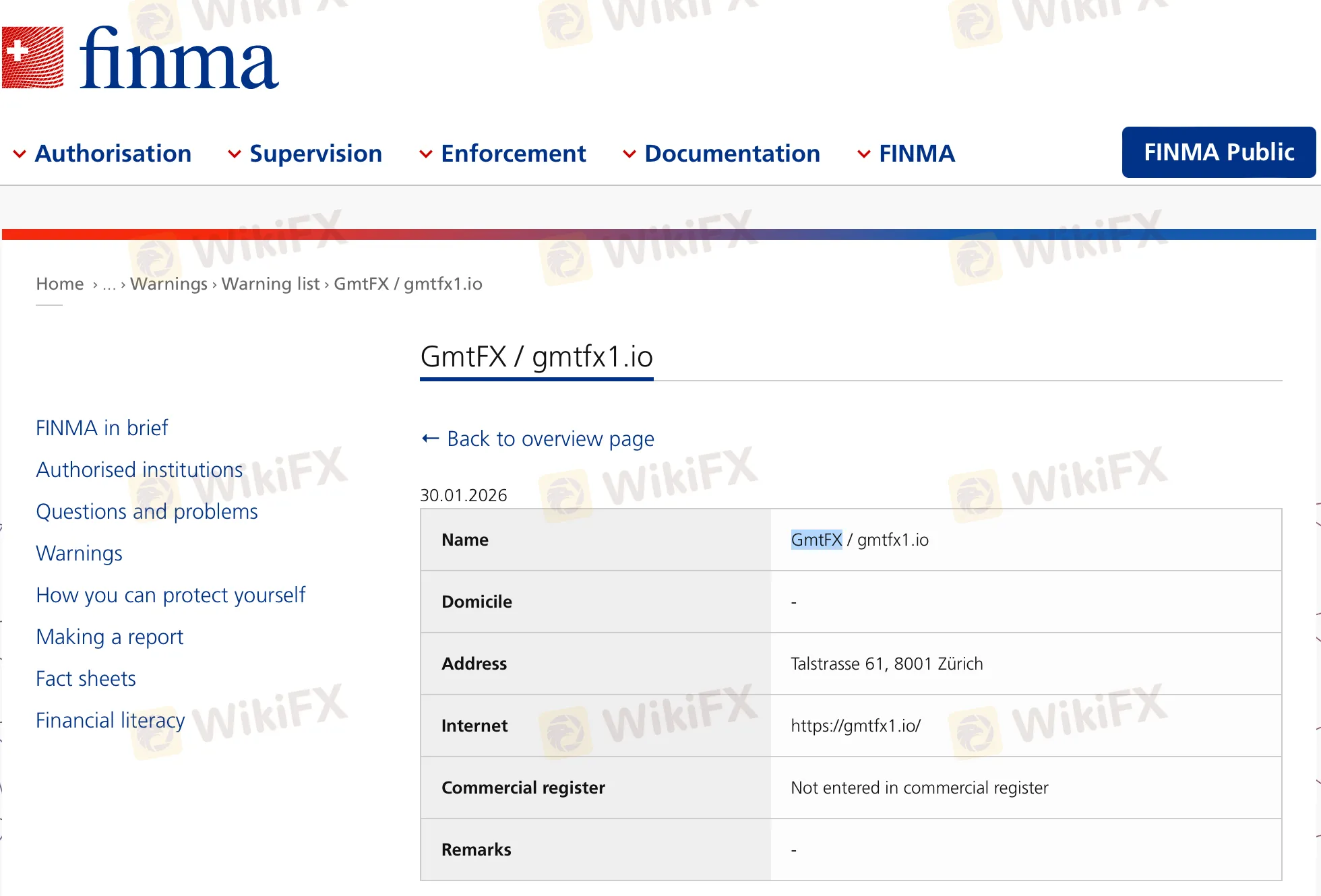

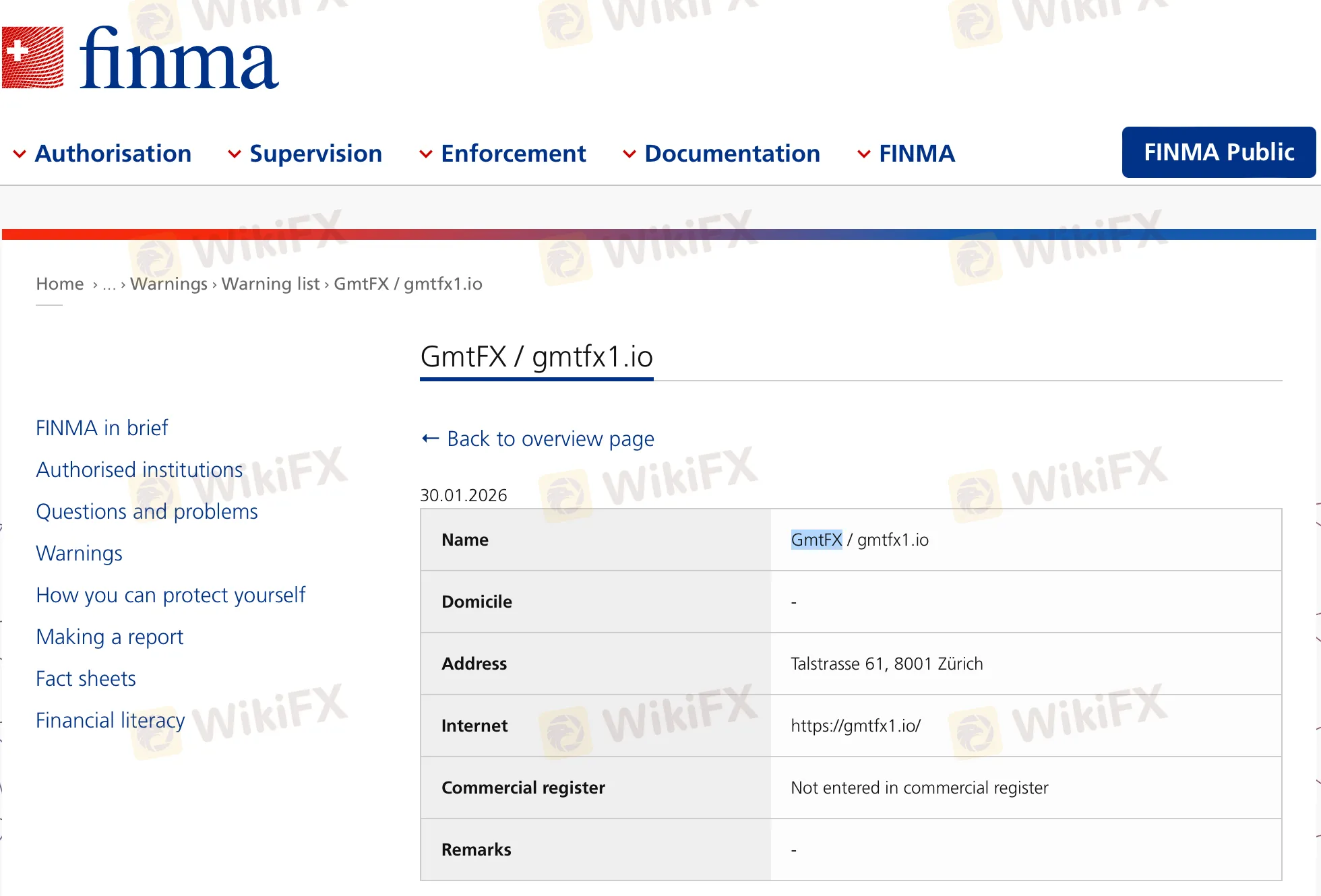

FINMA Warning: No Authorisation, No Registration

On January 30, 2026, the Swiss Financial Market Supervisory Authority (FINMA) added GmtFX / gmtfx1.io to its official warning list. According to the notice, the entity is not entered in the Swiss commercial register and has no licence to offer financial or investment services in Switzerland.

The platform presents a Zurich address — Talstrasse 61, 8001 Zürich — but FINMAs disclosure confirms that this address does not correspond to any authorised or registered financial institution. This discrepancy alone is a critical red flag, as Swiss law requires financial service providers to be properly registered and supervised.

Marketing Claims Raise Further Concerns

Beyond its regulatory status, GmtFX has attracted scrutiny for the way it promotes its services. The platform frequently uses phrases such as “AI-driven trading” and “high-yield automated strategies” to appeal to retail investors. Industry observers have repeatedly warned that such narratives are commonly used by unregulated platforms to create an illusion of technological sophistication and consistent profitability.

Without regulatory oversight, there is no independent verification of how these systems operate — or whether they exist at all. In similar cases, investors often report difficulties withdrawing funds, sudden account restrictions, or pressure to deposit additional capital under the guise of “margin requirements” or “system upgrades.”

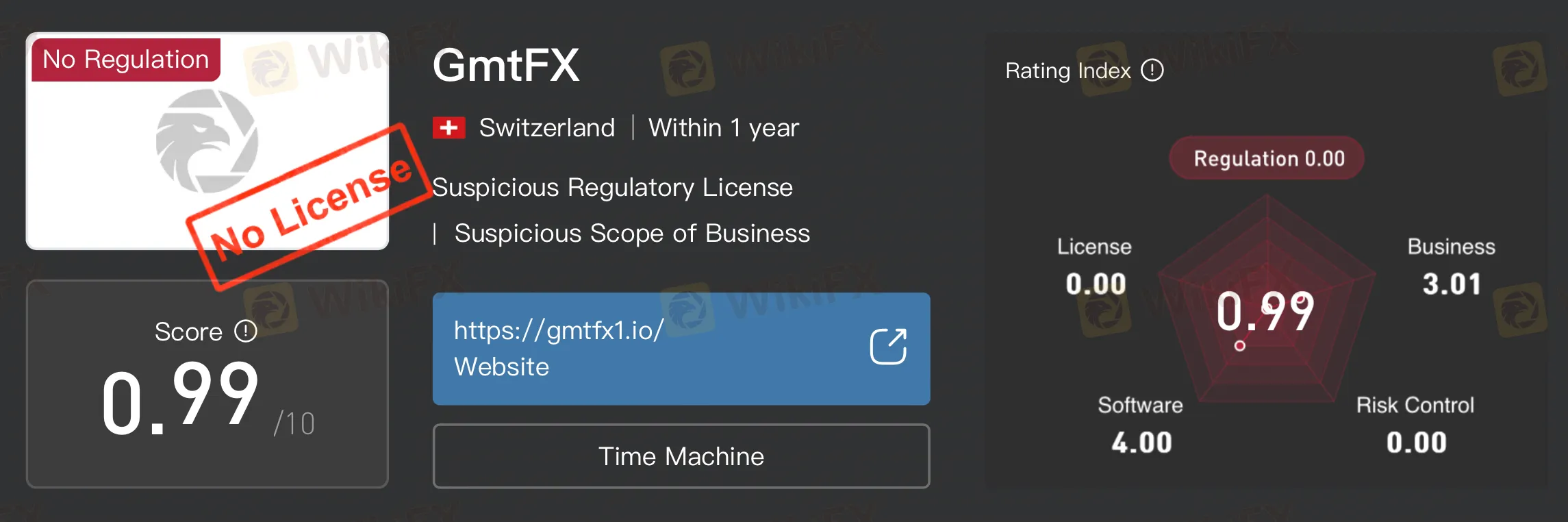

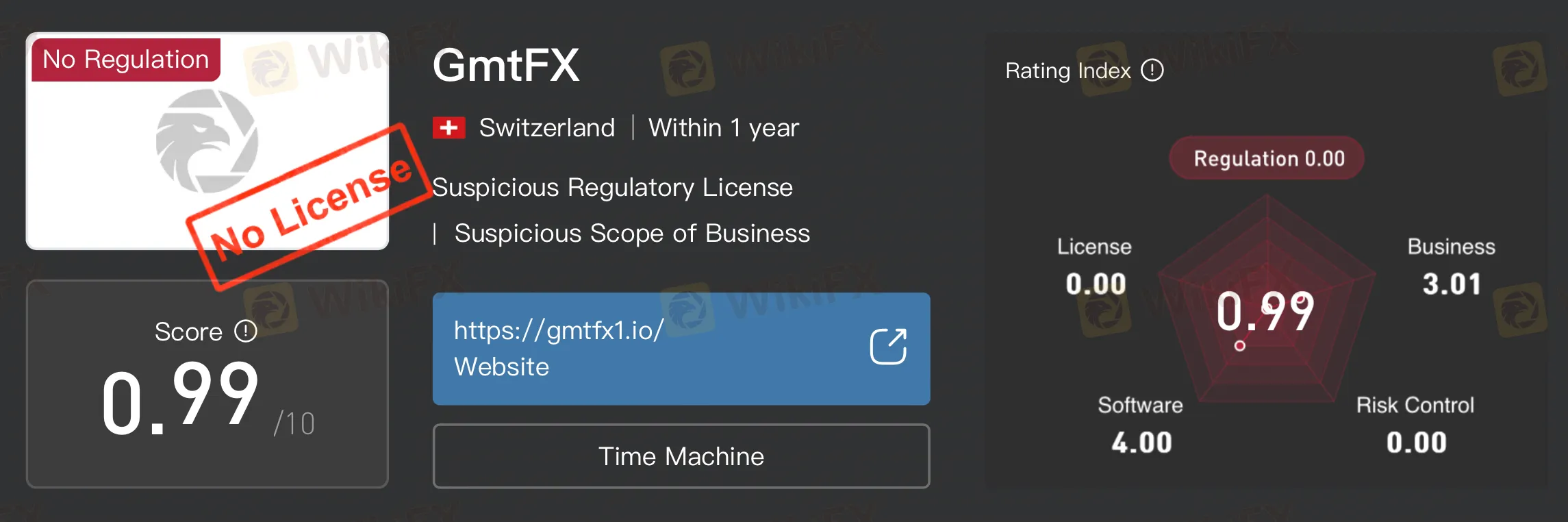

WikiFX Data: No Licence, Low Safety Score

Independent broker intelligence platform WikiFX also flags GmtFX as a high-risk entity. According to WikiFX records, the platform holds no valid regulatory licence and currently carries an extremely low safety score of 0.99/10, reflecting weaknesses across regulation, risk control, and operational transparency.

WikiFX data further shows that the domain gmtfx1.io is less than one year old, a pattern frequently observed among short-lived, high-risk trading websites that disappear once user complaints accumulate.

More details can be found on the WikiFX broker page:

https://www.wikifx.com/en/dealer/3445577306.html

Why the Risk Is Structural, Not Accidental

What makes cases like GmtFX particularly concerning is not a single isolated issue, but the combination of warning signs:

- No authorisation from any recognised financial regulator

- Use of a prestigious financial address without registration

- Aggressive marketing focused on AI and high returns

- A newly registered domain with no verifiable operating history

- Independent risk platforms assigning extremely low credibility scores

When these factors appear together, they point to a structural risk profile rather than temporary compliance gaps.

A Cautionary Note for Investors

In todays market, professional-looking websites and advanced-sounding technology claims are no longer reliable indicators of legitimacy. Regulatory verification and independent risk checks remain essential steps before engaging with any trading platform.

Platforms operating outside regulatory frameworks leave investors without legal protection if disputes arise. As seen in many similar cases, once problems surface, recovery options can be extremely limited.

About WikiFX

As a global broker information and risk-monitoring platform, WikiFX helps investors verify regulatory status, assess operational risk, and identify warning signs before committing funds. By combining official regulatory data, technical analysis, and user feedback, WikiFX enables traders to make more informed decisions — particularly when encountering unfamiliar or aggressively promoted platforms.

In an environment where unlicensed entities increasingly mimic legitimate brokers, independent verification remains one of the most effective tools for investor protection.