Abstract:A Malaysian activist has alleged the emergence of a new scam compound near Myawaddy, Myanmar, dubbed “KK Park 2.0,” highlighting how fraud syndicates may be adapting to regional crackdowns by shifting operations to remote, heavily secured locations.

Recent reports from Malaysian civil society observers suggest that a new scam compound, informally dubbed “KK Park 2.0,” may have emerged in the Myawaddy region of Myanmar. Although earlier large-scale scam hubs were dismantled through joint international operations, these newer facilities are believed to have shifted into more remote mountainous and jungle areas, with tighter security measures. This development indicates that scam syndicates have not disappeared, but are instead adapting and evolving their methods.

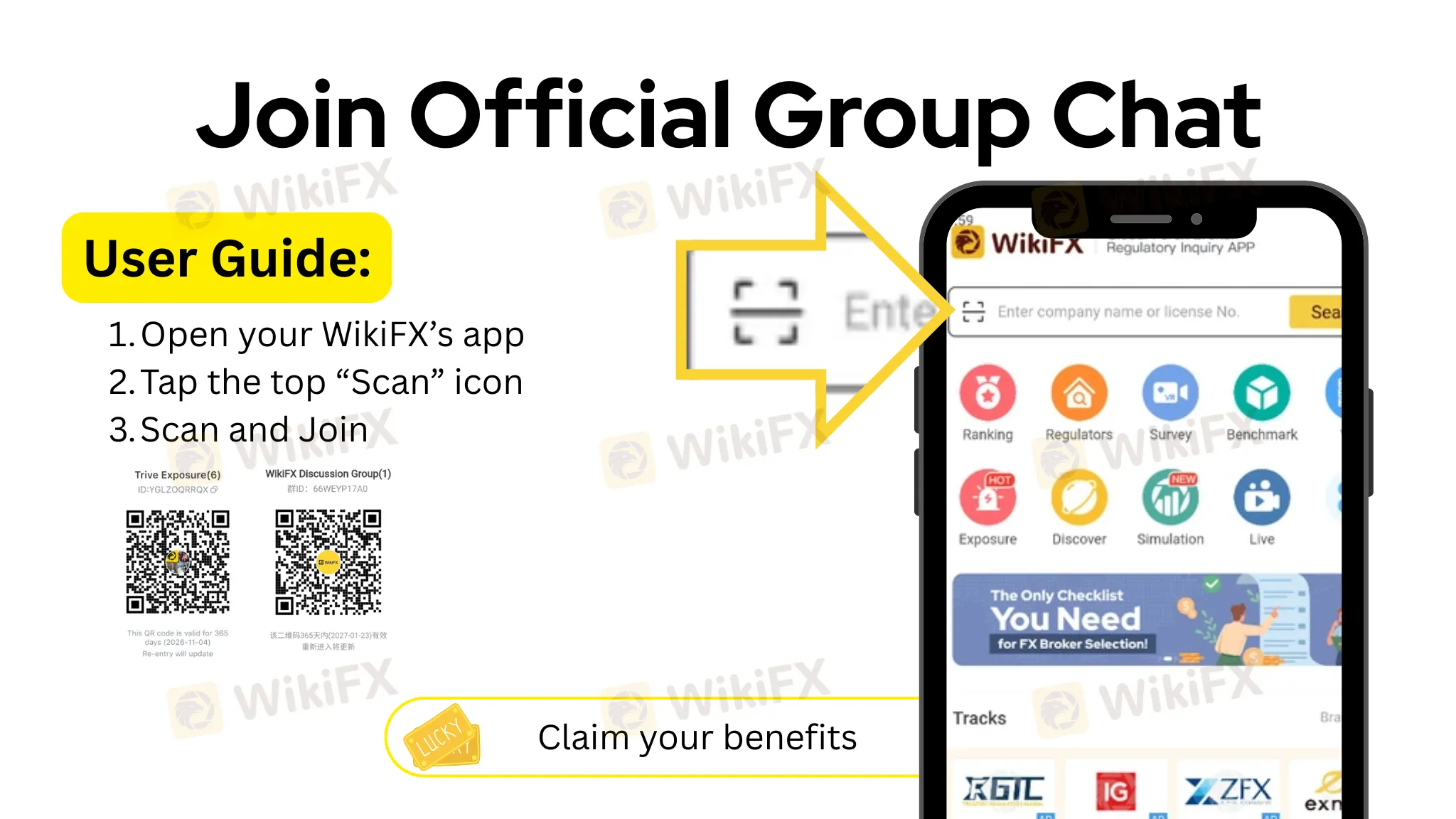

What should concern the Malaysian public even more is the frequent link between such cross-border scam networks and online investment fraud. In many cases, the ultimate objective of these operations is not limited to telecommunications scams, but extends to luring victims into so-called high-return investment schemes. Forex and cryptocurrency are among the most commonly exploited themes. Victims are often first approached through social media, unsolicited calls, or suspicious message links, before being guided into chat groups or persuaded to download trading platforms, where trust is gradually built.

These schemes are typically presented in highly convincing ways. Scammers may pose as investment mentors, platform representatives, or successful traders, showcasing seemingly professional analyses and fabricated profit records. Some even permit small withdrawals to enhance credibility. However, once larger sums are invested, problems frequently arise — ranging from withdrawal restrictions to demands for additional payments or sudden account limitations. The promised high returns often prove to be nothing more than bait.

In the current environment, Malaysians should exercise heightened caution. Avoid answering calls from unknown sources and be wary of clicking links received via SMS, WhatsApp, or Telegram. Many investment scams begin with what appears to be a harmless interaction. Legitimate financial institutions and regulated brokers do not typically promote “guaranteed profit” opportunities through unsolicited contact.

Similarly, any investment promising unusually high returns within a short period should be treated with skepticism. Financial markets inherently involve risk, and there is no such thing as consistent, risk-free windfall profits. The notion that “there is no free lunch” is not merely a cliché, but a reality reinforced by countless scam cases. Offers that sound too good to be true are often the clearest warning signs.

While scam tactics continue to grow more sophisticated, their underlying strategy remains unchanged: exploiting trust, greed, and information gaps. Whether involving phone scams or fraudulent trading platforms, the first line of defense is always personal vigilance and proper verification. Before committing funds, investors should confirm the regulatory status of any platform or institution and consult multiple independent sources of information.

With scams becoming increasingly pervasive, staying cautious and level-headed is far more effective than dealing with the consequences afterward. Safeguarding personal information and financial security must remain a priority for both investors and the general public.