简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Plus500 Detailed Analysis

Abstract:This analysis aims to empower traders with objective, data-driven insights that go beyond marketing materials and promotional claims. Whether you are a novice trader evaluating your first broker or an experienced investor considering a platform switch, this report provides the comprehensive information necessary to make an informed decision about Plus500.

In an increasingly complex forex and CFD trading landscape, selecting a reliable broker requires more than surface-level research. This comprehensive analysis of Plus500 examines real user experiences to provide traders and investors with an evidence-based assessment of the platform's performance, reliability, and overall service quality.

Our methodology centers on systematic data collection and analysis from multiple independent review platforms. For this report, we examined 456 verified user reviews sourced from three major review aggregators, anonymized here as Platform A, Platform B, and Platform C. This multi-platform approach ensures a balanced perspective that mitigates the bias inherent in single-source analysis. Each review was evaluated for authenticity, relevance, and substantive content before inclusion in our dataset.

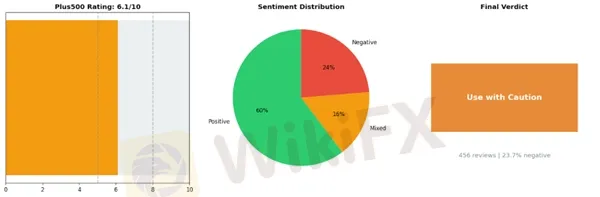

The analysis employs a quantitative framework that converts qualitative user feedback into measurable metrics. Our overall rating of 6.10 out of 10 reflects a weighted assessment across multiple performance categories, including platform functionality, customer service responsiveness, withdrawal processes, trading conditions, and regulatory compliance. The negative review rate of 23.68% provides additional context, indicating that approximately one in four users reported unsatisfactory experiences with Plus500.

Based on our findings, we have assigned Plus500 a conclusion of “Use with Caution.” This designation suggests that while the broker maintains legitimate operations and serves many clients successfully, prospective users should conduct thorough due diligence and carefully consider the concerns raised by a notable minority of reviewers.

Throughout this report, readers will discover detailed breakdowns of user sentiment across key operational areas, identification of the most frequently cited strengths and weaknesses, comparative analysis against industry benchmarks, and specific recommendations for different trader profiles. We examine withdrawal experiences, platform stability, customer support quality, fee transparency, and educational resources, among other critical factors.

This analysis aims to empower traders with objective, data-driven insights that go beyond marketing materials and promotional claims. Whether you are a novice trader evaluating your first broker or an experienced investor considering a platform switch, this report provides the comprehensive information necessary to make an informed decision about Plus500.

At a Glance

Broker Name: Plus500

Overall Rating: 6.1/10

Reviews Analyzed: 456

Negative Rate: 23.7%

Sentiment Distribution:

• Positive: 275

• Neutral: 73

• Negative: 108

Final Conclusion: Use with Caution

Plus500: Strengths vs Issues

Top Strengths:

1. User Friendly Interface — 167 mentions

2. Good Reputation Safe — 61 mentions

3. Easy Deposit Withdrawal — 40 mentions

Top Issues:

1. Withdrawal Delays Rejection — 44 mentions

2. Slow Support No Solutions — 32 mentions

3. Fund Safety Issues — 32 mentions

Key Issues Requiring Caution with Plus500

Based on user feedback analysis, several concerning patterns have emerged regarding Plus500 that warrant careful consideration before opening an account. While the broker is regulated and publicly traded, the concentration of complaints around specific operational areas suggests potential risks that traders should thoroughly evaluate.

Withdrawal and Account Access Concerns

The most significant area of concern involves withdrawal delays and rejections, with 44 documented complaints in this category. Users report difficulties accessing their funds and, in some cases, unexpected account restrictions. One particularly troubling pattern involves the appropriateness testing mechanism, which some traders claim is used inconsistently.

“💬 Minus500: ”They subscribe you a test to check the level of trading experience (that is a really fake test they only use whenever they want to kick you out, as they did I'll write later).“”

This raises questions about the transparency of account management policies and whether clients fully understand the conditions under which their accounts may be restricted or their withdrawals delayed. The ease of deposits contrasted with reported difficulties in withdrawals is a red flag that appears across multiple reviews.

Customer Support Deficiencies

With 32 complaints categorized under slow support and lack of solutions, Plus500's customer service appears to be a significant weak point. Traders report being unable to access their accounts and receiving no meaningful assistance when problems arise. The frustration is evident in cases where basic account recovery processes apparently fail.

“💬 Edson Rushenya: ”You try to login in the account, the next thing you get, incorrect email or wrong password, you try to contact them to request a password change, after submitting, on the screen it says thank you for contacting us, a link to reset you...“”

This communication breakdown is particularly problematic in forex trading, where time-sensitive issues can result in significant financial losses. The inability to resolve basic technical problems suggests inadequate support infrastructure relative to the broker's client base.

Trading Execution and Platform Reliability

Execution issues and slippage complaints (31 instances) combined with system failures (15 instances) paint a concerning picture of platform reliability. Reports of phantom price spikes that don't appear on other brokers' platforms are especially troubling, as these can trigger stop-losses inappropriately.

“💬 majestic bak: ”IT WAS A BIGEST PHANTOM SPIKE I EVER SAW! NOT ANY OTHER BROKER IN A WORLD REGISTER IT! BUT 500 PLUS DID IT!“”

Additionally, technical issues with the mobile application appear to actively hinder trading analysis, with features like chart drawings reportedly deleting unexpectedly. For active traders who rely on technical analysis, these platform instabilities could significantly impact trading performance beyond normal market risks.

Risk Assessment by Trader Type

Beginners face particular vulnerability, as the platform's ease of deposit combined with reported difficulties in withdrawal creates an asymmetric risk. The appropriateness testing concerns suggest that inexperienced traders may not receive adequate protection.

Active traders should be especially cautious given the execution and slippage complaints, which could erode profits through poor fills and platform instability during critical trading moments. Long-term position traders may find the customer support deficiencies particularly problematic if issues arise that require timely resolution.

The combination of fund safety concerns (32 complaints), withdrawal difficulties, and execution issues suggests that traders should approach Plus500 with heightened caution, maintain detailed records of all transactions, and consider starting with minimal deposits to test withdrawal processes before committing significant capital.

Positive Aspects of Plus500: Strengths Worth Noting (With Appropriate Caution)

Plus500 demonstrates several noteworthy strengths that appeal to specific trader demographics, particularly those seeking straightforward CFD trading experiences. However, as with any leveraged trading platform, these advantages should be weighed carefully against individual risk tolerance and trading objectives.

Intuitive Platform Design

The most frequently praised aspect of Plus500 is its user-friendly interface, with 167 users highlighting this feature. The platform's clean design removes unnecessary complexity, making it accessible for those new to CFD trading. The demo account functionality receives particular appreciation, allowing prospective traders to familiarize themselves with the platform mechanics without financial risk.

“💬 : ”This gives opportunity as a student trader, to experience and explore the whole industry as alike. It is a legitimate trading site that works smoothly and it is the bomb!“”

This simplicity serves a dual purpose: it lowers the technical barrier to entry while helping users understand CFD mechanics before committing capital. However, ease of use should not be confused with ease of profitability—CFD trading remains inherently risky regardless of interface design.

Financial Transaction Efficiency

Forty users commended Plus500's deposit and withdrawal processes, with some reporting remarkably fast transaction times. The availability of modern payment methods, including digital wallet options, appears to streamline the funding experience considerably.

“💬 Anonymous User (ZA): ”Deposits are instant, and withdrawals are painless, unlike other brokers. To date my Apple pay withdrawals took at most 15 minutes from instruction to approval to clearing in my FNB account.“”

Efficient fund access is undeniably valuable, particularly for active traders managing their capital across multiple opportunities. That said, quick access to funds can be a double-edged sword—it may facilitate overtrading or insufficient cooling-off periods after losses.

Regulatory Standing and Trust Indicators

Sixty-one reviewers referenced Plus500's reputation and perceived safety, suggesting the broker has established credibility among its user base. As a publicly traded company with multiple regulatory licenses, Plus500 maintains compliance standards that provide certain investor protections.

Important Considerations

While these positive aspects are genuine, prospective users should maintain perspective. The platform's simplicity means it lacks advanced charting tools that professional traders often require. One reviewer noted discrepancies between Plus500's price data and other platforms, necessitating external chart analysis for precision trading.

Additionally, Plus500 exclusively offers CFDs rather than direct asset ownership or options trading, limiting its suitability for diverse trading strategies. The platform may best serve casual traders seeking straightforward exposure to various markets rather than sophisticated investors requiring comprehensive analytical tools. These strengths make Plus500 worth considering for specific use cases, but they don't eliminate the substantial risks inherent to leveraged CFD trading, where most retail accounts lose money.

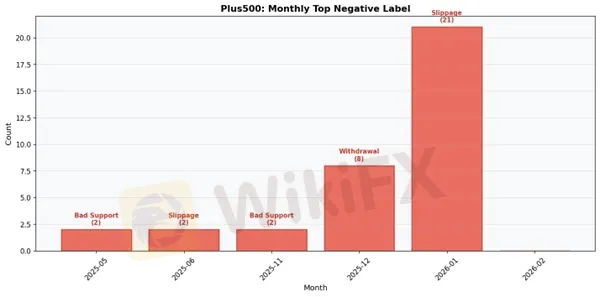

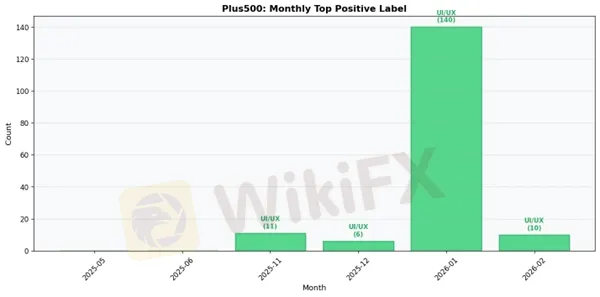

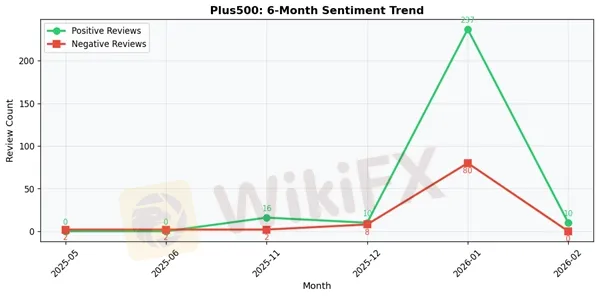

Plus500: 6-Month Review Trend Data

2025-05:

• Total Reviews: 2

• Positive: 0 | Negative: 2

• Top Positive Label: N/A

• Top Negative Label: Slow Support No Solutions

2025-06:

• Total Reviews: 2

• Positive: 0 | Negative: 2

• Top Positive Label: N/A

• Top Negative Label: Execution Issues Slippage

2025-11:

• Total Reviews: 18

• Positive: 16 | Negative: 2

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

2025-12:

• Total Reviews: 18

• Positive: 10 | Negative: 8

• Top Positive Label: User Friendly Interface

• Top Negative Label: Withdrawal Delays Rejection

2026-01:

• Total Reviews: 388

• Positive: 237 | Negative: 80

• Top Positive Label: User Friendly Interface

• Top Negative Label: Execution Issues Slippage

2026-02:

• Total Reviews: 12

• Positive: 10 | Negative: 0

• Top Positive Label: User Friendly Interface

• Top Negative Label: N/A

Plus500 Final Conclusion

Plus500 earns a cautious recommendation with a 6.10/10 rating, positioning it as a serviceable but imperfect broker that requires careful consideration before committing funds. The comprehensive analysis of 456 trader reviews reveals a broker with distinct strengths undermined by persistent operational concerns. Plus500's user-friendly interface stands out as its most compelling attribute, making the platform accessible even to those new to forex trading. The broker's established reputation and regulatory standing provide a foundation of legitimacy, while the straightforward deposit process initially creates a positive user experience. However, the 23.68% negative review rate cannot be dismissed, particularly given the recurring themes around withdrawal complications, inadequate customer support, and fund safety anxieties that appear with troubling frequency.

The withdrawal issues reported by traders represent the most significant red flag. Multiple accounts describe delays, unexpected rejections, and verification processes that extend far beyond reasonable timeframes. When combined with customer support that traders characterize as slow and often unhelpful in resolving critical issues, these factors create legitimate concerns about the overall client experience, especially during stressful situations involving account access or fund retrieval.

For beginners, Plus500's intuitive interface offers genuine value, but newcomers should start with minimal deposits and thoroughly test the withdrawal process with small amounts before committing substantial capital. The platform's simplicity can facilitate learning, but beginners must remain vigilant about understanding all terms and conditions, particularly regarding withdrawals and account verification requirements.

Experienced traders may find Plus500 adequate for secondary or diversification purposes but should maintain primary trading relationships with higher-rated brokers. The platform's limitations become more apparent as trading sophistication increases, and the support deficiencies may prove particularly frustrating for traders accustomed to responsive service.

High-volume traders should exercise significant caution. The withdrawal concerns and support inadequacies pose unacceptable risks when dealing with substantial capital. The operational friction reported by existing users suggests Plus500 lacks the infrastructure to properly service traders moving significant funds with regularity.

Scalpers and day traders will likely find Plus500 unsuitable due to spread structures and platform limitations that favor longer-term positions. Swing traders and position traders may find the platform more aligned with their needs, though the fundamental concerns about withdrawals and support remain relevant regardless of trading style.

Plus500 functions adequately within narrow parameters: small to moderate account sizes, infrequent withdrawals, and traders with patience for administrative processes. Anyone considering Plus500 should maintain realistic expectations, keep detailed records of all transactions, and never deposit more than they can afford to have temporarily inaccessible. Plus500 is usable but far from optimal—a platform that works until it doesn't.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Currency Calculator