简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

INZO Review: Safety, Regulation & Forex Trading Details

Abstract:INZO is a Seychelles-regulated broker with a low WikiFX score of 2.32, currently facing numerous user complaints regarding withdrawal blocks and arbitrary changes to trading conditions. Area of high risk include unannounced leverage reductions and excessive verification hurdles during fund withdrawals.

According to WikiFX records, INZO is a Forex broker established in 2021 and headquartered in Saint Vincent and the Grenadines. While the broker claims a modern trading experience with various account types, a deep dive into market data and user experiences reveals significant safety concerns. With a low WikiFX score of 2.32, INZO is currently flagged for a high volume of complaints.

Key Takeaways

- Regulatory Status: Holds an offshore license (FSA Seychelles), which offers limited protection compared to major global regulators.

- Withdrawal Issues: Multiple reports indicate that INZO uses extensive “video verification” and document rejections to delay or block withdrawals.

- Operational Risk: Users have documented sudden changes in leverage (e.g., from 1:500 to 1:20) and spreads without prior notice.

- Complaint Volume: 11 serious complaints have been recorded by WikiFX in the last three months alone.

INZO Broker Summary: Safety Score and Key Issues

The INZO broker profile shows a company that has expanded quickly across markets in Germany, Iraq, Egypt, and the UK. However, its safety score is negatively impacted by its “C” influence rank and a high number of reported “unusual activities.”

While the broker offers popular platforms like MT5 and cTrader, the technical reliability is overshadowed by claims of price manipulation. Market data suggests that while the entry condition is accessible at $50, the risk of capital loss due to administrative hurdles is high.

Regulation: Is the License Real?

INZO is regulated by the Seychelles Financial Services Authority (FSA). It is important for Forex traders to understand that this is an offshore regulation. Offshore licenses generally do not provide the same level of investor compensation schemes or strict oversight as regulators like the FCA (UK) or ASIC (Australia).

| Regulator | License Type | Status | License Number |

|---|---|---|---|

| Seychelles FSA | Offshore Regulatory | Regulated | SD163 |

Although the license is currently listed as “Regulated,” the high volume of complaints suggests that the regulatory oversight may not be sufficient to protect users from the internal policies of the INZO broker.

User Reviews: Withdrawal Complaints and Trading Risks

Internal market data and recent reports from 2024 and 2025 highlight a pattern of behavior that investors should find concerning.

1. Withdrawal and Verification Barriers

Recent evidence from 2024 indicates that INZO often introduces new verification requirements only when a client attempts to withdraw funds.

- In April 2024, a user from Portugal reported that after being fully verified, the broker demanded a “video conference” and “video selfie” repeatedly, effectively blocking access to their money.

- By March 2024, another report surfaced where a user was asked to withdraw via Perfect Money despite depositing via bank transfer, a common tactic used to complicate the refund process.

2. Arbitrary Changes to Trading Terms

Several traders have shared documented evidence of “policy shifts” that occur without warning.

- In July 2024, a trader noted that after depositing funds, their leverage was slashed from 1:100 down to 1:20.

- In June 2024, multiple users reported that INZO changed the available trading pairs and increased spreads significantly right after a large deposit was made.

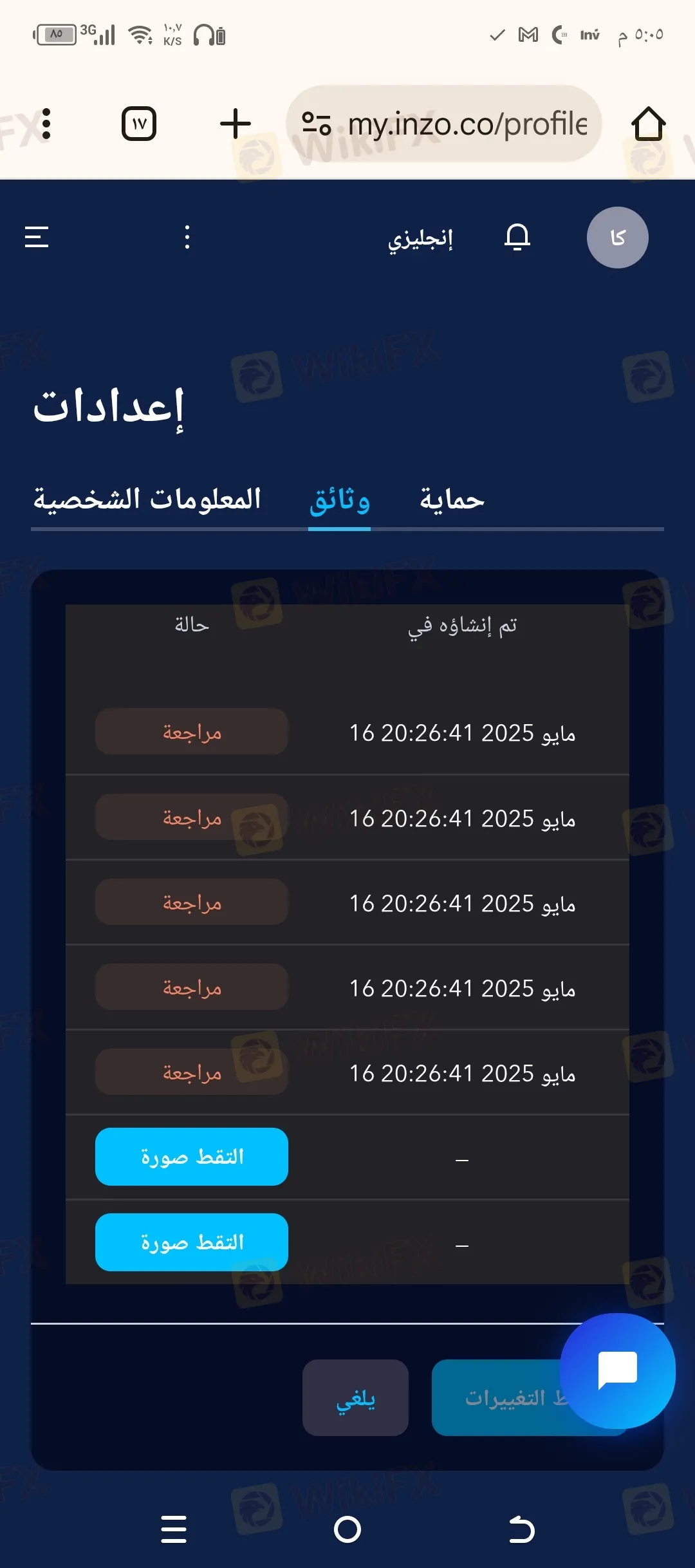

3. Account Access and Identification Issues

According to reports from May 2025, some users are finding it impossible to complete the initial setup. One user in Iraq reported that they submitted all legal documents, but the broker ignored the verification request for days, preventing any account activity.

Conclusion: Final Review Recommendation

Our analysis of the INZO broker reveals a troubling gap between their advertised services and the actual user experience. While they provide access to USD pairs and other Forex instruments through MT5, the safety of your principal investment is at high risk.

The combination of offshore regulation, consistent reports of withdrawal delays, and arbitrary leverage changes makes INZO a high-risk choice for both new and experienced traders. We recommend that investors seek brokers with stronger regulatory standing (such as those regulated by Tier-1 authorities) to ensure the safety of their funds and a fair trading environment.

Risk Warning: Trading Forex involves significant risk. Ensure you only use platforms with a proven track record of transparency and reliable withdrawal processing.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Currency Calculator