Perfil de la compañía

| Kontakperkasa Futures Resumen de la revisión | |

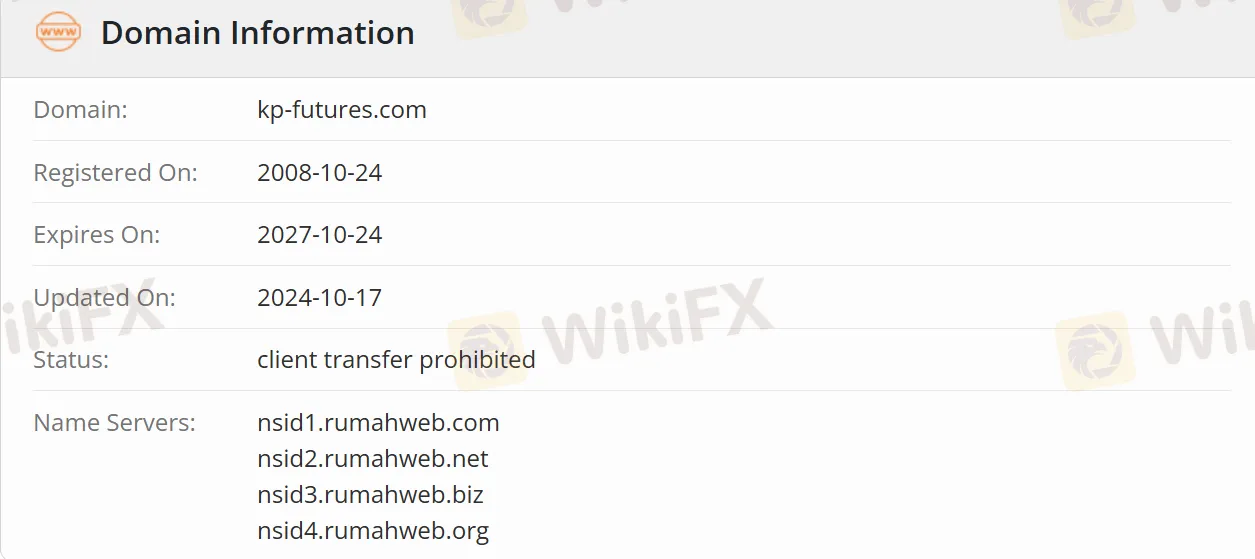

| Fecha de fundación | 2008-10-24 |

| País/Región registrado | Indonesia |

| Regulación | Regulado |

| Instrumentos de mercado | Futuros de materias primas, Derivados de índices bursátiles, Forex y Metales preciosos |

| Cuenta demo | ✅ |

| Plataforma de trading | TradingView |

| Soporte al cliente | customer.care@kontak-perkasa-futures.co.id |

| Telp: (021) 5793 6555 | |

| Fax: (021) 5793 6550 | |

| Sudirman Plaza, Gedung Plaza Marein Lt. 7 & 19 Jl. Jend. Sudirman Kav. 76-78, Jakarta 12910 | |

Kontakperkasa Futures Información

PT Kontak Perkasa Futures es una firma de corretaje de futuros regulada en Indonesia. Con sede en Jakarta, ofrece servicios de trading para futuros de materias primas, derivados de índices bursátiles, divisas, etc., y admite la apertura de cuentas en línea y el trading en tiempo real. Es adecuado para inversores interesados en el mercado indonesio o en commodities específicos como el oro y el aceite de palma.

Ventajas y desventajas

| Pros | Cons |

| Regulado | Se enfoca principalmente en el mercado doméstico indonesio |

| Múltiples instrumentos de trading | Tarifas nocturnas |

| Cuenta demo disponible | Barrera del idioma |

| TradingView disponible | Apalancamiento no divulgado |

¿Es Kontakperkasa Futures legítimo?

Kontakperkasa Futures posee una Licencia de Negocios de Corretaje de Futuros (No 41/BAPPEBTI/SI/XII/2000) emitida por BAPPEBTI y está registrada en la Bolsa de Futuros de Jakarta y la Cámara de Compensación de Futuros de Indonesia.

¿Qué puedo negociar en Kontakperkasa Futures?

| Categoría de producto | Nombre/Código del producto | Especificaciones del contrato |

| Futuros de materias primas | Futuros de oro (GOL) | 1 kg/lote, pureza ≥99.99% estándar LBMACambio mínimo de precio: Rp50/gramo |

| Futuros de oro de 250 gramos (GOL250) | 250 gramos/loteSe requieren ≥4 lotes para la entrega | |

| Futuros de oleína (OLE) | 20 toneladas/loteCambio mínimo de precio: Rp5/kg | |

| Derivados de índices bursátiles | Índice Hang Seng (HKK50_BBJ) | $5/punto de índice |

| Nikkei 225 (JPK50_BBJ) | $5/punto de índice | |

| Forex y Metales preciosos | EURUSD/GBPUSD/USDJPY, etc. | Opciones de lote estándar/mini lote |

| Futuros de plata (XAG10_BBJ) | 10 onzas/lote |

Tipo de cuenta

Kontakperkasa Futures proporciona cuentas de demostración para principiantes para practicar el trading. Las cuentas reales se dividen en cuentas individuales y cuentas institucionales.

Kontakperkasa Futures Tarifas

| Tipo | Estructura de Tarifas |

| Comisión Básica | $15 por lado$30 por lote completo (compra + venta) |

| Impuesto al Valor Agregado (IVA)(11% de la comisión) | $3.3 por lote completo |

| Tarifa Nocturna | $3 por lote por noche (HKK5U) |

| $2 por lote por noche (JPK50) | |

| $5 por lote por noche (XUL10) |

Depósito y Retiro

Las transferencias bancarias admiten cuentas IDR y USD de los principales bancos indonesios (como BCA, Mandiri y CIMB Niaga). El tiempo de procesamiento de retiro es de 1 día laborable (T+1), y se necesita verificar la identidad y los registros de transacciones.