公司簡介

| Kontakperkasa Futures 評論摘要 | |

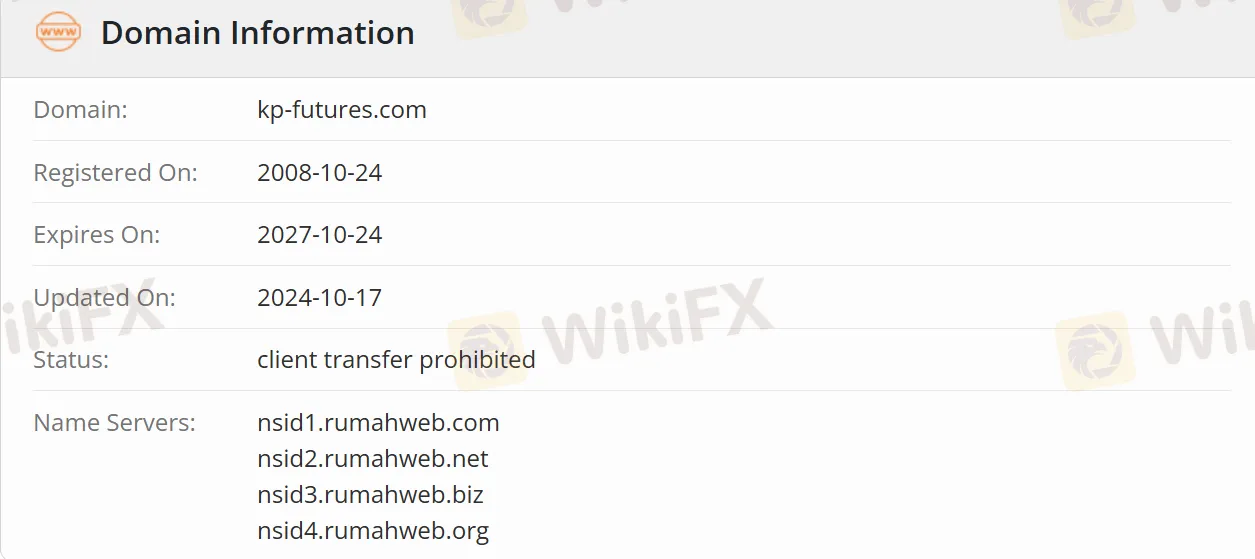

| 成立日期 | 2008-10-24 |

| 註冊國家/地區 | 印尼 |

| 監管 | 受監管 |

| 市場工具 | 商品期貨、股指衍生品、外匯和貴金屬 |

| 模擬帳戶 | ✅ |

| 交易平台 | TradingView |

| 客戶支援 | customer.care@kontak-perkasa-futures.co.id |

| 電話: (021) 5793 6555 | |

| 傳真: (021) 5793 6550 | |

| Sudirman Plaza, Gedung Plaza Marein Lt. 7 & 19 Jl. Jend. Sudirman Kav. 76-78, Jakarta 12910 | |

Kontakperkasa Futures 資訊

PT Kontak Perkasa Futures 是印尼一家受監管的期貨經紀公司。總部設於雅加達,提供商品期貨、股指衍生品、外匯等交易服務,支援線上開戶和即時交易。適合對印尼市場或特定商品(如黃金和棕櫚油)感興趣的投資者。

優缺點

| 優點 | 缺點 |

| 受監管 | 主要針對印尼國內市場 |

| 多種交易工具 | 隔夜費用 |

| 提供模擬帳戶 | 語言障礙 |

| 可使用TradingView | 未公開槓桿 |

Kontakperkasa Futures 是否合法?

Kontakperkasa Futures 持有由BAPPEBTI頒發的期貨經紀業務許可證(編號41/BAPPEBTI/SI/XII/2000),並在雅加達期貨交易所和印尼期貨結算所註冊。

Kontakperkasa Futures 可以交易什麼?

| 產品類別 | 產品名稱/代碼 | 合約規格 |

| 商品期貨 | 黃金期貨(GOL) | 1 公斤/手,純度≥99.99% LBMA 標準最小價格變動:Rp50/克 |

| 250 克黃金期貨(GOL250) | 250 克/手,交割需≥4 手 | |

| 棕櫚油期貨(OLE) | 20 噸/手最小價格變動:Rp5/公斤 | |

| 股指衍生品 | 恆生指數(HKK50_BBJ) | $5/指數點 |

| 日經225(JPK50_BBJ) | $5/指數點 | |

| 外匯和貴金屬 | EURUSD/GBPUSD/USDJPY 等 | 標準手/迷你手選項 |

| 白銀期貨(XAG10_BBJ) | 10 盎司/手 |

帳戶類型

Kontakperkasa Futures 為初學者提供模擬帳戶以練習交易。真實帳戶分為個人帳戶和機構帳戶。

Kontakperkasa Futures 費用

| 類型 | 費用結構 |

| 基本佣金 | $15 每邊$30 每手(買入 + 賣出) |

| 增值稅(佣金的11%) | $3.3 每手 |

| 隔夜費 | $3 每手每晚(HKK5U) |

| $2 每手每晚(JPK50) | |

| $5 每手每晚(XUL10) |

存款和提款

銀行轉帳支持印尼主要銀行(如BCA、Mandiri和CIMB Niaga)的IDR和USD帳戶。提款處理時間為1個工作日(T+1),需要驗證身份和交易記錄。