Buod ng kumpanya

| FFG Securities Buod ng Pagsusuri | |

| Itinatag | 2007 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Instrumento sa Merkado | Mga Stock, Bonds, ETFs, REITs, Investment Trusts |

| Demo Account | ❌ |

| Platform ng Pagtrade | FFG Securities App, FFG Internet Trading |

| Minimum na Deposito | / |

| Suporta sa Customer | Telepono: 092-771-3836 |

| Address: 9F, Fukuoka Bank Head Office, Fukuoka | |

Impormasyon Tungkol sa FFG Securities

Itinatag noong 2007, ang FFG Securities Co., Ltd. ay isang Hapones na kumpanya ng serbisyong pinansiyal na regulado ng FSA. Nagbibigay ito ng access sa mga investment trust, ETFs, bonds, U.S. at domestic equities. Bagaman accessible ang mobile at internet trading systems, ang kakulangan ng MT4/MT5 at malalaking gastos sa offline ay maaaring disadvantage para sa mga nasa budget.

Mga Kalamangan at Disadvantage

| Kalamangan | Disadvantage |

| Regulado ng FSA sa Hapon | Walang demo o Islamic accounts |

| Malawak na hanay ng domestic at foreign instruments | Mataas ang fees para sa in-person transactions |

| Discounted fees para sa internet-only orders | Minimum deposit hindi ipinahayag |

| Suporta sa U.S. stocks at margin trading | |

| Mahabang oras ng operasyon |

Tunay ba ang FFG Securities?

Oo, ang FFG Securities Co., Ltd. (FFG証券株式会社) ay regulated. May Retail Forex License ito na inisyu ng Financial Services Agency (FSA) ng Hapon, na may license number na 福岡財務支局長(金商)第5号.

Ano ang Maaari Kong I-trade sa FFG Securities?

Kasama ang mga stocks, bonds, ETFs, REITs, at investment trusts, FFG Securities ay nag-aalok ng malawak na hanay ng domestic at dayuhang mga instrumento sa pananalapi. Nagbibigay din ito ng kakayahan sa margin trading at nagbibigay ng mobile app para sa market data at real-time trading.

| Mga Asset sa Pagnenegosyo | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

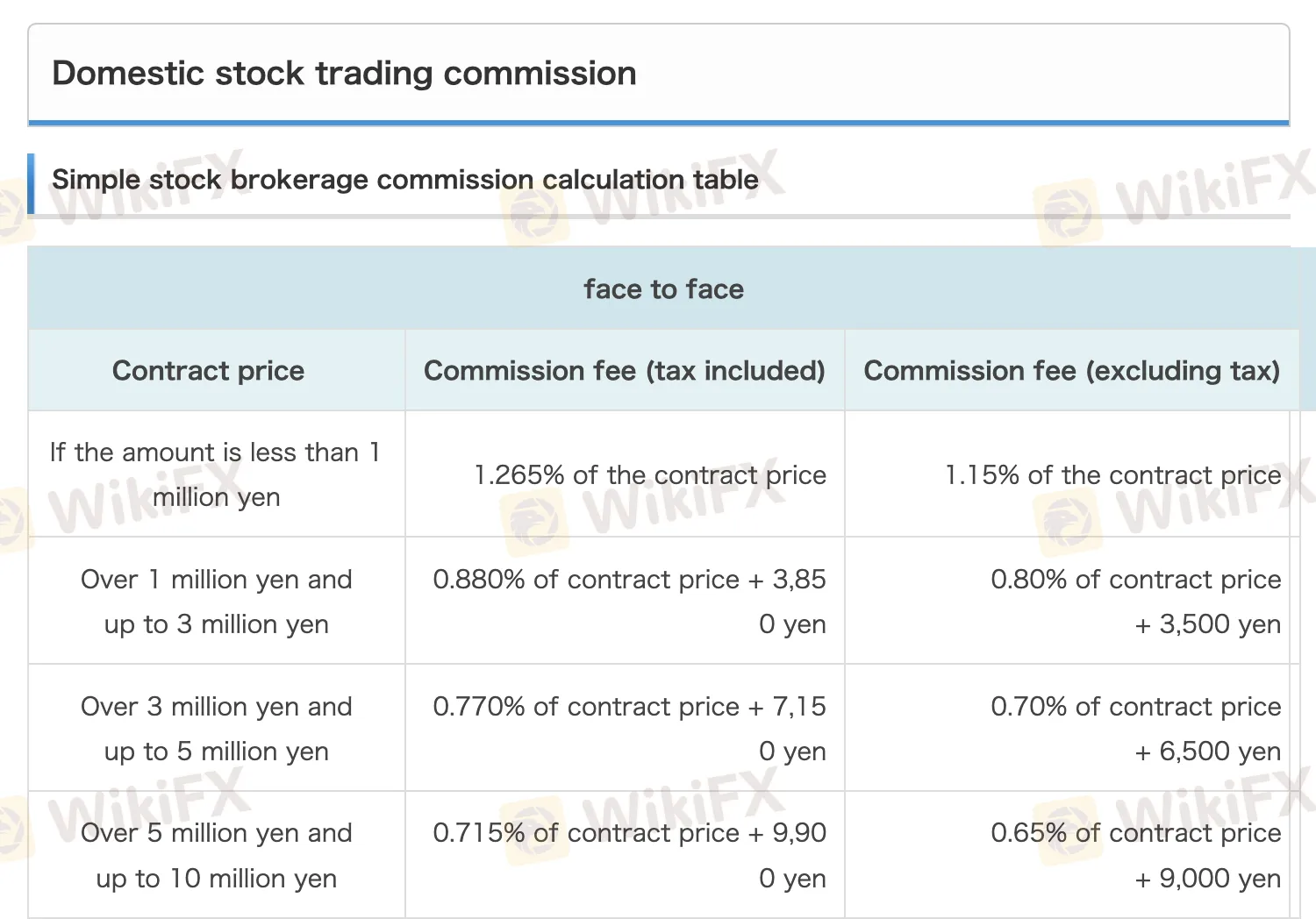

Mga Bayarin ng FFG Securities

Ang kabuuang mga bayarin ng FFG Securities ay medyo mataas kumpara sa karaniwang online brokers, lalo na para sa face-to-face transactions at malalaking sukat ng kontrata. Gayunpaman, mayroong malalaking diskwento (hanggang 90%) na ipinapataw sa online-only trading, na ginagawang mas cost-effective para sa mga digital na gumagamit.

| Uri ng Bayarin | Detalye |

| Domestic Stock Trading | Hanggang sa 1.265% ng presyo ng kontrata (face-to-face); 90% diskwento para sa online-only |

| Minimum Commission Fee | Face-to-face: ¥2,750; Online-only: ¥275 |

| Margin Trading | Buy interest: 1.97% p.a.; Bayad sa stock lending (short): 1.15% |

| Dayuhang Stocks | 1.10% para sa <¥1M; 0.33% + ¥218,900 para sa >¥100M |

| Convertible Bonds (CB) | 1.10% para sa <¥1M; 0.165% + ¥765,600 para sa >¥1B |

| Investment Trusts | Nag-iiba depende sa produkto; Mga diskwento sa online available (hanggang 10% off) |

| Mga Bayarin sa Pamamahala ng Account | Domestic: Libre; Dayuhang: Libre |

| Mga Bayarin sa Paglipat (Stocks) | Nagsisimula sa ¥1,100 (1 yunit o mas kaunti); capped sa ¥6,600 |

| Paper Delivery (Mga materyales ng shareholder) | ¥660 bawat stock |

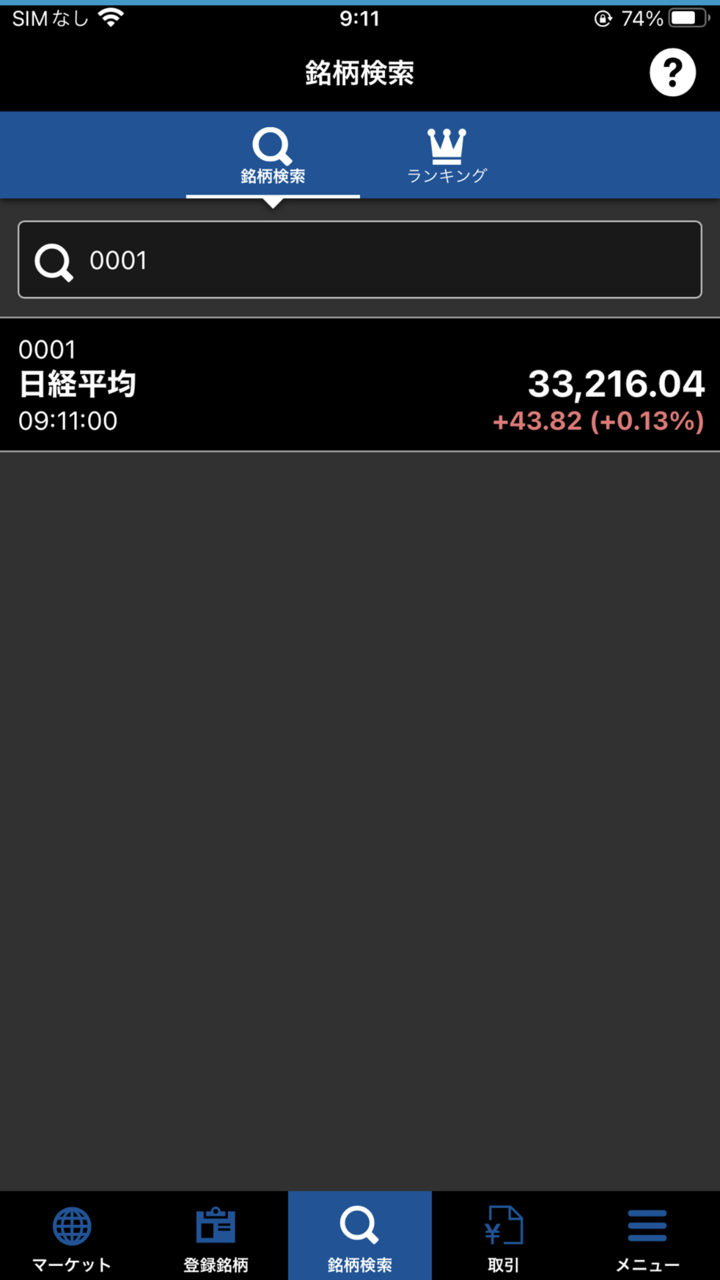

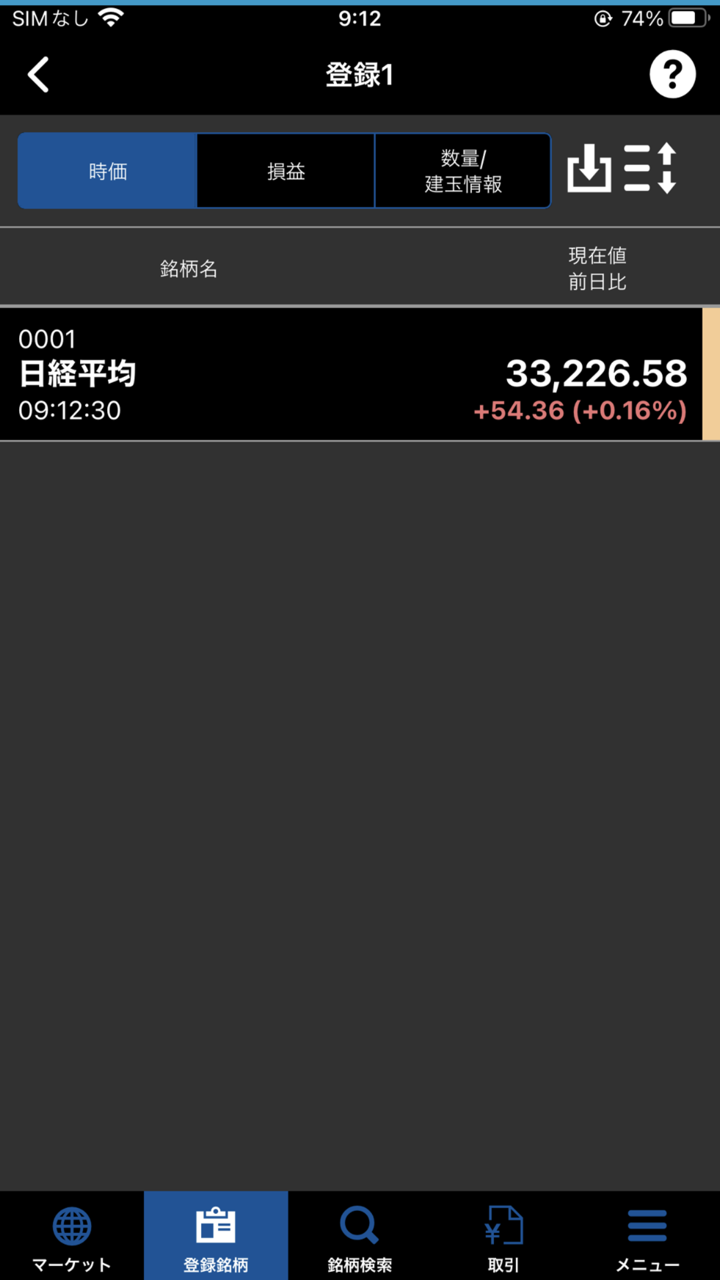

Platform ng Pagnenegosyo

| Platform ng Pagnenegosyo | Supported | Available Devices |

| FFG Securities App | ✔ | iOS, Android |

| FFG Internet Trading | ✔ | PC, Mac, web, mobile |

Deposito at Pag-Atas

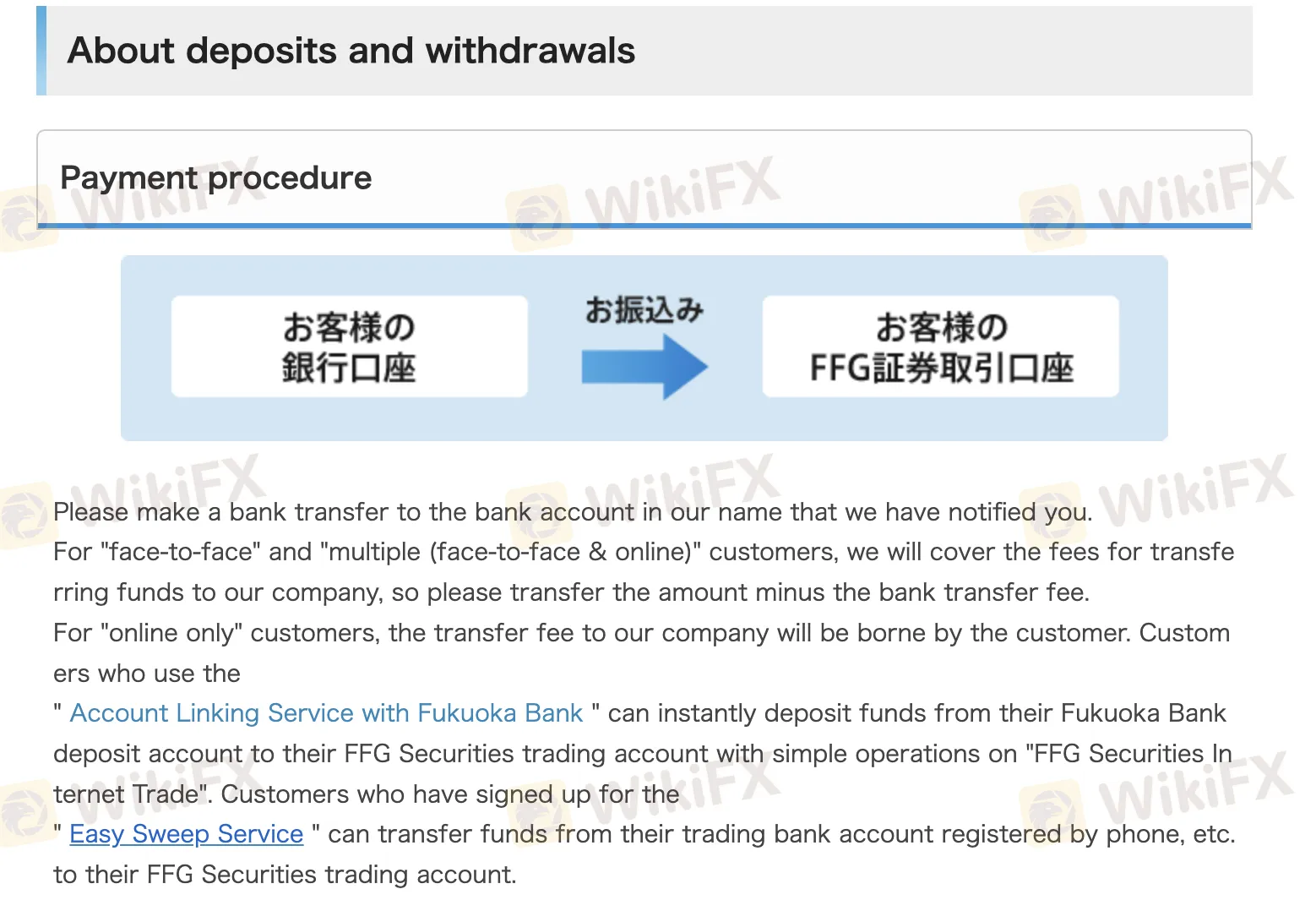

FFG Securities ay walang singil para sa mga deposito o pag-withdraw para sa mga customer na face-to-face o hybrid (face-to-face & online). Gayunpaman, ang mga customer na online-only ay dapat magbayad ng transfer fee para sa deposito nila.

| Pamamaraan ng Pagbabayad | Bayad | Oras ng Proseso |

| Bank Transfer (Face-to-face/Hybrid) | ❌ | Sameday kung bago magtanghali |

| Bank Transfer (Online-only) | ✔ | Maaaring sa susunod na araw ng negosyo |

| Fukuoka Bank Account Link | ❌ (via linked account) | Instant |