Présentation de l'entreprise

| FFG Securities Résumé de l'examen | |

| Fondé | 2007 |

| Pays/Région Enregistré | Japon |

| Régulation | FSA |

| Instruments de Marché | Actions, Obligations, ETF, SCPI, Fonds d'Investissement |

| Compte de Démo | ❌ |

| Plateforme de Trading | FFG Securities App, FFG Internet Trading |

| Dépôt Minimum | / |

| Support Client | Téléphone: 092-771-3836 |

| Adresse: 9F, Siège de la Banque de Fukuoka, Fukuoka | |

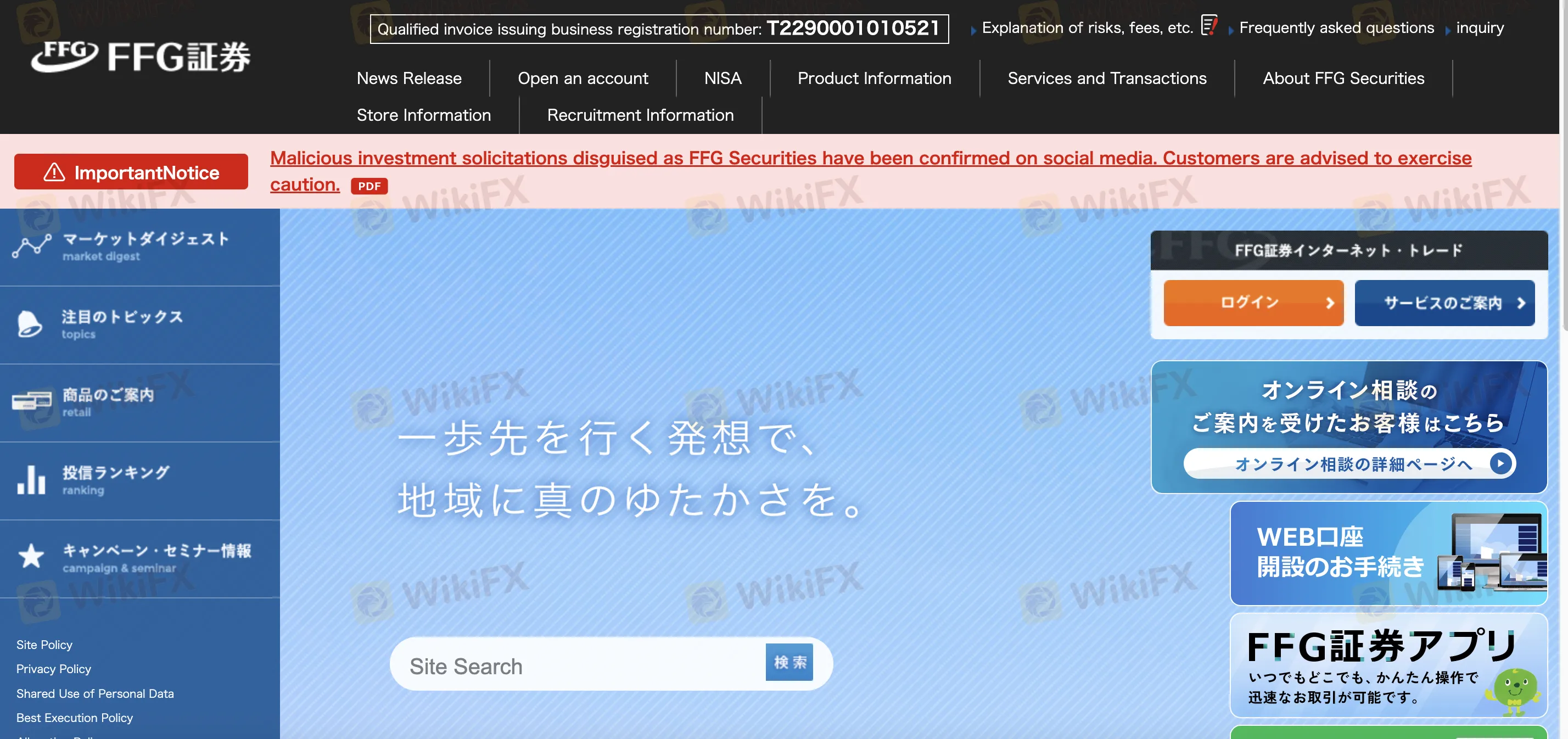

Informations sur FFG Securities

Fondée en 2007, FFG Securities Co., Ltd. est une société de services financiers japonaise réglementée par la FSA. Elle offre un accès à des fonds d'investissement, des ETF, des obligations, des actions américaines et nationales. Bien que des systèmes de trading mobiles et sur internet soient accessibles, l'absence de MT4/MT5 et des coûts élevés hors ligne peuvent être un inconvénient pour ceux qui ont un budget limité.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Régulé par la FSA au Japon | Pas de comptes de démonstration ou islamiques |

| Large gamme d'instruments nationaux et étrangers | Frais élevés pour les transactions en personne |

| Frais réduits pour les commandes uniquement sur internet | Dépôt minimum non divulgué |

| Prise en charge des actions américaines et du trading sur marge | |

| Longue durée d'opération |

FFG Securities est-il Légitime ?

Oui, FFG Securities Co., Ltd. (FFG証券株式会社) est réglementé. Il détient une licence de courtier Forex de détail délivrée par l'Agence des Services Financiers (FSA) du Japon, avec le numéro de licence 福岡財務支局長(金商)第5号.

Que Puis-je Trader sur FFG Securities ?

Incluant des actions, des obligations, des ETF, des SCPI et des fonds d'investissement, FFG Securities propose une large gamme d'instruments financiers nationaux et étrangers. Il permet également le trading sur marge et fournit une application mobile pour les données de marché et le trading en temps réel.

| Actifs de Trading | Pris en charge |

| Actions | ✔ |

| Obligations | ✔ |

| ETF | ✔ |

| SCPI | ✔ |

| Fonds d'Investissement | ✔ |

| Forex | ❌ |

| Matieres Premières | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

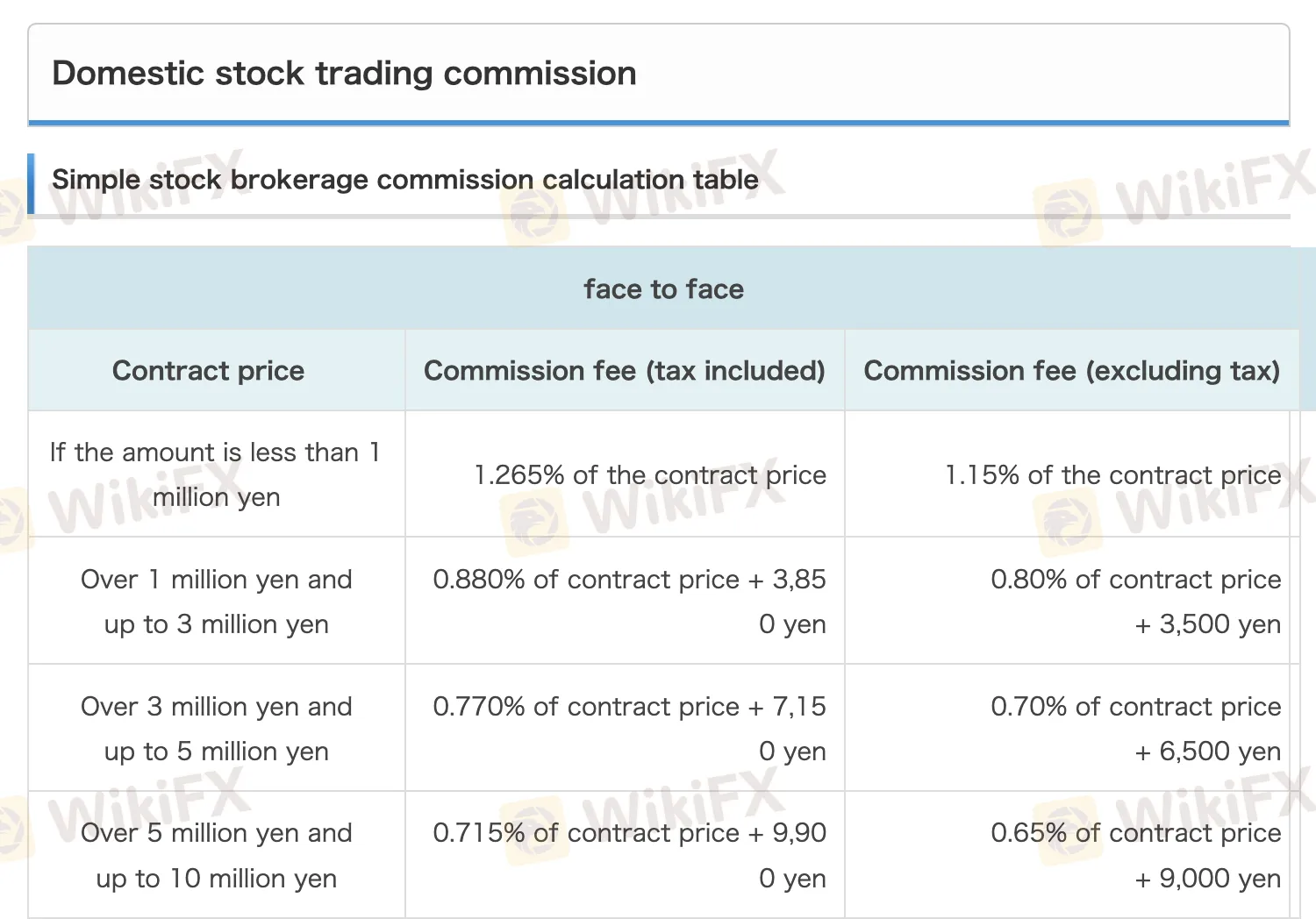

Frais de FFG Securities

Les frais de FFG Securities sont relativement élevés par rapport aux courtiers en ligne standard, notamment pour les transactions en face-à-face et les grandes tailles de contrat. Cependant, des remises significatives (jusqu'à 90%) sont appliquées au trading en ligne uniquement, le rendant plus rentable pour les utilisateurs numériques.

| Type de Frais | Détails |

| Trading d'Actions Nationales | Jusqu'à 1,265% du prix du contrat (en face-à-face); remise de 90% pour le trading en ligne uniquement |

| Frais de Commission Minimum | En face-à-face: ¥2,750; En ligne uniquement: ¥275 |

| Trading sur Marge | Intérêt d'achat: 1,97% p.a.; Frais de prêt d'actions (court): 1,15% |

| Actions Étrangères | 1,10% pour <¥1M; 0,33% + ¥218,900 pour >¥100M |

| Obligations Convertibles (CB) | 1,10% pour <¥1M; 0,165% + ¥765,600 pour >¥1B |

| Fonds d'Investissement | Varie selon le produit; Remises en ligne disponibles (jusqu'à 10% de réduction) |

| Frais de Gestion de Compte | National: Gratuit; Étranger: Gratuit |

| Frais de Transfert (Actions) | À partir de ¥1,100 (1 unité ou moins); plafonné à ¥6,600 |

| Envoi de Documents Papier (Matériaux pour les Actionnaires) | ¥660 par action |

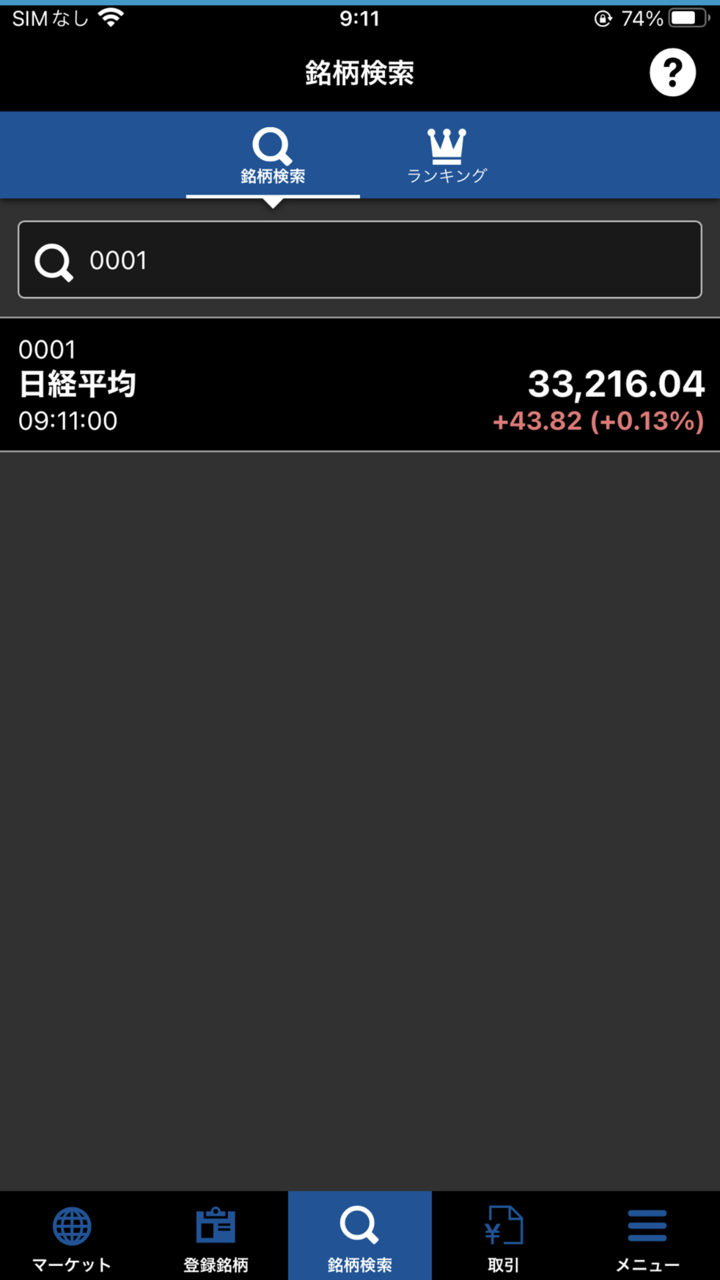

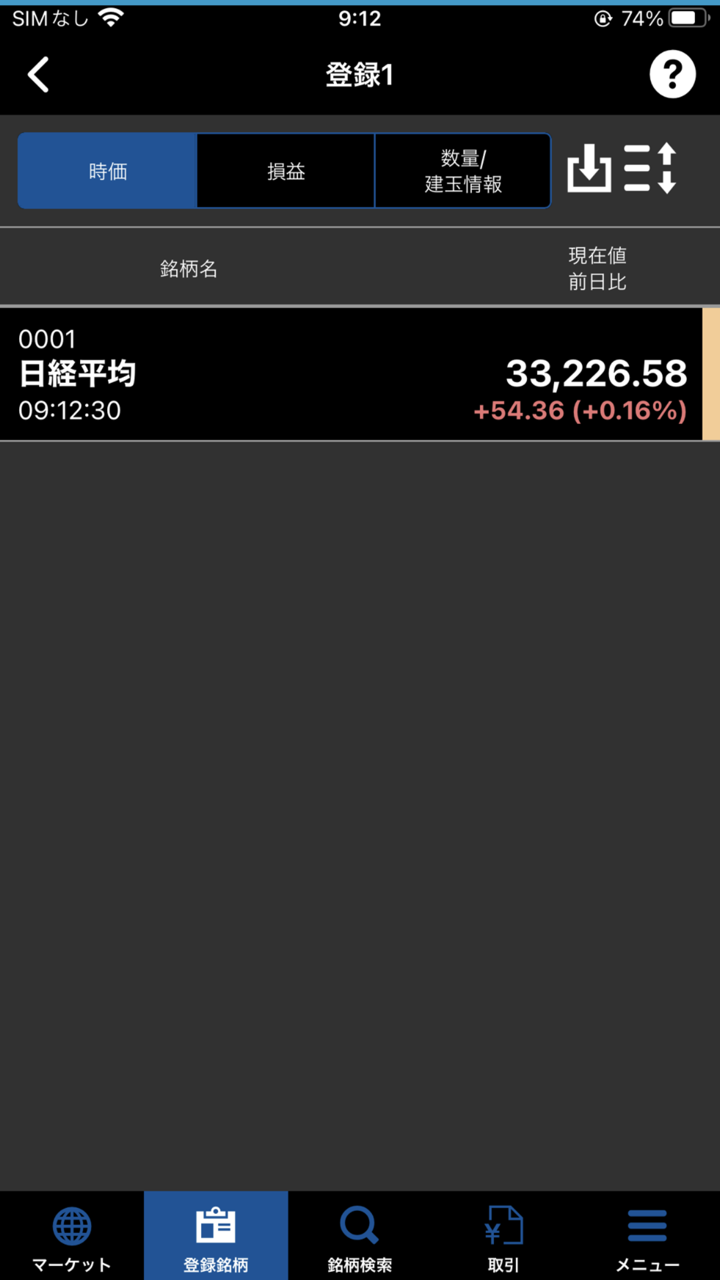

Plateforme de Trading

| Plateforme de Trading | Pris en charge | Appareils Disponibles |

| Application FFG Securities | ✔ | iOS, Android |

| Trading Internet FFG | ✔ | PC, Mac, web, mobile |

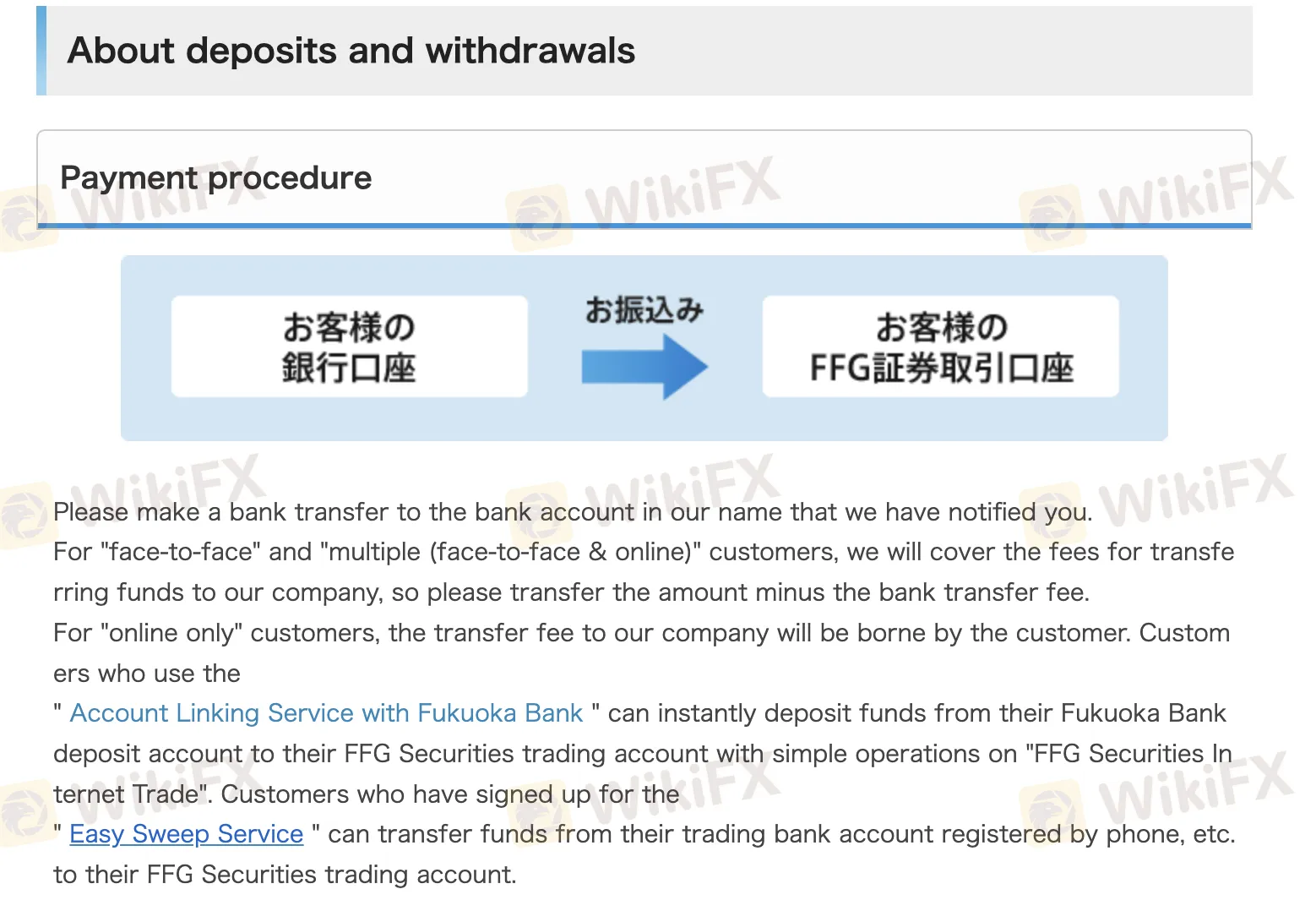

Dépôt et Retrait

FFG Securities ne facture aucuns frais pour les dépôts ou les retraits des clients en personne ou hybrides (en personne et en ligne). Cependant, les clients en ligne uniquement doivent supporter eux-mêmes les frais de transfert de dépôt.

| Méthode de paiement | Frais | Délai de traitement |

| Virement bancaire (En personne/Hybride) | ❌ | Le jour même si avant midi |

| Virement bancaire (En ligne uniquement) | ✔ | Peut être le jour ouvrable suivant |

| Lien de compte bancaire Fukuoka | ❌ (via compte lié) | Instantané |