Buod ng kumpanya

| Oriental Securities Corporation Buod ng Pagsusuri | |

| Itinatag | 1979 |

| Rehistradong Bansa/Rehiyon | Taiwan |

| Regulasyon | Taipei Exchange |

| Mga Instrumento sa Merkado | Securities, Futures, Bonds |

| Platform ng Paggagalaw | Oriental Securities Corporation-亞東e指賺 |

| Suporta sa Customer | Tel: 02-7753-1899;0800-088-567;02-405-0218 |

| Email: service@osc.com.tw | |

Impormasyon Tungkol sa Oriental Securities Corporation

Ang Oriental Securities Corporation, itinatag sa Taiwan noong 1979 at niregula ng Taipei Exchange, ay isang online na plataporma ng pangangalakal na nag-aalok ng pag-trade sa iba't ibang mga asset sa pinansyal at nagbibigay ng mobile trading platform.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

|

|

| |

|

Tunay ba ang Oriental Securities Corporation?

Ang Oriental Securities Corporation ay may lisensiyang "Dealing in securities" na niregula ng Taipei Exchange sa Taiwan.

Ano ang Pwede Kong I-trade sa Oriental Securities Corporation?

Ang plataporma ng Oriental Securities Corporation ay nag-aalok ng mga asset sa pinansyal na pwedeng i-trade, kabilang ang securities, futures, at bonds.

| Mga Tradable na Instrumento | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Bonds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Mga Pangunahing Negosyo

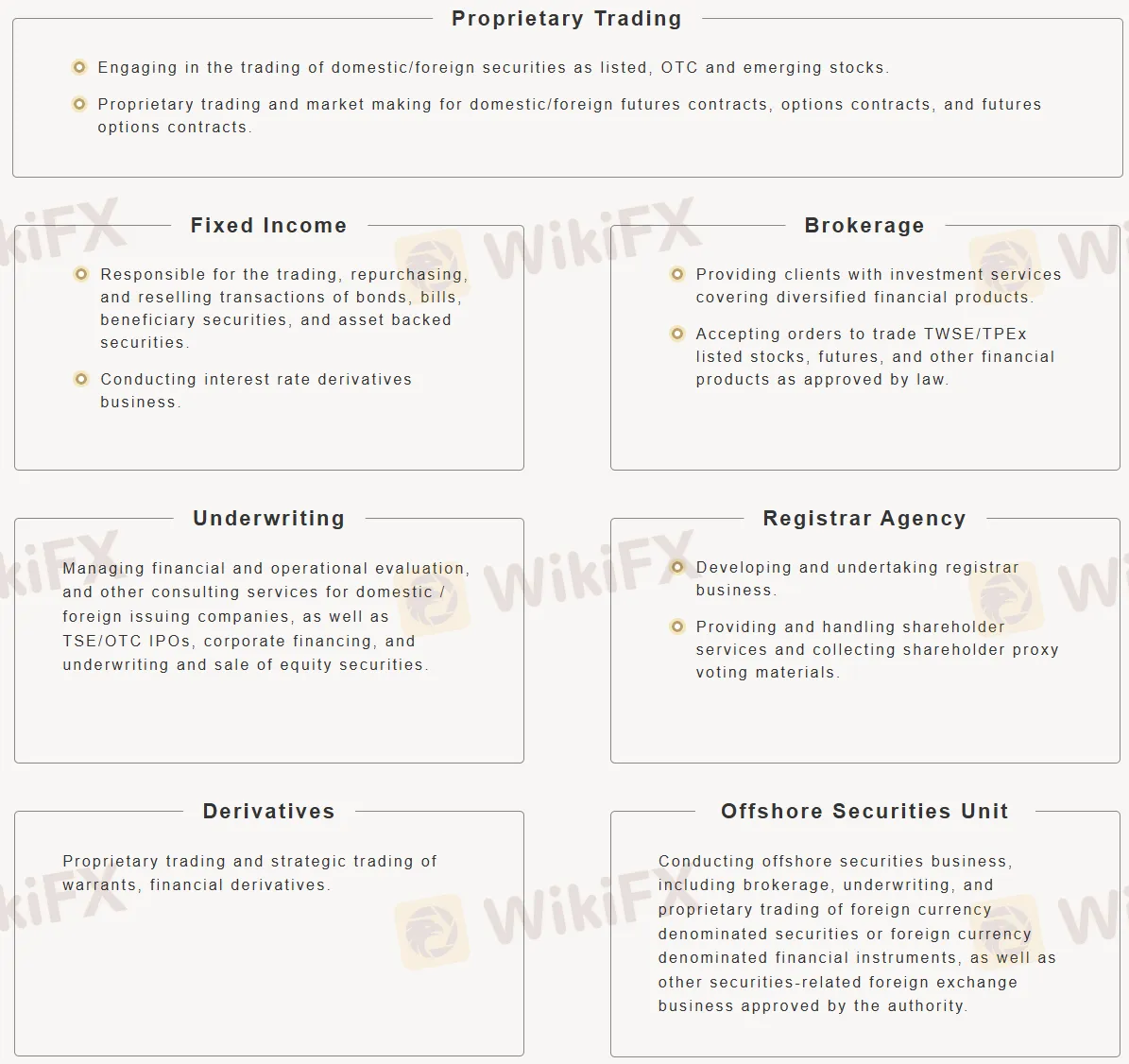

Narito ang mga pangunahing negosyo ng Oriental Securities Corporation:

- Proprietary Trading: Nagtutrade ng mga stocks at iba't ibang futures/options.

- Fixed Income: Kumikilos sa mga bond at interest rate derivatives.

- Brokerage: Nag-aalok ng mga serbisyong pang-invest at nagsasagawa ng mga trade para sa mga kliyente (stocks, futures, at iba pa).

- Underwriting: Namamahala ng IPOs, corporate financing, at equity sales.

- Registrar Agency: Namamahala ng mga serbisyong para sa mga shareholder at proxy voting.

- Derivatives: Nagtutrade ng mga warrant at financial derivatives.

- Offshore Securities Unit: Nagpapatupad ng international securities business (brokerage, underwriting, proprietary trading sa mga dayuhang currencies).

Plataforma ng Paghahalal

| Plataforma ng Paghahalal | Supported | Available Devices |

| Oriental Securities Corporation-亞東e指賺 | ✔ | IOS, Android |