Shoofar

1-2年

How do Oriental Securities Corporation's swap fees, or overnight financing charges, stack up against those of other brokerage firms?

As someone who actively evaluates brokers on the nuances that affect my trading costs, swap fees—or overnight financing charges—are always prominent on my checklist. When researching Oriental Securities Corporation, I found that the platform primarily focuses on securities, futures, and bonds, and does not explicitly offer forex, so traditional forex swap fees, as I understand them, don’t directly apply here. Instead, for positions in their eligible assets, overnight financing costs may relate more to margin requirements or specific market conventions tied to the instruments (like bonds or futures).

What raises a red flag for me is the very limited public information regarding their fee structure—especially compared to global brokers where overnight financing rates, commission schedules, and administrative costs are clearly disclosed. Transparent cost structures are important for both risk management and trust. With Oriental Securities Corporation, the lack of swap fee details means I cannot confidently benchmark their overnight charges against those of internationally recognized brokers that service forex or multi-asset traders. For my own portfolio, this lack of transparency would warrant a cautious approach, and I would insist on direct clarification from their support team before considering active trading, particularly for strategies that require holding positions overnight. Conservative due diligence is crucial in this domain.

Broker Issues

Fees and Spreads

joalund

1-2年

Is Oriental Securities Corporation overseen by any regulatory bodies, and if so, which financial authorities are responsible for its regulation?

From my experience as a trader, ensuring that a broker is properly regulated is absolutely essential for managing risk and maintaining peace of mind. As I researched Oriental Securities Corporation, I found that it is indeed regulated, specifically by the Taipei Exchange in Taiwan. This is notable because the Taipei Exchange is recognized as a legitimate financial authority, providing a layer of oversight and holding the broker to established compliance standards in the region. For me, knowing a broker operates under such supervision does instill a sense of trust, since it means the company must adhere to certain legal and operational requirements, and its activities are subject to scrutiny.

However, I must point out that this regulatory coverage pertains mainly to securities trading and not to forex or other international asset classes. The broker's main business focuses on securities, futures, and bonds rather than forex or CFDs, so the regulatory scope may not extend to all the areas that some global traders might seek. While the oversight by the Taipei Exchange is a positive factor in terms of legitimacy for its allowed business scope, I would still approach with care, always double-checking that regulatory coverage matches the specific products or markets I intend to trade. That cautious approach has served me well throughout my trading career.

LoukiaCharilaou

1-2年

Can you explain how the different account types at Oriental Securities Corporation differ from one another?

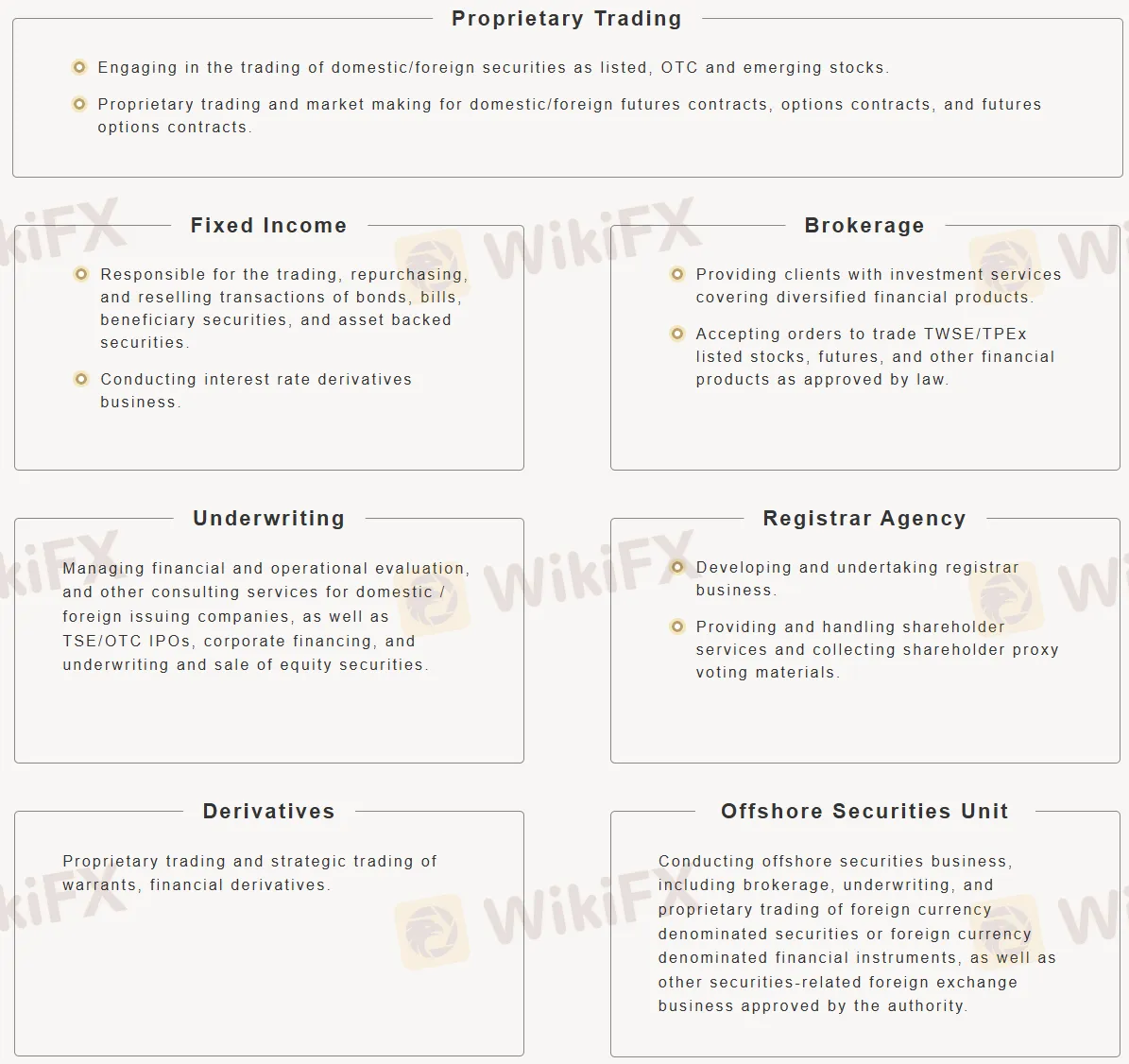

As someone who prioritizes transparency and clarity in all my trading relationships, I found Oriental Securities Corporation’s approach somewhat lacking when it comes to account type details. Based on my experience reviewing their offerings, there is no explicit information publicly available regarding multiple retail account types, specific fee structures, or tailored conditions that are commonly provided by global brokers. The focus at Oriental Securities Corporation is largely on traditional securities brokerage and proprietary trading, under clear regulation by the Taipei Exchange, with a strong track record in the Taiwanese market.

Their trading platform supports securities, futures, and bonds, but crucially, they do not offer forex, commodities, or CFD products. Most trading activity for individual clients appears to go through their self-developed mobile application, “亞東證券-亞東e指賺.” This emphasis on a streamlined service is typical for regional, regulated brokers in East Asia, but it means there’s less flexibility or account segmentation by experience level, margin needs, or trading style.

Because the broker lacks published guidance about account tiers, minimum deposits, or preferential spreads, I’d recommend approaching with due caution and contacting their customer service directly for personal circumstances. In my own practice, I never commit funds to any institution unless I am clear on all conditions—including account types and costs—so without this, I can only consider Oriental Securities Corporation suitable for straightforward securities or futures trading, not for diverse or leveraged forex accounts. My advice is to verify every aspect before opening an account, especially if you are used to the more granular offerings of international online brokers.

Broker Issues

Instruments

Leverage

Platform

Account

J Forex Trader

1-2年

What is the highest leverage Oriental Securities Corporation provides on major forex pairs, and how does this leverage differ for other asset types?

In my experience evaluating Oriental Securities Corporation, one point that stands out is that this broker does not actually provide trading in major forex pairs. Their business model, as observed from all available information, revolves around securities, futures, and bonds, rather than spot forex trading or contracts for difference on currencies. For someone accustomed to the highly leveraged forex environments many global brokers offer, this is a significant distinction. There is no mention or indication of leverage on major forex pairs because forex products are simply not on their list of supported instruments.

What Oriental Securities Corporation does offer is access to regulated trading in Taiwan on securities, futures, and bonds, primarily through their own self-developed mobile trading platform. While leverage may be available for certain futures contracts—common in the industry—exact ratios are not disclosed, and there is no transparent information on margin requirements. This lack of detail requires a careful and conservative approach, especially if one is considering trading leveraged products. For me, understanding the available leverage is crucial for risk management, and the absence of specifics necessitates extra due diligence.

If you are specifically seeking high-leverage forex or a standard offering of margin on major currency pairs, Oriental Securities Corporation is not aligned with that goal. Instead, their regulated focus in Taiwan emphasizes traditional securities and derivatives, which can provide stability for longer-term investors but is less relevant for active forex traders searching for high leverage opportunities. As always, I prioritize platforms with clear, detailed disclosures, particularly on leverage and margin, before committing funds or positions.

Broker Issues

Leverage

Instruments

Account

Platform