Buod ng kumpanya

| CCB Futures Buod ng Pagsusuri | |

| Itinatag | 2013 |

| Nakarehistrong Bansa/Rehiyon | China |

| Regulasyon | CFFE (Regulated) |

| Instrumento sa Merkado | Futures |

| Demo Account | ✅ |

| Platform ng Paggawa ng Kalakalan | Wenhua Winshun Cloud Market Trading Software HD Version (wh6), Fast trading terminal, Infinite Easy (Pro Professional Edition), Flush Futures PC Version, Boyi Master, Polestar 9.5 Jianxin Futures Edition, Polestar 9.3 Jianxin Futures Edition, at iba pa. |

| Suporta sa Customer | Live chat |

| Tel: 400-90-95533 | |

| Email: ptg@ccbfutures.com | |

Impormasyon ng CCB Futures

Ang CCB Futures ay isang reguladong broker, nag-aalok ng kalakalan sa mga hinaharap na platform ng kalakalan.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Iba't ibang mga platform ng kalakalan | Limitadong uri ng mga produkto sa kalakalan |

| Maayos na regulado | |

| Mga available na Demo account | |

| Suporta sa live chat |

Tunay ba ang CCB Futures?

Oo. Ang CCB Futures ay lisensyado ng CFFEX upang mag-alok ng mga serbisyo.

| Regulated na Bansa | Tagapamahala | Kasalukuyang Kalagayan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| China Financial Futures Exchange (CFFEX) | Regulated | CCB Futures有限责任公司 | Lisensya sa Futures | 0103 |

Ano ang Maaari Kong Kalakalan sa CCB Futures?

CCB Futures nag-aalok ng pag-trade sa mga futures.

| Mga Tradable Instruments | Supported |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Uri ng Account

Ang CCB Futures ay hindi malinaw na nagbibigay ng mga uri ng account na inaalok nito, ngunit nag-aalok ito ng demo accounts para sa mga kliyente.

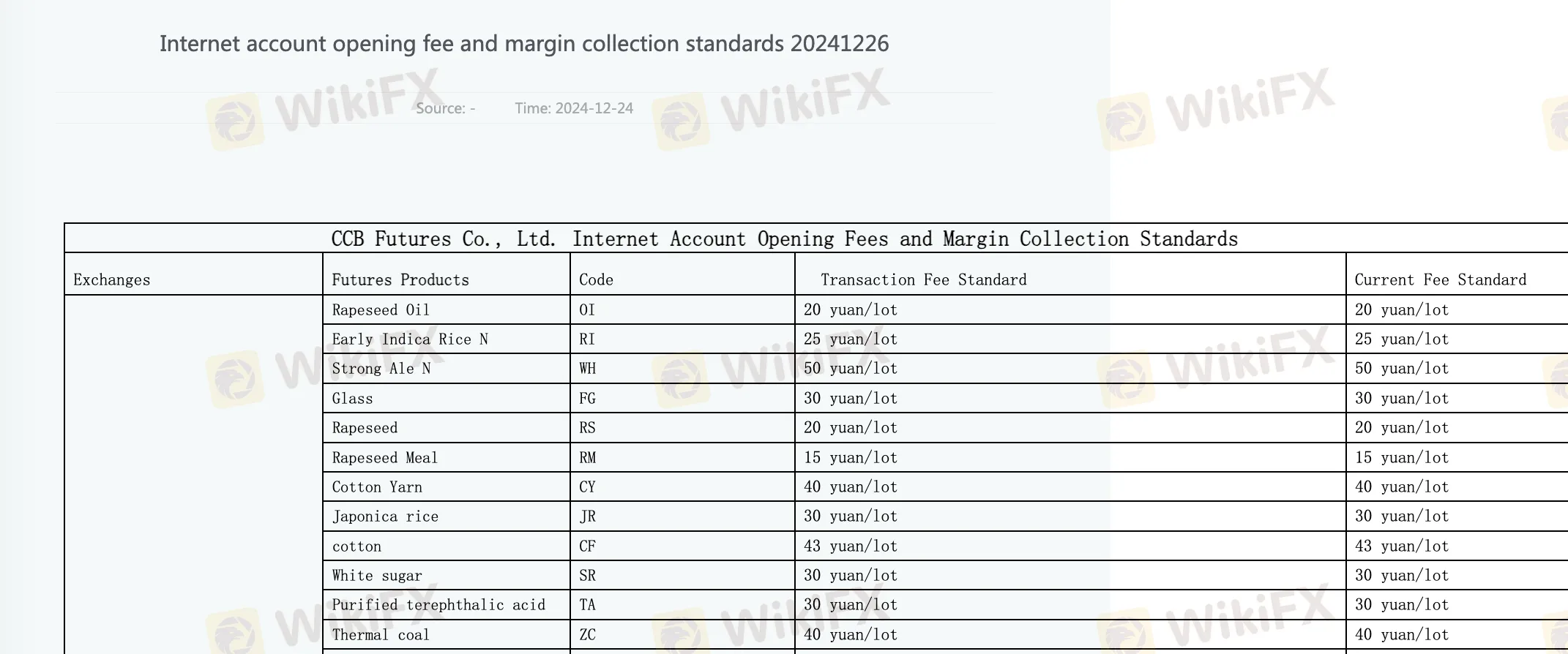

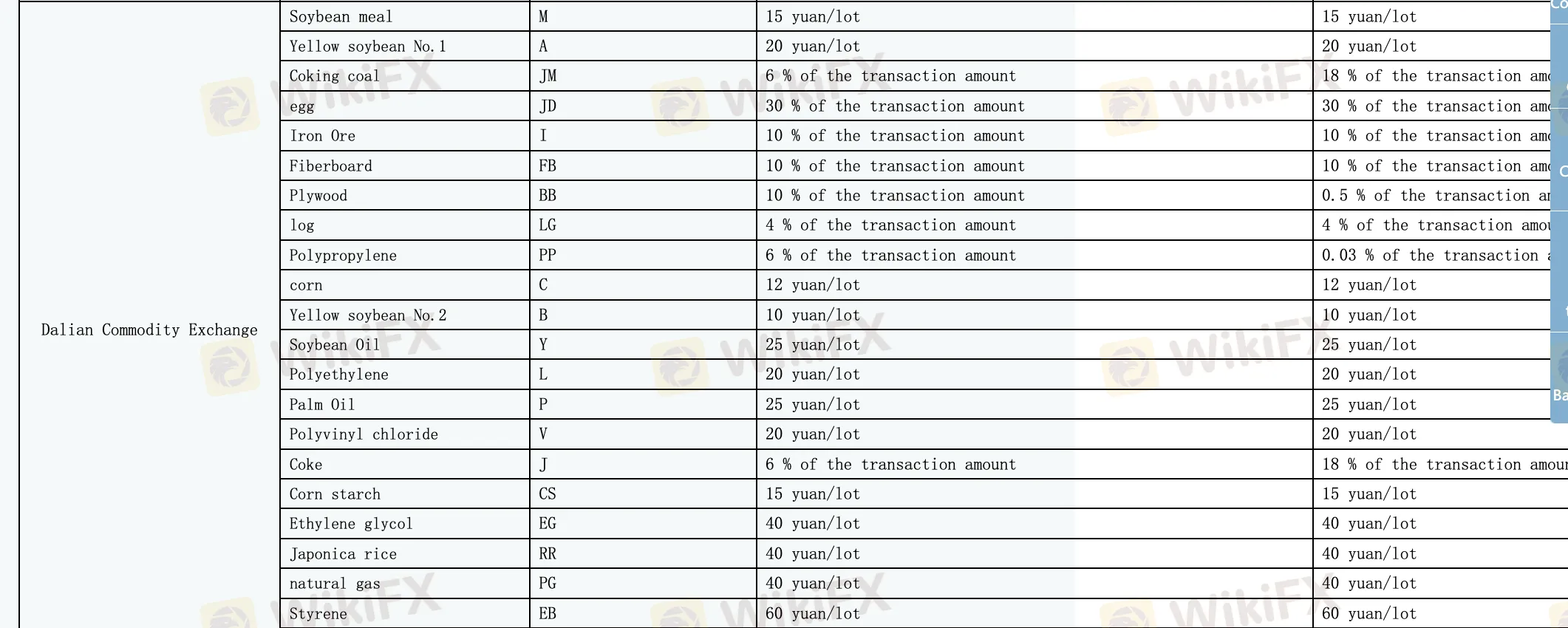

Mga Bayad ng CCB Futures

Ang CCB Futures ay nangangailangan ng internet account opening fee, kasalukuyang bayad at may mga pamantayan sa koleksyon ng margin.

| Mga Produkto ng Futures | Kasalukuyang Pamantayan sa Bayad |

| Rapeseed oil | 20 yuan/lot |

| Cotton | 43 yuan/lot |

| Palm oil | 25 yuan/lot |

Plataforma ng Pag-trade

Nagbibigay ang broker ng iba't ibang mga plataporma ng pag-trade, kabilang ang Wenhua Winshun Cloud Market Trading Software HD Version (wh6), Fast trading terminal, Infinite Easy (Pro Professional Edition), Flush Futures PC Version, Boyi Master, Polestar 9.5 Jianxin Futures Edition, Polestar 9.3 Jianxin Futures Edition, Kuaiqi V3 Trading Terminal, Trading Pioneer, Pyramid Decision Trading System, Fast trading terminal-national secret version, Jianxin Futures App at Yisheng Yixing Mobile Trading Software.

Mga Available na Device: desktop at mobile.

Deposito at Pag-Wiwithdraw

Sa panahon ng patuloy na oras ng pagtetrading, ang mga kliyente ay maaaring magdeposito ng pondo ngunit hindi maaaring magwithdraw ng pondo. Walang itinakdang minimum na halaga ng deposito o withdrawal at walang mga bayarin o singil na itinakda.