joalund

1-2年

In what ways does CCB Futures’s regulatory oversight help safeguard my funds?

In my experience as a trader, strong regulatory oversight is one of the key factors I consider when evaluating any broker, and CCB Futures operates under the regulation of the China Financial Futures Exchange (CFFEX). This means they hold a valid futures license (License No. 0103), which adds a layer of accountability and supervision that I find reassuring. Regulators like CFFEX impose operational standards and monitoring, helping ensure that the broker follows strict financial protocols and ethical conduct. For me, this translates to a higher likelihood that client funds are managed appropriately and that the broker is subject to external audits, reducing the risk of mismanagement.

What also stands out for me is how regulatory scrutiny limits a broker’s ability to engage in fraudulent or deceptive activities. With CCB Futures, being under regulation requires adherence to transparent business practices, clearer fee structures, and accountability if complaints arise. However, I should note that while regulation can significantly lower risks, it cannot eliminate all of them, particularly if there are red flags like limited product offerings or unclear business scopes. Ultimately, regulation means that if things go wrong, there are legal avenues for recourse, which gives me more confidence compared to unregulated brokers. Still, it remains essential to exercise caution and conduct thorough due diligence before committing any significant funds.

Bhavani Durga K

1-2年

What potential risks or drawbacks should I watch out for when dealing with CCB Futures?

From my perspective as an experienced trader, evaluating CCB Futures requires a careful and conservative approach. CCB Futures is regulated by the China Financial Futures Exchange (CFFEX) and has operated for 5-10 years. Regulation does provide some degree of confidence, but it mainly means the company follows local compliance requirements rather than guaranteeing trader protection. I noticed that the broker is transparent about its futures license and regulatory status, which is always one of my first checkpoints when considering a new platform.

However, there are some factors that make me cautious. First, CCB Futures specializes only in futures contracts and does not offer forex, commodities, indices, or other asset classes. This lack of diversification could be a drawback if your trading needs might change or if you seek broader opportunities. I also found that its account types and associated terms are not clearly stated. The fee structure—such as the per-lot costs for specific futures—requires close attention, as fees can impact profitability over time.

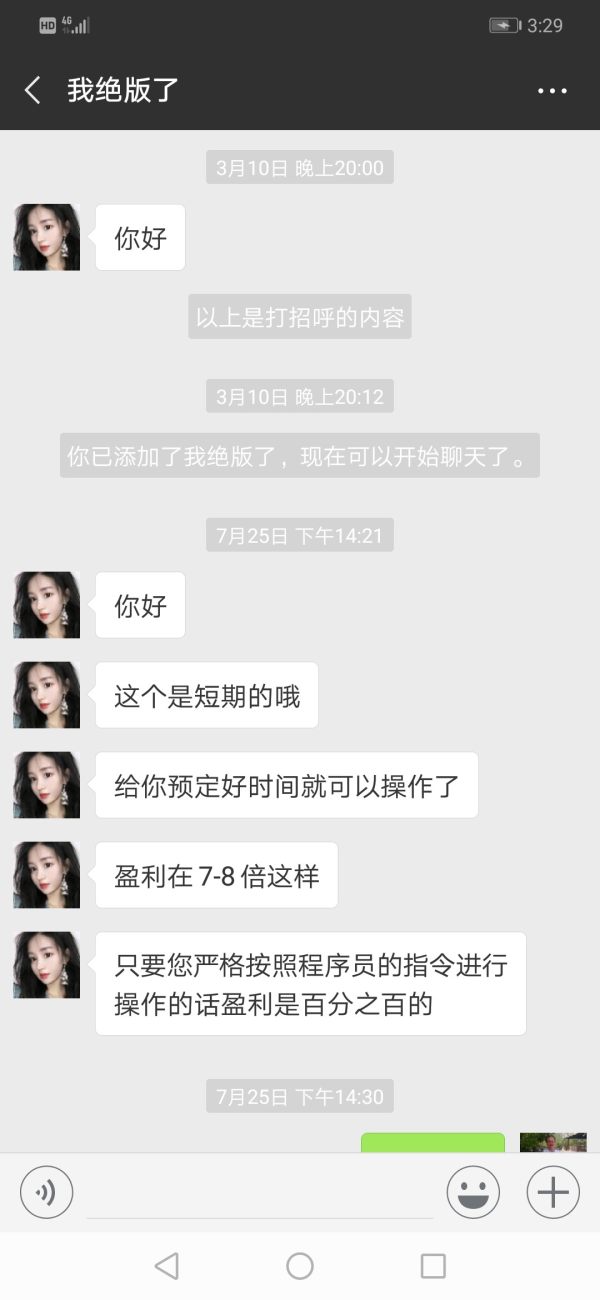

Another point that honestly gives me pause is the mention of "suspicious scope of business" and exposure reports detailing fraud attempts through unauthorized apps. Although these seem more related to clones or fraudulent impersonations rather than CCB Futures itself, it serves as a reminder to always verify that I’m using official, verified channels before depositing funds or downloading any trading software. In summary, while CCB Futures appears regulated and relatively established, I would be extremely vigilant about due diligence, use only official contact points, and remain cautious about the narrow product range and evolving risks in digital finance.

seejay

1-2年

How much is the minimum deposit needed to start a live trading account at CCB Futures?

Based on my thorough review of CCB Futures, I could not find a specifically stated minimum deposit requirement to open a live trading account. In my experience, this omission is fairly common among traditional futures brokers, especially those with local regulatory oversight. Sometimes, the minimum deposit may be determined by the margin requirements of the specific futures contracts a trader wishes to access rather than a set amount mandated by the broker. This structure is typical in the Chinese futures market, where client suitability and initial margin standards play a bigger role than an arbitrary universal minimum.

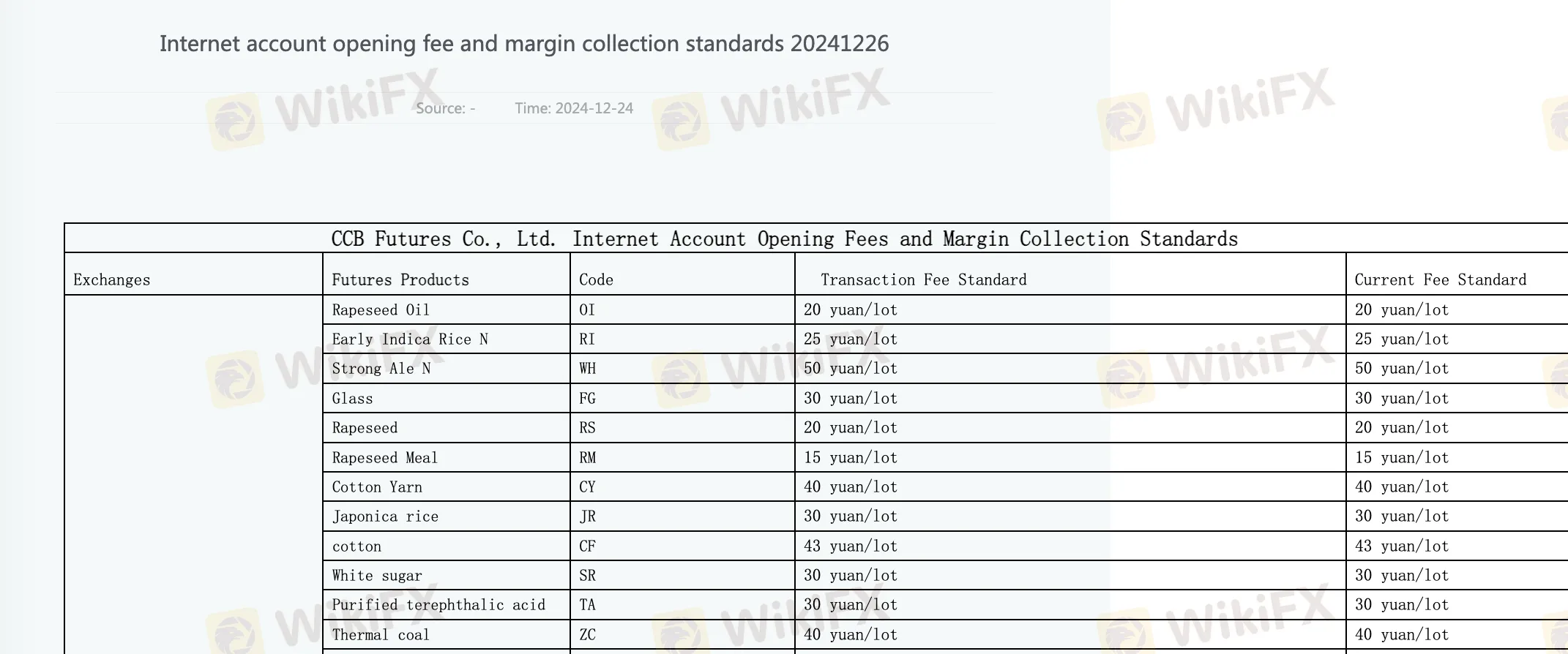

For me, the lack of clear information about minimum deposit underscores the importance of reaching out directly to their customer service before committing any funds, especially since CCB Futures does not publicly outline its full account types or funding policies. The only detail I noted was that there are fees linked to internet account opening and ongoing trading, with margin standards applying to individual contracts.

As someone who prioritizes transparency and risk management, I find it crucial to get explicit confirmation on funding requirements and withdrawal processes, particularly since CCB Futures also restricts withdrawals during certain trading periods. I prefer to have all the facts up front to ensure my capital is protected and I understand the operational limitations before opening an account with any broker, including CCB Futures.

Broker Issues

Deposit

Withdrawal

TradeTimeAllWasted

1-2年

Could you break down the total trading costs involved for indices such as the US100 when trading on CCB Futures?

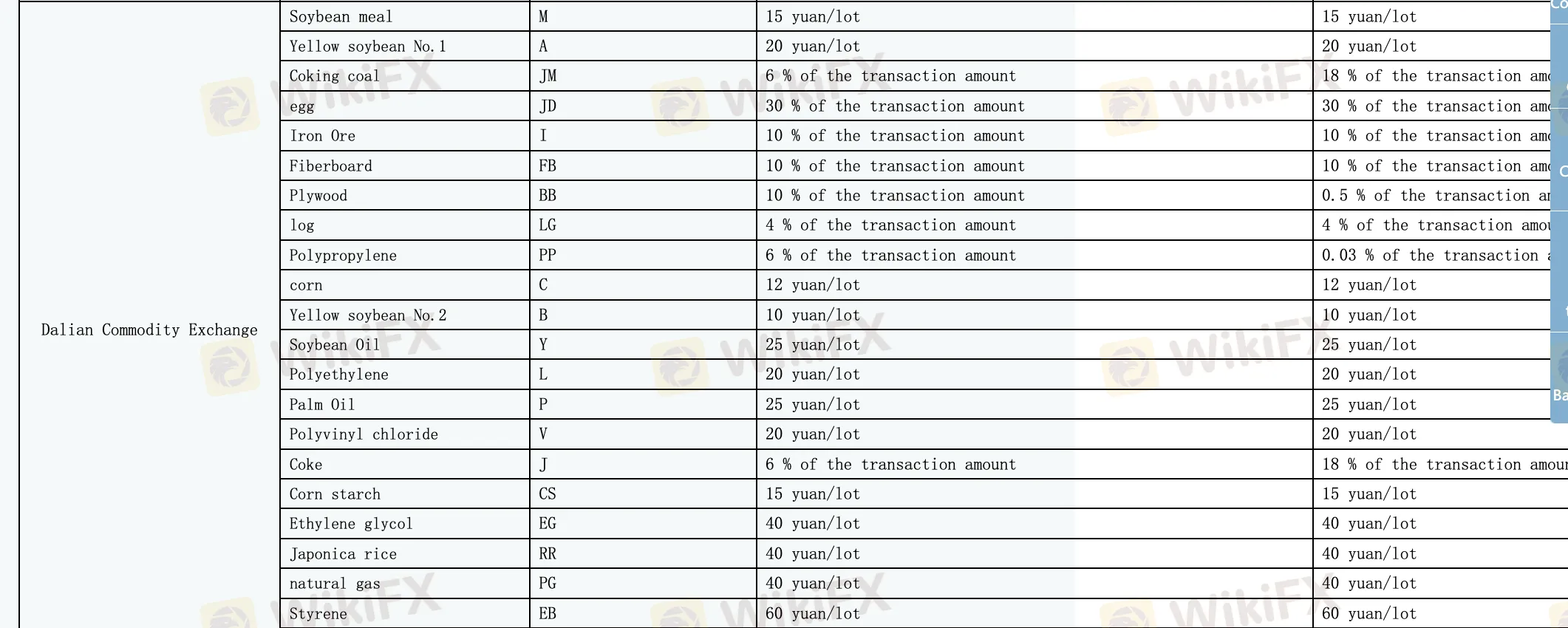

As someone with years of hands-on trading experience, it's important for me to clarify what CCB Futures actually offers before I get into the matter of trading costs. According to the regulatory and product details, CCB Futures specializes in futures trading and is strictly regulated in China under the CFFEX. I did not find any evidence that CCB Futures provides access to index contracts such as the US100 or similar international indices. Their permitted trading instruments are exclusively domestic futures like rapeseed oil, cotton, and palm oil.

For cost transparency, CCB Futures lists fee standards for select products—for example, trading rapeseed oil has a 20 yuan per lot fee, while cotton is 43 yuan per lot. These are product-specific fees and don’t extend to indices like the US100, simply because CCB Futures does not appear to offer those products. Additionally, opening an account involves an internet account fee, and margin requirements will vary by contract. There’s no clear information on any inactivity fees, spreads, or additional costs for products not listed.

If your strategy hinges on indices such as the US100, from my research and experience, CCB Futures would not meet your needs. I would advise verifying all costs directly with the broker before committing capital, and only proceed if the product offering fits your precise trading requirements. This cautious approach aligns with best risk management practices for any serious trader.

Broker Issues

Fees and Spreads