Présentation de l'entreprise

| Turing Résumé de l'examen | |

| Fondé | 1996 |

| Pays/Région enregistré(e) | Royaume-Uni |

| Régulation | Non réglementé |

| Instruments de marché | Forex, Métaux et Cryptomonnaies |

| Compte de démonstration | Oui |

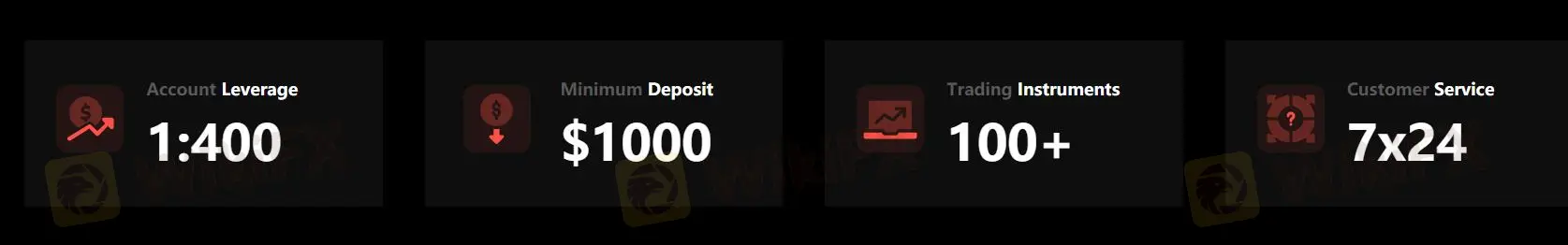

| Effet de levier | Jusqu'à 1:400 |

| Spread | À partir de 0,0 pips |

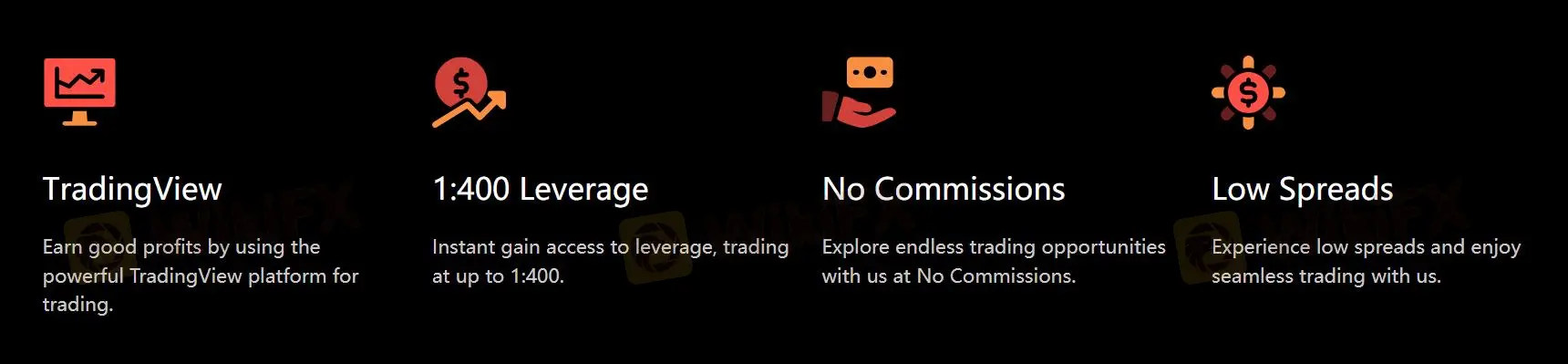

| Plateforme de trading | TradingView |

| Dépôt minimum | $1000 |

| Assistance clientèle | support@turingfx.pro |

| Assistance par chat en direct 24/7 | |

Informations sur Turing

Turing est une plateforme de trading en ligne qui propose plus de 100 instruments de trading, notamment le Forex, les métaux et les cryptomonnaies. Turing offre des spreads réduits et un effet de levier élevé allant jusqu'à 1:400 sans commissions via la plateforme TradingView. Cependant, il nécessite un dépôt minimum élevé de 1000 $.

Avantages et inconvénients

| Avantages | Inconvénients |

|

|

|

|

|

|

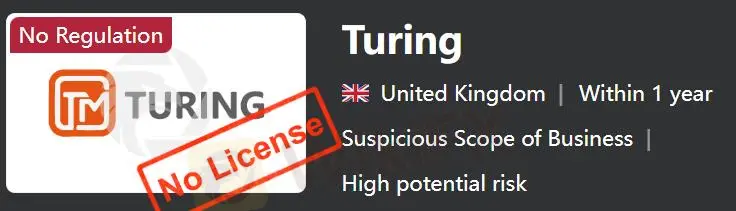

Turing est-il légitime ?

Turing n'est pas réglementé.

Que puis-je trader sur Turing ?

Turing propose plus de 100 instruments de trading, principalement le Forex, les métaux et les cryptomonnaies.

| Instruments tradables | Pris en charge |

| Forex | ✔ |

| Cryptomonnaie | ✔ |

| Métaux | ✔ |

| Indices | ❌ |

| Matières premières | ❌ |

| Actions | ❌ |

Frais Turing

Turing propose des spreads réduits et un effet de levier élevé allant jusqu'à 1:400 sans commissions.

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| TradingView | ✔ | PC et mobile | Investisseurs de tous niveaux d'expérience |

Dépôt et retrait

Turing exige un dépôt minimum élevé de 1000 $.