Présentation de l'entreprise

| Ebury Résumé de l'examen | |

| Fondé | 2009 |

| Pays d'enregistrement | Royaume-Uni |

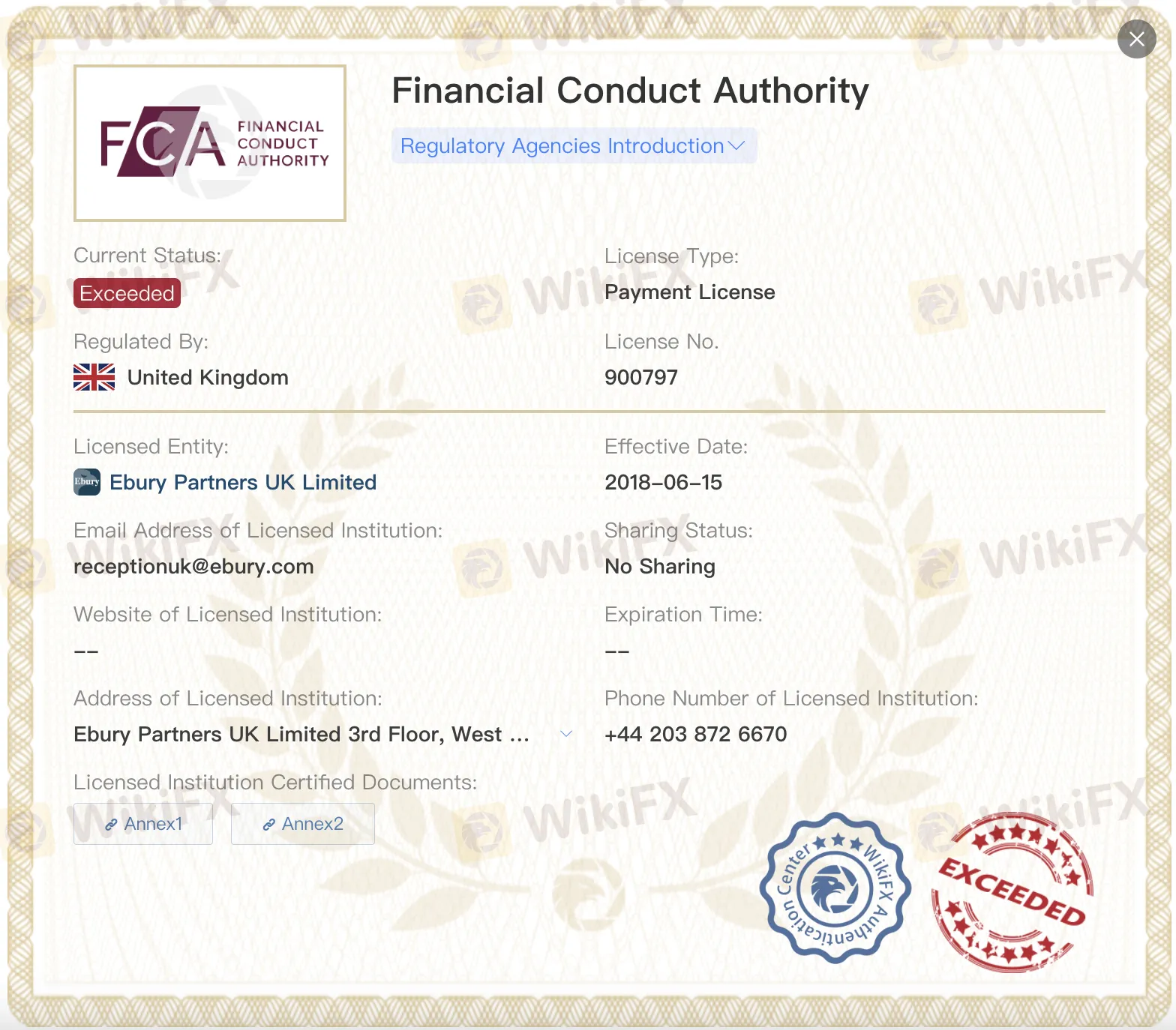

| Régulation | FCA (Dépassé) |

| Services | Paiements, gestion des risques de change, prêts commerciaux, paiements de masse, solutions spécifiques à l'industrie (commerce électronique, ONG, maritime, institutions) |

| Plateforme numérique | Portail en ligne, application mobile, API |

| Support client | Téléphone : +44 (0) 20 3872 6670 |

| Email : info@ebury.com | |

| Adresse : 100 Victoria Street, SW1E 5JL, Londres | |

Informations sur Ebury

Ebury, une institution financière réglementée accréditée par l'Autorité de conduite financière, a été créée au Royaume-Uni en 2009. Cependant, le statut de régulation est "Dépassé". Elle utilise la technologie numérique pour fournir une large gamme de services aux organisations multinationales et aux investisseurs institutionnels, tels que les paiements transfrontaliers, la gestion des risques de change et le financement des entreprises.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la FCA au Royaume-Uni | Licences "Dépassées" |

| Large gamme de services financiers mondiaux | Informations limitées sur les frais |

| Soutient à la fois les clients corporatifs et institutionnels |

Ebury est-il légitime ?

Oui, elle est réglementée par la Financial Conduct Authority (FCA) du Royaume-Uni sous deux licences : une licence de paiement (n° 900797) et une licence de conseil en investissement (n° 784063). Cependant, les deux licences sont répertoriées comme "Dépassées".

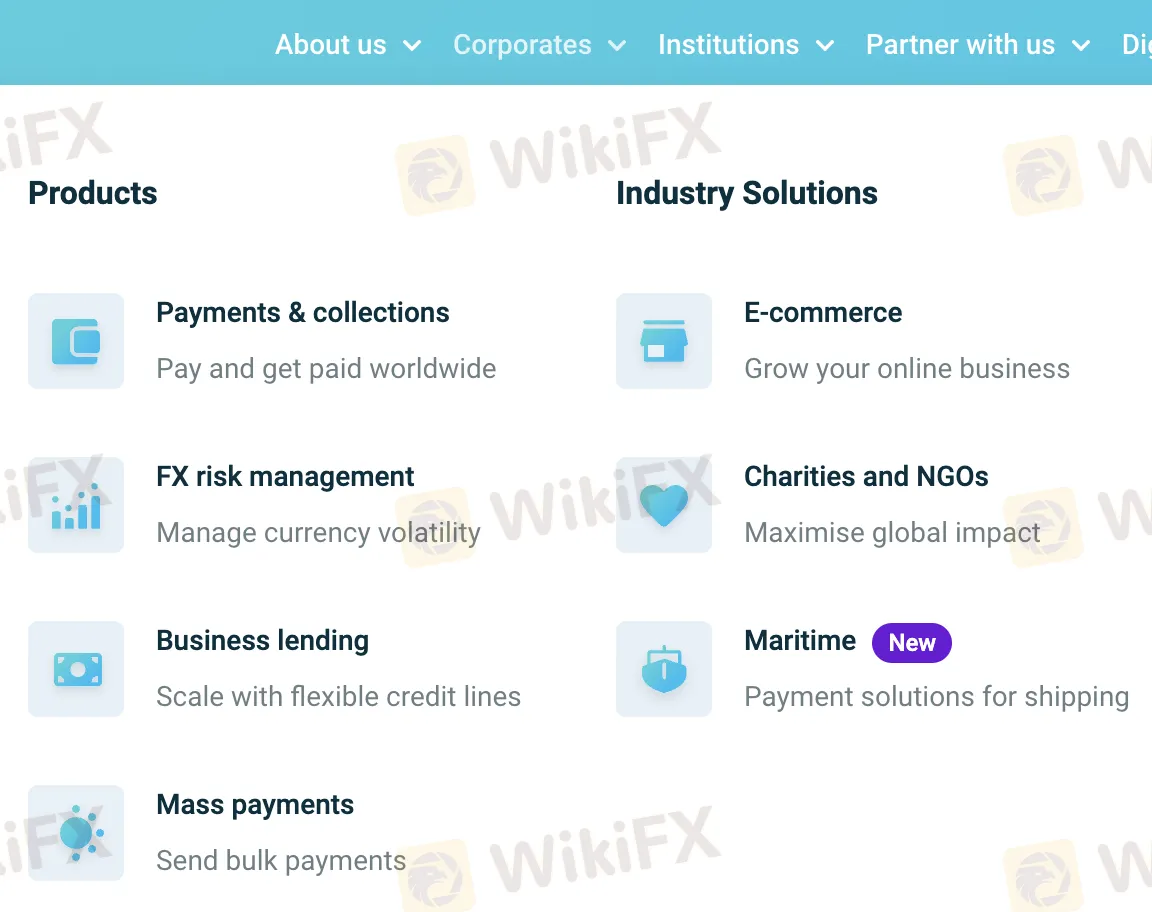

Produits et Services

Ebury propose des solutions financières mondiales, notamment des paiements, la gestion des risques de change et des prêts commerciaux. Elle propose également des services spécialisés dans des domaines tels que le commerce électronique, la charité et le maritime.

| Segment | Catégorie | Service |

| Entreprises | Produits | Paiements et Encaissements |

| Gestion des risques de change | ||

| Prêts commerciaux | ||

| Paiements de masse | ||

| Solutions sectorielles | Commerce électronique | |

| Charités et ONG | ||

| Maritime (Nouveau) | ||

| Institutions | Institutionnel | Solutions institutionnelles de Ebury |

| Comptes mondiaux | ||

| Gestion des risques | ||

| Paiements mondiaux | ||

| Appariement de financement de fonds (Nouveau) |

Plateforme Numérique

Grâce à son site web, son application mobile et ses connexions API, Ebury fournit une plateforme numérique sûre et facile à utiliser. Les entreprises de toutes tailles peuvent utiliser ces outils pour faire des affaires dans le monde entier, suivre leur argent et automatiser des tâches.

| Plateforme | Principales fonctionnalités |

| Ebury en ligne | Interface simple, rapports améliorés, paiements mondiaux sécurisés, support expert |

| Application mobile | Gérer les flux de trésorerie en déplacement, suivre les transactions, authentification à deux facteurs |

| API | Intégration rapide, automatiser les tâches administratives, étendre les offres de produits, outils évolutifs |