Présentation de l'entreprise

| Ichiyoshi Securities Résumé de l'examen | |

| Fondé | 1950 |

| Pays/Région enregistré | Japon |

| Régulation | FSA |

| Produit de trading | Valeurs mobilières |

| Plateforme de trading | / |

| Support client | Tél : 03-4346-4500 |

Informations sur Ichiyoshi Securities

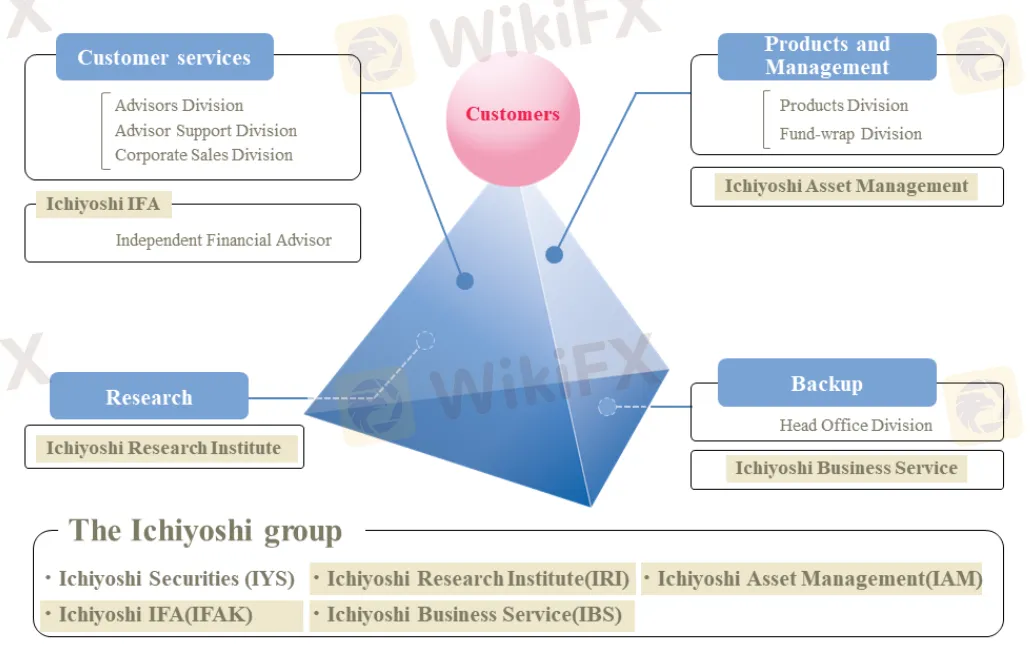

Ichiyoshi Securities Co., Ltd., fondé au Japon en 1950 et réglementé par la FSA, fonctionne avec une structure de gestion pyramidale triangulaire et privilégie les intérêts des clients individuels à travers ses "Sept normes Ichiyoshi", en mettant l'accent sur des produits fiables et moins complexes.

Avantages et inconvénients

| Avantages | Inconvénients |

|

|

|

|

Ichiyoshi Securities est-il légitime ?

Ichiyoshi Securities détient une licence de courtier Forex au détail réglementée par l'Autorité des services financiers (FSA) au Japon avec un numéro de licence 関東財務局長(金商)第24号.

| Autorité de réglementation | Statut actuel | Pays réglementé | Type de licence | Numéro de licence |

| Autorité des services financiers (FSA) | Réglementée | Japon | Licence de courtier Forex au détail | 関東財務局長(金商)第24号 |

Forces de Ichiyoshi Securities

- Gestion en pyramide triangulaire: La force de Ichiyoshi Securities réside dans sa structure de gestion en pyramide triangulaire avec des divisions interconnectées (Services client, Produits & Management, Recherche, Sauvegarde) favorisant la synergie pour maximiser la fonction de chaque division, visant finalement à fournir des services, produits et informations supérieurs pour la gestion des actifs et des affaires des clients.

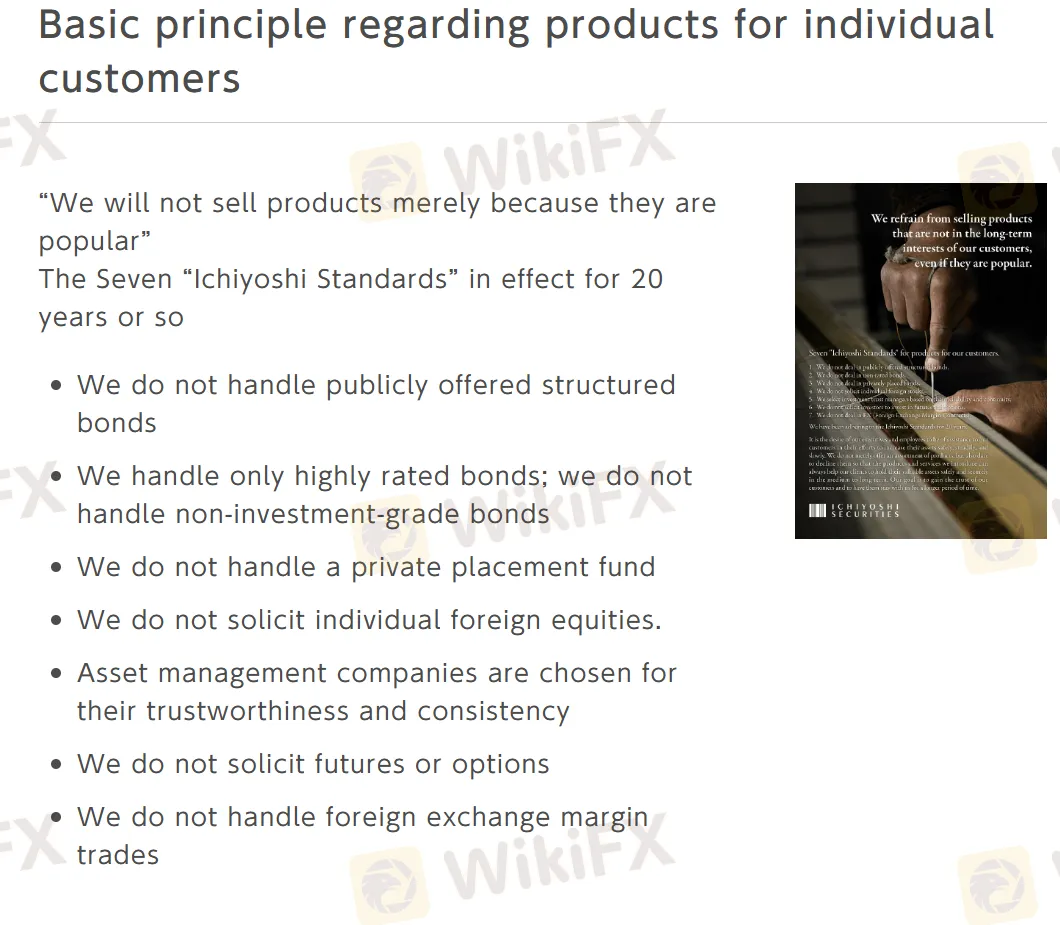

- Principes de base concernant les produits pour les clients individuels: Ichiyoshi Securities donne la priorité aux intérêts des clients individuels en respectant les "Sept normes Ichiyoshi" depuis environ 20 ans, en se concentrant sur des produits de haute qualité et fiables, et en évitant les offres complexes ou à haut risque comme les obligations structurées, les obligations de catégorie non-investissement, les placements privés, les actions étrangères, les contrats à terme/options et les opérations de marge sur devises.

Chiffres statistiques importants

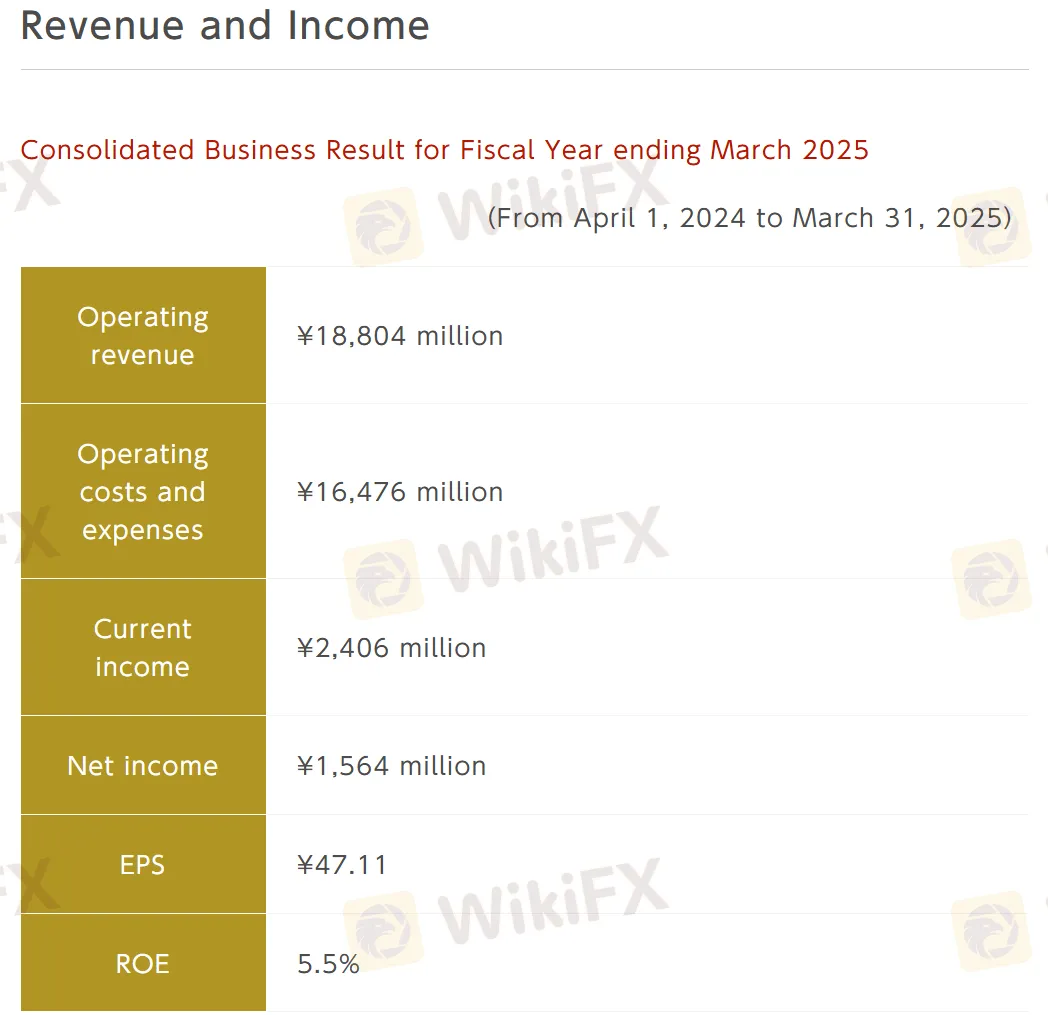

- Revenus et bénéfices: Du 1er avril 2024 au 31 mars 2025

| Métrique | Valeur |

| Revenus d'exploitation | ¥18,804 million |

| Coûts et dépenses d'exploitation | ¥16,476 million |

| Bénéfice courant | ¥2,406 million |

| Bénéfice net | ¥1,564 million |

| BPA | ¥47.11 |

| ROE | 5.5% |

- Résumé financier: Au 31 mars 2025

| Métrique | Valeur |

| Total des actifs | ¥41,900 million |

| Valeur nette | ¥27,461 million |

| Ratio des capitaux propres | 65.4% |

| Actifs nets par action | ¥861.85 |

| Ratio d'adéquation des capitaux | 448.0% |