Profil perusahaan

| NatWest Ringkasan Ulasan | |

| Didirikan | 1997 |

| Negara/Daerah Terdaftar | Inggris Raya |

| Regulasi | Tidak diatur |

| Layanan | Perbankan, pinjaman, asuransi, tabungan, investasi |

| Platform/APP | Aplikasi Perbankan Seluler NatWest |

| Dukungan Pelanggan | Obrolan online |

Informasi NatWest

NatWest, didirikan pada tahun 1997 dan bermarkas di Inggris Raya, tidak diatur oleh FCA atau lembaga keuangan global utama lainnya. NatWest menawarkan berbagai layanan keuangan pribadi seperti rekening saat ini, pinjaman, asuransi, tabungan, dan produk investasi, namun tidak memiliki kemampuan perdagangan canggih atau alternatif akun contoh.

Pro dan Kontra

| Pro | Kontra |

| Menawarkan berbagai layanan perbankan ritel | Tidak diatur |

| Tidak ada biaya bulanan pada akun dasar | |

| Dukungan obrolan langsung |

Apakah NatWest Legal?

Otoritas Jasa Keuangan (FCA) Inggris dan badan regulasi global lainnya seperti ASIC (Australia) dan NFA (AS) tidak mengawasi NatWest, meskipun terdaftar di Inggris. Harap waspada terhadap risiko!

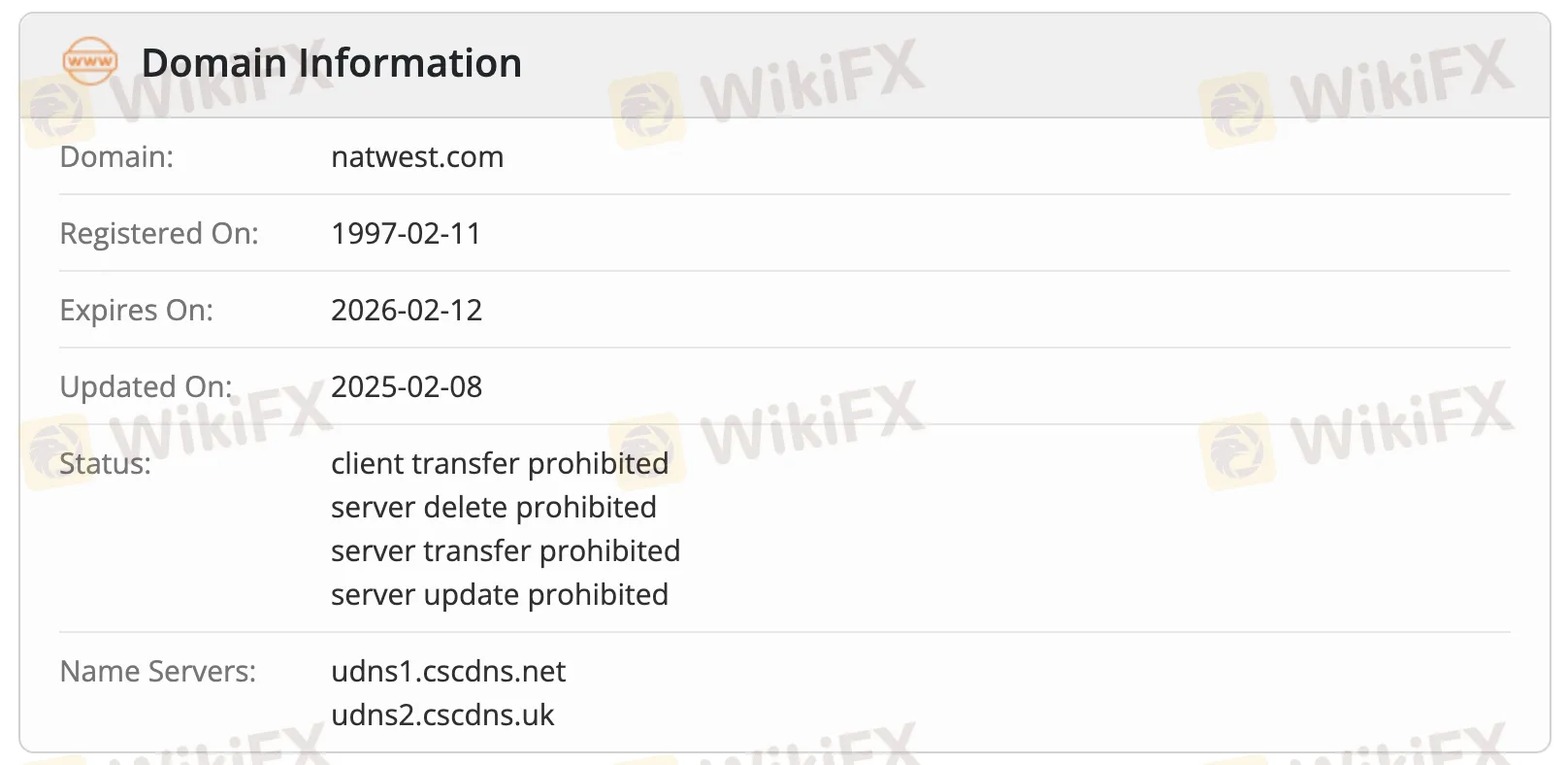

Data WHOIS menunjukkan bahwa natwest.com didaftarkan pada 11 Februari 1997, terakhir diperbarui pada 8 Februari 2025, dan masih aktif. Domain ini akan kedaluwarsa pada 12 Februari 2026. Domain ini dilengkapi dengan berbagai kunci registrasi (larangan klien dan server) untuk menjaganya tetap aman, yang berarti ini adalah domain resmi dengan banyak perlindungan dan tetap aktif dipelihara.

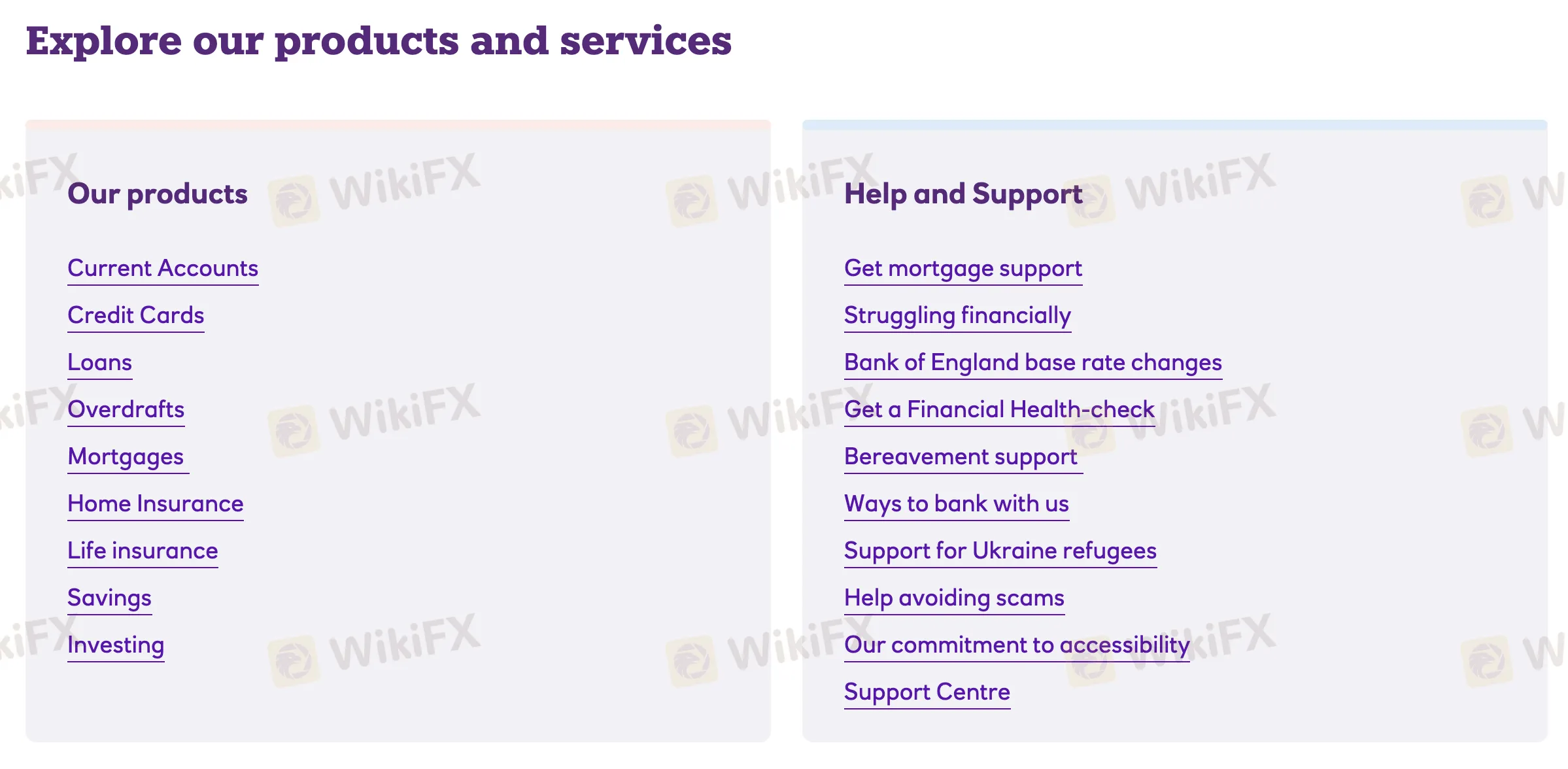

Produk dan Layanan

NatWest memiliki beragam produk keuangan pribadi, seperti layanan perbankan, pinjaman, asuransi, dan investasi untuk individu dan keluarga.

| Produk & Layanan | Didukung |

| Rekening Saat Ini | ✔ |

| Kartu Kredit | ✔ |

| Pinjaman | ✔ |

| Overdraft | ✔ |

| Hipotek | ✔ |

| Asuransi Rumah | ✔ |

| Asuransi Jiwa | ✔ |

| Tabungan | ✔ |

| Investasi | ✔ |

Jenis Akun

NatWest memiliki empat kategori rekening saat ini: Personal, Premier (untuk klien berkekayaan tinggi), Student & Youth (untuk usia 3-25 tahun), dan Business & Corporate (untuk startup hingga organisasi besar).

Biaya

NatWest biasanya mengenakan biaya bulanan rendah atau tidak ada untuk layanan perbankan dasar, dengan manfaat tambahan yang ditawarkan melalui tingkat akun premium. Banyak akun, seperti akun Select dan Student, bebas biaya, sedangkan akun Reward dan bundel mengenakan biaya bulanan sebagai imbalan atas cashback atau manfaat asuransi.

| Jenis Akun | Biaya Bulanan | Catatan |

| Akun Dasar | £0 | Tidak ada biaya bulanan; termasuk alat anggaran dan fitur tabungan |

| Akun Reward | £2 | Cashback dari Debit Langsung dan penggunaan aplikasi |

| Akun Student | £0 | Termasuk overdraft tanpa bunga (batasan berlaku) |

| Akun Adapt (11–17) | Mendapatkan bunga 2,25%; mendukung Apple/Google Pay | |

| Rooster Money (3–17) | Gratis (pengguna NatWest) | Langganan dibebaskan untuk pelanggan NatWest; jika tidak, £1,99/bulan |

| Reward Silver | £10 | Termasuk asuransi perjalanan/ponsel, pengeluaran asing bebas biaya |

| Reward Platinum | £22 | Menambahkan asuransi global dan penutupan mobil di UK |

| Premier | Bervariasi | Dimulai dari £0, biaya bergantung pada pilihan produk |

| Akun Bisnis | Biaya dan fitur berdasarkan jenis bisnis dan layanan yang dipilih |

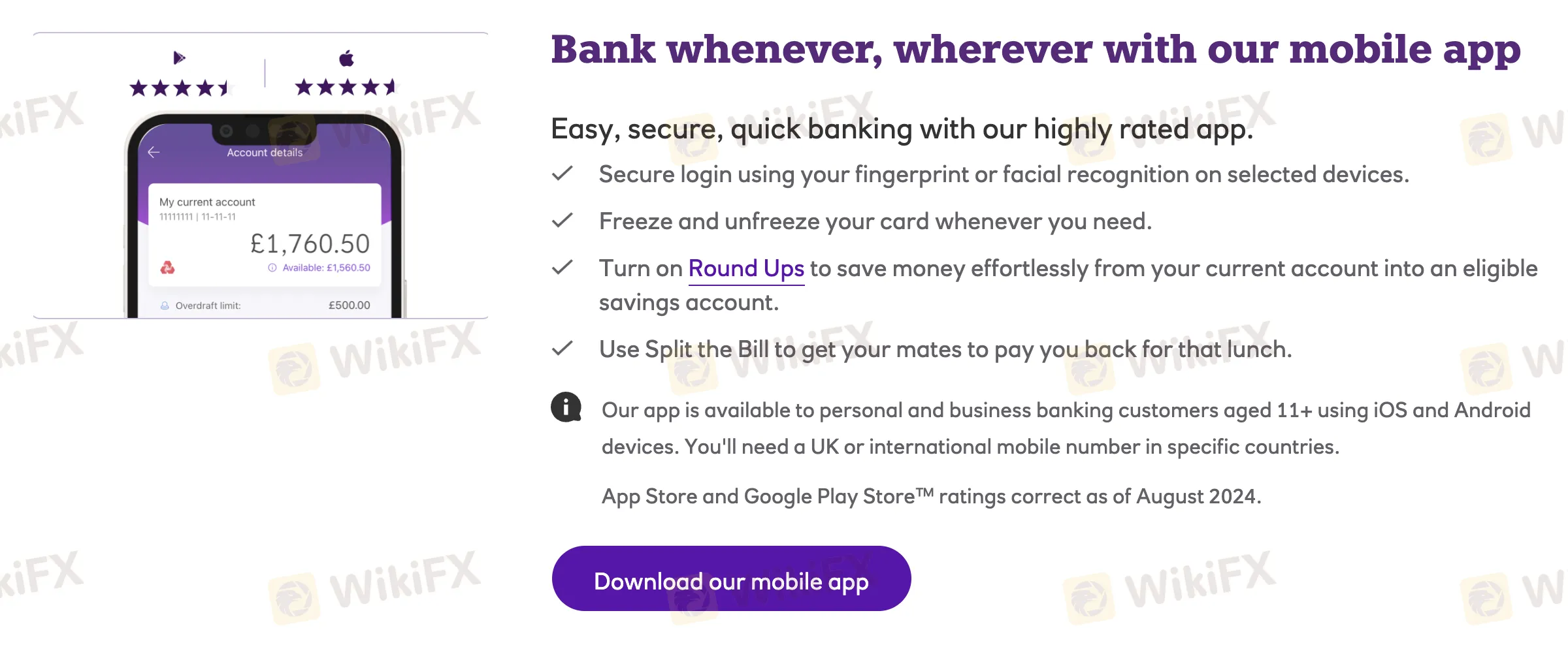

Platform/APP

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Aplikasi Perbankan Mobile NatWest | ✔ | iOS, Android | Perbankan pribadi & bisnis, usia 11+, penggunaan sehari-hari |