公司简介

| NatWest 评论摘要 | |

| 成立时间 | 1997 |

| 注册国家/地区 | 英国 |

| 监管 | 无监管 |

| 服务 | 银行业务、贷款、保险、储蓄、投资 |

| 平台/应用 | NatWest 移动银行应用 |

| 客户支持 | 在线聊天 |

NatWest 信息

NatWest成立于1997年,总部位于英国,不受英国金融监管局或其他主要全球金融机构监管。它提供各种个人理财服务,如活期账户、贷款、保险、储蓄和投资产品,但没有高级交易功能或示例账户选择。

优缺点

| 优点 | 缺点 |

| 提供广泛的零售银行服务 | 无监管 |

| 基本账户免月费 | |

| 在线聊天支持 |

NatWest 是否合法?

英国金融行为监管局(FCA)和其他主要全球监管机构如ASIC(澳大利亚)和NFA(美国)并不监管NatWest,尽管其注册在英国。请注意风险!

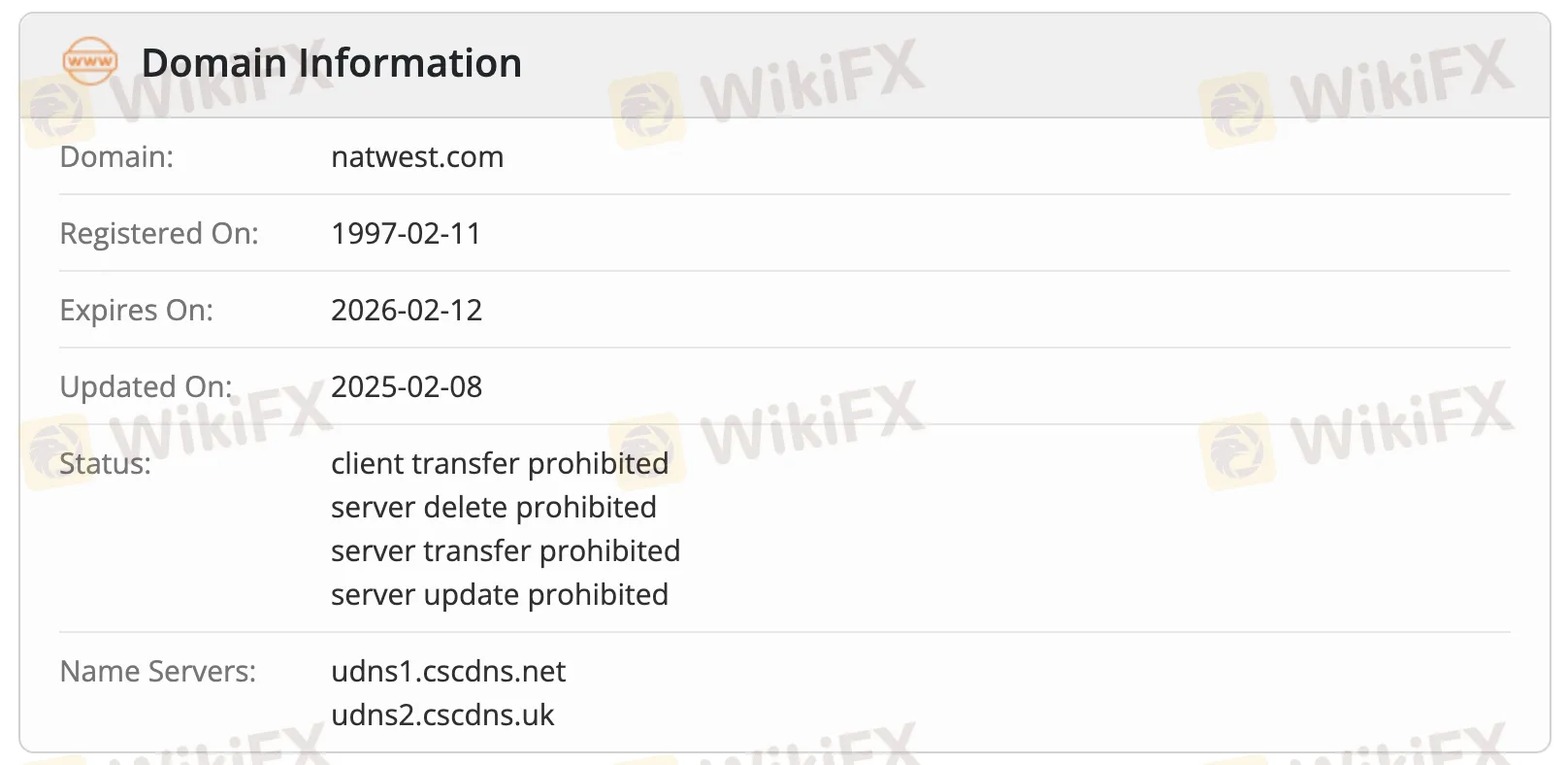

WHOIS数据显示,natwest.com 于1997年2月11日注册,最近更新于2025年2月8日,目前仍然活跃。它将于2026年2月12日到期。它具有各种注册锁定(客户端和服务器禁止),以确保安全,这意味着这是一个受保护的官方域,并且得到积极维护。

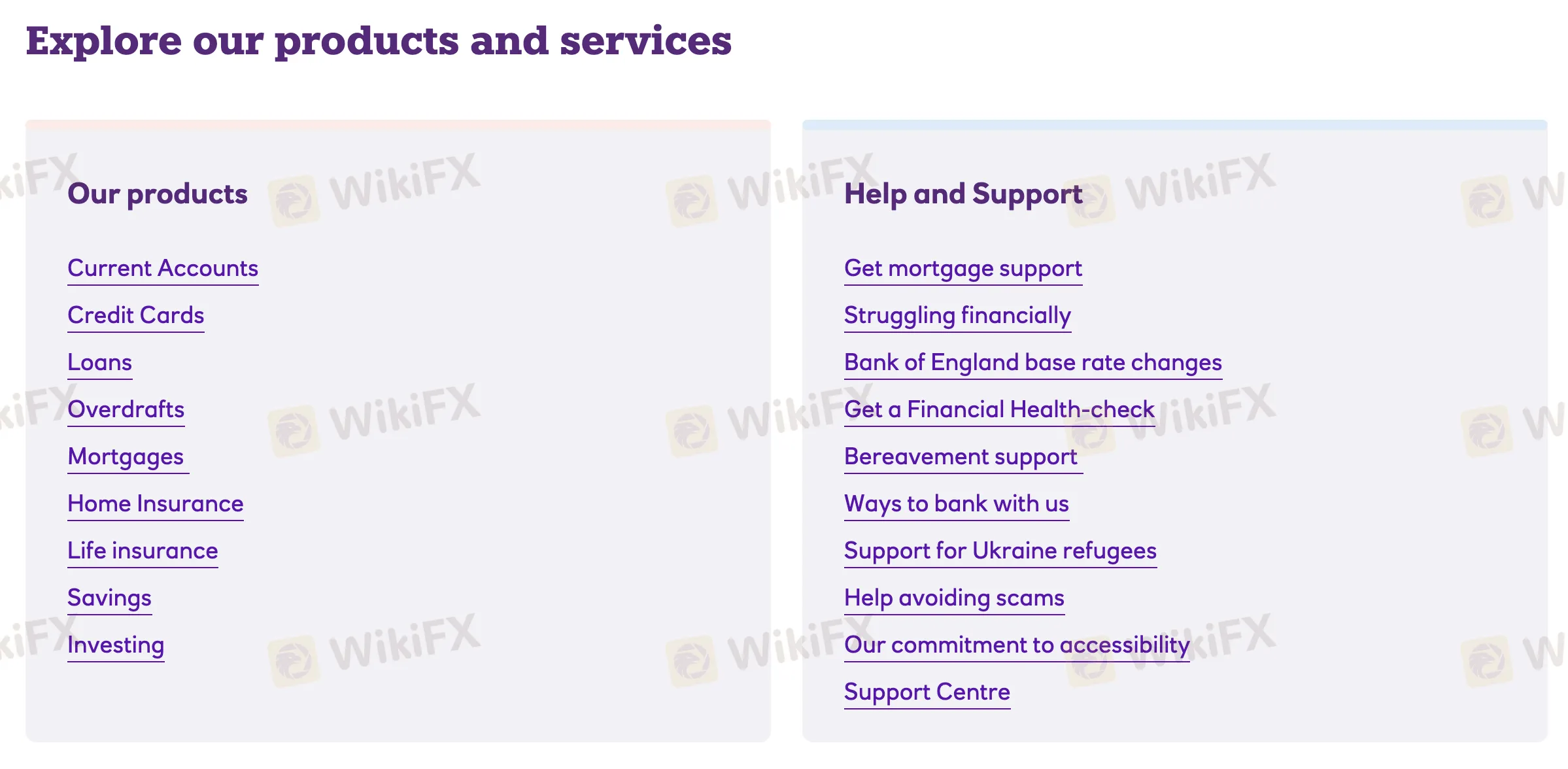

产品和服务

NatWest拥有许多个人理财产品,如银行业务、贷款、保险和投资服务,适用于个人和家庭。

| 产品 & 服务 | 支持 |

| 活期账户 | ✔ |

| 信用卡 | ✔ |

| 贷款 | ✔ |

| 透支 | ✔ |

| 抵押贷款 | ✔ |

| 家庭保险 | ✔ |

| 人寿保险 | ✔ |

| 储蓄 | ✔ |

| 投资 | ✔ |

账户类型

NatWest有四个当前账户类别:个人,首席(高净值客户),学生和青年(3-25岁),以及商业和企业(初创企业到大型组织)。

费用

NatWest通常对基本银行服务收取低或无月度手续费,通过高级账户等级提供额外的福利。许多账户,如Select和Student账户,是免费的,而Reward和捆绑账户每月收取手续费,以换取返现或保险福利。

| 账户类型 | 月费 | 备注 |

| 基本账户 | £0 | 无月费;包括预算工具和储蓄功能 |

| 奖励账户 | £2 | 来自直接借记和应用使用的返现 |

| 学生账户 | £0 | 包括免息透支(限额适用) |

| 适应账户(11-17岁) | 获得2.25%利息;支持Apple/Google Pay | |

| Rooster Money(3-17岁) | 免费(NatWest用户) | NatWest客户免除订阅费;否则每月£1.99 |

| 奖励银 | £10 | 包括旅行/手机保险,免费外币消费 |

| 奖励白金 | £22 | 增加全球保险和英国汽车故障援助 |

| 首席 | 各异 | 从£0起,手续费取决于产品选择 |

| 商业账户 | 根据业务类型和选择的服务收取费用和功能 |

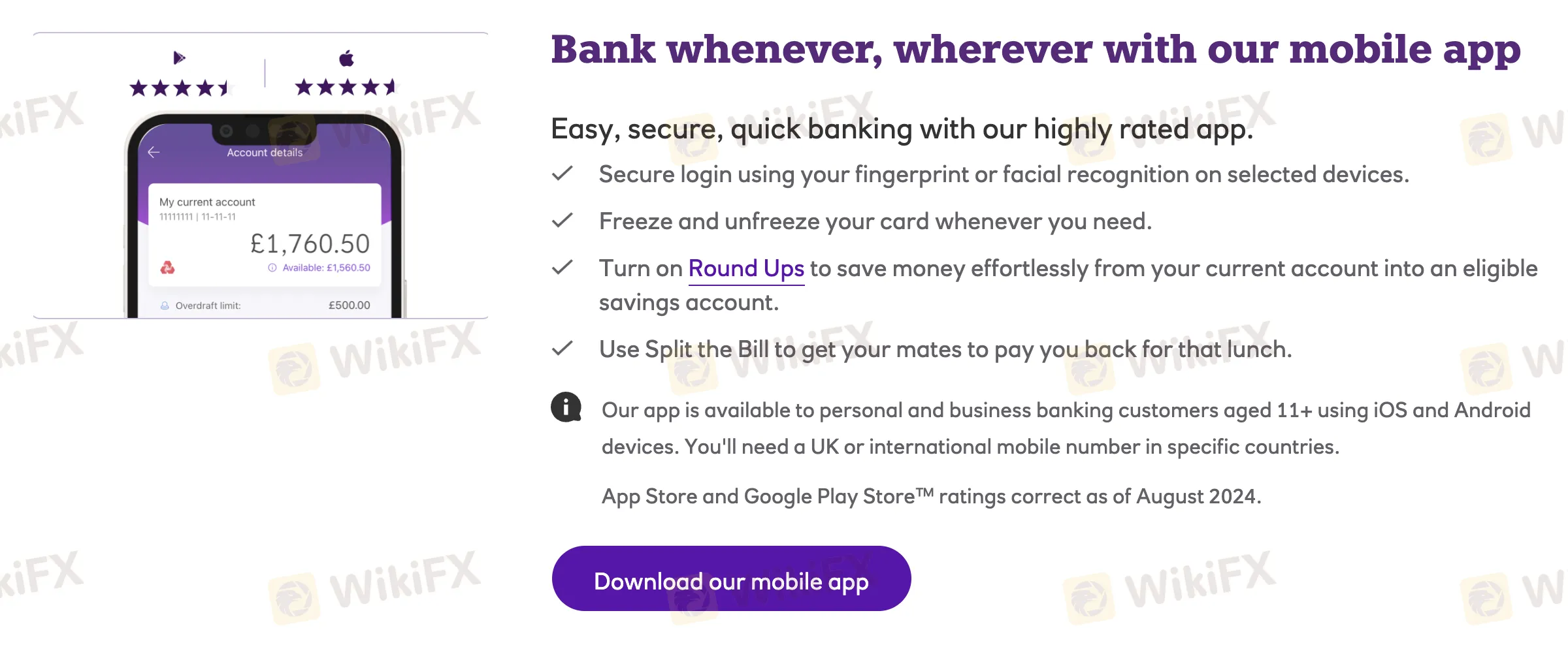

平台/应用

| 交易平台 | 支持 | 可用设备 | 适用于 |

| NatWest移动银行应用 | ✔ | iOS,Android | 个人和商业银行,11岁以上,日常使用 |