Profil perusahaan

| CFE Ringkasan Ulasan | |

| Didirikan | 1945 |

| Negara/Daerah Terdaftar | Inggris |

| Regulasi | FCA |

| Produk atau layanan | Investment Banking, Saham, Pendapatan Tetap, Riset Saham, Manajemen Aset, Prime Brokerage, Manajemen Kas |

| Dukungan Pelanggan | Email: hari.chandra@cantor.com |

| Telepon: +44 207 894 8741 | |

Informasi CFE

Cantor Fitzgerald Europe (CFE) adalah lembaga keuangan yang terkenal dan diatur oleh FCA yang berbasis di Inggris. Dengan pengalaman lebih dari 80 tahun dan jejak global yang kuat, CFE menyediakan layanan profesional kepada klien institusional dan berkekayaan tinggi. Ini adalah salah satu dari hanya 25 Dealer Utama AS dan menawarkan solusi diversifikasi dalam investment banking, saham, dan manajemen aset.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FCA dengan lisensi Market Maker | Tidak ada penawaran investor ritel |

| Lebih dari 80 tahun berkecimpung dalam bisnis | Tidak ada informasi tentang platform perdagangan |

| Rentang produk institusional yang luas & U.S. Treasuries | Tidak ada informasi publik tentang biaya atau leverage |

CFE Legal?

Cantor Fitzgerald Europe (CFE) adalah entitas yang sah dan diatur, yang diotorisasi oleh Financial Conduct Authority (FCA) Inggris dengan lisensi Market Maker (MM) dengan nomor 149380.

Apa yang Bisa Saya Perdagangkan di CFE?

Dirancang untuk klien institusional dan berkekayaan tinggi, Cantor Fitzgerald Europe (CFE) menawarkan beragam peluang perdagangan dan layanan keuangan. Penawaran mereka meliputi investment banking, saham, pendapatan tetap, riset saham, manajemen aset, dan layanan prime.

| Produk | Didukung |

| Investment Banking | ✔ |

| Saham (termasuk US Treasuries) | ✔ |

| Pendapatan Tetap | ✔ |

| Riset Saham | ✔ |

| Manajemen Aset | ✔ |

| Layanan Prime Brokerage | ✔ |

Manajemen Kas

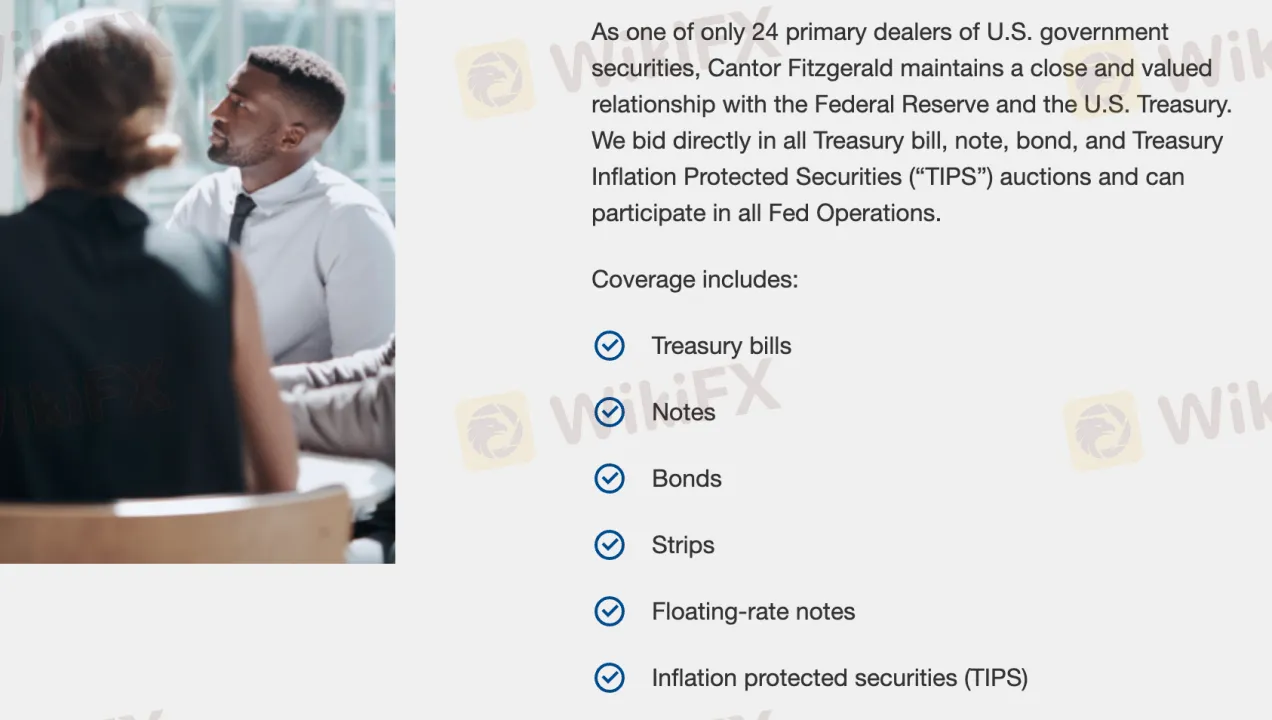

Dengan posisinya sebagai salah satu dari hanya 24 dealer utama surat berharga pemerintah Amerika Serikat, Cantor Fitzgerald Europe (CFE) juga menawarkan layanan manajemen kas yang kuat. CFE menyediakan organisasi dengan berbagai alat kas dan likuiditas melalui keterlibatan langsung dalam operasi Federal Reserve dan lelang Departemen Keuangan Amerika Serikat.

| Manajemen Kas | Didukung |

| Surat Utang Negara | ✔ |

| Surat Berharga Negara | ✔ |

| Obligasi Negara | ✔ |

| STRIPS Departemen Keuangan | ✔ |

| Surat Berharga Floating-Rate | ✔ |

| Surat Berharga Terlindungi Inflasi Departemen Keuangan | ✔ |

Statistik Perusahaan

Beroperasi dari lebih dari 60 kantor, Cantor Fitzgerald Europe (CFE) adalah perusahaan keuangan global yang dimiliki secara pribadi dengan pengalaman lebih dari 80 tahun. Sebagai salah satu dari hanya 25 Dealer Utama Amerika Serikat, perusahaan ini telah menyelesaikan lebih dari 700 transaksi perbankan investasi sejak tahun 2016 dan menawarkan riset saham untuk lebih dari 450 bisnis di seluruh dunia.

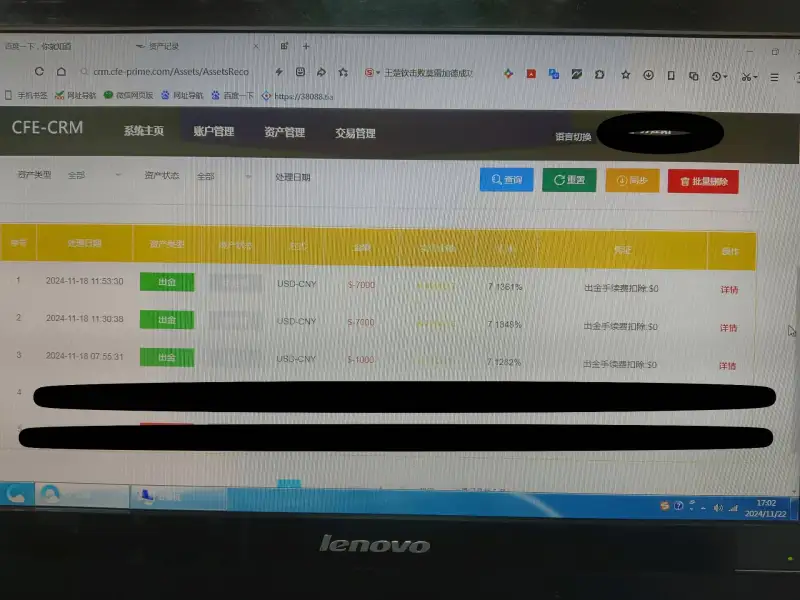

道一4256

Hong Kong

Mengajukan penarikan pada tanggal 18 November, sudah seminggu. Hari ini tanggal 23, tetapi saya masih belum menerima penarikan dan tidak ada tanggapan dari tiket dukungan.

Paparan

道一4256

Hong Kong

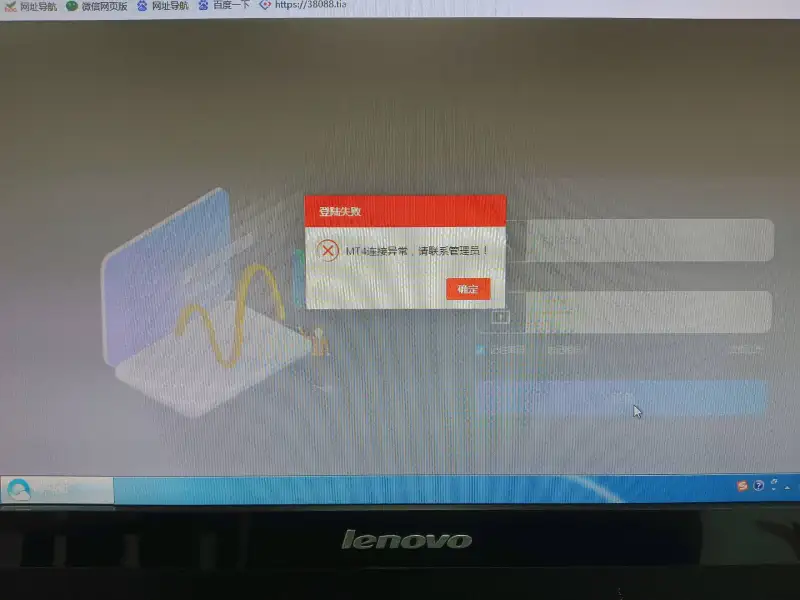

Saya adalah seorang investor Tiongkok. Saya mengajukan penarikan pada tanggal 18 November 2024, tetapi hingga tanggal 21, saya belum menerima dana investasi tersebut, dan saya tidak dapat masuk ke akun saya.

Paparan

WQ

Hong Kong

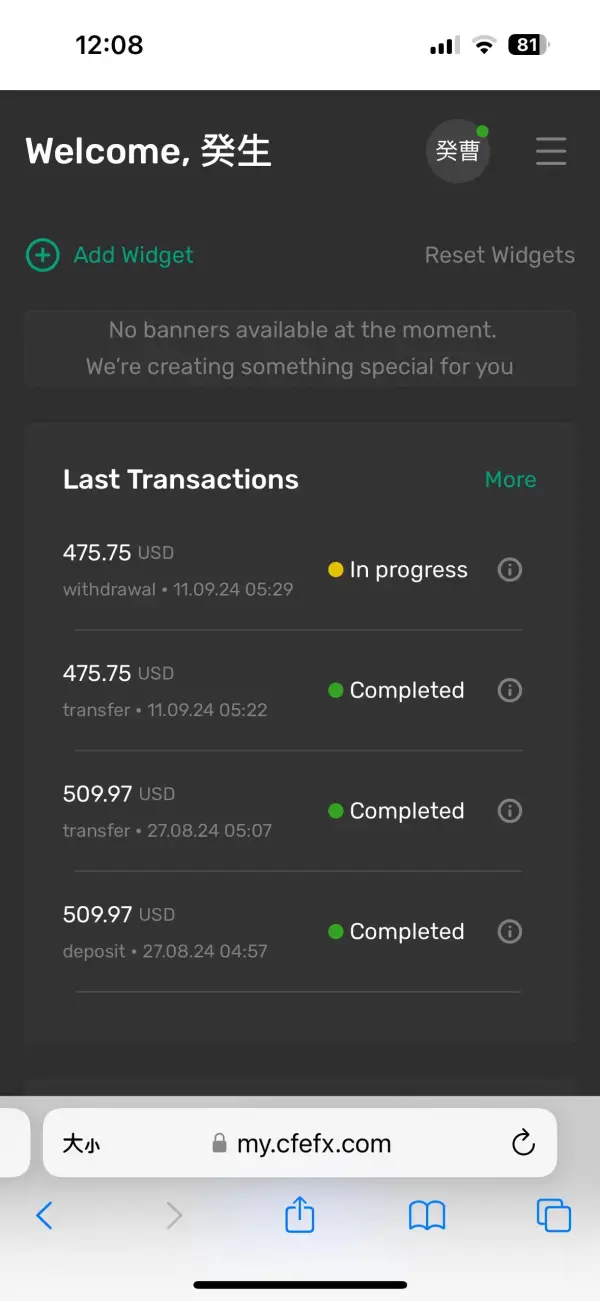

Sekarang saya tidak bisa menarik uang, saya sudah menunggu begitu lama, tetapi saya tidak bisa menariknya.

Paparan

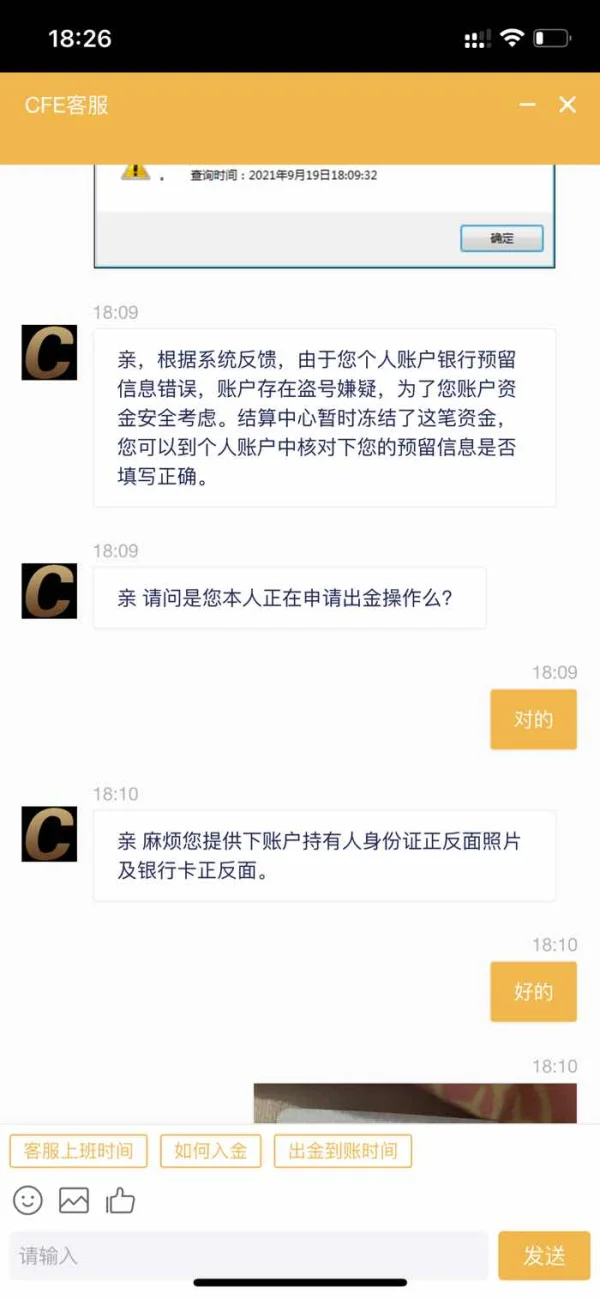

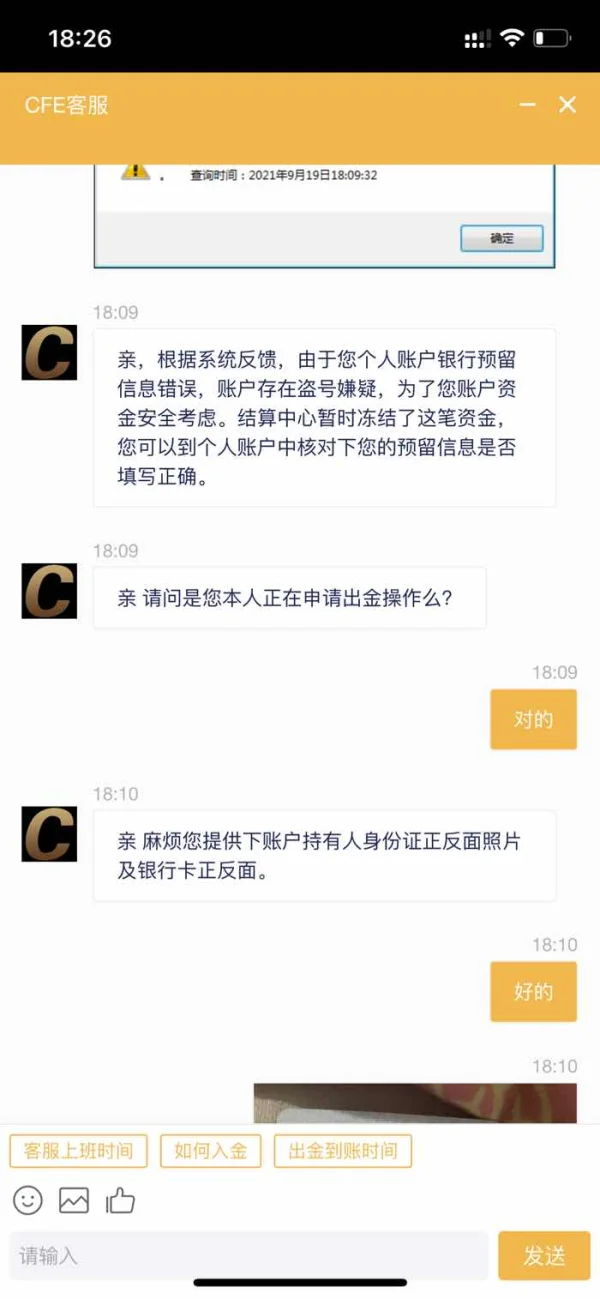

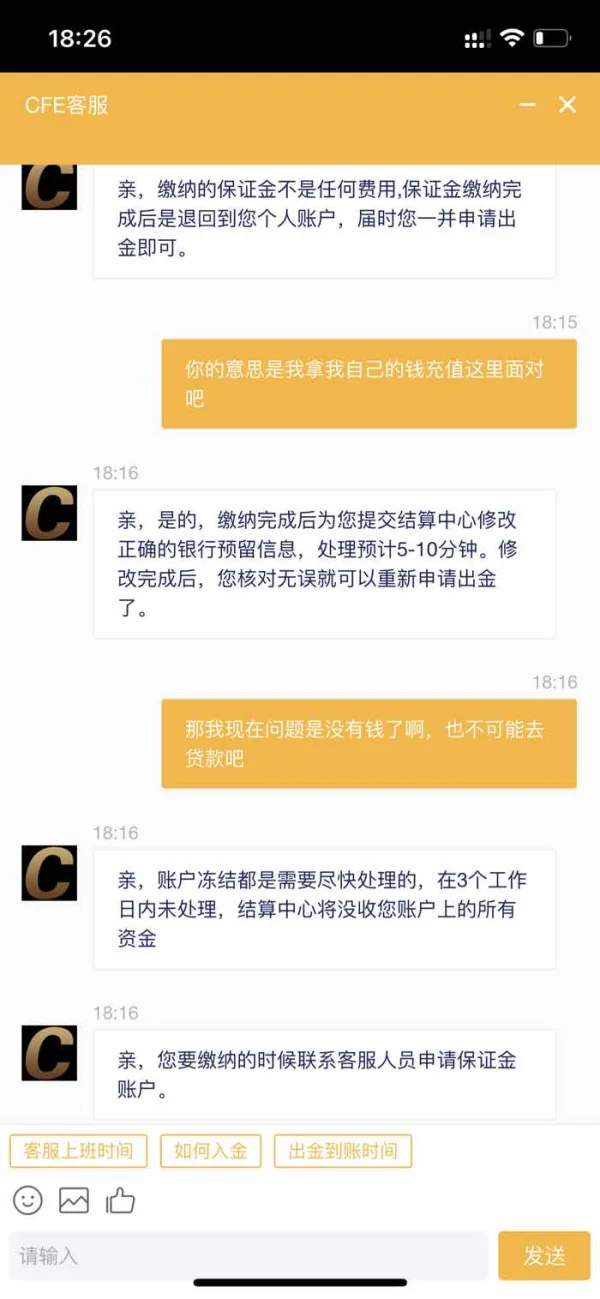

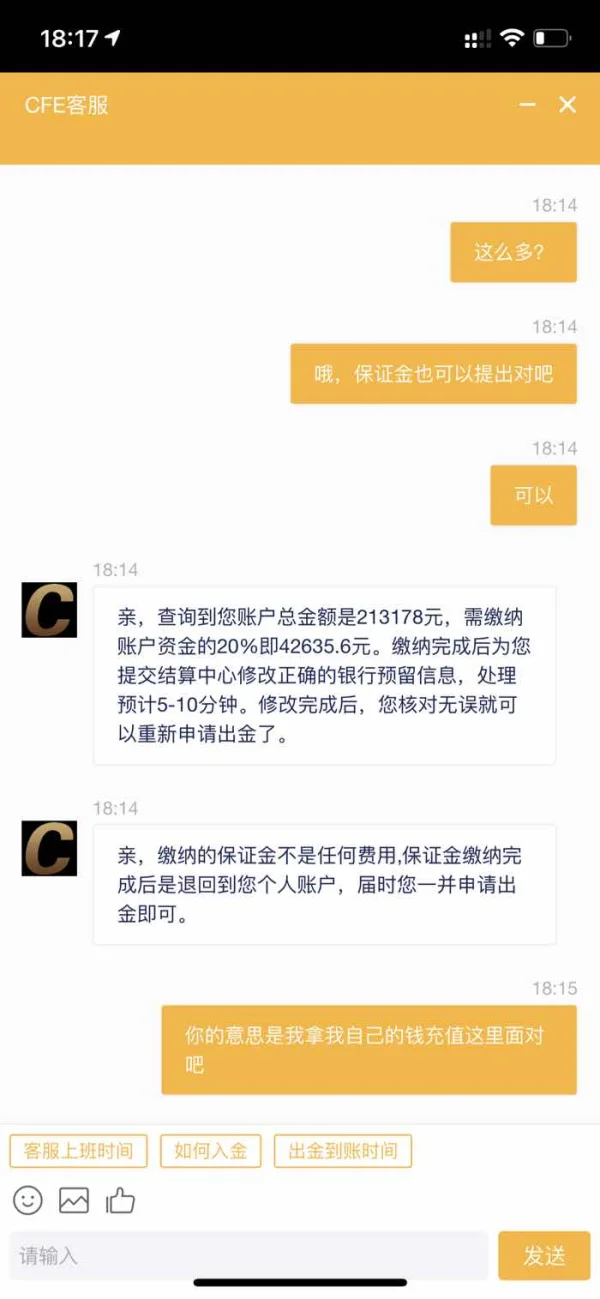

小螺号9404

Hong Kong

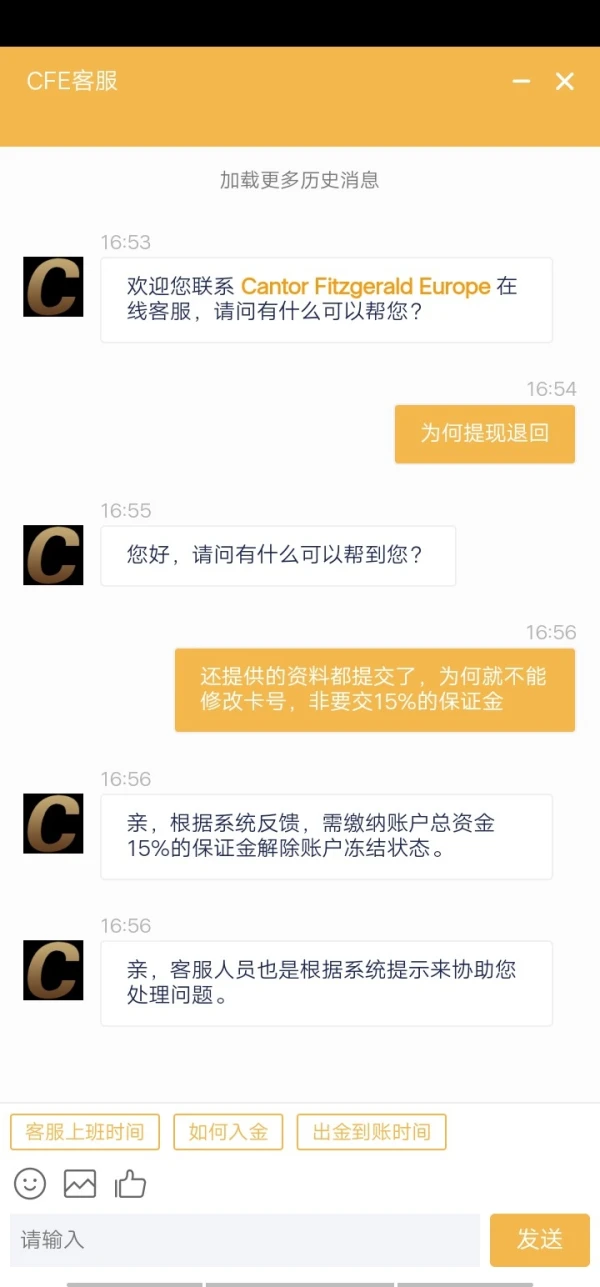

Akun saya diblokir karena salah nomor kartu. Tapi saya menyediakan materinya. Itu masih menyuruh saya untuk membayar margin 15%.

Paparan

長樂

Hong Kong

Saya membuat kesalahan di rekening bank. Tetapi layanan pelanggan tidak memperbaikinya untuk saya.

Paparan

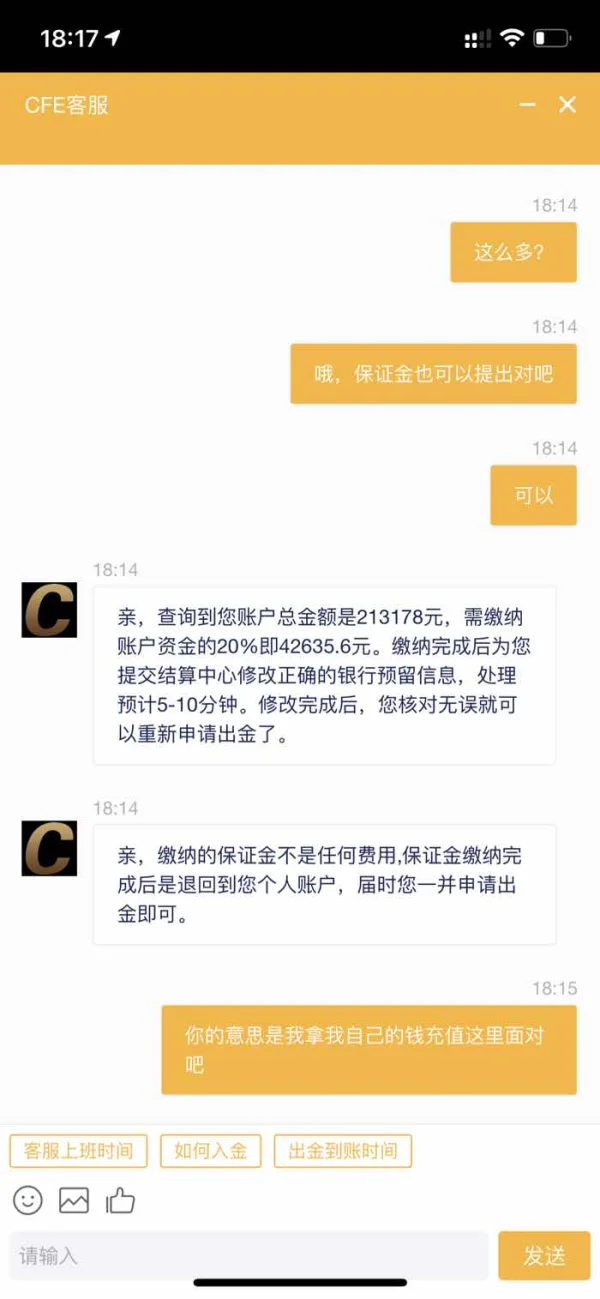

長樂

Hong Kong

Saya memasukkan nomor kartu yang salah dan memberi tahu layanan pelanggan untuk mengubahnya. Namun itu meminta saya untuk menyetor 20% jika saya ingin mengubah nomor kartu.

Paparan