Company Summary

| CFE Review Summary | |

| Founded | 1945 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Products or services | Investment Banking, Equities, Fixed Income, Equity Research, Asset Management, Prime Brokerage, Cash Management |

| Customer Support | Email: hari.chandra@cantor.com |

| Phone: +44 207 894 8741 | |

CFE Information

Cantor Fitzgerald Europe (CFE) is a well-established and FCA-regulated financial institution based in the UK. With over 80 years in operation and a strong global footprint, CFE provides professional services to institutional and high-net-worth clients. It is one of only 25 U.S. Primary Dealers and offers diversified solutions in investment banking, equities, and asset management.

Pros and Cons

| Pros | Cons |

| Regulated by the FCA with Market Maker license | No retail investor offerings |

| Over 80 years in business | No information on trading platform |

| Broad institutional product range & U.S. Treasuries | No public info on fees or leverage |

Is CFE Legit?

Cantor Fitzgerald Europe (CFE) is a legitimate and regulated entity, authorized by the UK's Financial Conduct Authority (FCA) with a Market Maker (MM) license under number 149380.

What Can I Trade on CFE?

Designed for institutional and high-net-worth clients, Cantor Fitzgerald Europe (CFE) offers a diverse spectrum of trading opportunities and financial services. Their offering include investment banking, equities, fixed income, equity research, asset management, and prime services.

| Products | Supported |

| Investment Banking | ✔ |

| Equities (including US Treasuries) | ✔ |

| Fixed Income | ✔ |

| Equity Research | ✔ |

| Asset Management | ✔ |

| Prime Brokerage Services | ✔ |

Cash Management

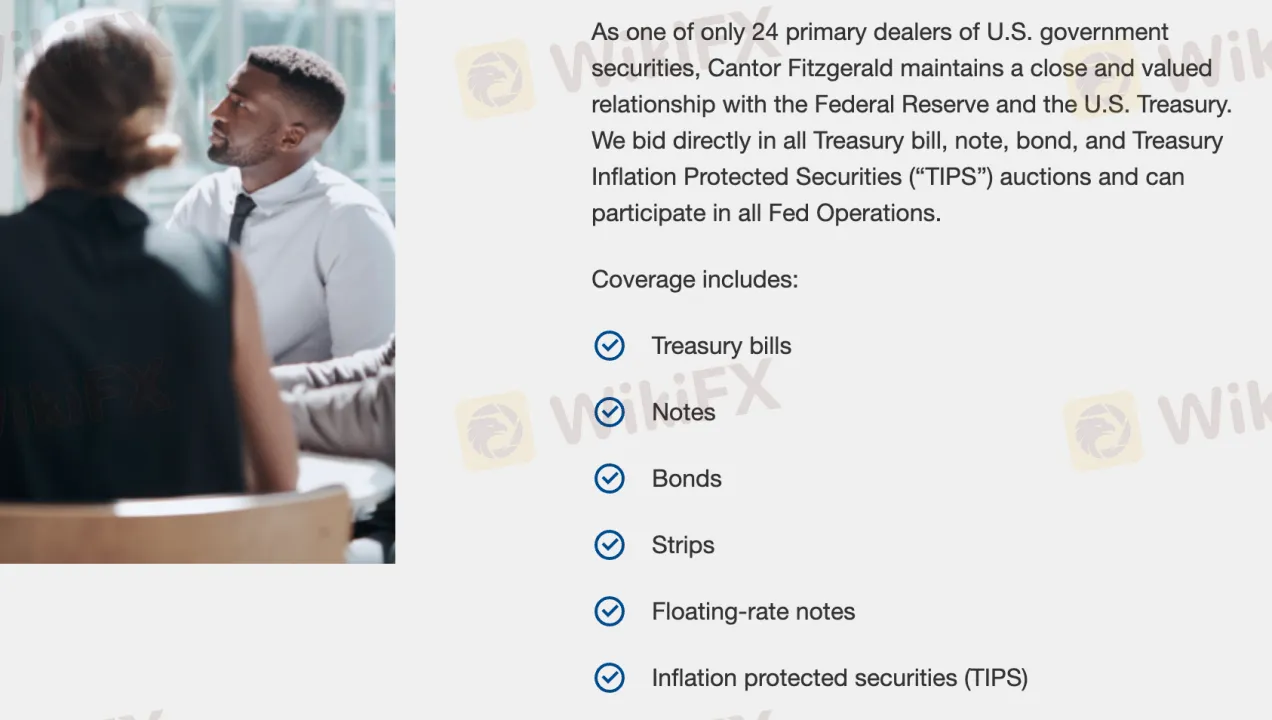

Using its position as one of just 24 primary dealers of U.S. government securities, Cantor Fitzgerald Europe (CFE) also offers strong cash management services. CFE provides organizations with a whole spectrum of cash and liquidity tools by means of direct involvement in Federal Reserve operations and U.S. Treasury auctions.

| Cash Management | Supported |

| Treasury Bills | ✔ |

| Treasury Notes | ✔ |

| Treasury Bonds | ✔ |

| Treasury STRIPS | ✔ |

| Floating-Rate Notes | ✔ |

| Treasury Inflation-Protected Sec. | ✔ |

Company Statistics

Operating from more than 60 offices, Cantor Fitzgerald Europe (CFE) is a privately held worldwide financial company with more than 80 years in operation. One of just 25 U.S. Primary Dealers, it has finished more than 700 investment banking deals since 2016 and offers stock research on more than 450 businesses worldwide.

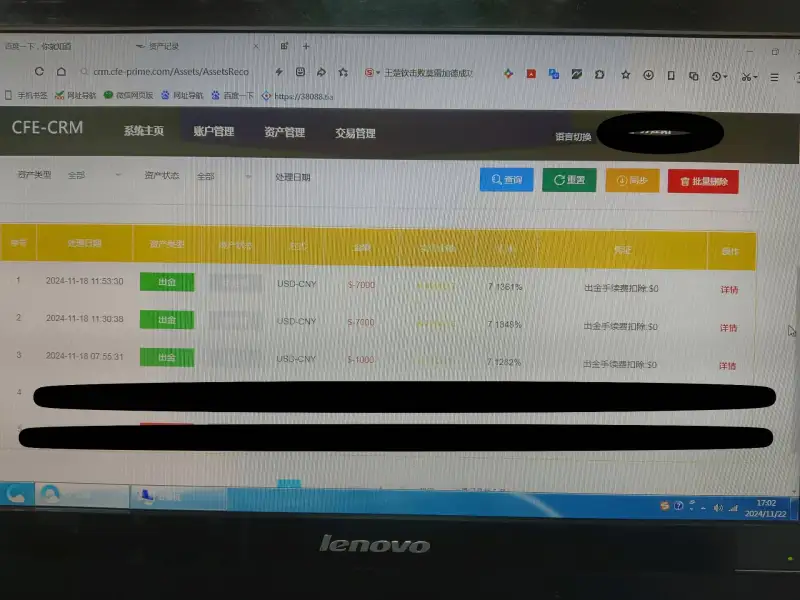

道一4256

Hong Kong

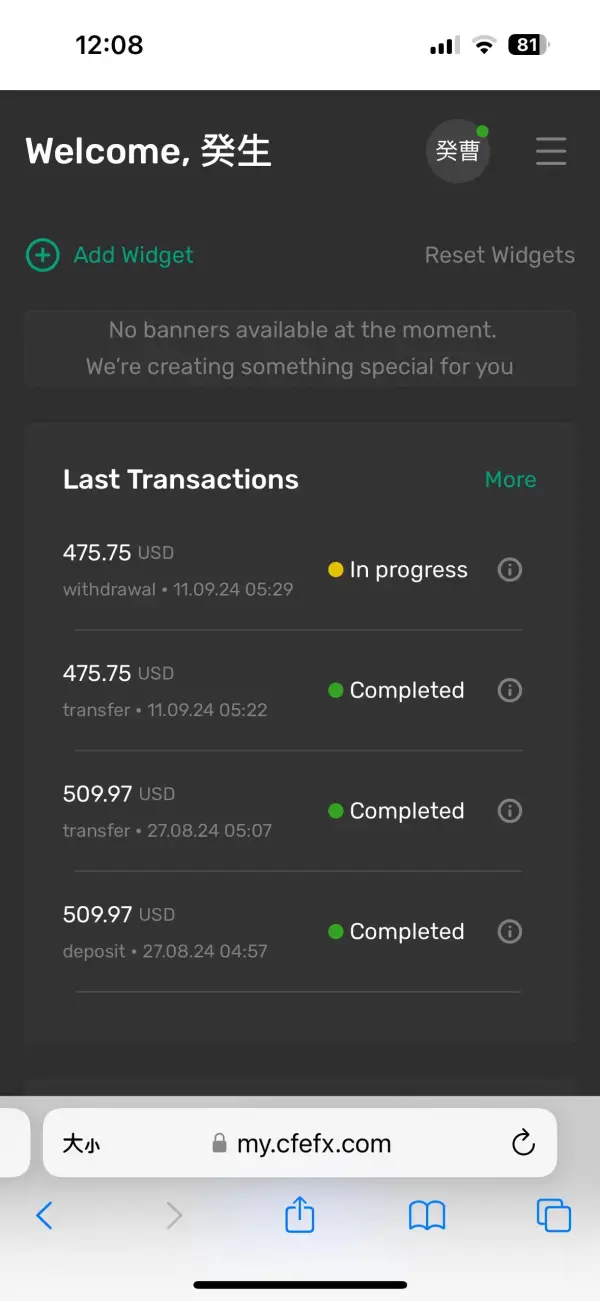

Applied for withdrawal on November 18th, it has been a week. Today is the 23rd, but I still haven't received the withdrawal and no response from the support ticket.

Exposure

道一4256

Hong Kong

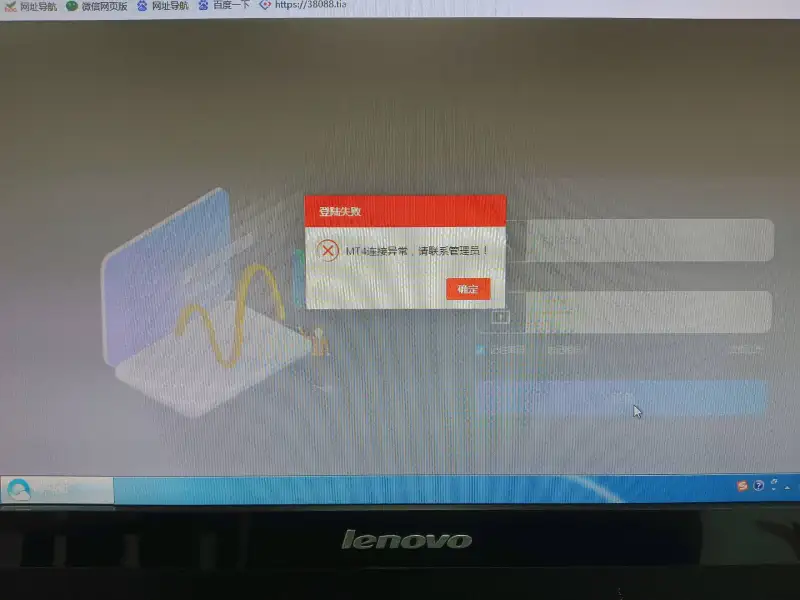

I am a Chinese investor. I applied for withdrawal on November 18, 2024, but I have not received the investment funds on the 21st, and I cannot log in to my account.

Exposure

WQ

Hong Kong

Now I can't withdraw money, I've been waiting for so long, but I can't withdraw it.

Exposure

小螺号9404

Hong Kong

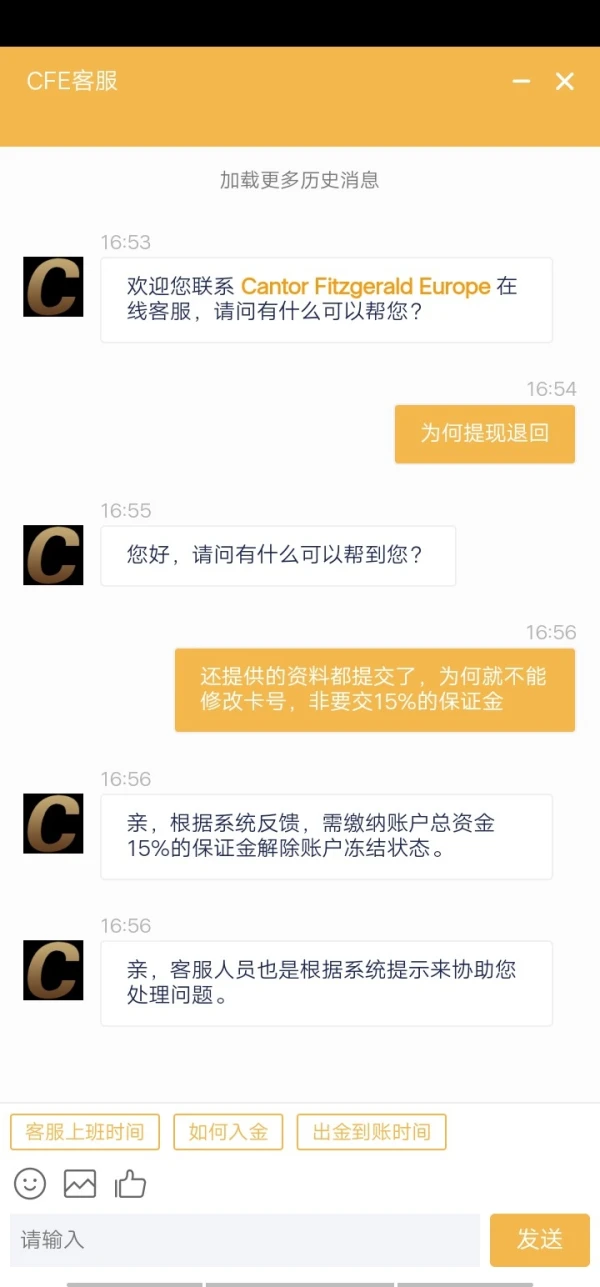

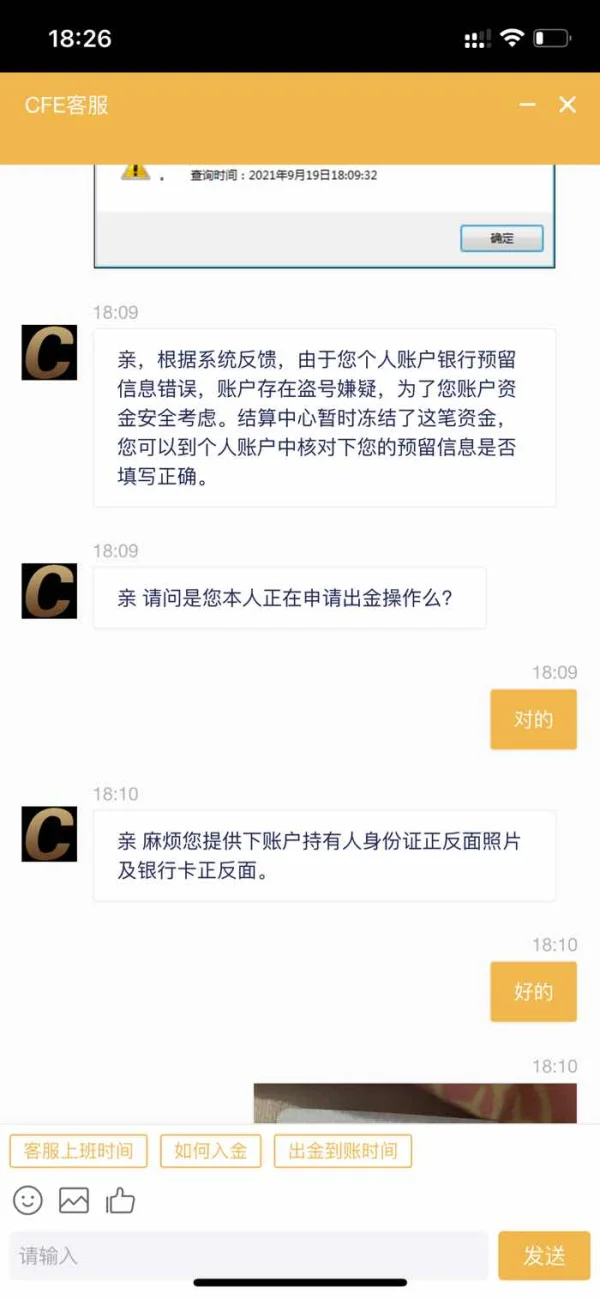

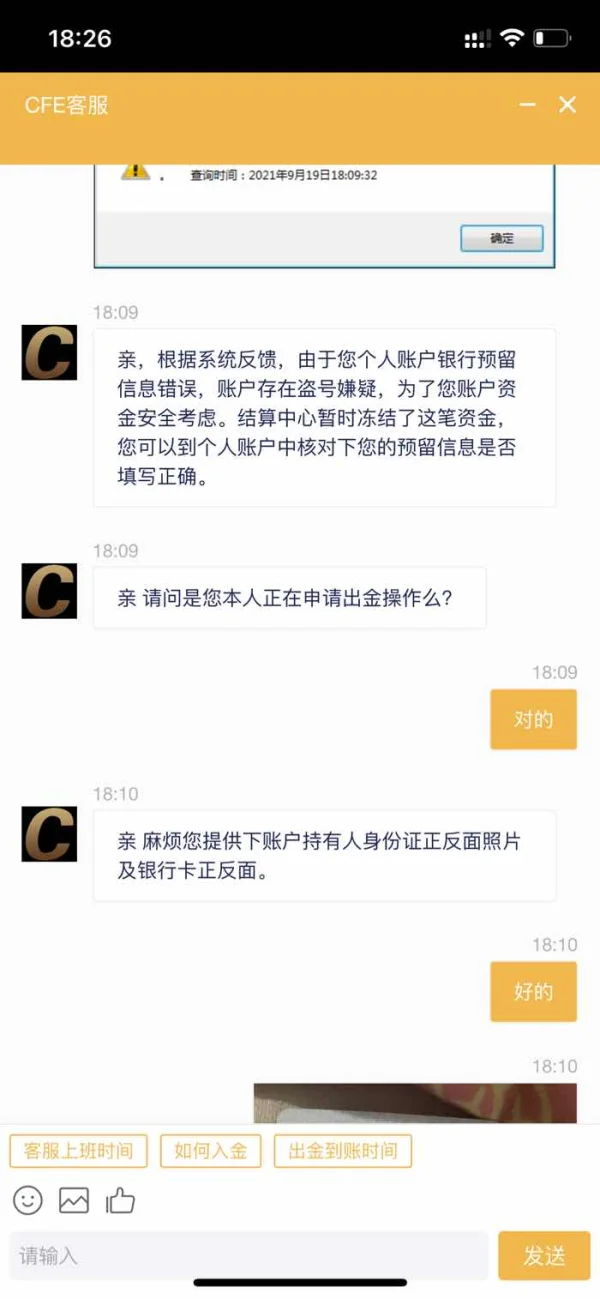

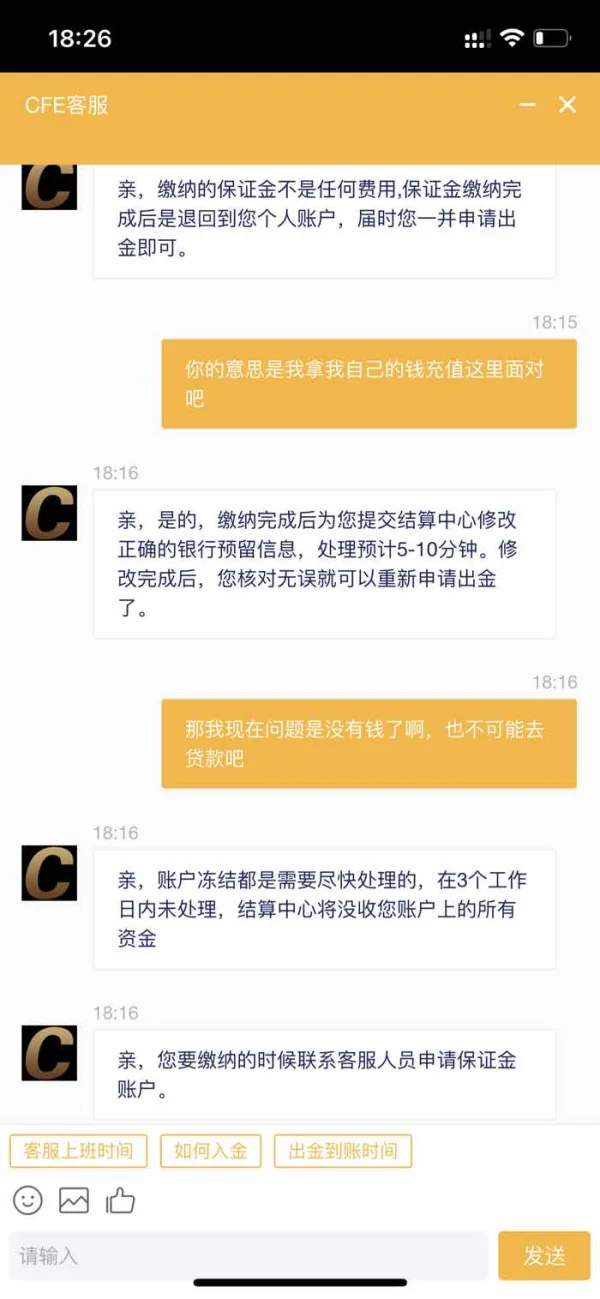

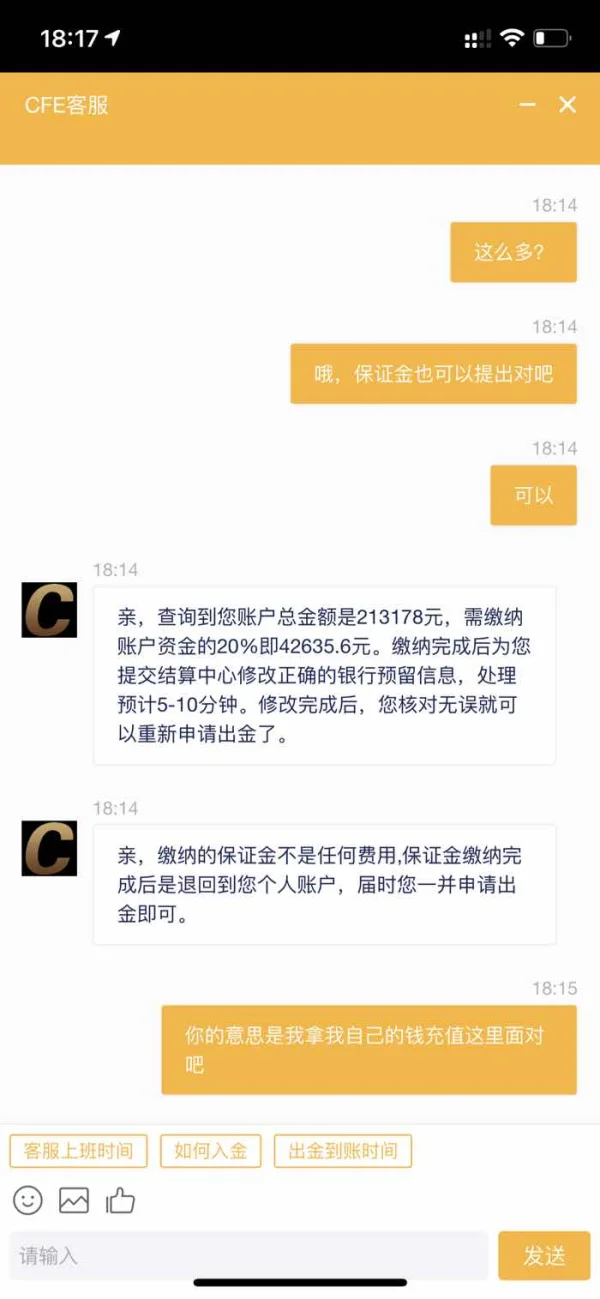

My account was blocked because of wrong card number. But I provided the materials. It still told me to pay 15% margin.

Exposure

長樂

Hong Kong

I made a mistake in the bank account. But the customer service did not correct it for me.

Exposure

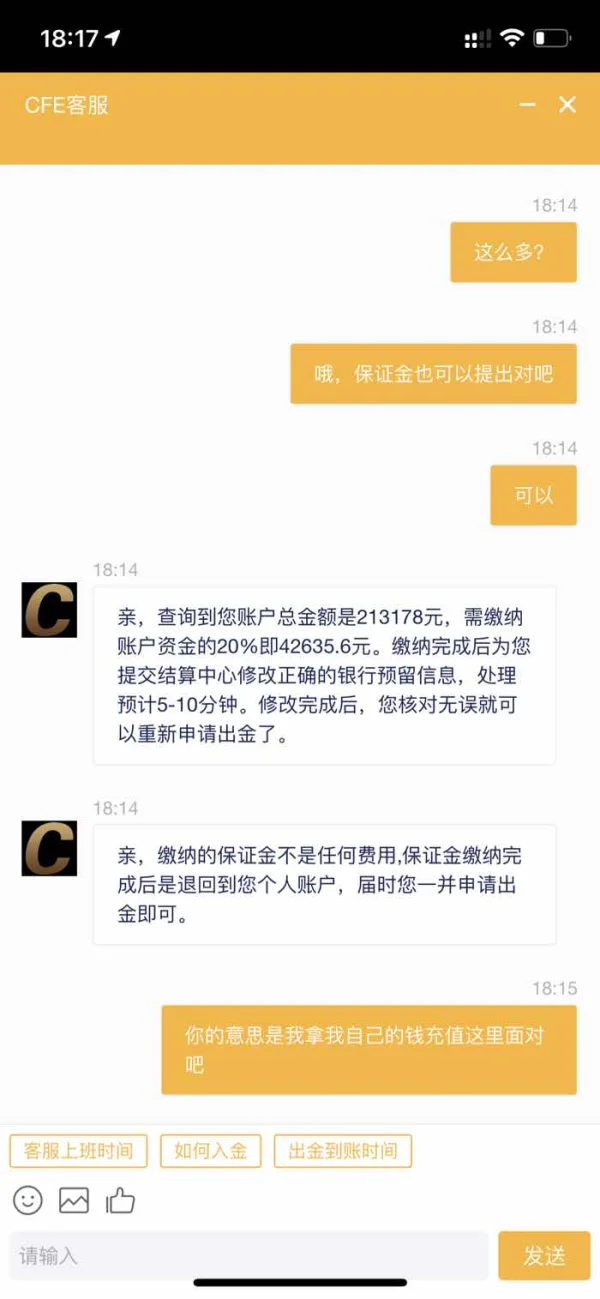

長樂

Hong Kong

I entered the wrong card number and told the customer service to change it. However it asked me to deposit 20% if I wanted to change the card number.

Exposure