Profil perusahaan

| KOSEI SECURITIES Ringkasan Ulasan | |

| Dibentuk | 1997 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Produk Perdagangan | Saham, Obligasi, Trust Investasi, ETF/REIT, Futures, Opsi, dan Asuransi/iDeco |

| Platform Perdagangan | / |

| Deposit Minimum | / |

| Dukungan Pelanggan | Tel: 0120-06-8617 |

| Alamat: 2-1-10 Kitahama, Chuo-ku, Osaka | |

Informasi KOSEI SECURITIES

Kantor pusat Kosei Securities terletak di Kitahama, Chuo-ku, Kota Osaka. Bisnisnya mencakup perdagangan sekuritas, trust investasi, futures dan opsi, agen asuransi jiwa, dll., sambil juga menyediakan layanan khusus seperti akun spesifik (pengisian pajak yang disederhanakan) dan akun NISA (pembebasan pajak untuk investasi skala kecil).

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA | Struktur komisi yang kompleks |

| Jaminan keamanan dana | Dukungan bahasa Inggris yang kurang (utamanya dalam bahasa Jepang) |

| Kombinasi online dan offline | |

| Sejarah operasional yang panjang | |

| Berbagai produk perdagangan | |

| Informasi biaya transparan |

Apakah KOSEI SECURITIES Legal?

Kosei Securities terdaftar di Bursa Efek Tokyo dan diaturoleh Otoritas Jasa Keuangan (FSA) Jepang. Dengan nomor lisensi 近畿財務局長(金商)第14号, ini adalah perusahaan sekuritas yang terdaftar secara legal.

| Otoritas yang Diatur | Status Saat Ini | Negara yang Diatur | Entitas Berlisensi | Tipe Lisensi | No. Lisensi |

| Otoritas Jasa Keuangan (FSA) | Diatur | Jepang | KOSEI SECURITIES株式会社 | Lisensi Forex Ritel | 近畿財務局長(金商)第14号 |

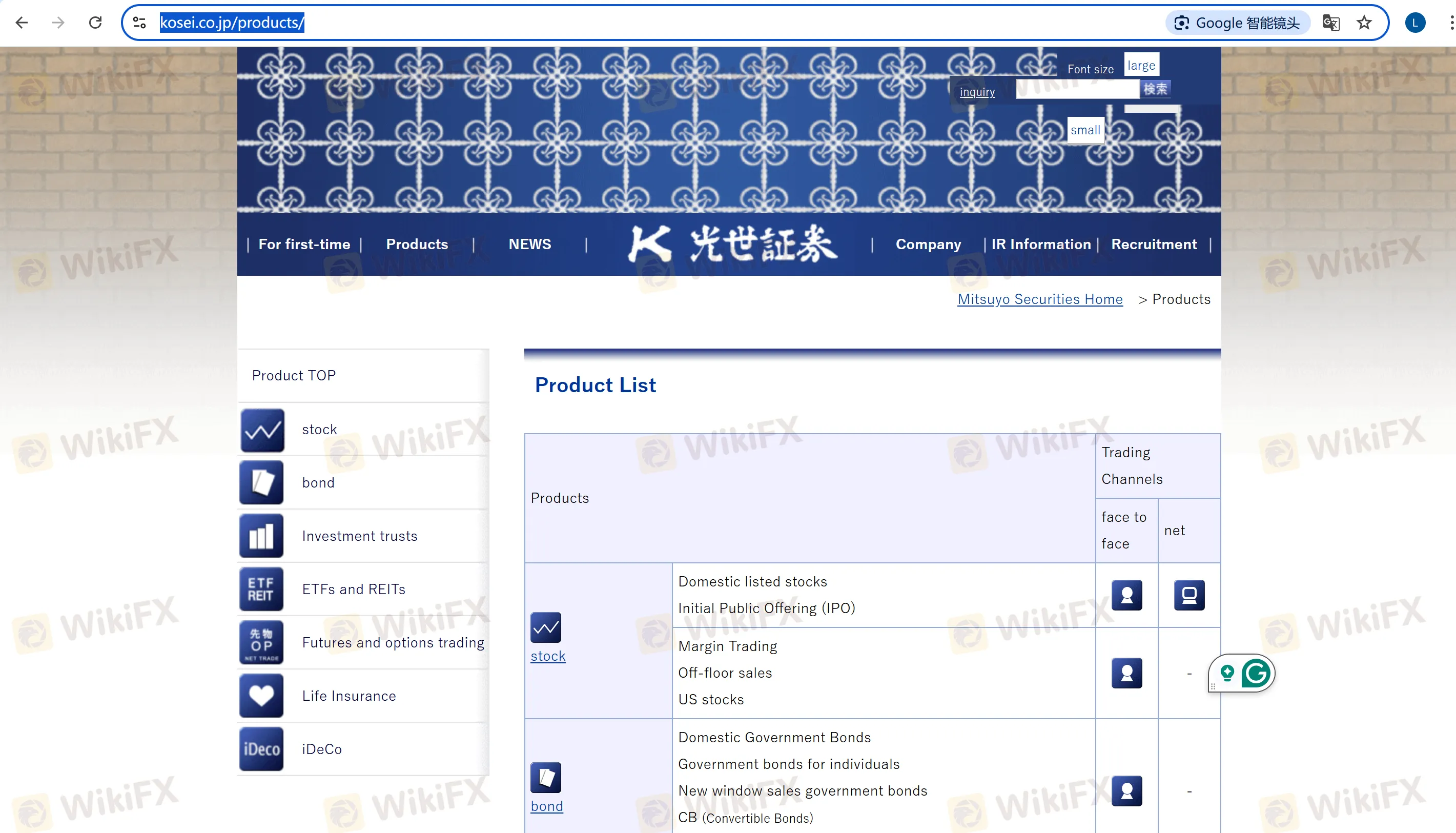

Apa yang Bisa Diperdagangkan di KOSEI SECURITIES?

| Produk Perdagangan | Didukung | Detail |

| Saham | ✔ | Saham terdaftar domestik, saham AS, penawaran saham perdana (IPO), dan perdagangan marjin |

| Obligasi | ✔ | Obligasi pemerintah individu, obligasi korporat, obligasi denominasi mata uang asing, dan obligasi konversi |

| Trust Investasi | ✔ | Trust investasi ekuitas, trust investasi obligasi korporat, dan dana tipe hedge fund |

| ETF/REIT | ✔ | Trust investasi terdaftar, real estate investment trusts (misalnya, Indeks REIT TOPIX) |

| Futures dan Opsi | ✔ | Futures Nikkei 225, opsi TOPIX, futures logam mulia (standar emas), dan futures indeks komoditas (minyak mentah CME) |

| Asuransi/iDeco | ✔ | Layanan agen asuransi jiwa, Nomura iDeco (akun pensiun) |

Jenis Akun

Akun Spesifik: Menghitung keuntungan dan kerugian atas nama klien, menangani pembayaran pajak, dan menyederhanakan pelaporan pajak tahunan.

Akun NISA: Akun yang bebas pajak untuk investasi skala kecil, dengan batas investasi tahunan sebesar ¥1,000,000. Dividen dan hasil penjualan bebas pajak selama 5 tahun.

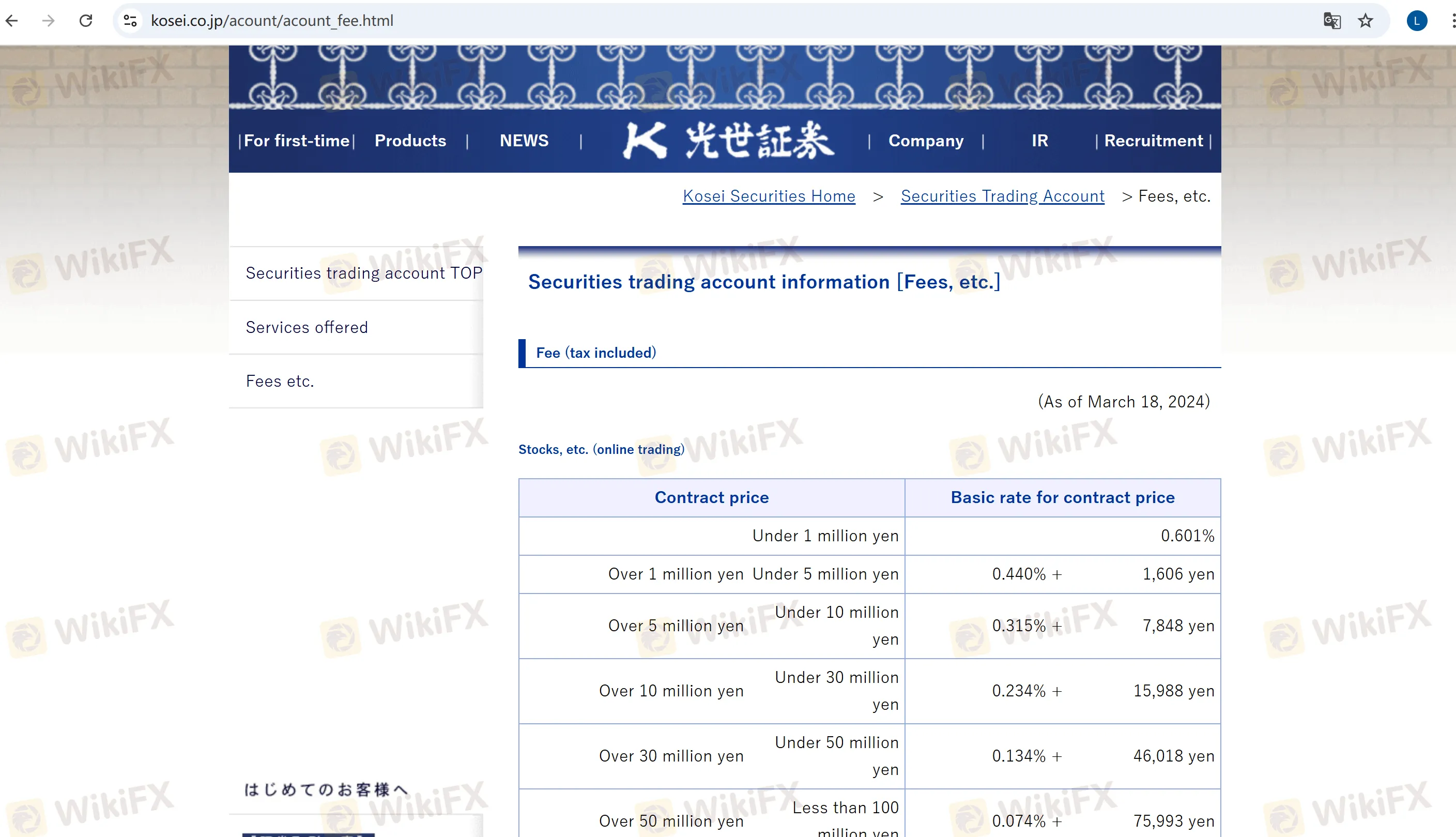

Biaya KOSEI SECURITIES

Biaya Komisi Utama:

Saham (Online): 0.601% untuk transaksi di bawah ¥1,000,000 (minimum ¥1,100). Untuk jumlah di atas ¥1,000,000,000, biaya tunduk pada negosiasi individual.

Saham AS: Flat 0.495% (minimum ¥550). Biaya SEC akan ditangguhkan sementara mulai 13 Mei 2025.

Futures & Opsi (Online): 0.022% untuk futures indeks, 0.0044% untuk futures obligasi pemerintah, dengan biaya minimum ¥440.

Biaya Pemeliharaan Akun: ¥2,200 per tahun (dikecualikan untuk klien yang memegang 100+ saham perusahaan).

Biaya Lainnya:

Tarif Pinjaman Marjin (Sisi Beli): Marjin institusional: 1.64%–1.92% (bunga tahunan); Marjin umum: 2.14%–2.42%.

Untuk informasi biaya akun yang lebih detail, silakan kunjungi situs web resmi.