公司簡介

| KOSEI SECURITIES 評論摘要 | |

| 成立年份 | 1997 |

| 註冊國家/地區 | 日本 |

| 監管 | FSA |

| 交易產品 | 股票、債券、投資信託、ETF/REIT、期貨、期權和保險/iDeco |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | 電話:0120-06-8617 |

| 地址:大阪市中央區北濱2-1-10 | |

KOSEI SECURITIES 資訊

Kosei Securities 的總部位於大阪市中央區北濱。其業務涵蓋證券交易、投資信託、期貨和期權、人壽保險代理等,同時還提供特殊服務,如特定帳戶(簡化納稅申報)和NISA帳戶(小型投資免稅)。

優缺點

| 優點 | 缺點 |

| 受FSA監管 | 複雜的佣金結構 |

| 資金安全保障 | 英語支援不足(主要以日語為主) |

| 線上與線下結合 | |

| 悠久的運營歷史 | |

| 多樣的交易產品 | |

| 透明的費用資訊 |

KOSEI SECURITIES 是否合法?

Kosei Securities在東京證券交易所上市,並受日本金融廳(FSA)監管。憑藉近畿財務局長(金商)第14號牌照,這是一家合法註冊的證券公司。

| 監管機構 | 當前狀態 | 監管國家 | 牌照實體 | 牌照類型 | 牌照號碼 |

| 日本金融廳(FSA) | 受監管 | 日本 | KOSEI SECURITIES株式会社 | 零售外匯牌照 | 近畿財務局長(金商)第14號 |

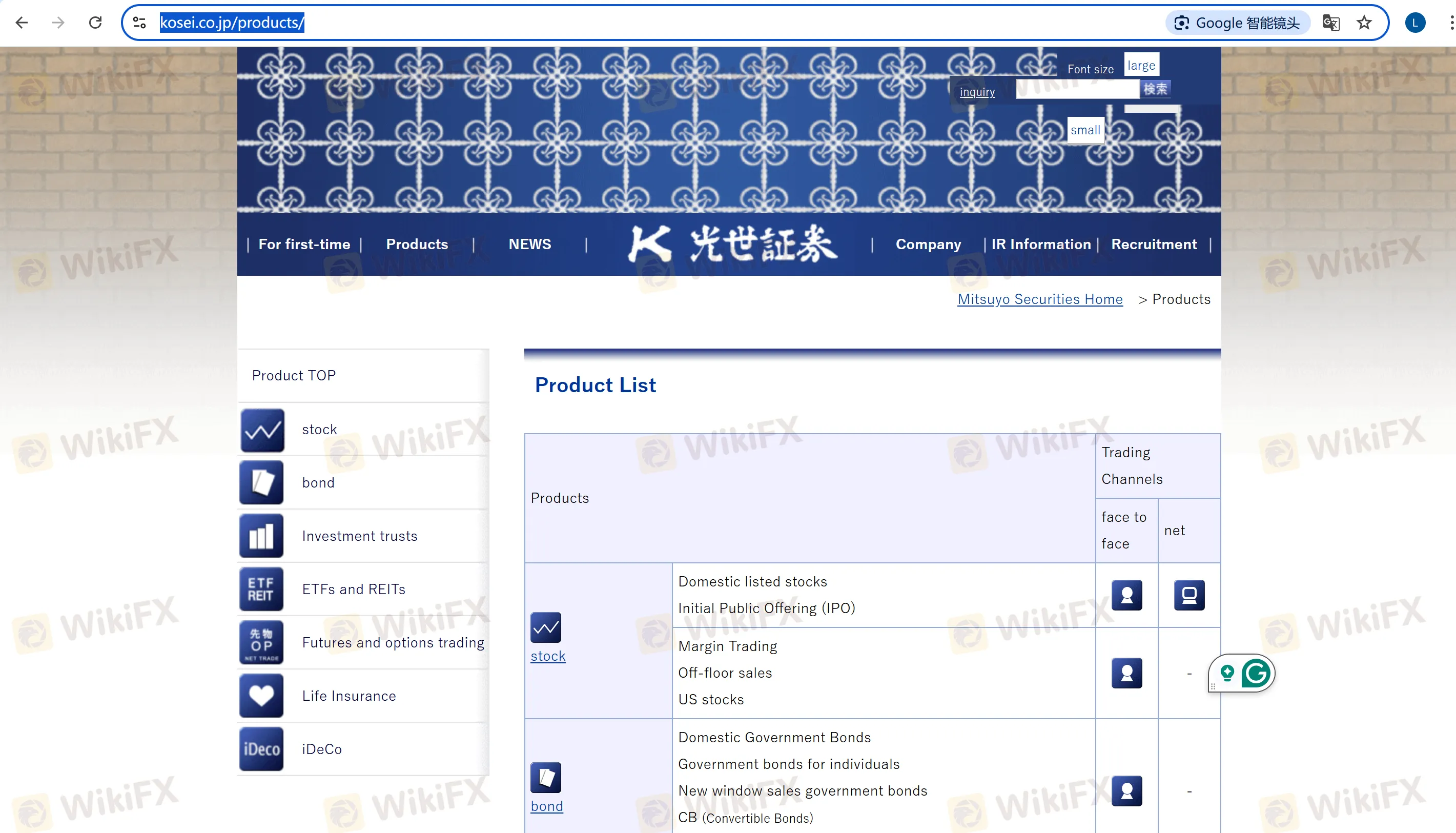

我可以在KOSEI SECURITIES上交易什麼?

| 交易產品 | 支援 | 詳情 |

| 股票 | ✔ | 國內上市股票、美國股票、首次公開募股(IPO)和保證金交易 |

| 債券 | ✔ | 個別政府債券、企業債券、外幣計價債券和可轉換債券 |

| 投資信託 | ✔ | 股權投資信託、企業債券投資信託和對沖基金類型基金 |

| ETFs/REITs | ✔ | 上市投資信託、房地產投資信託(例如TOPIX房地產信託指數) |

| 期貨和期權 | ✔ | 日經225期貨、TOPIX期權、貴金屬期貨(黃金標準)和商品指數期貨(芝加哥商品交易所原油) |

| 保險/iDeco | ✔ | 人壽保險代理服務、野村iDeco(養老金帳戶) |

帳戶類型

特定帳戶:代表客戶計算利潤和損失,處理稅款支付,並簡化年度稅務申報。

NISA帳戶:適用於小規模投資的免稅帳戶,年度投資上限為¥1,000,000。股息和銷售收益在5年內免稅。

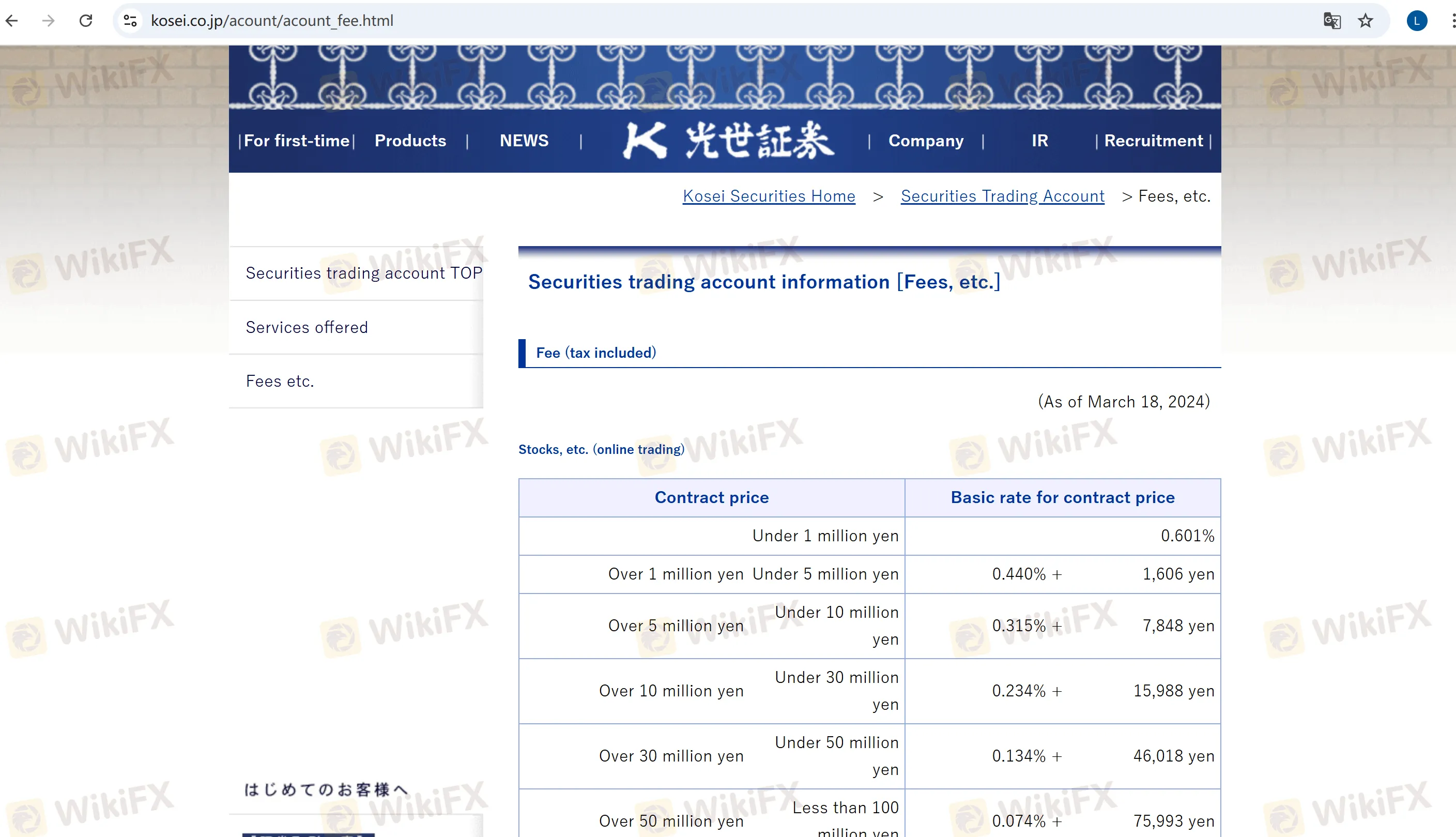

KOSEI SECURITIES 費用

主要佣金費用:

股票(網上):交易金額低於¥1,000,000的佣金為0.601%(最低¥1,100)。金額超過¥1,000,000,000的費用需進行個別協商。

美國股票:固定0.495%(最低¥550)。SEC費用將於2025年5月13日起暫時免除。

期貨和期權(網上):指數期貨為0.022%,政府債券期貨為0.0044%,最低費用為¥440。

帳戶維護費:每年¥2,200(對持有公司股份100股以上的客戶免費)。

其他費用:

保證金貸款利率(買方):機構保證金:1.64%–1.92%(年利率);一般保證金:2.14%–2.42%。

有關更詳細的帳戶費用信息,請訪問官方網站。