Riepilogo dell'azienda

Informazioni generali e regolamento

FFG Securities è stata fondata nel 1945 ed è diventata membro a pieno titolo della Borsa di Fukuoka nel 1949 e ha fondato l'ufficio di Shimabara (trasformato in una filiale nel 1980). Nell'ottobre 1985, FFG Securities ha acquisito la qualifica di negoziazione di futures relativi a titoli di stato e altri titoli alla Borsa di Tokyo. Nel novembre 1990, FFG Securities è diventata membro a pieno titolo della Borsa di Tokyo e nel dicembre 1998 è stata registrata come società di titoli ai sensi del Securities and Exchange Act rivisto. Nel 2007, il nome di questa società è stato cambiato in FFG Securities Co., Ltd. FFG Securities è attualmente regolamentata dalla Financial Services Agency del Giappone e detiene la sua licenza di cambio valuta al dettaglio autorizzata e autorizzata, numero regolamentare: 2290001010521.

prodotti e servizi

I prodotti e i servizi finanziari offerti da FFG Securities sono principalmente azioni domestiche, obbligazioni, negoziazione di margini di cambio, fondi comuni di investimento, ecc.

Commissioni

FFG Securities ha fissato commissioni diverse per i prodotti finanziari che offre. Per la negoziazione di azioni domestiche, se il prezzo del contratto è inferiore a 1 milione di yen per gli ordini faccia a faccia, la commissione di spedizione è dell'1,265% del prezzo del contratto e la commissione è dell'1,15% del prezzo del contratto, per i prezzi del contratto superiori 1 milione di yen e meno di 2 milioni di yen, 0,80% del prezzo del contratto + 3.850 yen e la commissione è dello 0,80% del prezzo del contratto + 3.500 yen. Per ulteriori informazioni sulle commissioni, consultare il sito web di FFG Securities.

Deposito e prelievo

FFG Securities richiede ai suoi abbonati di depositare denaro sui loro conti tramite bonifico bancario e la società coprirà le spese di trasferimento. Se i trader hanno bisogno di prelevare fondi, possono chiamare il broker o utilizzare il metodo di prelievo online per prelevare i fondi.

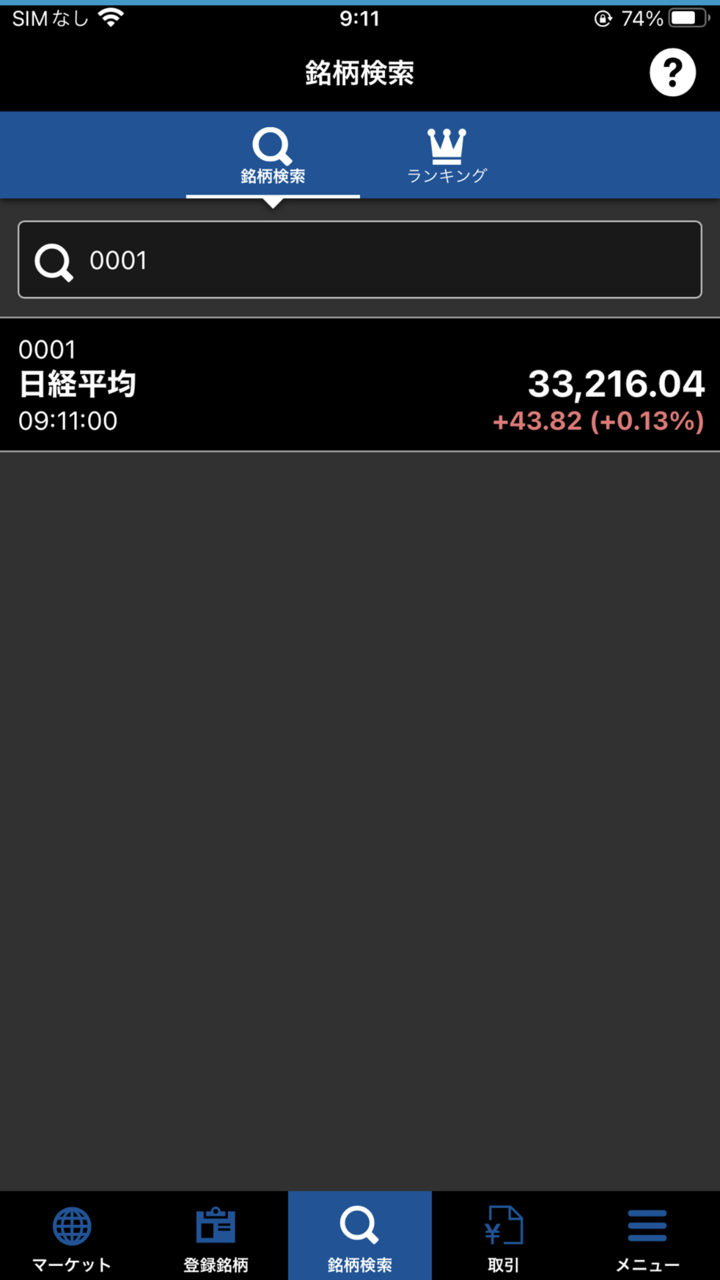

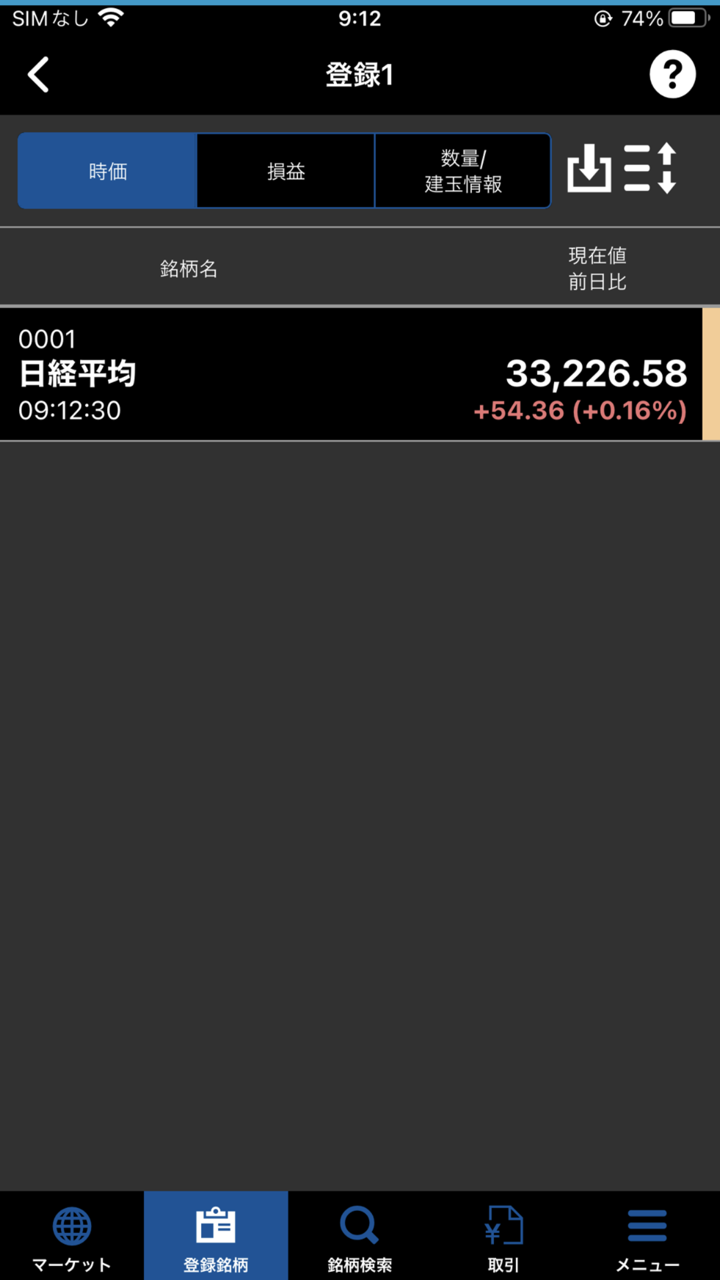

Commercio online

FFG Securities offre un sistema di trading basato sul Web che consente ai trader di negoziare azioni e fondi comuni di investimento utilizzando un computer, un tablet o uno smartphone. FFG Securities afferma che i trader possono godere di uno sconto del 50% sul trading di azioni online rispetto al trading faccia a faccia e di uno sconto del 10% sulle applicazioni di fondi di investimento online rispetto al trading faccia a faccia. L'orario di trading online va dalle 6:00 alle 2:00 del giorno successivo.

Pro e contro

Alcuni vantaggi e svantaggi dei Titoli FFG sono elencati di seguito:

| Professionisti | Contro |

| Regolamentato dalla FSA con stabilimento di lunga data | Nessun conto multivaluta disponibile |

| Ampie gamme di prodotti | Metodi di pagamento limitati |

| Nessuna commissione di deposito o prelievo | Nessun supporto chat online |

| Strumenti di trading limitati |