회사 소개

| Pubali Bank 리뷰 요약 | |

| 설립 연도 | 1959 |

| 등록 국가/지역 | 방글라데시 |

| 규제 | 규제 없음 |

| 거래 플랫폼 | PI 뱅킹 |

| 고객 지원 | 전화 지원: +8809666016253, 16253 |

| PABX 번호: +88 02223381614 | |

| IPPBX 번호: +88 09666 82 00 00, +88 09666 82 08 20 | |

| 팩스: 880-2-9564009 | |

| 이메일: info@pubalibankbd.com | |

Pubali Bank 정보

방글라데시의 Pubali Bank은 디지털 뱅킹 및 다양한 투자를 포함한 다양한 뱅킹 제품 및 서비스를 제공하는 오랜 기간의 기관입니다.

장단점

| 장점 | 단점 |

| 다양한 제품 포트폴리오 | 규제 부족 |

| 오랜 기간 경험 | 거래 수수료에 대한 제한된 정보 |

Pubali Bank 합법성

Pubali Bank은 규제되지 않은 플랫폼입니다. 리스크를 인식해주십시오!

WHOIS에서 pubalibangla.com 도메인은 2002년 1월 24일에 등록되었으며, 2027년 1월 24일에 만료됩니다. 현재 상태는 "클라이언트 삭제/갱신/이전/업데이트 금지"입니다.

서비스

Pubali Bank은 지점 및 ATM/CDM/CRM 위치, 이윤 및 이자율, 수수료 일정 및 서비스 개요를 포함한 서비스에 빠르게 접근할 수 있습니다.

제품

Pubali Bank은 디지털 및 모바일 뱅킹, 다양한 카드 서비스, 이슬람 금융, 사업 및 개인 자금 (리스 금융과 같은), 정기 예금, 송금 및 해외 뱅킹 솔루션을 포함한 다양한 제품을 제공합니다.

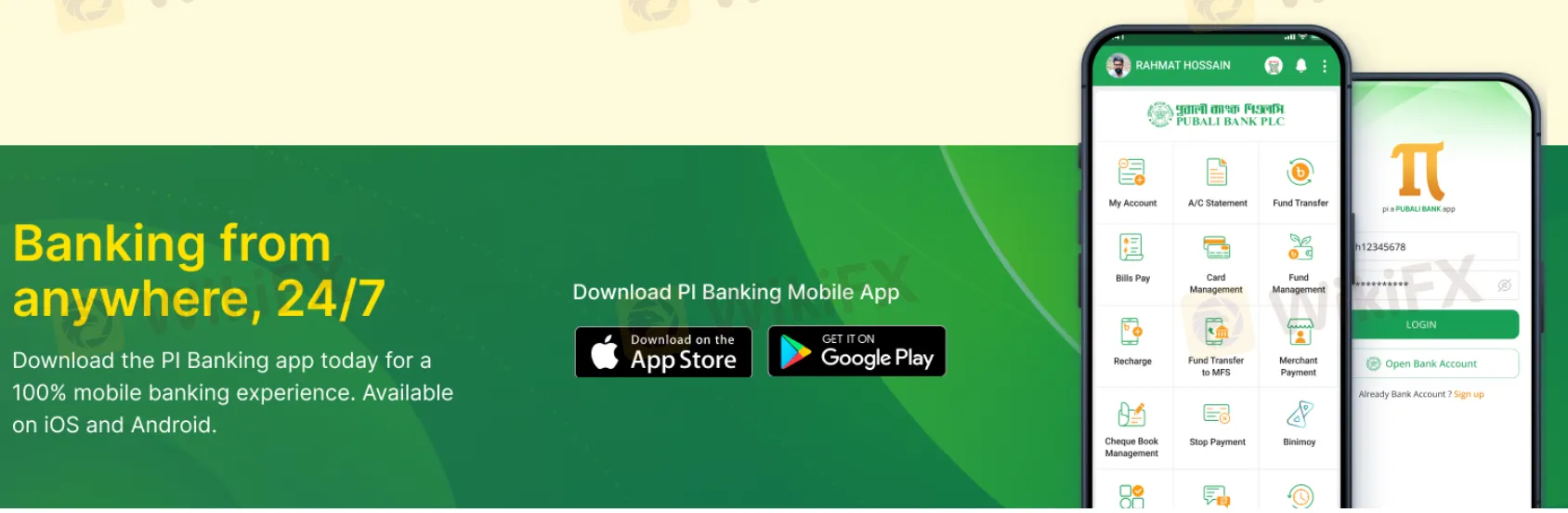

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| PI 뱅킹 | ✔ | iOS, Android |