公司简介

| HoxtonWealth评论摘要 | |

| 成立时间 | 2023 |

| 注册国家/地区 | 英国 |

| 监管 | 无监管 |

| 投资解决方案 | 管理投资组合、低成本投资、退休规划、另类投资和道德投资 |

| 平台/应用 | Hoxton Wealth App |

| 客户支持 | 联系表单 |

| 电话:+1 737 249 9620 | |

| 实际地址:美国德克萨斯州奥斯汀市国会大道111号,500室 | |

| 美国新泽西州泽西市哈德逊街101号 | |

HoxtonWealth信息

HoxtonWealth成立于2023年,总部位于英国。该公司提供五种投资解决方案,并将Hoxton Wealth App作为其交易平台。然而,该公司没有受到监管。

优缺点

| 优点 | 缺点 |

| 提供五种投资解决方案 | 无监管 |

| 提供各种金融服务 |

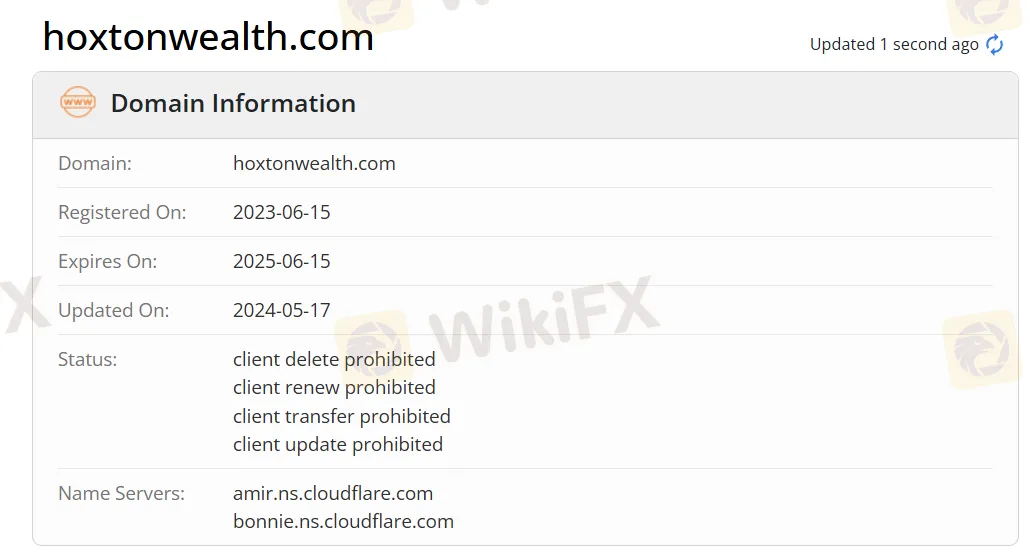

HoxtonWealth是否合法?

HoxtonWealth是无监管的,其域名hoxtonwealth.com于2023年6月15日注册,到期日为2025年6月15日。

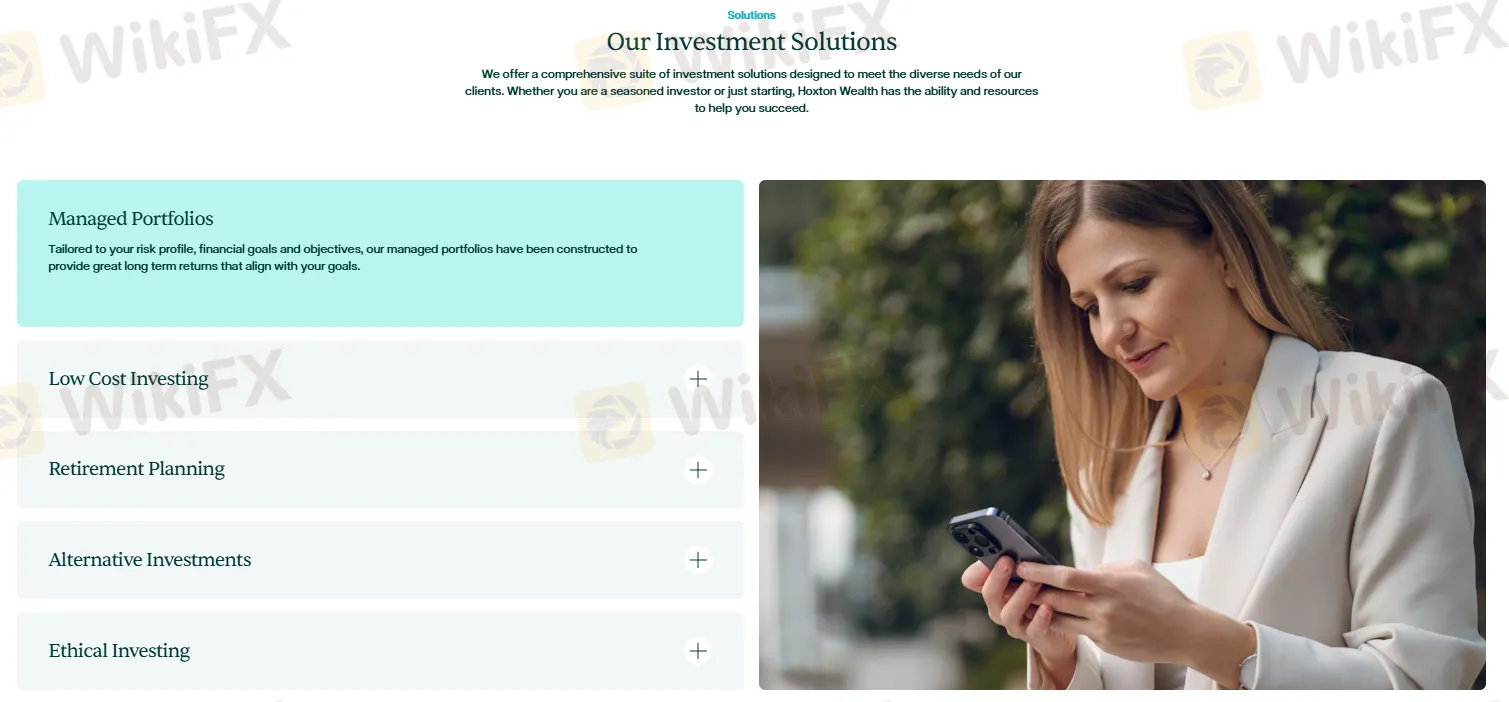

投资解决方案

Hoxton Wealth提供五种投资解决方案,包括管理投资组合、低成本投资、退休规划、另类投资和道德投资。

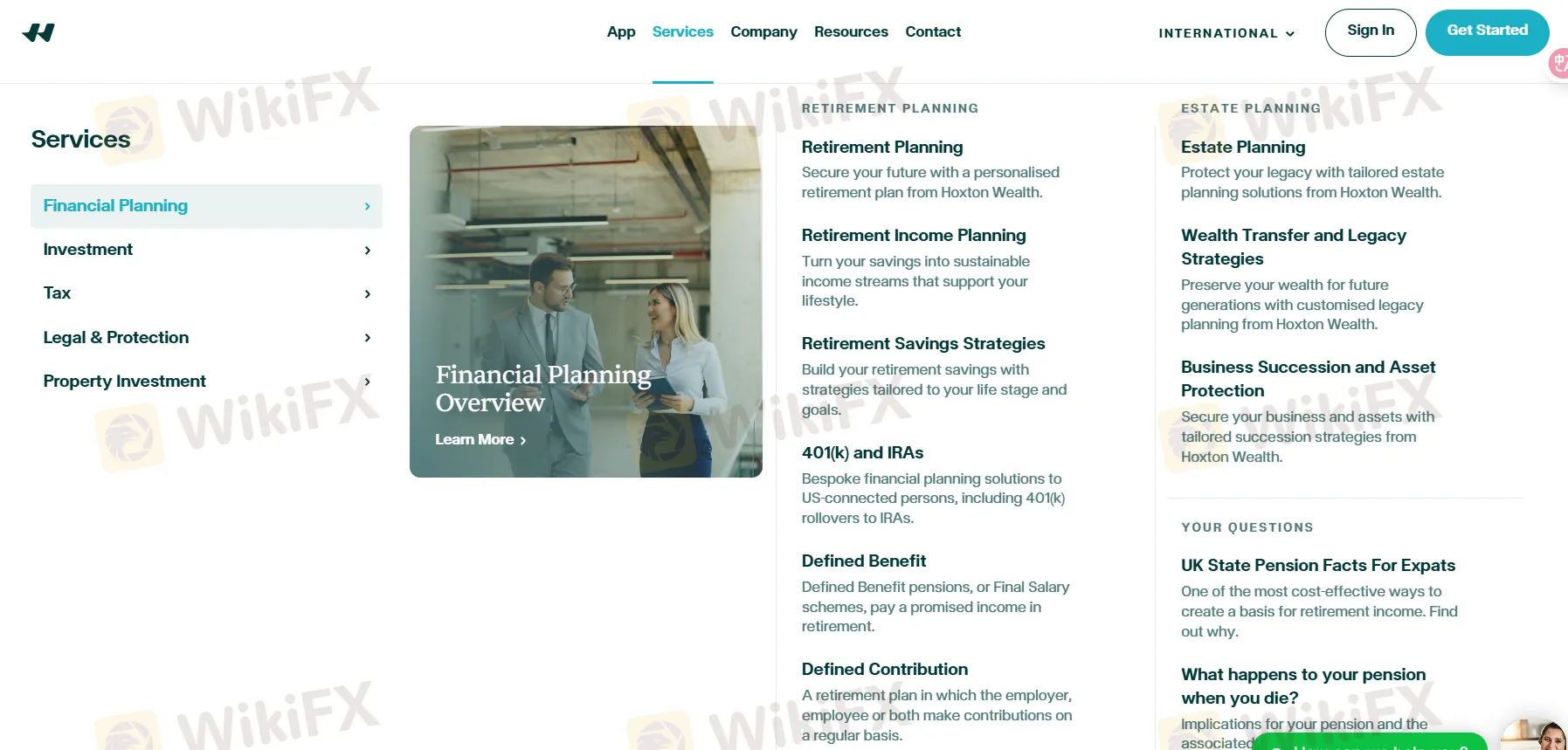

金融服务

Hoxton Wealth提供广泛的金融服务,包括退休规划、投资建议、税务支持、法律和保险解决方案、房地产投资咨询以及遗产和财富转移规划。他们还就英国国家养老金等问题提供指导。

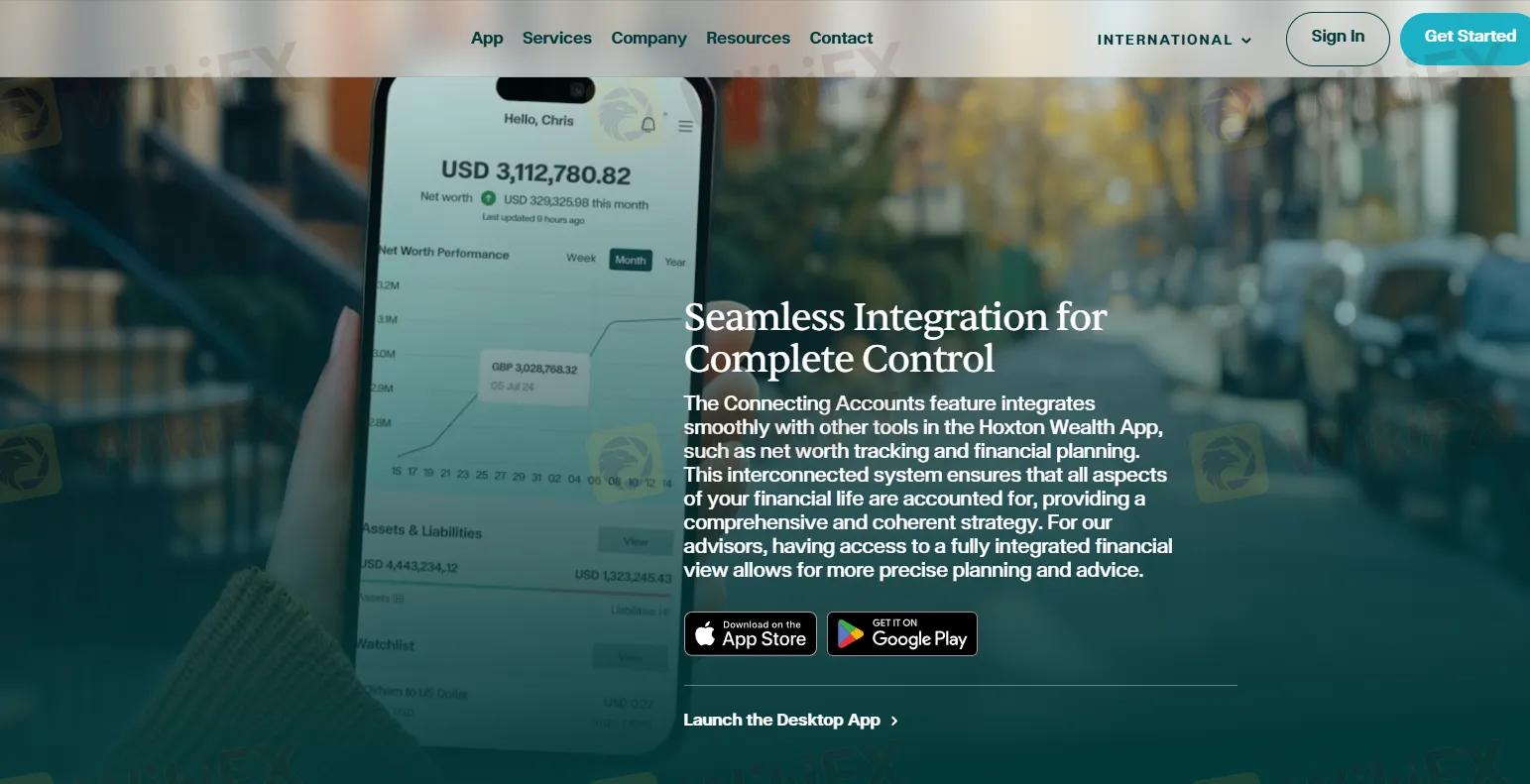

交易平台

Hoxton Wealth的交易平台是Hoxton Wealth App。它可以连接到各种金融账户,不受货币、机构或地区的限制,并提供实时净值跟踪。该应用可从Apple App Store和Google Play下载,也是桌面应用程序。