公司简介

| 申银万国 评论摘要 | |

| 成立时间 | 2007 |

| 注册国家/地区 | 中国 |

| 监管 | CFFEX |

| 市场工具 | 商品期货、金融指数期货、债券期货、商品期权、金融指数期权、ETF期权、现货ETF |

| 模拟账户 | ✅ |

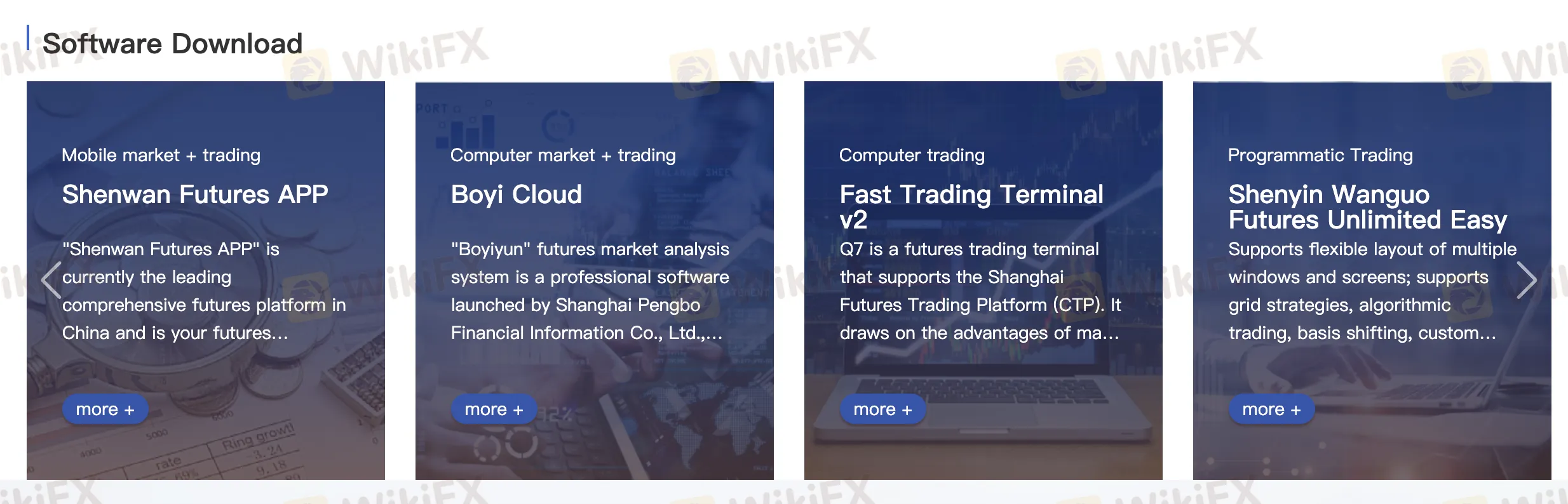

| 交易平台 | 申万期货APP、博易云、快速交易终端v2、申银万国期货无限易 |

| 最低存款 | / |

| 客服支持 | 电话:021-5058-8811 |

| 传真:021-5058-8822 | |

申银万国 信息

申银万国成立于2007年,是一家中国期货经纪商,持有中国金融期货交易所颁发的0131号牌照。为零售和机构交易者提供广泛的期货、期权和现货市场服务,以及先进的交易平台。

优点和缺点

| 优点 | 缺点 |

| 受CFFEX监管 | 主要关注中国国内市场 |

| 多样的可交易工具 | 复杂的费用结构 |

| 多个专业交易平台 |

申银万国 是否合法?

是的,申银万国 受监管。它持有中国金融期货交易所(CFFEX)颁发的期货牌照,牌照号码为0131。这表明该公司在中国期货业务方面受到正式监管。

我可以在 申银万国 上交易什么?

申银万国提供许多不同的交易产品,如期货、期权和现货合同,在许多中国交易所上。客户可以交易大宗商品、金融指数、金属、能源、农产品和ETF。

| 可交易工具 | 支持 |

| 大宗商品期货 | ✔ |

| 金融指数期货 | ✔ |

| 债券期货 | ✔ |

| 大宗商品期权 | ✔ |

| 金融指数期权 | ✔ |

| ETF期权(上海/深圳) | ✔ |

| 现货ETF | ✔ |

| 外汇 | × |

| 股票 | × |

| 加密货币 | × |

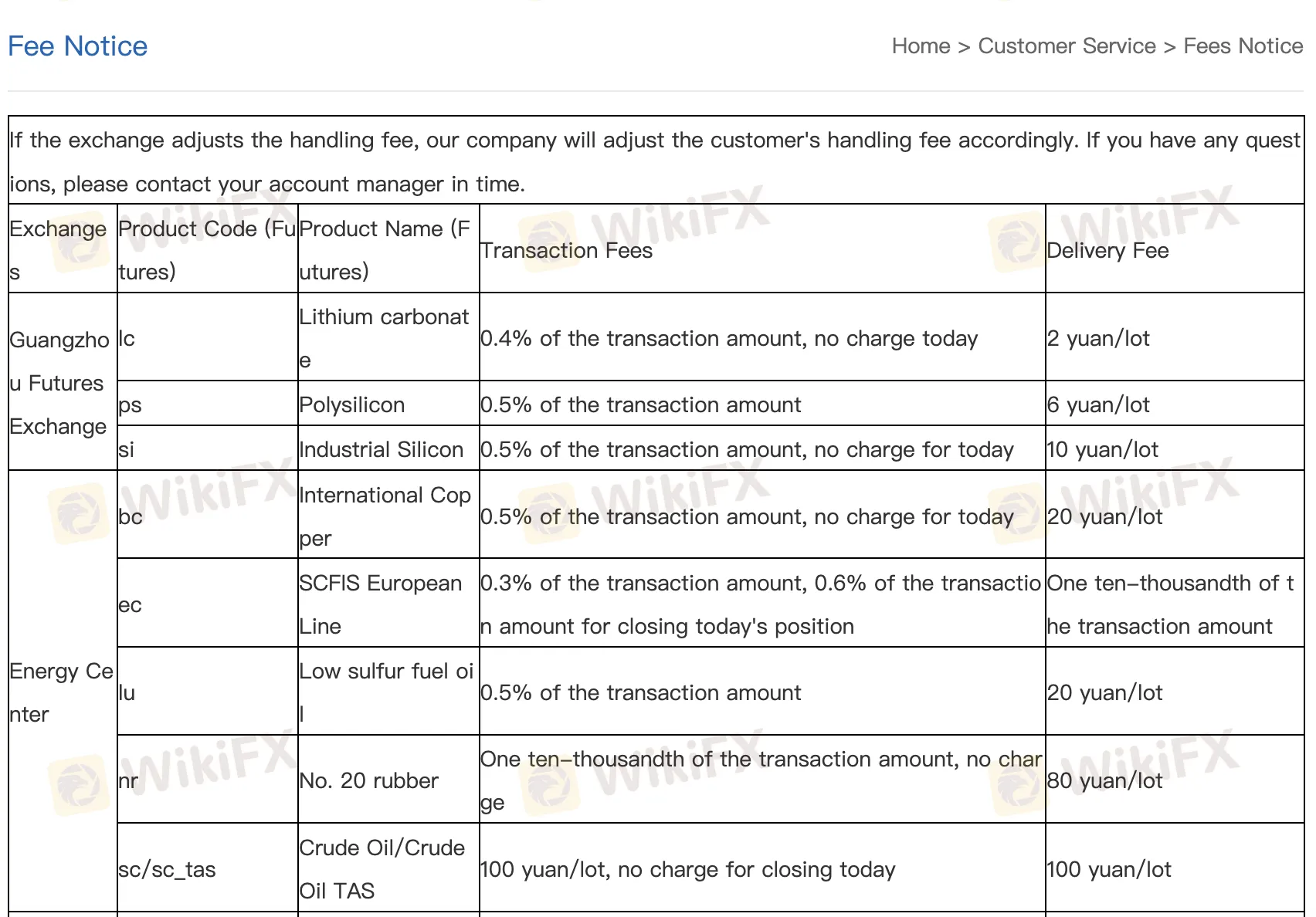

申银万国 费用

总体而言,与行业标准相比,申银万国的手续费被认为是中等的。交易成本因产品和交易所而异,尽管它们通常遵循中国期货市场制定的标准价格。然而,一些工具有特别优惠,如免除平仓手续费,这可能会降低活跃交易者的成本。

| 费用类型 | 典型收费示例 |

| 手续费(期货) | 交易金额的0.25% – 1.15% 或固定¥5–¥100/手 |

| 交割费(期货) | 每手¥2 – ¥200 |

| 手续费(期权) | 每手¥1 – ¥75 |

| 执行/绩效费(期权) | 每手¥2.5 – ¥750 |

| ETF期权费 | 每手¥8(买入/卖出开/平仓),执行费¥10 |

| ETF现货费 | 交易金额的0.003045 |

交易平台

| 交易平台 | 支持 | 可用设备 |

| 申万期货APP | ✔ | iOS,Android |

| 博易云 | ✔ | Windows |

| 快速交易终端v2 | ✔ | Windows |

| 申银万国期货无限轻松 | ✔ | Windows |