公司简介

| 平证香港 评论摘要 | |

| 成立时间 | 2006 |

| 注册国家/地区 | 香港 |

| 监管 | SFC |

| 产品和服务 | 企业融资与资本市场、全球股票、全球期货、资产管理 |

| 模拟账户 | ❌ |

| 交易平台 | 全球财富宝手机App、港股快车闪电交易专业版 (Windows) |

| 客户支持 | 电话(香港):+852 3762 9688 |

| 电话(中国):+86 400 841 1061 | |

| 电子邮件:cs.pacshk@pingan.com | |

| 传真:+852 3762 9668 | |

平证香港 信息

专注于期货交易和投资服务,Ping An of China Securities (Hong Kong) Company Limited(“平证香港”)是平安证券有限公司的首家全资海外子公司(深圳总部成立于1991年8月)。它是香港SFC监管的持牌金融机构。其专有平台和实体开户流程包括保证金融资、私募基金访问和IPO解决方案。

优缺点

| 优点 | 缺点 |

| 在香港由SFC监管 | 没有模拟或伊斯兰账户 |

| 可访问私募基金和结构化投资工具 | 仅限现场开户 |

| 提供移动和PC交易平台 | 不支持Mac或基于浏览器的交易 |

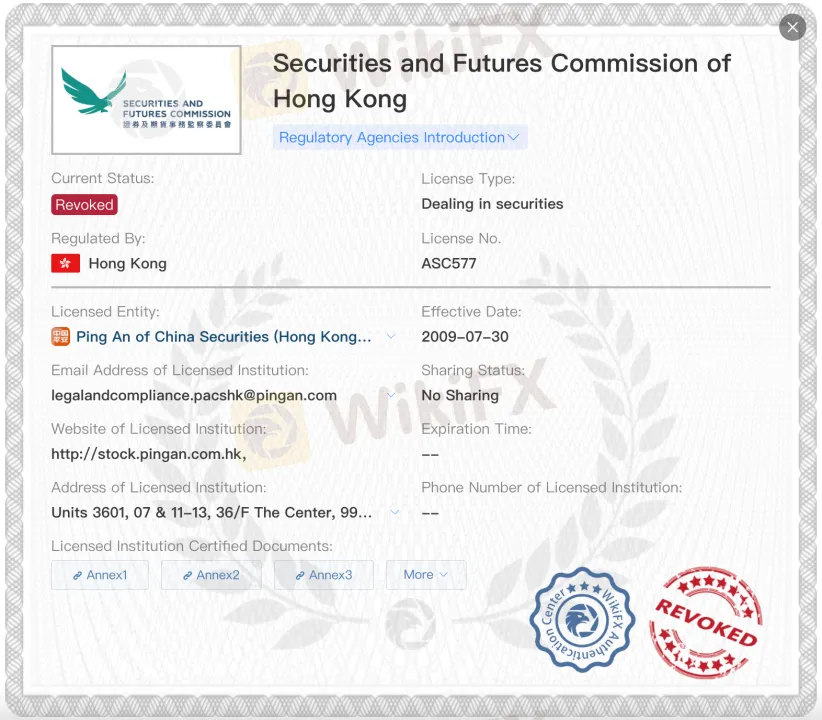

平证香港 是否合法?

是的,平证香港受到监管。香港证监会(SFC)自2012-03-30起授予其期货合约交易许可证号码AXR954。

然而,中国平安证券(香港)的证券交易许可证(许可证号ASC577)已被吊销。在确认平安集团的服务或业务时,这种差异至关重要。

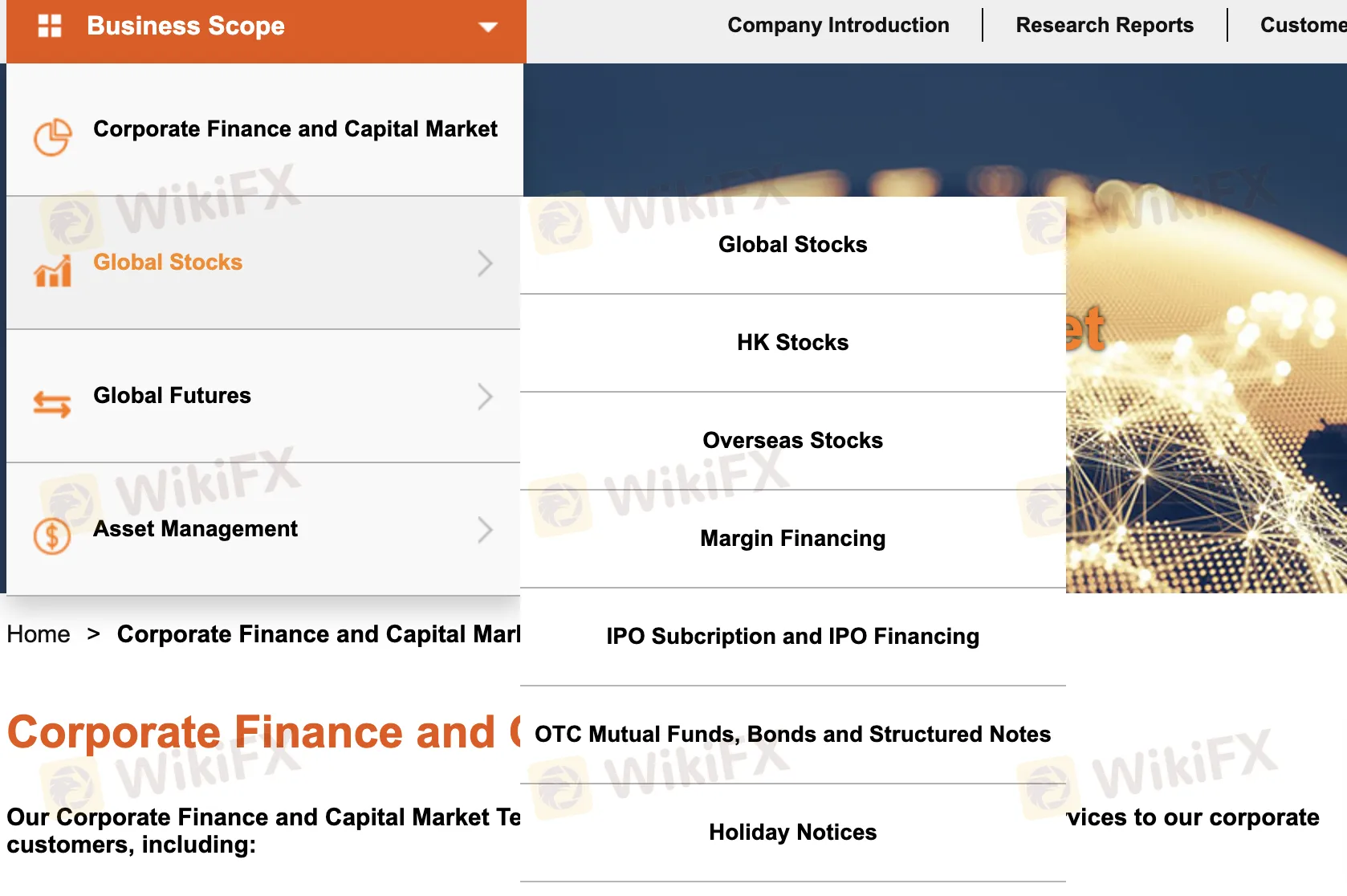

平证香港 可以交易什么?

平证香港提供包括企业融资解决方案、全球证券交易、期货和期权以及资产管理在内的广泛金融产品和服务。

| 类别 | 提供的产品/服务 |

| 企业融资与资本市场 | IPO赞助和承销 |

| 债券和优先股发行 | |

| 可转换债券发行 | |

| 二级市场配售 | |

| M&A财务咨询 | |

| 私募股权融资 | |

| 全球股票 | 香港股票(HK股票) |

| 海外/全球股票 | |

| 融资融券 | |

| IPO认购和融资 | |

| 场外交易 互惠基金 | |

| 场外交易 债券 | |

| 场外交易 结构性产品 | |

| 全球期货 | 香港期货和期权 |

| 全球期货 | |

| 资产管理 | 私募基金 |

账户类型

平证香港提供两种实时交易账户:企业账户和个人/联合账户。不提供伊斯兰(无隔夜利息)账户或模拟账户。开设账户需亲自办理;每种账户类型均根据个人或机构需求定制。

| 账户类型 | 描述 | 适用对象 |

| 个人/联合 | 适用于个人或联合投资者亲自开设 | 零售或私人投资者 |

| 企业 | 适用于公司或机构投资者 | 企业或法人实体 |

| 模拟账户 | 不可用 | — |

| 伊斯兰账户 | 不可用 | — |

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于何种交易者 |

| 全球财富宝 Mobile App | ✅ | iOS,Android(智能手机) | 寻求便利的移动焦点交易者 |

| 港股快车闪电交易专业版(Windows PC版本) | ✅️ | Windows PC | 需要桌面工具的专业交易者 |

| Mac版本 | ❌ | — | 不支持 |

| 基于Web的平台 | ❌ | — | 不支持 |

存款和取款

平证香港不收取手续费取款或存款费用。所有转账必须通过注册银行账户进行;不允许第三方或现金存款。

存款方式

| 存款方式 | 最低入金 | 费用 | 处理时间 |

| 中行子账户(特定客户) | 未提及 | 免费 | 1-2个工作日 |

| 汇丰银行/渣打银行/中行账户 | 未提及 | 免费 | 1-2个工作日 |

取款方式

| 取款方式 | 最低取款额 | 费用 | 处理时间 |

| 至注册银行账户 | 未提及 | 免费 | 1-2个工作日 |

| 至非注册银行账户(通过表格) | 未提及 | 免费 | 1-3个工作日 |