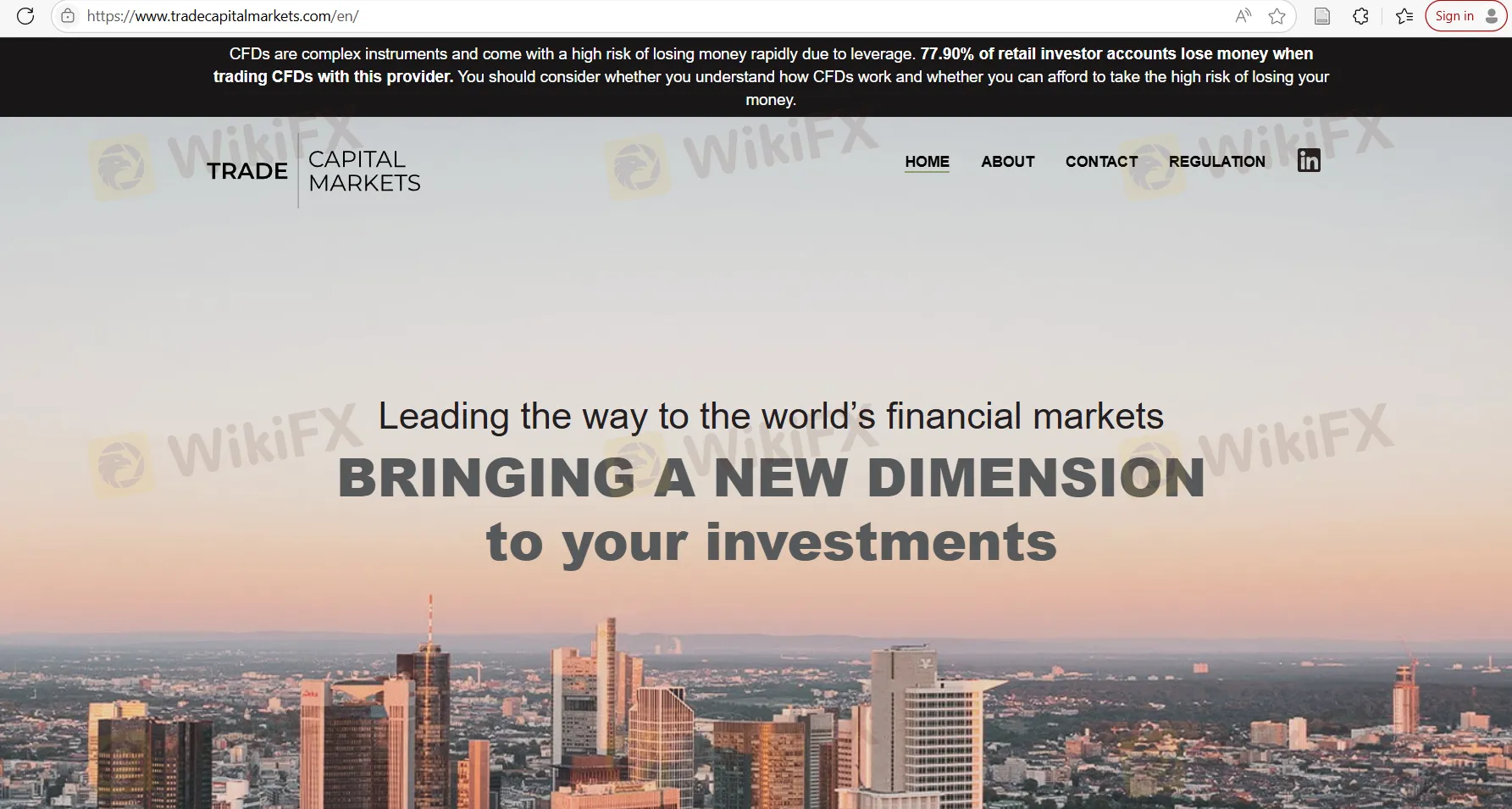

公司简介

| TCM 评论摘要 | |

| 成立时间 | 2019 |

| 注册国家/地区 | 塞浦路斯 |

| 监管 | CYSEC(受监管),FSCA(可疑克隆) |

| 市场工具 | 差价合约(CFDs) |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:+357 22 030446 |

| 电子邮件:info@tradecapitalmarkets.com | |

| 公司地址:148 Strovolos Avenue, 1st floor, CY 2048, 尼科西亚,塞浦路斯 | |

| 社交媒体:LinkedIn | |

| 区域限制 | 日本,加拿大,西班牙,比利时,美国 |

TCM 信息

TCM(Trade Capital Markets)是一家总部位于塞浦路斯的在线交易平台。TCM声称在差价合约(CFD)交易中提供广泛的投资产品和服务。该平台已获塞浦路斯证券交易委员会(CySEC)和金融行为监管局(FSCA)的监管,但其FSCA许可证被怀疑是一个虚假克隆。

优缺点

| 优点 | 缺点 |

| CYSEC监管 | 可疑克隆的FSCA许可证 |

| 多种联系渠道 | 区域限制 |

| 模拟账户不可用 | |

| 费用结构不清晰 |

TCM 是否合法?

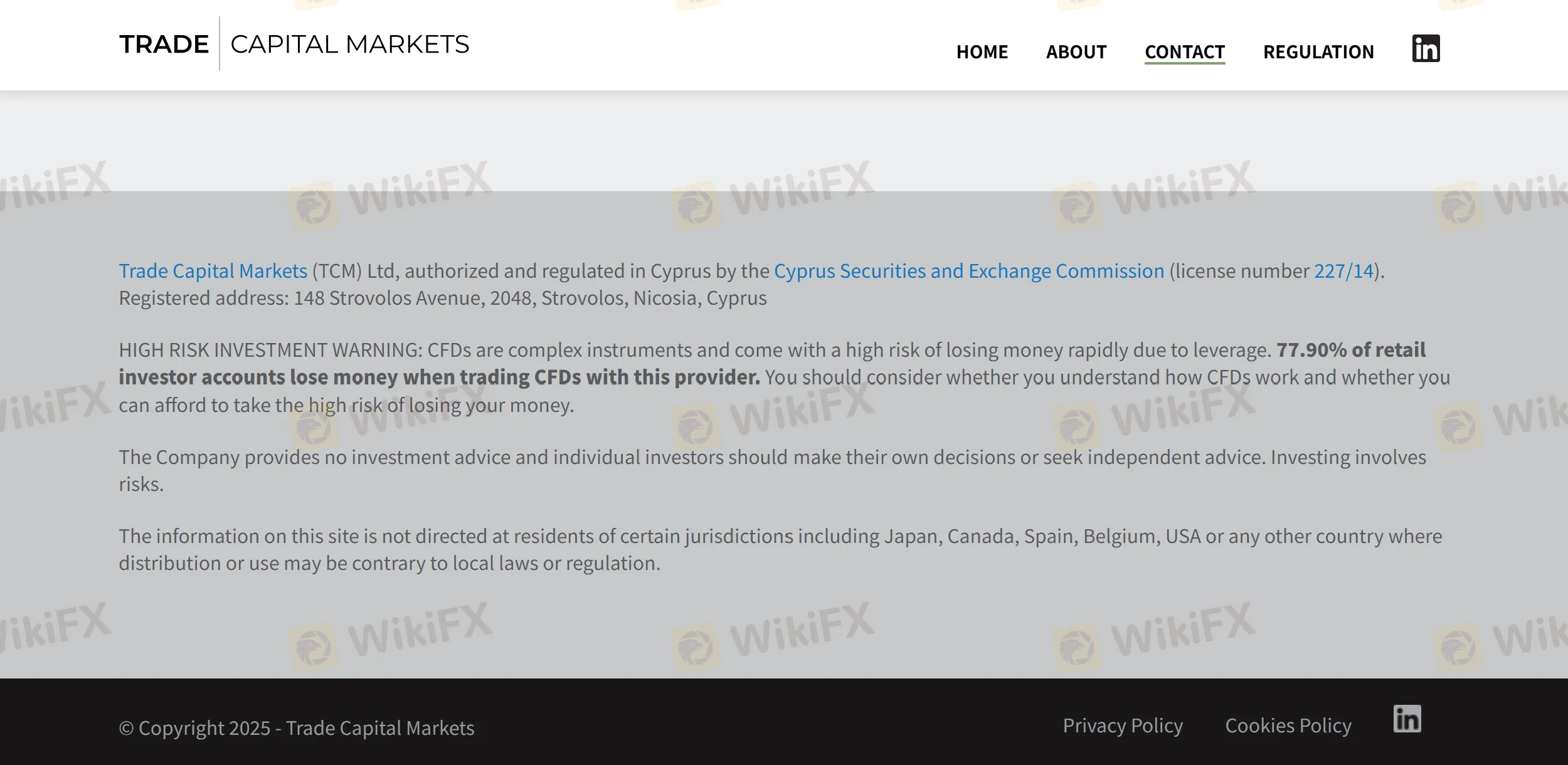

TCM在塞浦路斯由塞浦路斯证券交易委员会(CySEC,许可证号227/14)授权和监管。同时,TCM还持有来自金融行为监管局(FSCA)的可疑克隆许可证。

| 受监管国家 | 监管机构 | 监管状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 塞浦路斯证券交易委员会(CySEC) | 受监管 | Trade Capital Markets(TCM)有限公司 | 做市商(MM) | 227/14 |

| 金融行为监管局(FSCA) | 可疑克隆 | TRADE C应用程序接口TAL MARKETS(TCM)有限公司 | 金融服务公司 | 47857 |

WikiFX现场调查

WikiFX现场调查团队访问了TCM在塞浦路斯的办公地址,并发现了其现场实体办公室。

我可以在TCM上交易什么?

TCM专注于差价合约交易,并声称提供最高质量标准的广泛投资产品和服务。

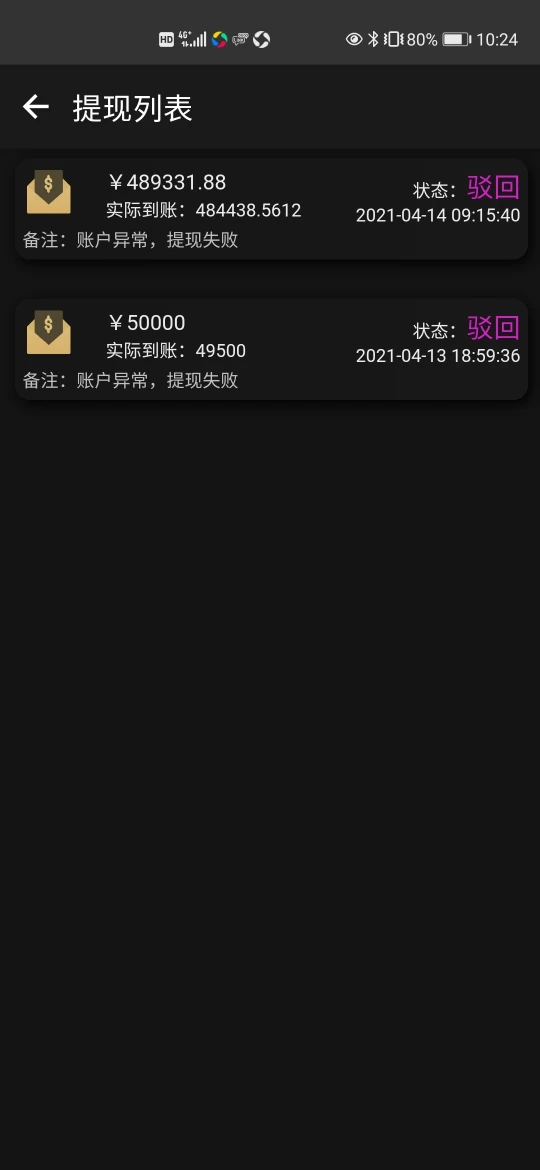

FX8831647032

香港

千万不要受骗千万不要受骗

曝光

+95798

香港

根本就不能提现。要怎么样才可以要回本金。这两个人都害死人了。

曝光

( ・᷅ὢ・᷄ )Amy

香港

擦亮眼睛不要上当了,骗子骗子,我们都是前车之鉴

曝光

xukrat

新西兰

中医是个彻头彻尾的骗子。他们在你入金之前就说平台近乎完美,各种花言巧语骗你,入金之后不理你和你的提现请求。

好评

涛哥33986

西班牙

总的来说,我觉得TCM提供的交易条件非常有吸引力,比如低保证金和高杠杆、MT5、模拟账户、各种交易工具……但是监管牌照接口似乎不太靠谱,我决定不要冒这个险。

中评