公司简介

| 海证期货 评论摘要 | |

| 成立时间 | 2008 |

| 注册国家/地区 | 中国 |

| 监管 | CFFE(受监管) |

| 市场工具 | 期货、金属、能源和化工 |

| 模拟账户 | ❌ |

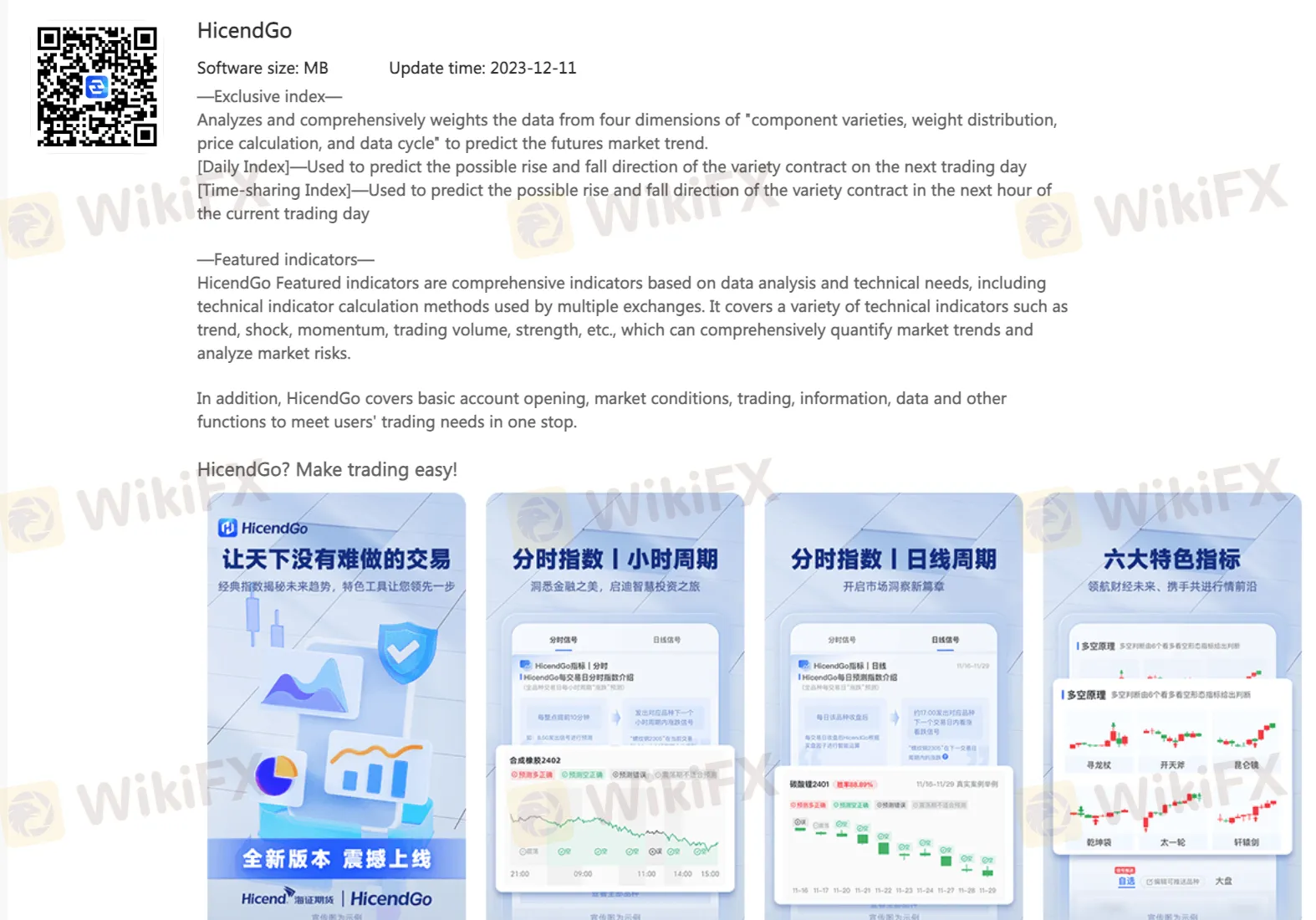

| 交易平台 | 快速交易终端V2、无限易客户端、易胜客户端8.5、易胜客户端8.3、随心易(仅限实时比赛)、闪电王、海证期货Go、上海证券期货、恒指期货、普华旅游、口袋贵金属、宜兴APP、快讯APP、大连财经新闻、趣贺APP |

| 客户支持 | 在线聊天 |

| 微信 | |

| 电话:400-880-8998;021-60169066/9058 | |

| 电子邮件:hzqh@hicend.com.cn | |

海证期货 信息

海证期货 是一家受监管的经纪商,提供期货、金属、能源和化工的交易,可在不同的交易平台上进行。

优点和缺点

| 优点 | 缺点 |

| 多样的交易平台 | 无演示 账户 |

| 良好的监管 | 申请和处理 手续费 收费 |

| 多渠道客户支持 | |

| 长时间运营 | |

| 在线聊天支持 |

海证期货 是否合法?

是的。海证期货 获得了CFFEX的许可以提供服务。

| 受监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可类型 | 许可证号 |

| 中国金融期货交易所 | 受监管 | 海证期货有限公司 | 期货许可 | 0155 |

我可以在海证期货上交易什么?

海证期货 提供期货、金属、能源和化工交易。

| 可交易工具 | 支持 |

| 金属 | ✔ |

| 能源和化工 | ✔ |

| 期货 | ✔ |

| 外汇 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

账户类型

海证期货 并未明确提供其提供的账户类型。客户可以使用一个账户交易五种主要期货。

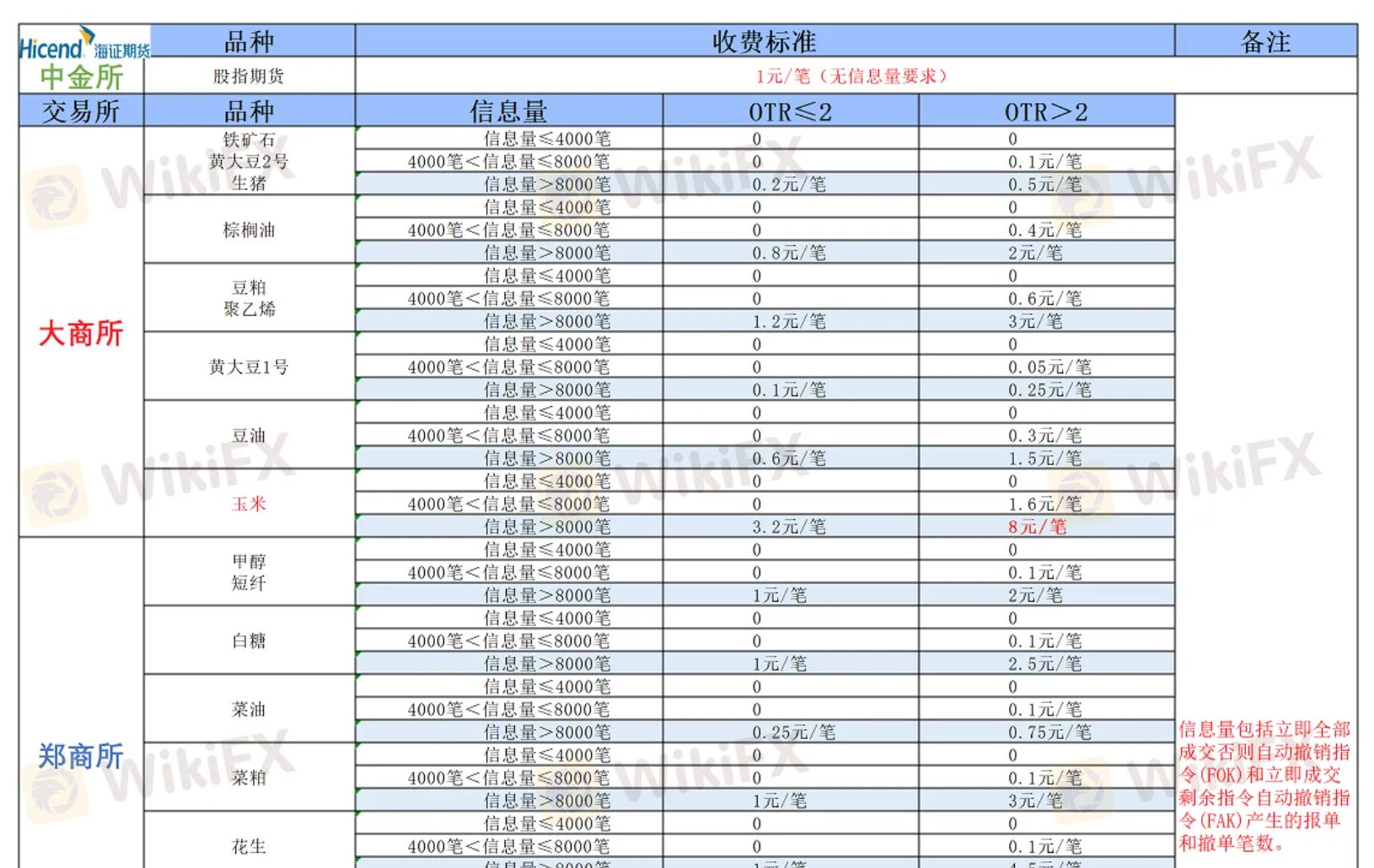

海证期货 费用

海证期货 在交易时需要申请和处理费用。

交易平台

海证期货 提供多种交易平台,包括 快速交易终端V2、无限轻松客户端、易盛客户端8.5、易盛客户端8.3、随心易(仅限实时比赛使用)、闪电王、海证期货Go、上海证券期货、恒指期货、普益旅行、口袋贵金属、宜兴APP、快讯APP、大连财经新闻和趣贺APP。

可用设备:台式机和移动设备。