公司简介

| 蓝山集团 评论摘要 | |

| 成立时间 | 1996 |

| 注册国家/地区 | 中国香港 |

| 监管 | SFC(已超出) |

| 市场工具 | 证券、股票 |

| 交易平台 | 蓝山集团 应用 |

| 客户支持 | 热线电话:+852 2137 2688 |

| 传真:+852 2137 2628 | |

| 电子邮件:cs@bluemount.com | |

蓝山集团 信息

蓝山集团 是一家总部位于中国香港的证券公司,为香港和全球市场提供证券交易服务。BLUE 还提供各种服务,包括账户管理服务的收集、现金股利、红利股票/认股权证、新股认购、股票认购、行使认股权以及股票合并/拆分等。目前该公司没有受到监管。

优缺点

| 优点 | 缺点 |

| 透明的费用结构 | 超出 SFC 许可 |

| 提供个人和联合交易账户 | 演示账户 不可用 |

| 长时间运营 | 有限的市场工具 |

| 有限的支付选项 |

蓝山集团 是否合法?

不,蓝山集团 持有香港证监会(SFC)的超出许可,这意味着其当前活动没有受到监管监督。

| 受监管国家 | 监管机构 | 监管状态 | 受监管实体 | 许可类型 | 许可证号 |

| 香港证券及期货事务监察委员会(SFC) | 超出 | 蓝山证券有限公司 | 证券交易 | BHR496 |

我可以在 蓝山集团 上交易什么?

蓝山集团的交易者可以访问股票和证券(现金和保证金)。

| 交易资产 | 可用 |

| 证券 | ✔ |

| 股票 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 基金 | ❌ |

| 交易所交易基金 | ❌ |

账户类型

交易者可以在该平台上开设个人账户和联合账户账户。

此外,该平台提供自营账户服务,指的是投资管理服务,其中财务顾问或投资组合经理被授权代表客户做出投资决策,无需为每笔交易事先征得批准。

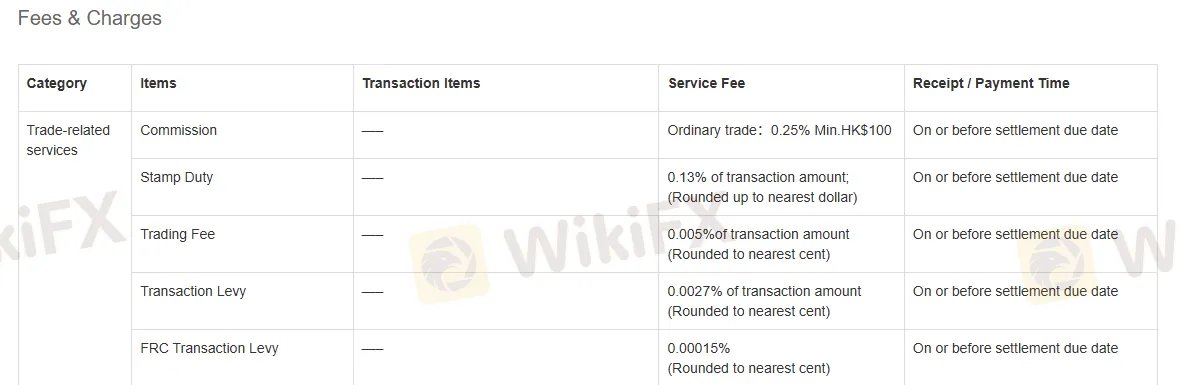

费用

蓝山集团向交易者提供清晰的费用结构,详细说明了每项服务的收费标准。例如,蓝山集团收取0.25%的佣金,最低金额为100港币。

有关该平台的手续费和费用的更多信息,请访问https://www.bluemount.com/手续费-charges?lang=en。

以下是与交易相关的各种手续费,以及它们的计算规则和付款时间轴。

| 项目 | 服务费 | 收款/付款时间 |

| 佣金 | 普通交易:0.25%; 最低100港币 | 结算截止日期前 |

| 印花税 | 交易金额的0.13%;(四舍五入至最接近的美元) | |

| 交易费 | 交易金额的0.005%(四舍五入至最接近的分) | |

| 交易征费 | 交易金额的0.0027%(四舍五入至最接近的分) | |

| FRC交易征费 | 0.00015%(四舍五入至最接近的分) |

交易平台

蓝山集团提供的交易应用程序可在Google Play和App Store上访问。

| 交易平台 | 支持 | 可用设备 |

| 蓝山集团 应用 | ✔ | 移动设备 |

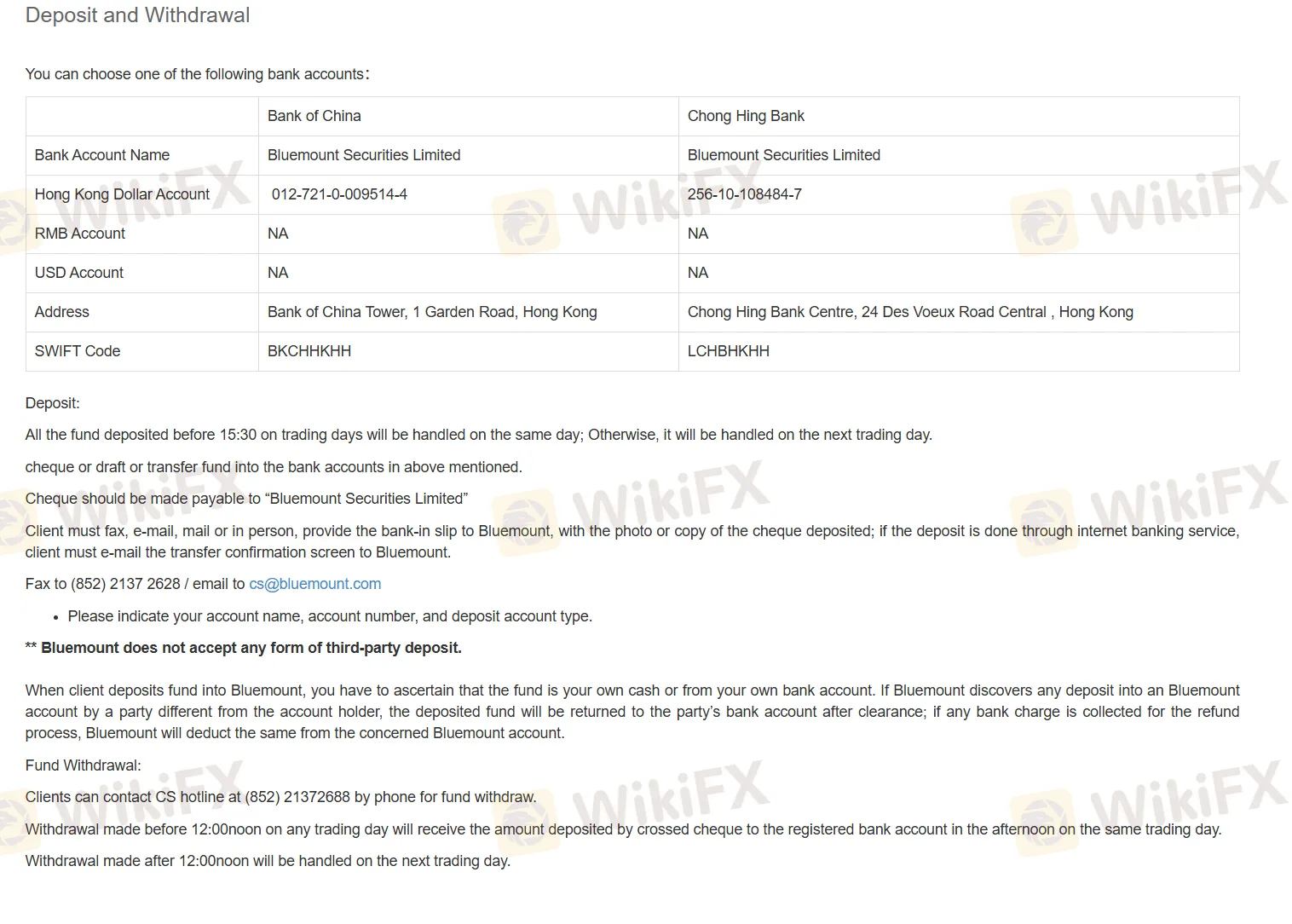

存款和取款

存款流程:

- 存款银行账户:

- 您可以将资金存入蓝山证券的中国银行或创兴银行账户。可用账户类型包括港币账户,但没有人民币或美元账户。每家银行均提供S钱包导入格T代码和地址。

- 存款时间:

- 交易日15:30前:当天处理。15:30后:次交易日处理。

- 存款方式:

- 支票/汇票/银行转账:支付对象为蓝山证券有限公司。如果通过支票存款,您必须提供银行存款收据、支票的照片或复印件,或转账确认。

重要提示:不接受第三方存款。所有存款必须来自您的账户。如果蓝山证券确认存款来自第三方,将退还资金至汇款人账户(扣除任何银行费用)。

取款流程:

- 如何取款:

- 您可以致电客户服务(CS)(852) 2137 2688 申请取款。

- 取款时间:

- 12:00 PM前:下午处理取款,并通过跨行支票存入您注册的银行账户,当天交易日。12:00 PM后:次交易日处理取款。